Detailed content of our market study

Inforamtion

Inforamtion

- Number of pages : 35 pages

- Format : Digital and PDF versions

- Last update :

Summary and extracts

Summary and extracts

1 Market overview

1.1 Definition and scope of study

1.2 Global market

World market for electrical installations France, ****-****, in billions of USD Source: ****

The global market for electrical installations in France shows strong growth forecast from **** to ****, rising from USD ***.** billion to USD ***.** billion. Forecasts indicate a steady increase every year, underlining growing demand for electrical installations.

1.3 French market

Market for electrical installation work in all premises (***) France, ****-****, in billions of € excl. tax Source: ****

The market for electrical installation work in France showed notable growth from **** to ****, rising from €**.** billion to €**.** billion excluding VAT. Despite a slight dip in ****, probably due to the COVID-** pandemic, the sector quickly rebounded to reach record levels. This trend points to increased demand for electrical installations, possibly reflecting sustained investment in infrastructure and the transition to more advanced, sustainable technologies.

Breakdown of electrical installation sales by type of work (***) France, ****-****, in Source: ****

The breakdown of sales for the electrical installation sector in the private market in France between **** and **** shows a predominance of low current (***) remain marginal. This distribution underlines the importance of current systems in private electrical installations, suggesting a focus on safety and energy efficiency.

2 Demand analysis

2.1 Demand divided between new installations and maintenance-renovations

Demand for electrical installations is divided into two main segments: new construction and maintenance-renovation.

New construction: This segment covers electrical installations in new residential, commercial and industrial buildings. Elements specific to this market include the installation of modern, efficient electrical systems, the integration of cutting-edge technologies such as home automation, advanced communication networks, electrical systems for the home and the building industry, as well as the development of new products and services.advanced communication networks, energy management systems, and electric vehicle charging infrastructures (***). New construction often requires solutions that comply with the latest safety and energy efficiency standards, as well as installations adapted to new connectivity and sustainability requirements.

Maintenance-renovation: This segment focuses on upgrading, repairing and modernizing existing electrical systems. Typical work includes bringing older installations up to current standards, replacing obsolete wiring, upgrading electrical distribution systems, and installing safety devices such as differential circuit breakers. In addition, renovation can incorporate solutions to improve energy efficiency, such as installing photovoltaic panels, modernizing lighting with LED solutions, and adding intelligent energy management systems.

Breakdown of electrical, plumbing and other installation sector sales by outlet France, ****, in Source: ****

In ****, the breakdown of sales in the electrical, plumbing and other installation sector in ...

2.2 The decline in the new-build market

In ****, companies in the construction sector face persistent challenges, particularly in new housing construction, affected by high prices and adjustments to government support schemes such as the end of the Pinel scheme and the refocusing of the PTZ. Non-residential construction is showing greater resilience, buoyed by the dynamism of e-commerce, growing tourism and public reindustrialization initiatives. Meanwhile, the existing housing market continues to show signs of slowing, influencing future activity in maintenance and improvement work.

Non-residential premises

Number of building permits for non-residential premises France, ****-*****, in millions of permits Source: ****

The number of non-residential premises under construction in France from **** to **** shows a variable trend, with relatively stable building permits but fluctuating housing starts and a gradual decline since ****. This dynamic indicates persistent challenges in bringing authorized projects to fruition, possibly reflecting economic and regulatory constraints affecting the non-residential construction sector.

Non-residential floor area under construction (***) France, **** - ****, in millions of square meters Source: Insee, Insee *first * months of ****, over ** sliding months

Non-residential floor area under construction (***) France, **** - ****, in millions of square meters Source: Insee, Insee *the term "non-residential premises" includes premises for public services or collective interest, transport, education-research, social action, special structureshealth, culture and leisure, hotel accommodation, ...

2.3 The maintenance-renovation market

Themaintenance-renovation segment is mainly underpinned by the demand for energy-efficiency improvement work. High energy prices (***). However, pressures on household purchasing power may limit their ability to pay for the remaining work.

Housing maintenance-renovation market France, ****-****, billions of euros Source: ****

The housing maintenance and renovation market recorded steady growth from **** to ****. Average annual growth rates for large-scale home improvement works and small-scale works are *.**% and *.**% respectively in terms of value.

It should be noted that this sector was one of the few to benefit from the health crisis, as part of the spending was redirected towards home improvements.

Growth in this sector is mainly due to the impact of inflation and rising prices in the industry, as well as new regulations encouraging private individuals to invest in renovating their homes.

Trend in sales of older homes France, ****-*****, by units sold **** : (***) Source: ****

Trends in the number of real estate transactions in the older housing segment have a direct influence on activity in the energy renovation sector. This is because, on a fairly regular basis, renovation work is undertaken following these sales.

Between **** and ****, we have observed continuous growth in the volume of sales of older homes, with an average increase of ...

2.4 Helping the French cope with energy renovation: the role of government incentives

What the French think and their fears about energy renovation

Energy renovation work carried out since January **** France, ****, %, %, %, %, %, %, %, %, %, %, %, % Source: ****

**% of homeowners have already carried out energy renovation work since January ****, while **% of homeowners have not yet undertaken such work, but intend to do so in the future.

Triggers for energy renovation work France, ****, % of total Source: ****

The main factor triggering energy renovation work is equipment failure, obsolescence or poor condition, which accounts for almost a third of cases. It should be noted that for the remaining **%, various reasons motivated the decision to undertake energy renovation work.

What are the main deterrents for homeowners to improve the energy performance of their homes? France, ****, % of homeowners Source: ****

The main reason most homeowners give for not improving the energy efficiency of their homes is the cost of the work, cited by **% of them, followed at a distance by the scope of the work, cited by **%.

What do you consider to be the most effective ways of encouraging homeowners to improve the energy performance of their homes? France, ****, % of respondents Source: ****

For **% and **% of French people respectively, the prospect of being able to deduct part of the cost of the work from their income ...

2.4 The smart grid in housing: the rise of the smart house

Smartgrids are "intelligent" electricity distribution networks that use information and computing technologies to optimize the production, distribution and consumption of electricity to improve energy efficiency.to optimize the production, distribution and consumption of electricity to improve energy efficiency.

The rise of smart grids in production facilities and homes represents a major opportunity for the electrical installation market. Smart houses and smart factories use advanced technologies to optimize energy management, integrating IoT devices and intelligent energy management systems. This enables more efficient and flexible consumption, supporting innovation and meeting growing needs for energy efficiency and sustainability.

Demand trends in home automation

Survey: Do you own any connected objects related to home automation? France, ****, in Source: ****

In ****, **% of those surveyed will own at least one connected object in their home, compared to **% in ****. Ownership of, and interest in, connected objects is higher among men, with **% already owning one and **% planning to use one, compared to women, where the figures are **% and **% respectively. This disparity reflects a wider issue of gender disparity in the adoption of new technologies, where access to and use of digital tools is often encouraged differently by gender from childhood onwards. The most significant gaps in ownership of connected objects ...

2.5 New demand trends in the electrical engineering market

Increasingly efficient solar panels

In terms of the number of installations, the French photovoltaic installed base is largely dominated by large-scale facilities (***).

France intends to accelerate the deployment of photovoltaic installations drastically in the coming years, increasing the number of new installations to * GW per year between **** and **** [***].

French photovoltaic installations by farm size France, Q* ****, in Source: ****

New installations in **** France, ****, in Source: ****

The solar photovoltaic market in France shows strong growth potential, with forecasts indicating * million self-consumers by ****, compared with ***,*** installations today, according to RTE (***). This expansion is being driven by rising electricity tariffs and growing demand for photovoltaic equipment from businesses, supermarkets and farms.

Innovations include bi-facial photovoltaic panels, which capture light from both sides, boosting efficiency. Hybrid solar panels produce both electricity and hot water, improving overall efficiency and limiting the risk of overheating. What's more, innovative micro-inverters make it possible to dispense with solar batteries and create autonomous mini power grids, operating even in the event of a power cut[***].

Electric vehicle charging infrastructure (***) Encouraged by the French government, the construction of electric vehicle charging infrastructures (***) in collective housing buildings, the installation of fast recharging stations at freeway service areas, and the improvement of territorial coverage. ...

3 Market structure

3.1 Value chain

3.2 Volume and geographical breakdown of companies and employees

The number of establishments in the electrical installation sector in France has increased from **,*** in **** to **,*** in ****, indicating steady growth. The number of salaried employees has also risen, from ***,*** in **** to ***,*** in ****, despite a slight drop in ****.

Number of companies in the electrical installation sector (***) France, ****-****, in units Source: ****

Number of employees in the electrical installation sector (***) France, ****-****, in units Source: ****

The regions stand out for their dynamism in the electrical installation sector: Ile-de-France dominates with *,*** companies and **,*** employees, followed by Auvergne-Rhône-Alpes with *,*** companies and **,*** employees. Occitanie and Nouvelle-Aquitaine also show a significant presence, with *,*** and *,*** companies respectively, reflecting a varied but concentrated distribution of electrical activity in France.

3.3 Trends in the electrical wholesale market

A market dominated by two electrical supplies giants: Rexel and Sonepar

The electrical supplies trading market is highly concentrated around the two groups Rexel and Sonepar, regularly resulting in more or less concerted pricing strategies.

In ****, Médiapart revealed that Schneider Electric, Legrand, Rexel and Sonepar were accused of having set up aprice cartel system, using"derogated price" mechanisms to keep prices high and limit competition. These practices, which were legal under certain conditions, enabled manufacturers to compensate distributors through credit balances, in exchange for maintaining high wholesale prices. Schneider and Legrand are said to have adopted these methods since the ****s and **** respectively, covering a significant proportion of their sales[***].

In ****, the FrenchCompetition Authority confirmed these accusations, again singling out Schneider, Legrand, Rexel and Sonepar for their system of derogated prices. The institution highlighted how these practices had affected pricing conditions in the electrical distribution sector, particularly on large construction sites, despite the apparent legality of these special contractual arrangements[***].

The strong bargaining power of these players therefore has a direct influence on the activity and pricing carried out by electricians, who are obliged to reflect this economic reality in the prices they charge.

The rise of online sales

Online ...

4 Offer analysis

4.1 Types of work that can be carried out

Heavy current

High-current installations encompass a wide range of services essential to the distribution and management of high-power electricity. These services include :

Low-voltage electrical installations: including the installation and maintenance of electrical systems in residential, commercial and industrial buildings. Site installations: Provide temporary solutions to power equipment and facilities on construction sites. lighting: Includes the installation of lighting systems for indoor and outdoor spaces, tailored to customers' specific needs. Machine power supply: Supplies power to industrial equipment and machinery in a variety of sectors.

Low voltage

Low-current installations focus on communication and control systems, essential for modern infrastructures and industrial environments. Main services include:

Industrial IT: Installation and maintenance of IT networks and systems in production environments. Voice Data Image (***) networks: Installation of communication networks integrating voice, data and images for commercial and residential applications. Automation: Installation of automated systems to improve efficiency and precision in various industrial processes. Instrumentation and Process: Integration of measurement and control devices to monitor and manage industrial processes.

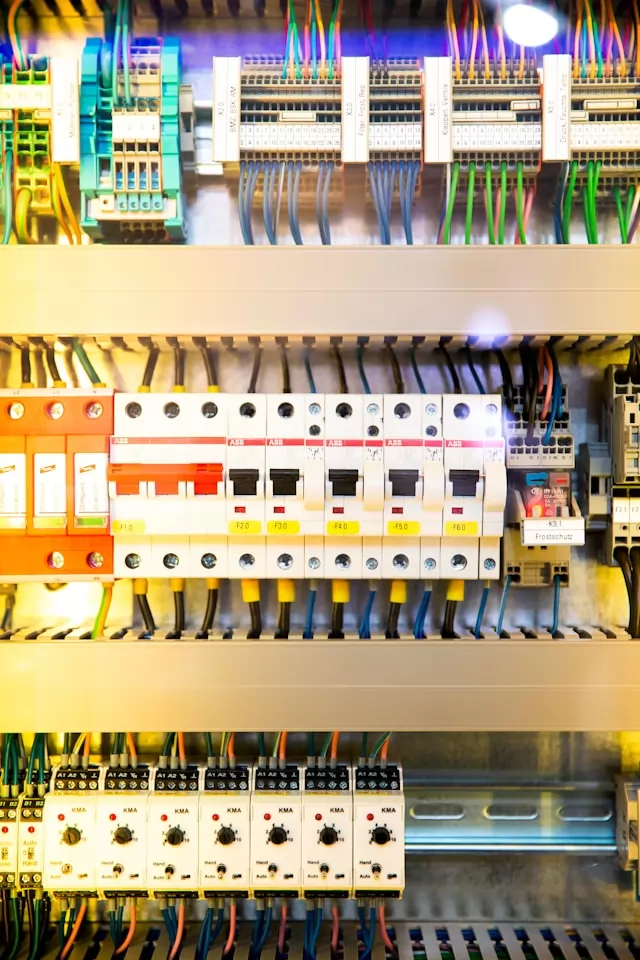

Electrical panels

Our wiring workshops specialize in the manufacture of custom-built switchboards to meet specific customer specifications. These panels can be produced in the customer's brand of choice and include:

Wired panelboards: Design and manufacture of customized ...

4.2 Electrical installation prices

New electrical installation prices by type of dwelling[***] [Travaux.com

Every electrical installation must include :

An electrical panel, An adequate length of cable to carry electricity to all premises, Switches, A ground connection.

Prices for individual new electrical installation work[***]

Prices for renovation work[***]

4.3 Rising raw materials costs

Copper plays a crucial role in electrical installations thanks to its superior electrical and mechanical properties. As a first-rate electrical conductor, copper offers exceptional conductivity, facilitating efficient transfer of electricity while minimizing energy losses. Its malleability makes it easy to shape and install in a variety of electrical equipment and cables. What's more, copper is corrosion-resistant, ensuring the long-term durability of electrical networks. However, variations in copper prices can have a direct impact on the cost of electrical installation projects, affecting construction and renovation budgets.

Production price index for copper metallurgy France, ****-**** Source: ****

Data on theproduction price index for copper metallurgy in France between **** and **** show a fluctuating trend, rising from ***.* in January **** to ***.* in October ****, with a slight drop thereafter to stabilize at around ***.* in early ****. These figures reflect the volatility of copper prices, influenced by various economic and industrial factors.

At the same time, according to a recent article, growing demand for copper is being driven by China's industrial recovery and increased needs in the energy transition, as well as by the anticipated rise of artificial intelligence. This trend could potentially push prices up to $**,*** per tonne by ****, underlining the growing importance of this metal in various economic ...

5 Regulations

5.1 Regulatory framework

Provisions relating to the safety of electrical installations in new buildings are set out in article R ***-** of the French Construction and Housing Code. Their application is defined by thedecree of October **, ****, which requires electrical installations in new buildings to comply with standards NF C **-*** and NF C **-*** in force at the time of construction.

Before being energized by an electricity distributor, new or completely renovated installations must obtain a certificate of compliance with the safety requirements imposed by the regulations in force. This obligation, introduced by the Decree of December **, **** and extended to renovated installations by Decree no.****-*** of March *, ****, requires that the certificate of compliance, drawn up and signed by the person carrying out the work, be endorsed by an approved body.

Order of August *, ****

For new homes for which the building permit has been submitted since September *, ****, the order of August *, **** requires at least two RJ**-type communication sockets depending on the number of rooms: * sockets in a T*, * sockets in a T*, and * sockets in a T* or more. Each RJ** socket must be connected to the communications panel by twisted-pair cables in a star configuration.

To be connected to the network, a ...

6 Positioning the players

6.1 Positioning the players

- Dalkia

- SPIE

- Bouygues Energie et Service (Equans)

- Eiffage Énergie Systèmes

- Snef

- Fauché Groupe

- RTE France

- Câblerie Daumesnil

- Abv

- Acal Bfi France

- Accunord

- Acheternet

- Activite Composants Distribution Service (Acds)

- Aerodis

- Ais Elec

- Aisfr (Aswo International Services France)

- Akuo Energy

- Akuo Energy Maintenance

- Alantys Technology

- Alarme Video Systemes

- Albioma

- Albioma Bois Rouge (Abr)

- Albioma Galion (Ag)

- Albioma Le Gol (Alg)

- Albioma Le Moule (Alm)

- Albioma Saint Pierre (As P)

- Allegro Microsystems France

- Alpiq Energie France

- Alpiq Solutions France

- Alsen

- Alterna Energie

- Altus Energy

- Amarenco Construction

- Amica (Entreprise Amica)

- Ams Technologies

- Apex Energies

- Application Electromécanique (Aem)

- Application Generale Mecanique Electrique (Egme)

- Aquitaine Power Newco

- Aquitaine Service Electrique

- Ardeche Applications Techniques D'Electricite Et De Mesures (Ardatem)

- Arrow France

- Arva Rf

- Asco Energie

- Aserti Electronic

- Aston Technologies

- At Bordelais Construct Electr (Abcd)

- Atelier Bobinage Chablais (Abc)

- Atelier Bobinage Electrique Soulas

- Ateliers De Bobinage De Pierrelaye

- Atoo Electronics

- Avenir Electrique De Limoges (Ael)

- Avnet Emg France

- Axpo France

- Azur Vinicole

- Bachmann

- Barillec

- Beauce Energie

- Best'R Developpements

- Beta Renewables France

- Bio Cogelyo Normandie

- Biofely

- Biomass Energy Solutions

- Biomasse Energie De Commentry

- Boralex Energie Verte

- Borelec

- Bouygues Energies & Services

- Bsav

- Btb Génie Electrique & Services (Btb G E S)

- Cegelec Bordeaux

- Cegelec Défense

- Cegelec Dauphiné

- Cegelec Elmo

- Cegelec Haute Normandie

- Cegelec Industrie Sud Est

- Cegelec Infra Bassin De Loire

- Cegelec Loire Océan

- Cegelec Maintenance Tertiaire Sud Est

- Cegelec Missenard

- Cegelec Mobility

- Cegelec Nord Industrie

- Cegelec Oil & Gas

- Cegelec Paris

- Cegelec Pau

- Cegelec Portes De Bretagne

- Cegelec Renewable Energies

- Cegelec Tertiaire Ile De France

- Cegelec Toulouse

- Celion

- Ceme (Cie Entreprise Mecanique Electriqu)

- Ceme Guerin

- Centrale Photovoltaique De Crucey 1

- Centrale Photovoltaique De Toul Rosieres 1

- Cesa

- Cg3N

- Chargeurs Batteries Services (Cbs)

- Cide Elec

- Cigma Ile De France

- Clemancon

- Clf

- Cli

- Cn'Air

- Cnr (Cie Nationale Du Rhone)

- Cogénération Biomasse D'Estrées Mons

- Cogénération Tavaux

- Cogelyo Nord Est

- Cogelyo Ouest

- Cogestar

- Cogestar 2

- Cogestar 3

- Comax France

- Comptel

- Conect

- Coopérative Electrique De Saint Martin De Londres (Cesml)

- Cote

- Courants Elect Forts Et Faible (Ceff)

- Creil Energie

- Dalkia Biomasse Angers

- Dalkia Biomasse Rennes

- Dalkia Electrotechnics Fab

- Dalkia Electrotechnics Ig

- Dalkia En

- Dalkia Froid Solutions

- Dalkia Smart Building

- Decima (Entreprise Decima)

- Derichebourg Energie Ep

- Dietsmann Technologies

- Dm Services

- Dossot

- Eao France

- Ebv Elektronik

- Eco Soley Hibiscus

- Ecomal France

- Edenkia

- Edf (Electricite De France)

- Edf Enr

- Edf Production Electrique Insulaire (Edf Pei)

- Edf Renouvelables Services

- Egm Wind

- Eiffage Energie Systèmes Alsace Franche Comte (Ees - Afc)

- Eiffage Energie Systèmes Aquitaine (Ees - Aq)

- Eiffage Energie Systèmes Basse Normandie (Ees - Bn)

- Eiffage Energie Systèmes Bourgogne Champagne (Ees - Bc)

- Eiffage Energie Systèmes Centre Loire (Ees - Cl)

- Eiffage Energie Systèmes Clemessy (Ees - Clemessy)

- Eiffage Energie Systèmes Clevia Normandie (Ees - Cln)

- Eiffage Energie Systèmes Fontanie (Ees - Fontanie)

- Eiffage Energie Systèmes Ile De France (Ees - Idf)

- Eiffage Energie Systèmes Indus Nord

- Eiffage Energie Systèmes Infra Loire Auvergne (Ees - Infra La)

- Eiffage Energie Systèmes Infra Nord

- Eiffage Energie Systèmes Infra Rhone Alpes (Ees - Infra Ra)

- Eiffage Energie Systèmes It Loire Auvergne (Ees - It La)

- Eiffage Energie Systèmes It Rhone Alpes (Ees - It Ra)

- Eiffage Energie Systèmes Loire Océan (Ees-Lo)

- Eiffage Energie Systèmes Lorraine Marne Ardennes (Ees-Lma)

- Eiffage Energie Systèmes Maine Bretagne (Ees - Mb)

- Eiffage Energie Systèmes Mediterranee (Ees - Mediterranee)

- Eiffage Energie Systèmes Nord

- Eiffage Energie Systèmes Poitou Charentes (Ees - Pc)

- Eiffage Energie Systèmes Quercy Rouergue Gevaudan (Ees - Qrg)

- Eiffage Energie Systèmes Régions France (Ees - Rf)

- Eiffage Energie Systèmes Services

- Eiffage Energie Systèmes Sud Ouest (Ees - So)

- Eiffage Energie Systèmes Transport & Distribution (Ees - T&D)

- Eiffage Energie Systèmes Val De Loire (Ees - Vl)

- Eiffage Energie Systemes Clemessy Motors (Ees-Clemessy Motors)

- Eiffage Energie Systemes Emcs Nord (Ees Emcs Nord)

- Eiffage Global Services (Egs)

- Electricité Chauffage Climatisation Sanitaire (Eccs)

- Electricité De Savoie

- Electricité De Strasbourg

- Electricité Générale Appliquée (Ega)

- Electricité Gay

- Electricité Industrielle De L'Est (Eie)

- Electricité Travaux Techniques (Ett)

- Electricite Mecanique Automatique (Elmecau)

- Electro Reparations Air Services

- Elios

- Emalec

- Emasolar

- Emge Sud Ouest

- Enalp

- Enedis

- Enercon Service France Nord

- Enercoop

- Energelec

- Energem

- Energie Développement Services Du Brianconnais (Edsb)

- Energie Et Services De Seyssel

- Energies Services Lannemezan

- Energies Services Occitans (Ene'O)

- Energies Strasbourg

- Energilec

- Energy Pool Développement

- Enerlis

- Enersteel

- Engie

- Engie Green France

- Engie Pv Curbans

- Engie Renouvelables

- Engie Thermique France

- Eni Gas & Power France

- Entreprise Bodin

- Envitec Biogas France

- Equipement Electrique

- Equipements Scientifiques

- Ere (Entreprise Redonnaise D'Electricite)

- Erelia Haute Marne

- Eris (Sté D'Etudes Et De Realisation D'Installations De Securite)

- Es Biomasse

- Eso Idf Normandie

- Eso Nord Est (Sorem)

- Eso Ouest

- Eso Sud Ouest

- Etablissements Chain

- Etablissements Roulin Pere Et Fils

- Ets De Reseaux Et Sources (Ers)

- Ets Gressier Et Fils

- Ets Jean Graniou

- Ets R Legrand

- Euris

- Eurocomposant

- Euromip

- Eurosatcom Vsatech Associe

- Exeltium

- Fantronic Composants

- Farnell France

- Fauché Centre Est

- Fayat Power

- Figenal Snc

- First Industries

- Fixations Location Services

- Flashelec

- Fonroche Energies Renouvelables

- Fouassin

- Fournie Grospaud Energie

- Fournie Grospaud Synerys

- Future Electronics

- Garage Du Raizet

- Gazelenergie Generation (Snet)

- Gazelenergie Solutions

- Gedia Energies & Services

- Geemarc Telecom

- Geg (Gaz Et Electricite De Grenoble)

- Geg Source D'Energies

- General Hybrid France

- Genindus Enernov

- Gennevilliers Energie

- Geredis Deux Sèvres

- Grand Paris Sud Energie Positive

- Greenalp

- Greenyellow

- Groupe Emile Dufour (Ged)

- Groupe Enki

- Holdelec

- Hybrico International

- Iberdrola Energie France

- Icape International Consulting Activites For Printed Circuit Boards And Electronics

- Idem Emi (Injection Diesel Electricite Maintenance Et Electro Mecanique Industries)

- Idex Territoires (Sinerg)

- Ims Securite Com

- Induselec

- Industheo

- Ineo Aquitaine

- Ineo Atlantique

- Ineo Centre (Seee)

- Ineo Hauts De France

- Ineo Industrie Et Services Idf

- Ineo Industrie & Tertiaire Est (Ineo Ite)

- Ineo Mplr (Ineo Midi Pyrenees Languedoc Roussillon Et Par Abreviation Ineo Mplr)

- Ineo Normandie

- Ineo Nucléaire

- Ineo Postes Et Centrales

- Ineo Provence Et Côte D'Azur

- Ineo Réseaux Est

- Ineo Rhône Alpes Auvergne

- Ineo Systrans

- Ingeteam

- Installations Depannages Entretiens Electriques (Idee)

- Integral Europe

- Integral Système

- Ipsos Electric

- Isdel Energy

- Isotrading

- Jeumont Electric

- Jmd

- Jst Maintenance

- Jst Transformateurs

- Jura Electromecanique

- Katpol Industrie

- Kogeban

- M Electronique

- M'Gys

- Madis Provence

- Maine Bobinage

- Marelec

- Matlog

- Mecavea

- Medikalia

- Mereso

- Mersen France Amiens

- Mersen France Sb

- Mi Electronics

- Mire

- Mk Energies

- Monnier

- Motralec

- Périgord Energie

- Palladiam Electronique

- Parc D'Energies Renouvelables Catalan

- Parc Eolien De La Champagne Picarde

- Parc Eolien De La Montagne Ardéchoise

- Parc Eolien De Salles Curan

- Pei Genesis France

- Perfect Wind

- Phibor Ets

- Pole Moteurs Industriels

- Positif

- Primeo Energie Grands Comptes

- Primeo Energie Solutions

- Proxelia

- Pulse Mc2

- S Inter

- Sanolec

- Santerne Ile De France

- Santerne Nord Tertiaire

- Scetec (Sté Cooperative D'Entretien Thermique Electrique Conditionnement)

- Scicae Est

- Sdel Elexa

- Sdel Tertiaire

- Seinergie

- Selia

- Semeru

- Seolis

- Services D'Equipements Electromecaniques (Seelec)

- Sethelec

- Seves

- Shb Electric

- Shem (Sté Hydro Electrique Du Midi)

- Sica Electricité Aisne (Sicae De L'Aisne)

- Sicae Oise

- Sie (Sté Industrielle D'Electricite)

- Sirbem (Sté D'Interventions Et Realisations En Bobinage Electricite Et Mecanique)

- Sloveg (Sté De Location Video Et D'Electricite Generale)

- Snc Cogelyo Ile De France

- Sncf Energie

- Snee

- Snef

- Snef Electro Mecanique (Sem)

- Sodel

- Solewa

- Solvay Energie France

- Solvay Energy Services

- Sorec

- Soregies

- Soteb (Sté De Travaux Electriques Du Bugey)

- Sovec Entreprises

- Sowee

- Spe Maintenance

- Spie Batignolles Energie Grand Sud (Sbe Grand Sud)

- Spie Building Solutions (Spie Industrie & Tertiaire)

- Spie Facilities

- Spie Nucléaire

- Srd

- Sté Auxiliaire De Constructions Electriques (Sacel)

- Sté D'Electrotechnique Et D'Electronique Appliquee (Seea)

- Sté D'Electrotechnique Industrielle Et De Bobinage

- Sté De Distribution De Chaleur Du Mont Gaillard

- Sté Des Régies De L'Arc (Sorea)

- Sté Fecampoise D'Ets Electriques (Sfee)

- Sté Hydraulique Etudes Missions Assistance (Shema)

- Sté Landaise De Travaux Electriques (Slte)

- Sté Publique Locale Chartres Métropole Energies (Spl Cme)

- Sté Rennaise D'Electronique & Composants (Sorelec)

- Sté Toulousaine De Bobinage (Stb)

- Sté Valmy Defense 38 En Abrege Svd 38

- St1É De La Somme Et Du Cambraisis

- Stab

- Steam France

- Steliau Technology

- Stpee (Stpee Soc Travaux Publics Entr Elec Scop)

- Strasbourg Electricité Réseaux

- Sunzil Services Caraibes

- Sve

- Synelva

- Synelva Collectivités

- Taranis Commodities

- Taranis Du Rouvray

- Tdk Electronics France

- Technologie Electronique Commerce Intern (Teci)

- Telegartner France

- Tellier Gouvion Electricite

- Terideal Segex Energies

- Terralis

- Total Eren

- Totalenergies Centrale Electrique Bayet

- Totalenergies Centrale Electrique Pont Sur Sambre

- Totalenergies Centrale Electrique Toul

- Totalenergies Marketing Services

- Totalenergies Renewables

- Transformateurs Solutions Venissieux Tsv

- Travaux Electriques Du Sud Ouest Telso

- Triangle Horizon

- Uem

- Westendorp

All our studies are available online in PDF format

Take a look at an example of our research on another market!

Choosing this study means :

Choosing this study means :

Access to more than 35 hours of work

Our studies are the result of over 35 hours of research and analysis. Using our studies allows you to devote more time and added value to your projects.

Benefit from 6 years' experience and over 1,500 industry reports already produced

Our expertise enables us to produce comprehensive studies in all sectors, including niche and emerging markets.

Our know-how and methodology enable us to produce reports that offer unique value for money.

Access to several thousand articles and paid-for data

Businesscoot has access to all the paid economic press as well as exclusive databases to carry out its market research (over 30,000 articles and private sources).

To enhance our research, our analysts also use web indicators (semrush, trends, etc.) to identify market trends and company strategies. (Consult our paying sources)

Guaranteed support after your purchase

A team dedicated to after-sales service, to guarantee you a high level of satisfaction. +44 238 097 0676

A digital format designed for our users

Not only do you have access to a PDF, but also to a digital version designed for our customers. This version gives you access to sources, data in Excel format and graphics. The content of the study can therefore be easily retrieved and adapted for your specific needs.

Our offers :

Our offers :

the market for electrical installation work | France

- What are the figures on the size and growth of the market?

- What is driving the growth of the market and its evolution?

- What is the positioning of companies in the value chain?

- Data from several dozen databases

Pack 5 études (-25%) France

- 5 études au prix de 74 €HT par étude à choisir parmi nos 1200 titres sur le catalogue

- Conservez -25% sur les études supplémentaires achetées

- Choisissez le remboursement des crédits non consommés au terme des 12 mois (durée du pack)

Consultez notre catalogue d’études sectorielles