Market overview

1.1 Definition and scope of study

The subject of retirement and employee savings is increasingly topical in French society, driven in particular by the aging population and forthcoming reforms.

The retirement and employee savings market can be divided into 3 segments:

- retirement savings

- employee savings plans

- life insurance.

However, this study does not cover the life insurance segment, which is characterized by completely different logics and players. The scope of the study is therefore that of retirement and employee savings.

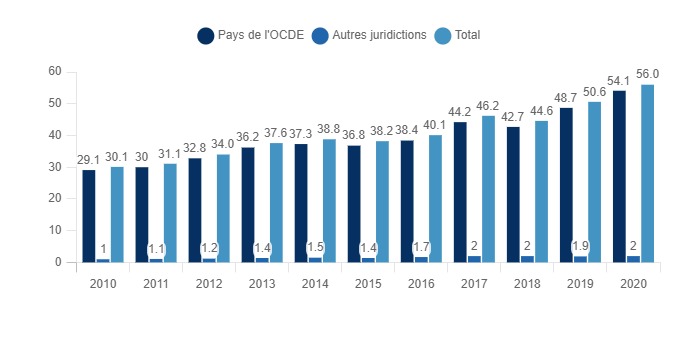

Globally, the retirement savings market is growing rapidly. between 2010 and 2020, assets under management rose by 86%. This rise is the result of an increase in the proportion of people covered by a pension plan worldwide, coupled with higher contribution rates in certain countries.

On a national level, outstandings in the retirement savings market have increased by 66% over the last decade. On the employee savings side, assets under management increased by 13.7% in 2021 compared with the previous year. The aging of the population and the French people's desire to save are driving growth in this market. In addition, demand is increasingly moving towards more responsible savings, particularly in environmental terms.

The national market was recently strongly impacted by the Pacte law, adopted and applied since 2019, which notably opened up asset management to competition, and harmonized the supplementary pension system with the introduction of a single product (the PER).

The main players in the retirement and employee savings market are insurers (AXA, Amundi, Natixis) and banking groups (Crédit Agricole, BNP Paribas). However, the latter are facing increasing competition from pure playerssuch as Yomoni and Ramify.

1.2 The global market

Pension systems differ widely from country to country, making it difficult to estimate the size of the global retirement and employee savings market. However, it is possible to observe the pension market as a whole.

for example, the total amount of retirement pensions worldwide reached 56 trillion US dollars in 2020. Between 2010 and 2020, the amount of assets increased by 86%. We can also note that the 38 OECD member countries account for the vast majority of retirement savings plan assets (96% in 2020).

Total retirement savings plan assets in OECD and other jurisdictions*, 2010-2020

World, 2010 - 2020, in trillions of USD

Source: OECD

*other jurisdictions includes all countries worldwide for which data is available

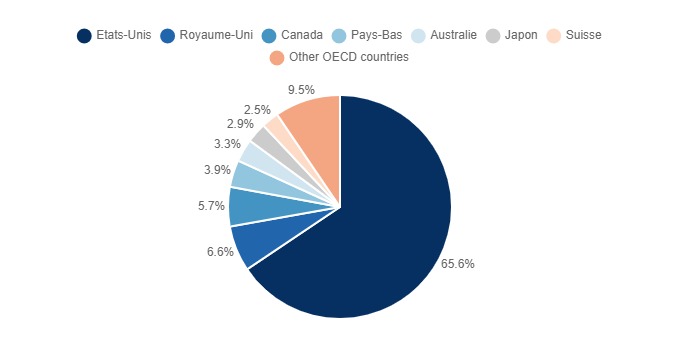

The United States largely dominates the global pension market (65.6% of assets). The UK (6.6%) and Canada (5.7%) complete the podium. Next come the Netherlands (3.9%) and Australia (3.3%).

Geographical distribution of pension assets in the OECD zone

OECD zone, 2020, % of total

According to the OECD, the significant growth in assets recorded in recent years is largely the result of an increase in the proportion of people covered by a pension plan worldwide.this increase in coverage has been particularly strong in countries with relatively recent mandatory pension schemes or automatic enrolment programs. What's more, in some countries, this increase has gone hand in hand with a rise in contribution rates, which explains the rise in assets.

1.3 The French market

retirement savings

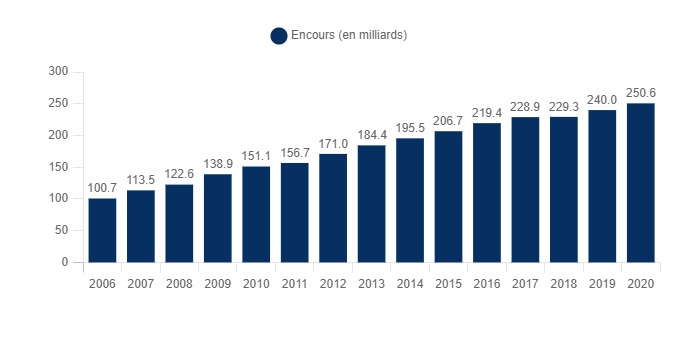

According to the DRESS (Direction de la recherche, des études, de l'évaluation et des statistiques) 2022 report, retirement savings supplement outstandings reached 250.6 billion euros at December 31, 2020. In 10 years, between 2010 and 2020, outstandings have increased by 66%. In 2020, 10.6 billion euros will have been collected.

Evolution of retirement savings supplements outstanding

France, 2006 - 2020, in billions of euros

employee savings

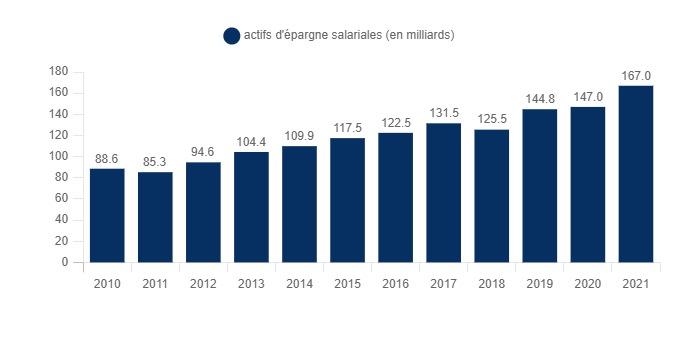

On the employee savings side, assets under management by employee savingss reached

167 billion euros at December 31, 2021, an increase of 20 billion over the previous year (up 13.6%). In particular, it is the application of the Pacte law (adopted in 2019 by Parliament) that is driving growth in this market. [

APG]

Evolution of employee savings assets

France, 2010 - 2021, in billions of euros

Demand analysis

2.1 The French and savings

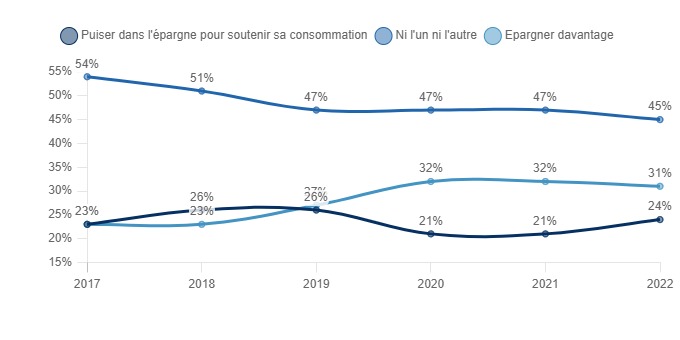

In addition, it's interesting to observe the savings intentions of the French. Between 2017 and 2022, the proportion of French people who intend to save more increased by 8 points, from 23% to 31%. It was in 2020, at the height of the pandemic, that the intention to save increased the most (+6 points in one year), reaching its peak (32%), a sign that the uncertainty created by the health crisis is driving the French people's willingness to save. At the same time, the intention to dip into savings decreased in 2020, and increased again in 2022. it should be noted, however, that the survey was carried out in February 2022, i.e. before the start of the invasion of Ukraine and the ensuing economic repercussions. The 2022 data therefore do not necessarily accurately reflect current French savings intentions.

Change in French savings intentions

France, 2017 - 2022, in

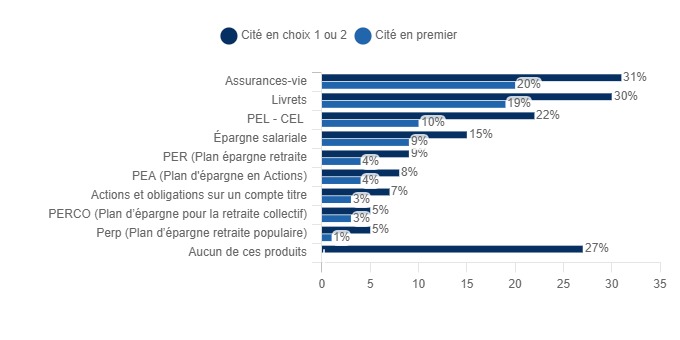

According to the French, the best savings products (cited first) are life insurance (20%) and passbooks (A / LDD / popular savings passbooks / youth passbooks) (19%). Next come PEL - CEL (10%) and employee savings (9%). The following chart shows that, unlike employee savings plans, the various retirement products (PER, PERCO, Perp) are not considered the best savings products, and this is holding back growth in this segment.

The best savings products according to the French (2 possible choices)

France, 2022, in

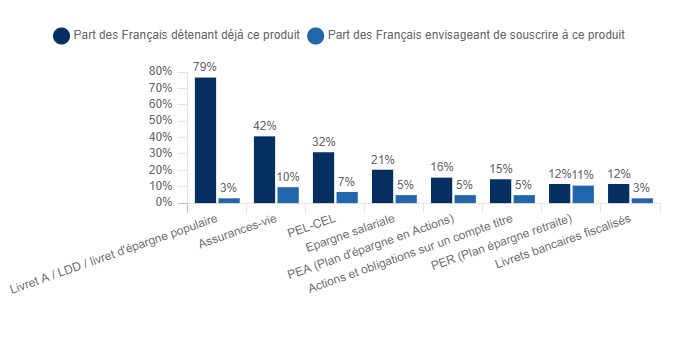

The following graph shows that in 2022, employee savings products and PER (Plan épargne retraite) are held by only 21% and 12% of respondents respectively, far behind the various passbooks and life insurance. However, 11% of respondents plan to subscribe to a PER, more than life insurance, which is the second most popular product. However, this high proportion is explained by the fact that it is no longer possible to subscribe to the following products - PERP (Plan d'épargne populaire), PERCO (Plan d'épargne pour la retraite collectif), Contrats Madelin, - since the reform of the Pacte law (cf.5.1). As for employee savings plans, 5% are considering subscribing to them.

Savings products for which the French plan to subscribe | Savings products already held

France, 2022, in

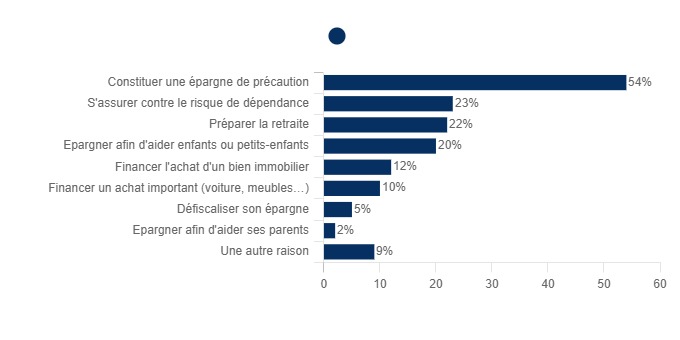

The main reasons why the French want to take out a savings product are to build up precautionary savings (54%) and to insure against the risk of dependency (23%). Preparing for retirement (22%) completes the podium, showing that the French also use other products to save for their retirement than dedicated products (PER held by only 12% of people, see chart above).

Reasons for holding a savings product (2 answers possible)

France, 2022, in

Focus on retirement savings

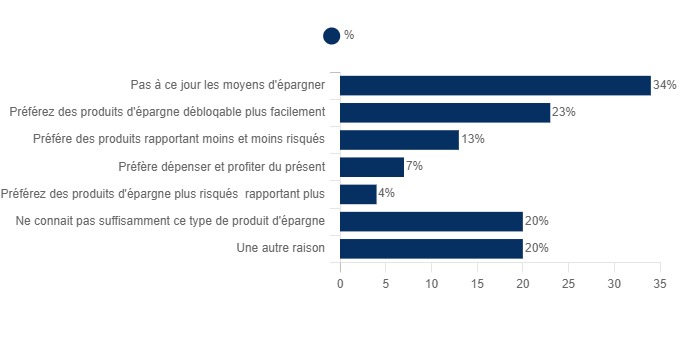

Among French people who don't have a retirement savings product and don't plan to take one, the three main obstacles are lack of funds to save (34%), preference for savings products that are easier to unlock, and lack of information on this type of savings product. This last point could be a particularly relevant area of action for industry players, since it is the major obstacle that is easiest to influence, by communicating better and more about the retirement savings product, for example.

Reasons for not having a retirement savings product (2 answers possible)

France, 2022, in

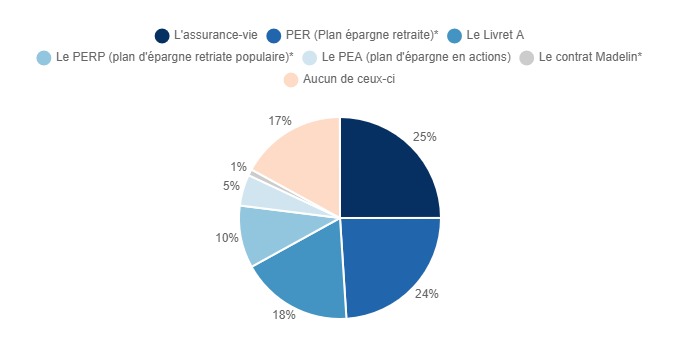

According to the survey's non-retired respondents,the main retirement savings product is life insurance. However, they were 50% to think so in 2017, compared with just 25% in 2022. In addition, the graph below shows thatproducts specifically dedicated to retirement savings are facing strong competition from other products in the preparation of French people's retirement savings. Among all respondents, the proportion who are not at all familiar with this savings product will rise to 52% in 2022.

The best retirement savings product according to non-retired French people

France, 2022, in

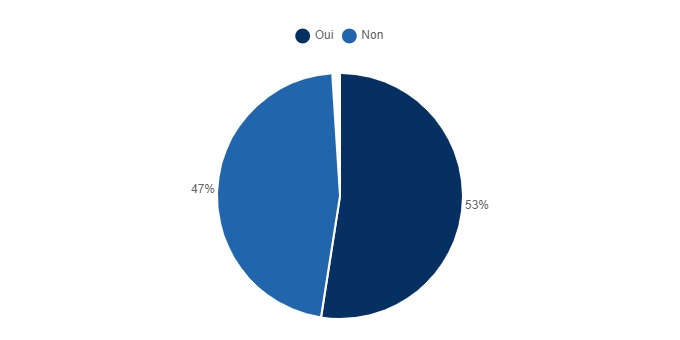

Proof of the French people's lack of knowledge about retirement savings is provided by the proportion of savers surveyed with a PERP, a Madelin contract or a PERCO (3 products replaceds since 2019 and the Pacte law by the PER) not knowing that these products have been abolished is 47%, or nearly half. However, this proportion has fallen compared with 2021, when 62% were unaware of the withdrawal.

Level of awareness of the abolition of PERP, PERCO or Madelin contracts (Among French people holding these products)

France, 2022, in

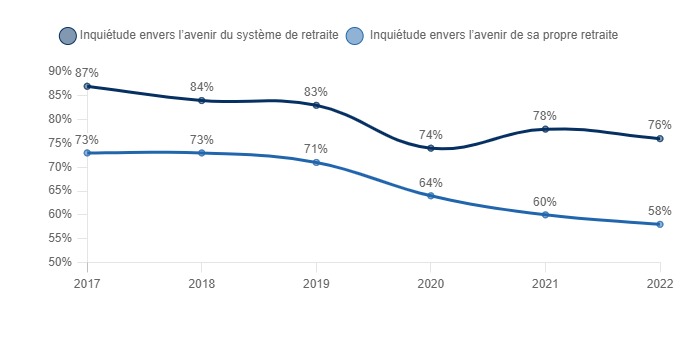

The future of the retirement system and the future of one's own retirement is a source of concern for the majority of French people, with 76% and 58% respectively worrying about it. Nevertheless, it is interesting to note on the graph below that these proportions have largely decreased since 2017

Worry about the future of the retirement system | Worry about the future of one's own retirement

France, 2017 - 2022

Furthermore, according to the future retirees questioned in this survey, the average age at which to start preparing for retirement from a financial point of view is 42.

2.2 Determinants of demand for retirement savings

Retirement savings in France are optional, unlike the compulsory basic and supplementary pension schemes. Retirement savings correspond to what is known as supplementary retirement. [cadreemploi].

- Share of supplementary pensions in total pension schemes (mandatory and optional) :

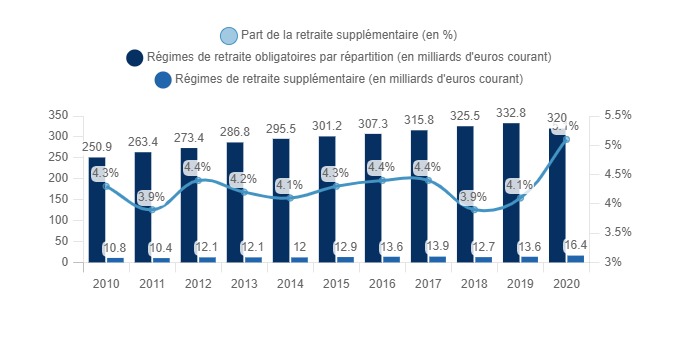

The chart below shows the share of supplementary pensions in total pension contributions. Over the past decade, this share has varied between 3.9% (2011 and 2018) and 5. 1% (2020).

In addition, we can note that, like contributions to mandatory pension schemes, contribution payments for supplementary retirement have been growing structurally over the past ten years (+52% between 2010 and 2020). This growth is particularly strong in 2020 (+21% compared with 2019).

Share of supplementary pensions in total pension plans

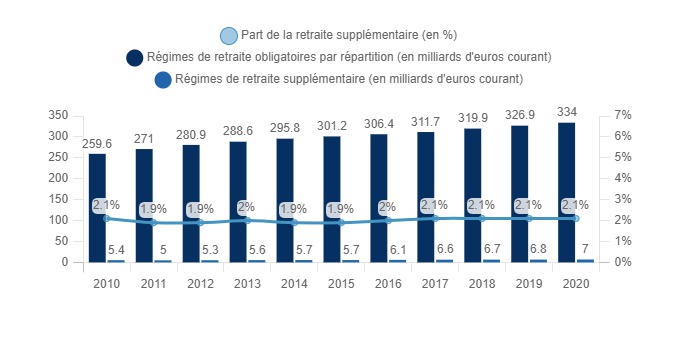

in terms of pension benefits paid out, the share of supplementary pensions in total pension schemes is lower, and fluctuates less (between 1.9% and 2.1% over the last decade).

Share of supplementary pensions in total pension benefits paid

France, 2010-2020, in billions of current euros and as a %

Breakdown of supplementary pension products

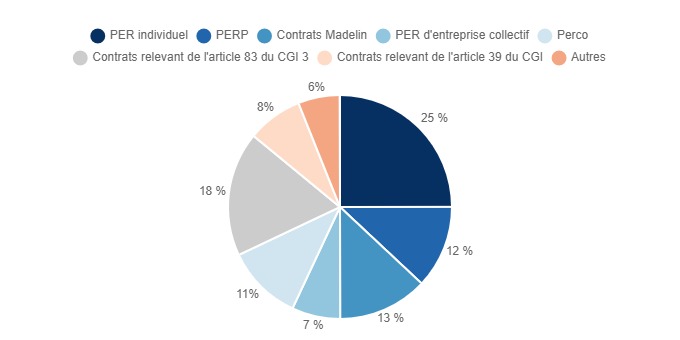

The following chart shows the breakdown of contributions by product type. 52% of contributions are made to individual products (individual PER, PERP, Madelin, etc.), compared with 48% to group products. Moreover, the individual PER is the leading individual savings product (25% of contributions).

Breakdown of different products in total supplementary retirement savings

France, 2020, in

it should be noted that the PERCO is not a retirement insurance contract, but an employee savings scheme. However, it is included in the graphs above and below, as it is included in the DREES perimeter for the various calculations relating to supplementary pensions.

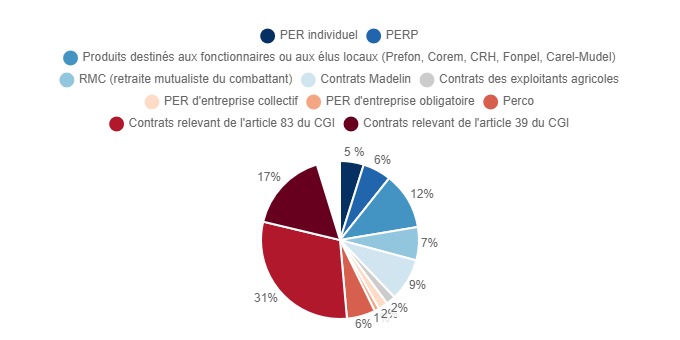

The trend is reversed for benefits, however, with individual PERs accounting for just 5% of the total in 2020, and group products (contrats 83 and contrats 39) accounting for the largest share. This disparity is explained by the shift in the model towards the

PER, a plan available since October 1, 2019, which is gradually replacing other retirement savings plans. [

Service-Public]

Breakdown of different products in total supplementary pension benefits

France, 2020, in

Focus on PER

The Pacte law introduced the PER (Plan épargne Retraite), a new savings scheme to be marketed from October 2019. This product combines and replaces previous schemes (Perco, Perp...).

Since its introduction, the number of PER policyholders has been rising steadily. Between October 2021 and June 2022, the number of policyholders rose by 41%.

Growth in the number of PERs in France

France, October 2021 - June 2022, in millions of PERs

the evolution of the PER is either the consequence of the opening of this product for the first time, or the effect of the transfer of a former scheme (Perp, Medelin...) to this one. In April 2022, 108,000 new PERs were created, for 13,600 transfers.

At the end of June 2022, total PER assets stood at 41.4 billion euros .

2.3 Determinants of demand for employee savings plans

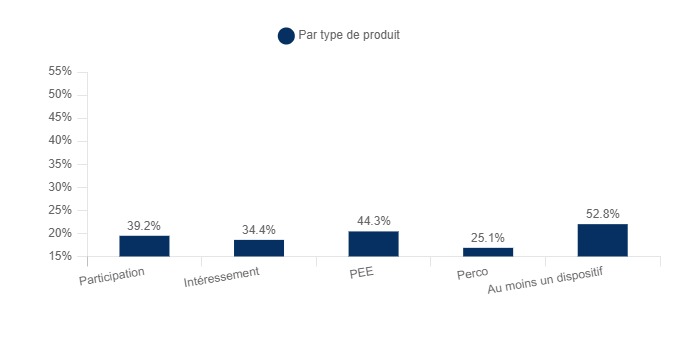

There are several employee savings schemes: profit-sharing, incentive schemes, PEE and Perco. According to the Dares report of April 2022, 52.8% of employees had access to at least one profit-sharing, incentive or employee savings scheme in 2020. The following graph shows that PEE (access for 44.3% of employees) and participation (39.2%) are more common than intéressement (34.4%) and Perco (25.1%).

Percentage of employees with access to a profit-sharing, incentive or employee savings scheme

France, 2020, in

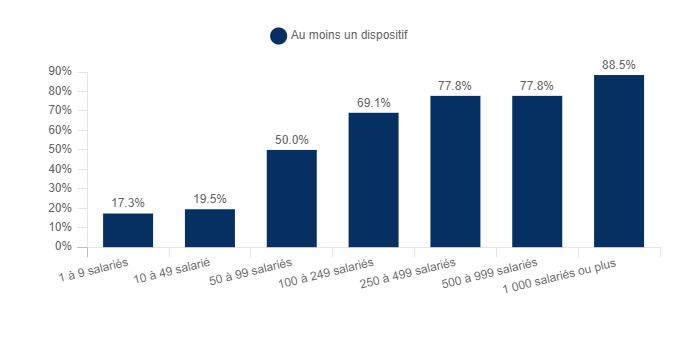

However, access to these employee savings schemes varies greatly according to company size. Indeed, the more employees a company has, the higher the proportion of employees with access to these schemes:

Percentage of employees with access to a profit-sharing, incentive or employee savings scheme, by company size

France, 2020, in

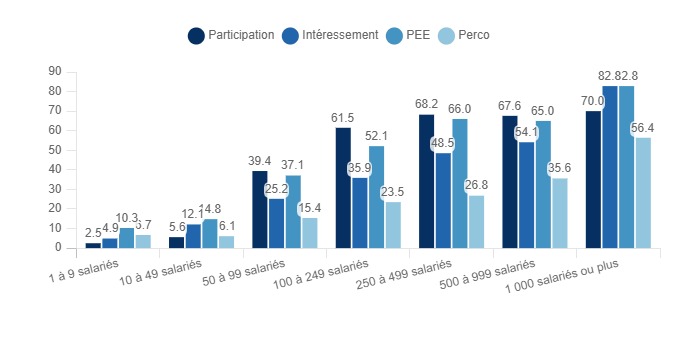

When we look in detail at the schemes on offer, we can see that they differ according to company size. For example, while companies with fewer than 49 employees are more likely to offer a company savings plan (PEE), companies with between 50 and 999 employees are more likely to offer a profit-sharing scheme.

Percentage of employees with access to a profit-sharing, incentive or employee savings scheme

France, 2020, in

2.4 Macroeconomic factors

Inflation trends can have an impact on the retirement and employee savings market, as they directly influence households' purchasing power and their ability or willingness to save (see below).

Inflation, which between 2010 and 2012 was contained below or barely above 2%

(the European Central Bank's target), exploded in 2022 following the war in Ukraine. Indeed, in September 2022, compared with September 2021,

inflation rose by 5.6% .

Inflation trend

France, 2010 - 2022, in

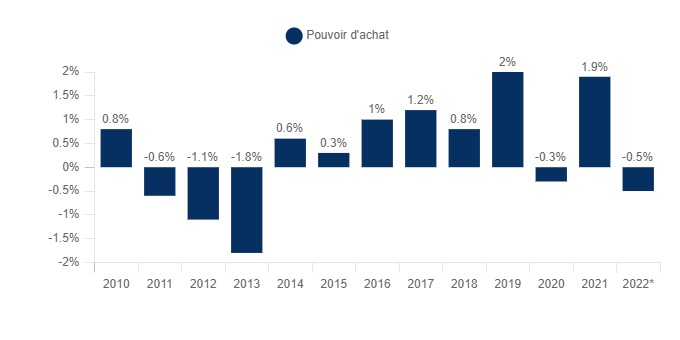

Nevertheless, according to INSEE's latest economic note at the time of writing, purchasing power is expected to fall by just 0.5% in 2022 (estimates made in September 2022). This relatively small drop, given the current deteriorated economic situation, can be explained by several public actions in favor of purchasing power (revaluation of the Smic, the civil service index point, various social benefits, the reduction in tax and social security contributions in the last quarter, etc.)[Capital]

Change in purchasing power per consumption unit

France, 2010 - 2022, in % (change versus previous year)

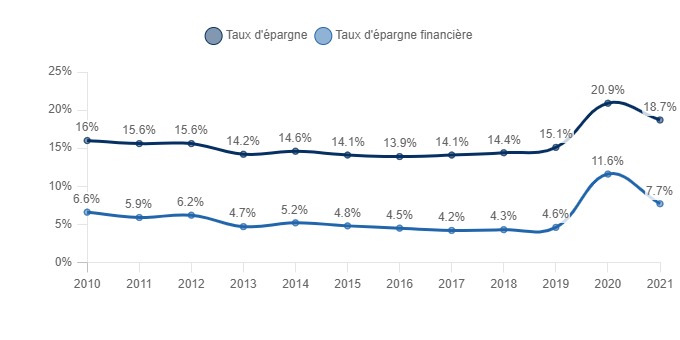

The following graph shows that the covid-19 pandemic has had a positive impact on household savings in 2020, which may be the consequence of the uncertainty generated by the health crisis. Despite a drop in the French savings rate in 2021, it remains higher than pre-pandemic levels. Furthermore, the year 2022, with its turbulent economic situation following the war in Ukraine, could have an impact on the savings rate in either direction. Indeed, the uncertainty linked to this crisis could lead households to save more in anticipation, but inflation could force them to consume more, which could influence their savings.

Household savings rate

France, 2010 - 2022*, as % of GDP

N.B.: "The savings rate measures the share of gross disposable income that is not used by households for final consumption expenditure. It is equal to the ratio between household savings and gross disposable income. The financial savings rate is the ratio of household financing capacity to gross disposable income"[INSEE].

2.5 Demographic factors

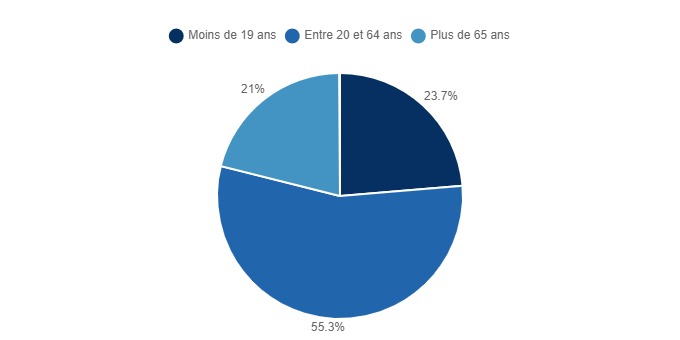

The retirement savings market is closely linked to the country's demographics, both in terms of the number of people able to contribute, and the number of people able to receive benefits. In 2022, the French population will number 67.8 million.

thus, people over 65, the main population group receiving retirement benefits, will represent 21% of the French population in 2022, or around 14.2 million people. The age group most likely to contribute to a supplementary pension (20-64 year-olds) will account for over half the population (55.3%), or 37.5 million people.

French population by age category

France, 2022, in

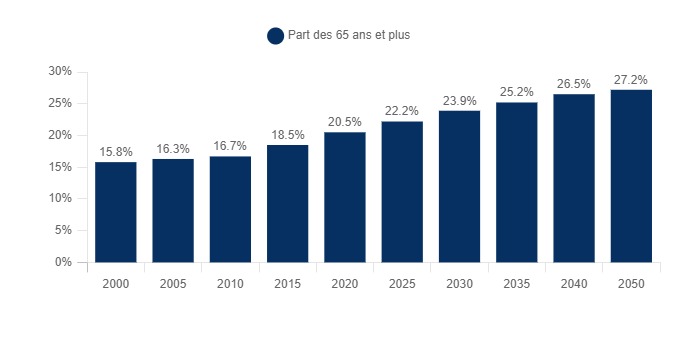

The aging of the population is a growth driver for the retirement and employee savings market. Indeed, between 2000 and 2020, the proportion of the population aged over 65 rose by 4.7 points to 20.5%. According to INSEE forecasts, the proportion of the population aged 65 and over is set to continue rising over the coming decades, as shown in the graph below. The players in the sector (see section 3) must take this demographic change into account when managing the balance between benefits and contributions.

Percentage of French population aged 65 and over

France, 2000 - 2050*, as % of total population

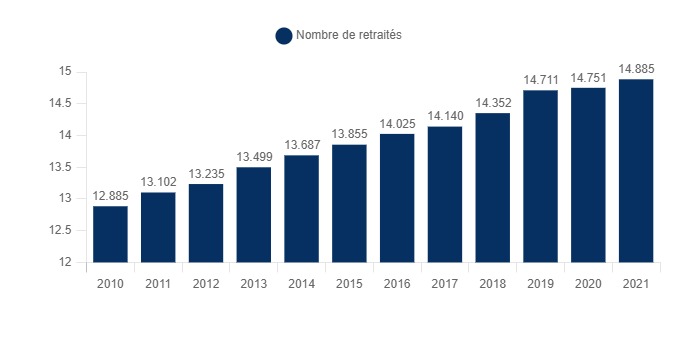

The number of retirees (see graph below), which has been rising steadily for a decade (+15.5%) between 2010 and 2021, is therefore set to continue growing.

number of retirees under the general pension scheme

France, 2010 - 2021, in millions

2.6 Demand trends: towards increasingly responsible savings?

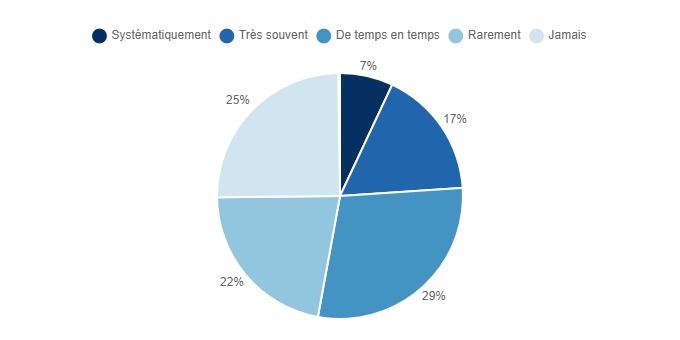

Ecological issues are becoming increasingly topical in many areas, including finance and, more specifically, savings. In 2021, 53% of French people will take ecological issues into account at least from time to time when making their savings and/or investment choices.

Answer to the question: Do you take sustainable development issues into account in your savings and investment choices?

France, 2021, in

What's more, even if this isn't always reflected in their actions (see previous graph), 76% of respondents say that the impact of investments on the environment is an important issue.

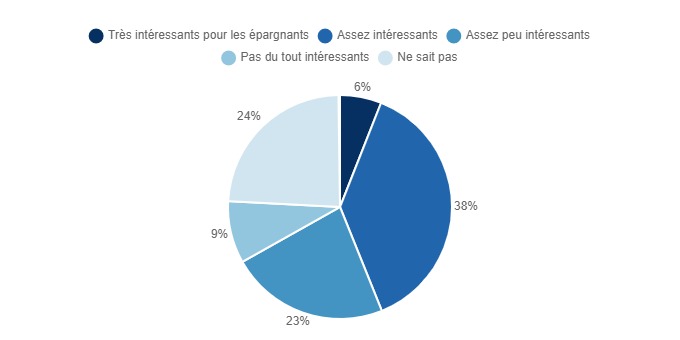

Looking more closely at savings, 61% of French people believe that responsible or sustainable investments are interesting for savers.

Are responsible or sustainable investments interesting for savers?

France, 2021, in

The ecological impact of different savings products is a factor that can influence a saver's choice of product.

Market structure

3.1 Structure of the retirement savings market

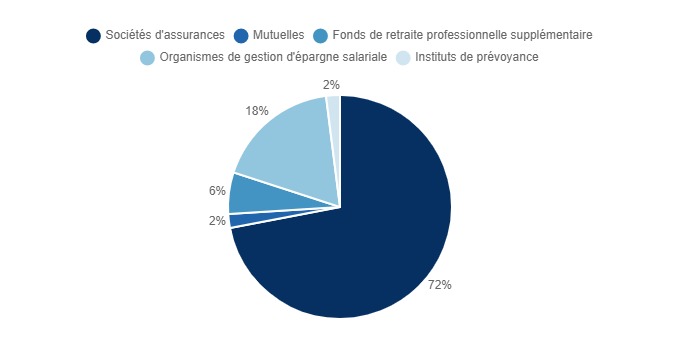

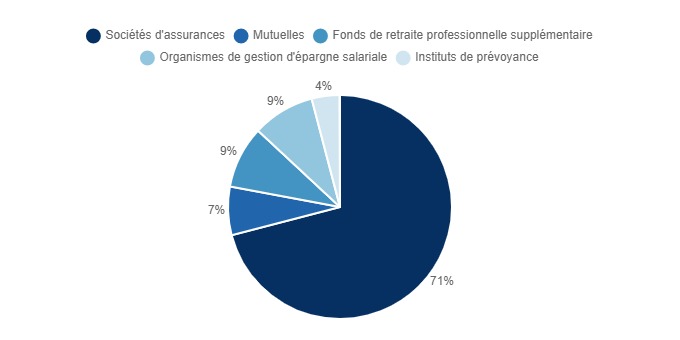

Breakdown of the retirement savings sector by type of organization

in the supplementary retirement sector, 5 categories of players can be distinguished: insurance companies (a category that includes pure insurers, but also banks with an insurance offering, such as LCL, CA, etc.), mutual insurance companies, supplementary occupational retirement funds, employee savings management organizations, and provident institutions.), mutual insurance companies, supplementary occupational pension funds, employee savings management organizations and provident institutions. [DRESS]

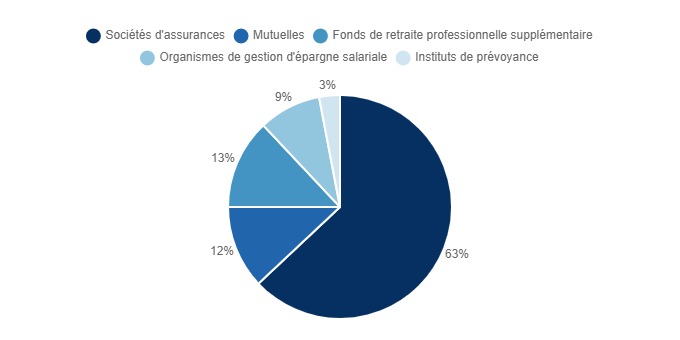

The following three graphs show the breakdown of contributions, benefits and mathematical reserves for supplementary pensions, by type of player.

Insurance companies largely dominate this market (72% of contributions, 63% of benefits, 71% of outstandings). They are followed by supplementary occupational pension funds and employee savings management organizations.

note that the Pacte law has opened up the retirement savings market to competition, which was previously in the hands of employee savings management organizations [économie.gouv].

Breakdown of contributions to supplementary pension plans, by type of organization

France, 2020, in

Distribution of supplementary pension benefits, by type of organization

France, 2020, in

Distribution of mathematical reserves for supplementary pensions, by type of organization

France, 2020, in

The main players in the retirement savings market

Below is a ranking of the organizations that will have collected the most contributions for supplementary pensions in 2021. At the top of the list are insurers (Axa France, Swiss Life, AG2R La Mondiale, Generali, Société générale Assurances, etc.axa France, followed by Crédit Agricole and Swiss Life, dominate the French market.

| Rank |

Insurer |

Direct premiums 2021 (in millions of euros) |

| 1 |

Axa France |

3 393 |

| 2 |

Crédit Agicole Assurances |

2 009 |

| 3 |

Swiss Life |

1 909 |

| 4 |

AG2R La Mondiale |

1 766 |

| 5 |

Generali |

1 277 |

| 6 |

Société générale Assurances |

1 156 |

| 7 |

Abeilles Assurances (ex-Aviva France) |

1 122 |

| 8 |

BNP Paribas Cardif |

1 112 |

| 9 |

Groupe des Assurances du Crédit mutuel |

836 |

| 10 |

Groupama Gan Vie |

630 |

| 11 |

CNP Assurances |

605 |

| 12 |

Allianz France |

561 |

| 13 |

Groupe BPCE Insurance |

377 |

| 14 |

Malakoff Humanis |

256 |

| 15 |

Covéa Group |

219 |

| 16 |

Agrica Group |

217 |

| 17 |

MACSF Epargne retraite |

202 |

| 18 |

Union Mutualiste Retraite |

129 |

| 19 |

Agéas France |

126 |

| 20 |

SMAvie |

110 |

Source: L'Argus de l'assurance

3.2 Structure of the employee savings market

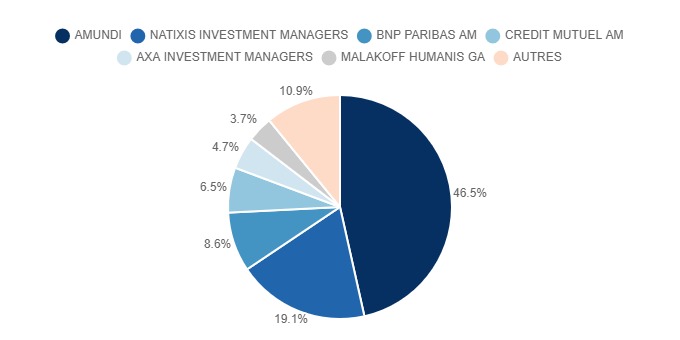

Below is a ranking of the companies holding the most employee savings assets in France in 2021. We can see that there are a few players who are also among the leading players in retirement savings (see 3.1), such as BNP Paribas, Axa, Malakoff Humanis and Swiss Life.

In addition,the same categories of players as for retirement savings(cf. 3.1), namely insurers and bancassurers, are also in the top positions.

| Rank |

Companies |

Total employee savings assets under management in 2021 (in millions of euros) |

| 1 |

AMUNDI |

77 652 |

| 2 |

NATIXIS INVESTMENT MANAGERS |

31 841 |

| 3 |

BNP PARIBAS AM |

14 336 |

| 4 |

CREDIT MUTUEL AM |

10 846 |

| 5 |

AXA INVESTMENT MANAGERS |

7 800 |

| 6 |

MALAKOFF HUMANIS GA |

6 246 |

| 7 |

HSBC GAM |

4 159 |

| 8 |

ERES GESTION |

3 068 |

| 9 |

GROUPAMA AM |

2 577 |

| 10 |

LA BANQUE POSTALE AM |

1 781 |

| 11 |

PROBTP FINANCE |

1 421 |

| 12 |

BDF GESTION |

1 011 |

| 13 |

FEDERAL FINANCE GESTION |

617 |

| 14 |

OFI AM |

381 |

| 15 |

EQUALIS CAPITAL |

342 |

| 16 |

ECOFI INVESTISSEMENTS |

293 |

| 17 |

LA FRANCAISE AM |

284 |

| 18 |

TRECENTO AM |

212 |

| 19 |

AVIVA INVESTORS France |

180 |

| 20 |

SWISS LIFE AM France |

120 |

Source : AFG

The employee savings sector is highly concentrated, with 6 players holding 90% of market assets. Aumundi dominates the sector by far (46.5% of employee savings assets), followed by Natixis (19.1%).

Market share of various asset companies for employee savings schemes

France, 2021, in

Source: Businesscoot processing - after AFG

3.3 The Pacte Act has turned the market upside down

The Loi Pacte (Law on the growth and transformation of businesses) of May 22, 2019 and applied since October 1 of the same year has 4 main objectives:[Euodia]

1/ Facilitate the creation and transfer of businesses, and the rebound in the event of failure.

2/ Enable SMEs to grow

3/ Encourage savers to finance the real economy rather than debt (as was the case before the Pacte law).

4/ Make companies more socially and environmentally responsible, through better profit-sharing

In the context of retirement and employee savings, it is essentially objectives 3 and 4 that have had an impact on the sector. In addition, the Pacte law has resulted in the convergence of retirement and employee savings systems .

The Pacte Act facilitates incentive and profit-sharing schemes, particularly for companies with between 0 and 250 employees in the case of incentive schemes, and for companies with between 0 and 50 employees in the case of profit-sharing schemes, by abolishing the social security flat-rate.

But above all, the Pacte law has enabled the introduction of the PER (Plan Epargne Retraite), a single product that has replaced several other products, in order to simplify their management and the legibility of the system.

In detail, the new PER is divided into three sub-products:

-

The Individual PER (PERIN), which replaces the PERP and Madelin retirement plans.

-

PER Collectif (PERCOL), replacing PERCO

-

The Categorical PER (PERCAT): replaces Article 83 contracts (PER entreprise)

The diagram below summarizes these changes:

Source : Avenue des investisseurs

Source : Avenue des investisseurs

The diagram below summarizes how the new retirement savings plan works. The different compartments correspond to the different types of payments possible for the saver. Each of the three PERs offers three different types of payment.

Source : Agrica Group

Finally,the Pacte law has also opened up asset managementto competition, and insurers, credit institutions and asset managers can position themselves across the entire market. Competitiveness between the various players is heightened by the possibility for savers to transfer assets free of charge fromfrom one management company to another free of charge after 5 years of contract, or even earlier, subject to a tax on assets of less than 1% in this case.

Offer analysis

4.1 PER offer typology

The table below shows the average of the various fees and the performance according to investor profile (from defensive to dynamic, depending on risk-taking) of 80 PERs on the market in 2021:

|

Average of 80 PER |

Minimum |

Maximum |

| Payment charges |

2,46% |

0% |

5% |

| Unit-linked management fee |

0,84% |

0,30% |

2,70% |

| Management fee € |

0,86% |

0,50% |

0,84% |

| Arrears charge |

1,23% |

0,00% |

3,00% |

| Perf. Gestion horizon Défensif |

6,95% |

-0,16% |

13,03% |

| Perf. Horizon Balanced |

10,63% |

5,06% |

18,10% |

| Perf. Gestion horizon Dynamique |

13,86% |

5,06% |

21,50% |

Source : Retraite.com

The various fees applied are as follows

- Membership fees: these are the fees for opening an account

- Instalment charges: these apply to each instalment paid into the savings plan

- Annual management fee: this is a rate applied to the capital in the plan and deducted annually

- Arbitration fee: an amount deducted in the event of a change of medium or a change in the structure of the PER

The following table details the various fees and the performance for 2021 of the main PERs on the market:

| Contract name PER |

Intermediary/ Insurer |

Payment charges |

Unit-linked management fees |

Management fees € fund |

Perf. 2021 € funds |

| Abeille retraite plurielle |

Abeille Assurances |

5,00% |

1,00% |

1,00% |

1,15% |

| AFER Retraite Individuelle |

Afer |

3,00% |

1,00% |

1,00% |

1,15% |

| Ambition Retraite Individuelle |

AG2R La Mondiale |

3,90% |

0,70% |

0,70% |

0,80% |

| PER Excellie Retraite |

AG2R La Mondiale |

4,50% |

1,00% |

1,00% |

|

| FAR PER |

Agipi |

5,00% |

1,00% |

0,75% |

1,05% |

| Allianz PER Horizon |

Allianz Vie |

4,80% |

0,85% |

0,85% |

1,45% |

| Securities @ PER |

Altaprofits |

0,00% |

0,84% |

0,65% |

0,95% |

| Ampli-PER Liberté |

Ampli Mutuelle |

0,00% |

0,50% |

0,65% |

2,10% |

| Intencial Liberalys Retraite |

APICIL |

4,50% |

2,70% |

1,00% |

0,70% |

| ASAC FAPES |

ASAC FAPES PER |

0,00% |

0,50% |

2,00% |

1,65% |

| PER evolution |

Assurancevie.com |

0,00% |

0,60% |

0,60% |

1,66% |

| Ma retraite |

AXA |

4,85% |

0,96% |

0,80% |

1,00% |

| Millevie PER |

Banque Pop. Caisses D'Épargne Vie |

3,00% |

0,60% |

0,80% |

|

| PENSION SAVINGS PLAN |

Banque Pop Caisses D'Épargne Vie |

3,00% |

0,60% |

0,80% |

|

| Matla |

Boursorama |

0,00% |

0,50% |

0,50% |

1,35% |

| PER Carac |

Carac |

0,00% |

0,90% |

0,90% |

0,00% |

| PER CARAVEL |

CARAVEL |

0,00% |

0,60% |

0,60% |

0,86% |

| BNPP Multiplacements Privilège PER |

Cardif Assurance Vie |

2,50% |

0,70% |

0,70% |

1,20% |

| BNP Paribas Multiplacements PER |

Cardif Assurance Vie |

2,50% |

0,70% |

0,70% |

1,20% |

| PERin Cardif Essentiel Retraite |

Cardif Assurance Vie |

4,75% |

0,85% |

0,80% |

1,20% |

| PER Cardif Elite Retraite |

Cardif Life Insurance |

4,75% |

0,85% |

0,85% |

1,20% |

| PER insurance Perspective |

Credit Agricole |

2,50% |

0,96% |

0,80% |

1,70% |

| PER Assurance Retraite |

Crédit Industriel Et Commercial |

4,00% |

1,00% |

1,00% |

|

| PER Objectif retraite by epargnissimo |

Epargnissimo |

0,00% |

0,60% |

0,85% |

1,50% |

| PER Eres |

ERES |

4,80% |

1,00% |

0,50% |

0,50% |

| PER Zen |

Gaipare Zen |

4,50% |

1,50% |

0,80% |

1,80% |

| PER Papisy |

Gan |

0,00% |

1,00% |

0,60% |

1,55% |

| Gan new life |

GAN |

4,50% |

0,96% |

0,70% |

1,55% |

| Garance sérénité |

Garance |

3,00% |

0,00% |

0,90% |

2,50% |

| PER La Retraite |

Generali |

4,95% |

0,96% |

0,70% |

1,30% |

| PER Generali Patrimoine |

Generali |

4,50% |

1,00% |

0,90% |

1,80% |

| La Retraite |

Generali Vie |

4,95% |

0,96% |

0,70% |

1,80% |

| Concordance PERIN |

Gresham |

0,00% |

1,00% |

1,00% |

1,04% |

| Groupama Nouvelle Vie |

Groupama Gan Vie |

4,50% |

0,96% |

0,70% |

1,55% |

| Cachemire PER |

La Banque Postale |

2,00% |

0,85% |

0,85% |

1,00% |

| LFM PER'Form |

La France Mutualiste |

1,00% |

0,77% |

0,77% |

1,62% |

| LCL Retraite PER |

LCL |

2,50% |

0,95% |

0,80% |

1,60% |

| Le Conservateur |

Le Conservateur |

4,50% |

0,96% |

0,96% |

1,10% |

| Conservateur Épargne Retraite |

Le Conservateur |

4,50% |

0,96% |

0,70% |

1,10% |

| Linxea PER |

Linxea |

0,00% |

0,60% |

0,85% |

0,86% |

| Linxea Spirit PER |

Linxea |

0,00% |

0,50% |

2,00% |

1,65% |

| PER Winalto Retraite |

MAAF Assurances |

2,00% |

0,60% |

0,60% |

1,50% |

| Multi Horizon Retraite Mutavie PER |

MACIF |

1,00% |

0,80% |

0,60% |

1,15% |

| PER Responsable et Solidaire |

MAIF |

2,40% |

0,60% |

0,60% |

1,30% |

| RES Retraite |

MASCF |

3,00% |

0,50% |

0,50% |

2,10% |

| Complice Retraite |

Matmut (in agency in 2022) |

3,00% |

0,80% |

0,80% |

1,92% |

| PER Medicis |

Medicis |

2,00% |

- |

0,50% |

1,85% |

| Meilleurtaux PER |

MeilleurPlacement |

0,00% |

0,60% |

0,85% |

0,86% |

| Meilleurtaux Liberté PER |

MeilleurPlacement |

0,00% |

0,50% |

2,00% |

1,65% |

| MIF PER |

MIF |

0,00% |

0,60% |

0,60% |

1,70% |

| MMA PER Avenir |

MMA Vie |

4,00% |

0,80% |

0,80% |

1,50% |

| My PENSION xPER |

My PENSION |

0,50% |

1,30% |

1,30% |

0,80% |

| PER Lineage |

Oradea |

4,65% |

0,96% |

0,84% |

1,10% |

| P-PER |

Patrimea |

0,00% |

0,60% |

0,85% |

0,70% |

| PER Placement-direct |

Placement-Direct |

0,00% |

0,60% |

0,60% |

1,00% |

| Galya Individual Retirement |

Predictis |

1,50% |

1,20% |

0,80% |

1,45% |

| Perfutura |

Predictis |

4,95% |

1,00% |

1,20% |

0,80% |

| Perfutura Premium |

Prédictis |

1,50% |

1,20% |

1,00% |

0,80% |

| Prefon Retraite |

Prefon |

3,90% |

- |

0,49% |

1,30% |

| PrimoPER |

Primonial |

4,00% |

0,98% |

0,80% |

2,35% |

| PER Individual |

SMA Vie |

2,50% |

0,84% |

0,84% |

1,30% |

| PER Acacia |

Societe Generale Group |

2,50% |

0,84% |

0,84% |

1,10% |

| La Médicale PERennité |

Spirica |

2,50% |

1,00% |

2,00% |

1,50% |

| Version Absolue Retraite |

Spirica (Credit Agricole) |

3,50% |

1,00% |

2,30% |

1,35% |

| Suravenir PER |

Suravenir (Crédit Mutuel Arkea subsidiary) |

0,00% |

0,60% |

0,80% |

1,50% |

| Projection Retraite |

Suravenir (Crédit Mutuel Arkea subsidiary) |

2,00% |

0,90% |

0,90% |

1,50% |

| PER SwissLife Individuel |

Swiss Life Assurance Et Patrimoine |

4,75% |

0,96% |

0,65% |

1,10% |

| Perivie |

UMR |

2,50% |

0,60% |

0,60% |

1,80% |

| COREM (PER in points) |

UMR |

3,50% |

0,00% |

0,30% |

3,37% |

| PER Yomoni |

Yomoni |

0,00% |

0,30% |

- |

N/A |

Source : Retraite.com

4.2 Supply trends: digitalization

Several players are positioning themselves as pure players in the retirement and employee savings market.

For example, Boursorama Banque, an online bank, offers 100% online PER subscription, as with its other services.

The same is true of roboadvisors. This term refers to digital platforms offering automated financial management services, using algorithms based on large data sets and customer profile segmentation. However, this is not a service based on technology alone: human expertise is often associated with this solution. yomoni is a roboadvisor that offers to open a PER on its application.

Other fintechs and insurtechs, such as Linxea and Ramify, take a similar approach

In addition, Nortia, a multi-specialist marketplace for innovative wealth management solutions serving CGPs (Conseillers en Gestion de Patrimoine), has launched Nortia Retraite, its new digital platform offering three open-architecture retirement savings plans. The range comprises three contracts (PER Panthéa with AEP, PER Private with Spirica, and PER Enedia with La Mondiale Partenaire. [ProfessionCGP]

So, these pure players in the market generally offer products from traditional players in the banking and insurance sectors, in the form of a BtoBtoC model. These pure players are therefore intermediaries. The advantage for the traditional players is that they can reach a wider customer base for their products via the pure players.

Regulations

5.1 PER (Plan Epargne Retraite) regulations

The PER is a new retirement savings product in place since October 1, 2019. This product is gradually replacing the old retirement savings plans (see 3.3), as it is no longer possible to subscribe to the old contracts (Perp, Madelin, etc) and it is possible to transfer savings from old plans already open to the new PER. [ServicePublic]

The PER is available in three sub-products:

The individual PER is a long-term savings product that allows you to save during your working life to obtain a capital sum or annuity when you reach retirement age. It is open to all, with no age or employment conditions.

The managing body must inform the customer about the characteristics of the plan, its management method and its taxation. In addition, each year, this organization must provide information on :

- Account performance

- Financial performance of investments

- The amount of fees deducted

- Plan transfer conditions

In the event of the death of the PER holder, the plan is closed. The savings are then paid out to the heirs or beneficiaries specified in the contract, in the form of capital or an annuity.

In terms of taxation, amounts paid into an individual PER plan in any given year are deductible from taxable income for that year, up to an overall ceiling set for each member of the tax household.

group of people filing a single tax return (e.g. husband, wife and dependent children).

: A sum of money or a rent

The individual PER is a long-term savings product that allows you to save, with the help of your company, during your working life to obtain a capital sum or an annuitywhen you reach retirement age. Allcompanies can offer their employees a collective PER, even if they have not set up a company savings plan(PEE).

The plan must be open to all employees. However, seniority may be required (maximum 3 months). However, employee enrolment is optional. In the event of a change of company, it is entirely possible to transfer this PER to the PER of the new company, or to transfer it to an individual PER.

Old products (Perco, Article 83) can also be transferred to the new product.

What's more, when you are hired, the company must provide you with a regulation informing you of the existence of the plan and its content. As with the individual PER, the manager must inform the saver annually of :

- The evolution of savings

- Financial performance of investments

- The amount of fees deducted

- Plan transfer conditions

In the event of death, the account is not automatically closed. Once the account has been closed "manually", the transfer conditions are the same as for the individual PER. However, in the event of death after the age of 70, any sums paid in excess of 30,500 euros are subject to inheritance tax.

In terms of taxation, sums paid into a group PER in any given year are deductible from taxable income for that year, up to an overall ceiling set for each member of the tax household.

- The mandatory company PER

The mandatory company PER is a group retirement savings plan that can be set up by the company for certain categories of employees, or for all of them.

This means that the employer can reserve this right for only one category of company employees. However, the criteria must be objective. Employees benefiting from the plan are obliged to subscribe to it.

It is the company's duty to inform the employees concerned of the compulsory nature of the plan.

For this PER, too, the company must issue regulations informing employees of the existence of the plan and its content, and the manager must inform the saver annually of :

- The evolution of savings

- Financial performance of investments

- The amount of fees deducted

- Plan transfer conditions

In the event of the holder's death, the plan is closed and the procedures are the same as for the group PER.

Positioning the players

6. Segmentation

| Segmentation |

Company |

Sales figures |

| Retirement savings players |

Axa France |

28.3 billion euros (2021) |

| Crédit Agicole |

37.0 billion euros (2021) |

| Swiss Life France |

7.1 billion euros (2021) |

| Generali |

15.5 billion euros (2021) |

| Employee savings players |

Natixis |

7.3 billion euros (2020) |

| BNP Paribas |

13.2 billion euros (2021) |

| Crédit Mutuel |

19.8 billion euros (2021) |

| Malakoff Humanis |

6.2 billion euros (2021) |

| Pure players |

Yomoni |

0.689 million euros (2018) |

| Boursorama Banque |

263.4 million euros (2021) |

Companies

Axa groupe

DUNS: 572093920

Turnover:

102.3 billion € (2022)

Description:

AXA is a French multinational insurance company based in the 8th arrondissement of Paris. It is active worldwide in insurance, asset management and other financial services.

The AXA Group operates mainly in Western Europe, North America, Asia-Pacific and the Middle East, with a presence in Africa. AXA is a conglomerate of independent companies, whose activities are governed by the laws and regulations of many countries. The company is included in the Euro Stoxx 50 index.

External Sources and News:

- - The business model is split equally between companies and individuals, with 50% each

- - 17,000 people to be hired worldwide by 2021, including 6,000 in France

Data:

DUNS: 572093920

Legal Name: AXA

Address: 25 AV MATIGNON DIRECTION JURIDIQUE CENTRALE, 75008 PARIS 8

Number of employees: Entre 6 et 9 salariés (2020)

Capital: 5 382 082 693 EUR

Financial Data:

| Year |

2021 |

2020 |

2019 |

2018 |

2017 |

2016 |

2015 |

| Turnover |

3 672 000 000 |

4 089 000 000 |

- |

- |

5 288 000 000 |

- |

- |

| Gross margin (€) |

3 745 000 000 |

55 000 000 |

6 079 000 000 |

4 187 000 000 |

15 000 000 |

14 000 000 |

7 000 000 |

| EBITDA (€) |

2 287 000 000 |

2 414 000 000 |

92 000 000 |

13 000 000 |

-14 997 500 000 |

-420 000 000 |

-1 618 000 000 |

| Operating profit (€) |

2 278 000 000 |

2 402 000 000 |

- |

- |

-14 998 500 000 |

-420 000 000 |

-1 618 000 000 |

| Net profit (€) |

2 819 000 000 |

4 236 000 000 |

4 301 000 000 |

307 000 000 |

4 958 000 000 |

432 000 000 |

1 747 000 000 |

| Turnover growth rate (%) |

-10,2 |

- |

- |

- |

- |

- |

- |

| Ebitda margin rate (%) |

62,3 |

- |

- |

- |

- |

- |

- |

| Operating margin rate (%) |

62 |

- |

- |

- |

- |

- |

- |

| Working Capital (turnover days) |

2,6 |

- |

- |

- |

- |

- |

- |

| Working Capital requirements (turnover days) |

- |

- |

- |

- |

- |

- |

- |

| Net margin (%) |

76,8 |

- |

- |

- |

- |

- |

- |

| Added value / Turnover (%) |

86,9 |

- |

- |

- |

- |

- |

- |

| Wages and social charges (€) |

975 000 000 |

11 000 000 |

18 000 000 |

14 000 000 |

21 000 000 |

- |

- |

| Salaries / Turnover (%) |

26,6 |

- |

- |

- |

- |

- |

- |

Company Managers:

| Position |

First Name |

Last Name |

Age |

Linkedin |

| Président du conseil d'administration,Administrateur |

Antoine |

Gosset-Grainville |

59 |

|

| Directeur général, Administrateur, Directeur général,Administrateur |

Thomas |

Dr Buberl |

52 |

|

| Administrateur |

Raymond |

De Oliviera-Cezar |

70 |

|

| Administrateur |

Jean-Pierre |

Clamadieu |

66 |

|

| Administrateur |

Angelien |

Kemna |

67 |

|

| Administrateur |

André |

Francois-Poncet |

65 |

|

| Administrateur |

Xiaoying |

Duan |

54 |

|

| Administrateur |

Bettina |

Baronesse Von Der Ropp |

61 |

|

| Administrateur |

Martine |

Bievre |

65 |

|

| Administrateur |

Isabel |

Hudson |

65 |

|

| Administrateur |

Antoine |

Gosset-Grainville |

59 |

|

| Administrateur |

Marie France |

Tschudin |

53 |

|

| Administrateur |

Helen |

Browne |

62 |

|

| Administrateur |

Guillaume |

Faury |

57 |

|

| Administrateur |

Ramon |

Fernandez |

57 |

|

| Administrateur |

Clotilde |

Fricker |

57 |

|

| Administrateur |

Gérald |

Harlin |

69 |

|

| Administrateur |

Rachel |

Picard |

58 |

|

| Commissaire aux comptes suppléant |

Patrice |

Morot |

59 |

|

Crédit Agricole Groupe

DUNS: 784608416

Turnover:

37 billion € (2021)

External Sources and News:

- Crédit Agricole SA results last year: 6.3 billion euros

- Percentage of regional bank shareholding in subsidiaries: around 60%

- Bill for Emporiki wreck: 8 billion euros in 2012

- Degroof Petercam: 150 years of history

- private banking, investment banking and securities services provider

- 71 billion euros in assets, 559 million in net banking income, 1,469 employees

- 15.6% minority stake in Cobepa holding company up for sale

- Consortium of shareholders (Philippson, Haegelsteen, Schockert, Siaens and CLdN) holds 51.46% of Degroof Petercam

- Peterbroeck and Van Campenhout family hold 20.86% via Petercam Inves

- t Valuation of Degroof Petercam: between 1 and 2 billion euros

10 th world bank, first worldwide cooperative, first bank in France

Data:

DUNS: 784608416

Legal Name: CREDIT AGRICOLE SA

Address: 12 PL DES ETATS UNIS , 92120 MONTROUGE

Number of employees: Entre 1 000 et 1 999 salariés (2020)

Capital: 9 127 682 148 EUR

Company Managers:

| Position |

First Name |

Last Name |

Age |

Linkedin |

| Président du conseil d'administration |

Dominique |

LEFEBVRE |

63 |

|

| Directeur général |

Philippe |

BRASSAC |

65 |

|

| Vice-président du conseil d'administration |

Raphaël |

APPERT |

63 |

|

| Directeur général délégué |

Xavier |

MUSCA |

65 |

|

| Directeur général délégué |

Jérôme |

GRIVET |

63 |

|

| Directeur général délégué |

Olivier |

GAVALDA |

61 |

|

| Administrateur |

Françoise |

GRI |

67 |

|

| Administrateur |

Jean-Pierre |

GAILLARD |

64 |

|

| Administrateur |

Jean-Paul |

KERRIEN |

63 |

|

| Administrateur |

Louis |

TERCINIER |

64 |

|

| Administrateur |

Christiane |

FOULIER |

63 |

|

| Administrateur |

Pascal |

LHEUREUX |

63 |

|

| Administrateur |

Pierre |

CAMBEFORT |

60 |

|

| Administrateur |

Marie-Claire |

COLIN |

54 |

|

| Administrateur |

Nicole |

MINGANT |

61 |

|

| Administrateur |

Agnès |

AUDIER |

60 |

|

| Administrateur |

Marianne |

LAIGNEAU |

60 |

|

| Administrateur |

Alessia |

MOSCA |

49 |

|

| Administrateur |

Olivier |

AUFFRAY |

57 |

|

| Administrateur |

Christophe |

LESUR |

53 |

|

| Administrateur |

Catherine |

UMBRICHT |

57 |

|

| Administrateur |

Hugues |

BRASSEUR |

59 |

|

| Administrateur |

Eric |

VIAL |

57 |

|

| Administrateur |

Sonia |

BERNARD |

62 |

|

| Commissaire aux comptes suppléant |

Jean-Baptiste |

DESCHRYVER |

54 |

|

| Administrateur représentant les salariés |

Eric |

WILSON |

54 |

|

Swiss Life France

DUNS: 341785632

Turnover:

7.1 billion € (2021)

Description:

SwissLife, formerly Société suisse d'Assurances générales sur la vie humaine, was founded in 1857 and was the first life insurance company to be established in Switzerland. Today, its three main markets are Switzerland, France and Germany. The Group also has an asset management arm, Swiss Life Asset Managers, which provides institutional and private investors with access to investment and asset management solutions. In Switzerland, Swiss Life is one of the largest institutional asset managers and the third-largest fund provider.

Data:

DUNS: 341785632

Legal Name: SWISSLIFE ASSURANCE ET PATRIMOINE

Address: 7 RUE BELGRAND , 92300 LEVALLOIS-PERRET

Number of employees: Entre 1 000 et 1 999 salariés (2021)

Capital: 169 036 086 EUR

Company Managers:

| Position |

First Name |

Last Name |

Age |

Linkedin |

| Président du conseil d'administration |

Tanguy |

Polet |

54 |

|

| Directeur général |

Eric |

Le Baron |

61 |

|

| Administrateur |

Nathalie, Laurence |

Abehsera |

58 |

|

| Administrateur |

Pierre |

Mongin |

70 |

|

| Administrateur |

Carine |

Piazzini |

52 |

|

| Administrateur |

Marie, Helene |

Poirier |

69 |

|

| Administrateur |

Brigitte |

Thirkell |

66 |

|

Natixis Wealth Management

DUNS: 306063355

Turnover:

130 million € (2020)

Description:

Natixis Wealth Management is part of the BPCE group and specializes in wealth management. It employs 474 people and has around 30.4 billion euros in assets under management. The company operates in France and Luxembourg. Natixis Wealth Management offers advisory and financial management services, as well as tailor-made solutions for its customers.

300 employees

june 3, 2020 - Interview with Audrey Koenig, Deputy Managing Director at Natixis Wealth Management - source(Décideurs Magazine)

- 2019 was a good year for Natixis Wealth Management

- With the health crisis, A. Koenig stresses the importance of diversifying investments

- Natixis develops partnerships with companies specializing in private equity to satisfy their clients, who are increasingly interested in this field

february 1, 2021 - Natixis invests in quality business models - source(Zonebourse)

- Against a backdrop of dollar weakness, Natixis favors emerging Asian equities

- Growing interest in the digital economy, energy transition and M&A sectors

Data:

DUNS: 306063355

Legal Name: NATIXIS WEALTH MANAGEMENT

Address: 115 RUE MONTMARTRE , 75002 PARIS 2

Number of employees: Entre 250 et 499 salariés (2018)

Capital: 129 048 296 EUR

Company Managers:

| Position |

First Name |

Last Name |

Age |

Linkedin |

| Directeur général |

Georges Eric |

Nivelleau de la Brunière |

60 |

|

| Directeur général |

Audrey |

Deschamps |

51 |

|

| Directeur général délégué |

Olivier |

Bouvet |

53 |

|

BNP Paribas Banque Privée

DUNS: 662042449

Turnover:

n/a

Description:

BNP Paribas Banque Privée has 200 private banking centers in France, 8 specialized wealth management centers and 70 maisons des entrepreneurs. BNP Paribas Banque Privée boasts France's leading private bank in terms of assets entrusted, with €93 billion in 2016.

External Sources and News:

- - Agreement between BNP Paribas and HSBC to take over HSBC's private banking activities in Germany.

- - Objective for BNP Paribas: to more than double assets under management in Germany.

- - Assets under management to reach 40 billion euros, positioning BNP Paribas as one of Germany's leading players in the sector.

- - BNP Paribas number one private bank in the euro zone with 446 billion euros in assets under management.

- - Specific target in Germany: the Mittelstand, i.e. German entrepreneurs and their families.

Data:

DUNS: 662042449

Legal Name: BNP PARIBAS

Address: 16 BD DES ITALIENS , 75009 PARIS 9

Number of employees: 200 000 employés (global) ()

Capital: 2 499 597 122 EUR

Financial Data:

| Year |

Turnover (€) |

Net Profit (€) |

Fiscal Year End |

Fiscal Year Duration |

| 2017 |

43 161 000 |

0 |

26/04/2025 |

|

| 2018 |

42 516 000 |

0 |

26/04/2025 |

|

| 2019 |

44 597 000 |

0 |

26/04/2025 |

|

| 2020 |

44 275 000 |

0 |

26/04/2025 |

|

Company Managers:

| Position |

First Name |

Last Name |

Age |

Linkedin |

| Directeur général délégué |

Philippe |

Bordenave |

70 |

|

| Directeur général délégué |

Thierry Alain Pierre |

Laborde |

64 |

|

| Directeur général délégué |

Yann Nicolas |

Gerardin |

63 |

|

Crédit Mutuel

DUNS: 784646689

Turnover:

17.34 billion € (2022)

Description:

crédit Mutuel is a French banking, insurance, electronic banking, telephony, home monitoring and media group. Its origins date back to 1847, when Frédéric-Guillaume Raiffeisen decided to create an "Association pour le pain" and a community bakery.

Crédit Mutuel is a mutual company made up of 5,390 local cooperative and mutualized mutuals, grouped into 18 regional federations, which in turn form a national confederation.

In addition to the Crédit Mutuel brand, the group operates under the CIC brand and also owns majority stakes in various companies active in the "bancassurance" market (Cofidis, Monabanq), mobile telephony (NRJ mobile) and regional press (with Groupe EBRA, which publishes Le Dauphiné libéré, Le Progrès, Dernières Nouvelles d'Alsace and L'Est républicain).

External Sources and News:

- Crédit Mutuel Leasing has been in business for 60 years.

- They have recently acquired Roulenloc and its online car leasing platform

- Crédit Mutuel Leasing has been in the car leasing business for 10 years.

- 35.000 car leasing contracts.

- 20% market share in equipment financing for professionals and businesses.

- Roulenloc has around twenty employees.

- 70% of Roulenloc's €14 million sales in 2022 will come from long-term leasing.

- The remainder of sales will come from rental with purchase option and a hybrid subscription format.

- Today, 80% of Roulenloc's solutions are aimed at private customers.

- The former managers of Roulenloc now hold over 10% of the capital.

- The Crédit Mutuel network has 4,500 branches.

- Crédit Mutuel is a French mutual banking group.

- The group is made up of the Arkéa branch (Brittany and South-West federations), the Confédération nationale du Crédit Mutuel (the group's central body) and 18 other member federations.

- The dispute between Arkéa and Confédération nationale du Crédit Mutuel lasted over ten years before a memorandum of understanding was reached.

- Creation of a delegated vice-presidency, to be attributed to Arkéa's Chairman

- A right of veto is granted to the federations in the event of infringement of their vital interests, particularly with regard to employment.

- The "Crédit Mutuel" brand may be used autonomously by the federations and caisses

- Crédit Mutuel Arkéa continues to review its fintech portfolio.

- The mutual bank is considering opening up the capital of Monext, its electronic payment subsidiary.

- Monext is valued at around 350 million euros.

- Crédit Mutuel Arkéa acquired Monext in 2009.

- Monext posted operating income (Ebitda) of 25 million euros in 2020.

- Monext achieved sales of 97.2 million euros in 2020.

Data:

DUNS: 784646689

Legal Name: CONFEDERATION NATIONALE CREDIT MUTUEL

Address: 46 RUE DU BASTION , 75017 PARIS

Number of employees: Entre 200 et 249 salariés (2021)

Malakoff Humanis

DUNS: 844914887

Turnover:

6.4 billion € (2022)

Description:

France's second-largest social protection group

In January 2019, the Malafoff Médéric and Humanis groups initiated a merger that enabled them to create a joint structure.

External Sources and News:

25/12/2023

- Klesia et Malakoff Humanis couvrent 40 % des 770.000 employés du secteur de l'hôtellerie-restauration et 85 % de leurs employeurs.

- La perte de ce contrat par Colonna représente près de la moitié de son chiffre d'affaires de 45 millions d'euros.

15/03/2023

deuxième groupe de protection sociale en France

Chiffres clés pertinents:

- 168 millions d'euros bénéfice net en 2021 - 222 millions d'euros bénéfice net en 2020

- - 8,2 milliards d'euros de fonds propres à fin 2022

- - Ratio de solvabilité de 246 %

- - 180 millions d'euros d'économies réalisées en 5 ans

- - 60 millions d'euros supplémentaires de baisse des coûts prévus pour la période 2023-2026

- - 6,4 milliards d'euros de chiffre d'affaire en 2021 - 6,56 milliards d'euros de chiffre d'affaire en 2019

Data:

DUNS: 844914887

Legal Name: SGAM MALAKOFF HUMANIS

Address: 21 RUE LAFFITTE , 75009 PARIS 9

Number of employees: 0 salarié (2022)

Yomoni

DUNS: 811266170

Turnover:

679700 € (2018)

Description:

Yomoni is a start-up that aims to make savings management easier. Its aim is to enable as many people as possible to make their money grow beyond the traditional savings accounts (Livre A, PEL, etc.). Based on technologies for analyzing and streamlining banking orders in order to reduce expenses and remain competitive, Yomoni focuses on simplicity: it is possible to subscribe in 15 minutes for savings of 1,000 euros or more.

september 10, 2020 - Yomoni raises 8.7 million euros - Source(French web)

- Yomoni boasts over 21,000 customers

- In 2020, it also claims 250 million euros in assets under management, compared with 186 million euros at the end of 2019.

- Despite the crisis, the company recorded an increase of 40% in new mandates and 35% in assets under management over the first eight months of the year.

Data:

DUNS: 811266170

Legal Name: YOMONI

Address: 231 RUE SAINT-HONORE , 75001 PARIS

Number of employees: 0 salarié (2024)

Capital: 5 092 679 EUR

Financial Data:

| Year |

2018 |

2017 |

2016 |

| Turnover |

679 736 |

974 756 |

70 947 |

| Gross margin (€) |

1 644 171 |

1 945 057 |

404 415 |

| EBITDA (€) |

-2 623 107 |

-2 146 493 |

-3 030 428 |

| Operating profit (€) |

-3 345 693 |

-2 613 081 |

-3 146 086 |

| Net profit (€) |

-3 407 408 |

-2 653 162 |

-3 148 101 |

| Turnover growth rate (%) |

-30,3 |

1 273,9 |

- |

| Ebitda margin rate (%) |

-385,9 |

-220,2 |

-4 271,4 |

| Operating margin rate (%) |

-492,2 |

-268,1 |

-4 434,4 |

| Working Capital (turnover days) |

-158,8 |

-289 |

-1 003 |

| Working Capital requirements (turnover days) |

-64,3 |

-144,8 |

-1 206 |

| Net margin (%) |

-501,3 |

-272,2 |

-4 437,3 |

| Added value / Turnover (%) |

-24,5 |

-7,7 |

-1 582,7 |

| Wages and social charges (€) |

2 187 311 |

1 817 236 |

1 842 626 |

| Salaries / Turnover (%) |

321,8 |

186,4 |

2 597,2 |

Company Managers:

| Position |

First Name |

Last Name |

Age |

Linkedin |

| Président |

Sebastien |

D'ornano |

50 |

|

| Commissaire aux comptes suppléant |

Antoine |

Gaubert |

66 |

|

Boursorama Banque

DUNS: 351058151

Turnover:

263.4 million € (2021)

Description:

Boursorama is a French company with two main activities: a financial markets information portal on the one hand, and an online bank on the other. While Boursorama was founded in 1998, the online banking business originated in 2005-2006 when Boursorama Banque was created. In 2013, this activity became 100% online. Boursorama Banque offers a comprehensive range of banking services, including life insurance, mortgages and a range of regulated savings products (Livret A, PEL, Codevi, PER).

External Sources and News:

- Société Générale subsidiary Boursorama plans to change its name to BoursoBank

- Online banking has become the only growth vector for customer numbers in French retail banking.

- Boursorama currently has 5 million customers, with a target of over 8 million by 2026.

- BforBank, a subsidiary of Crédit Agricole, plans to grow from its current 200,000 customers to 3 million by 2030.

- Hello Bank, a subsidiary of BNP Paribas, aims to reach one million customers by benefiting from the closure of Orange's banking activities.

- Revolut, a British competitor, already has 2.5 million customers in France.

- N26, a German neobank, plans to grow from 2.5 million to 5 million customers in France by 2025.

Data:

DUNS: 351058151

Legal Name: BOURSORAMA

Address: 44 RUE TRAVERSIERE , 92100 BOULOGNE-BILLANCOURT

Number of employees: Entre 500 et 999 salariés (2021)

Capital: 51 171 598 EUR

Company Managers:

| Position |

First Name |

Last Name |

Age |

Linkedin |

| Président du conseil d'administration |

Philippe |

Aymerich |

59 |

|

| Directeur général |

Benoit |

Grisoni |

50 |

|

| Administrateur |

Claire |

Roussel |

56 |

|

| Administrateur |

Bernardo |

Sanchez Incera |

65 |

|

| Administrateur |

Laurent |

Saucie |

50 |

|

| Administrateur |

Petra |

Friedmann |

71 |

|

| Administrateur |

Jean-francois |

Sammarcelli |

74 |

|

| Administrateur |

Claire |

Calmejane |

42 |

|

| Administrateur |

Sylvie |

Jans |

61 |

|

Generali

DUNS: 572044949

Turnover:

94.6 billion € (2019)

Description:

Assicurazioni Generali S.p.A. is an Italian insurance company based in Trieste. In 2019, it is the largest of its kind in Italy, and ranks among the world's top ten insurance companies in terms of net premiums and assets. It is also known worldwide for its asset management services.

External Sources and News:

- The competing asset managers have the following assets under management: Amundi (€1,935 billion), Natixis IM (€1,112 billion), AXA IM (€823 billion) and BNP Paribas AM (€555 billion)

- Acquisition of Spanish Liberty Seguros and Taiwanese Conning

- Conning's assets under management are estimated at 144 billion euros.

- Generali Investments Holding's total assets under management will increase to 775 billion euros

- Italy's leading insurance company, Generali, acquires Liberty Seguros for 2.3 billion euros.

- generali's biggest acquisition in ten years.

- Liberty Seguros has a portfolio of over 1.2 billion euros in premiums in 2022.

- Liberty Seguros has around 1,700 employees and 5,600 intermediaries in its markets.

- Generali acquired the Italian insurer Cattolica in 2021 for 1.2 billion euros

- Generali acquired the La Médicale group in February 2022 for 435 million euros

- Generali achieved a net profit of 2.9 billion euros in 2022.

Data:

DUNS: 572044949

Legal Name: GENERALI FRANCE

Address: 2 RUE PILLET WILL , 75009 PARIS 9

Number of employees: 7400 ()

Capital: 114 336 053 EUR

Financial Data:

| Year |

Turnover (€) |

Net Profit (€) |

Fiscal Year End |

Fiscal Year Duration |

| 2021 |

5 416 000 EUR |

329 241 000 EUR |

31/12/2021 |

12 |

Source :

Source :