Detailed content of our market study

Inforamtion

Inforamtion

- Number of pages : 35 pages

- Format : Digital and PDF versions

- Last update :

Summary and extracts

Summary and extracts

1 Market overview

1.1 Market definition and scope

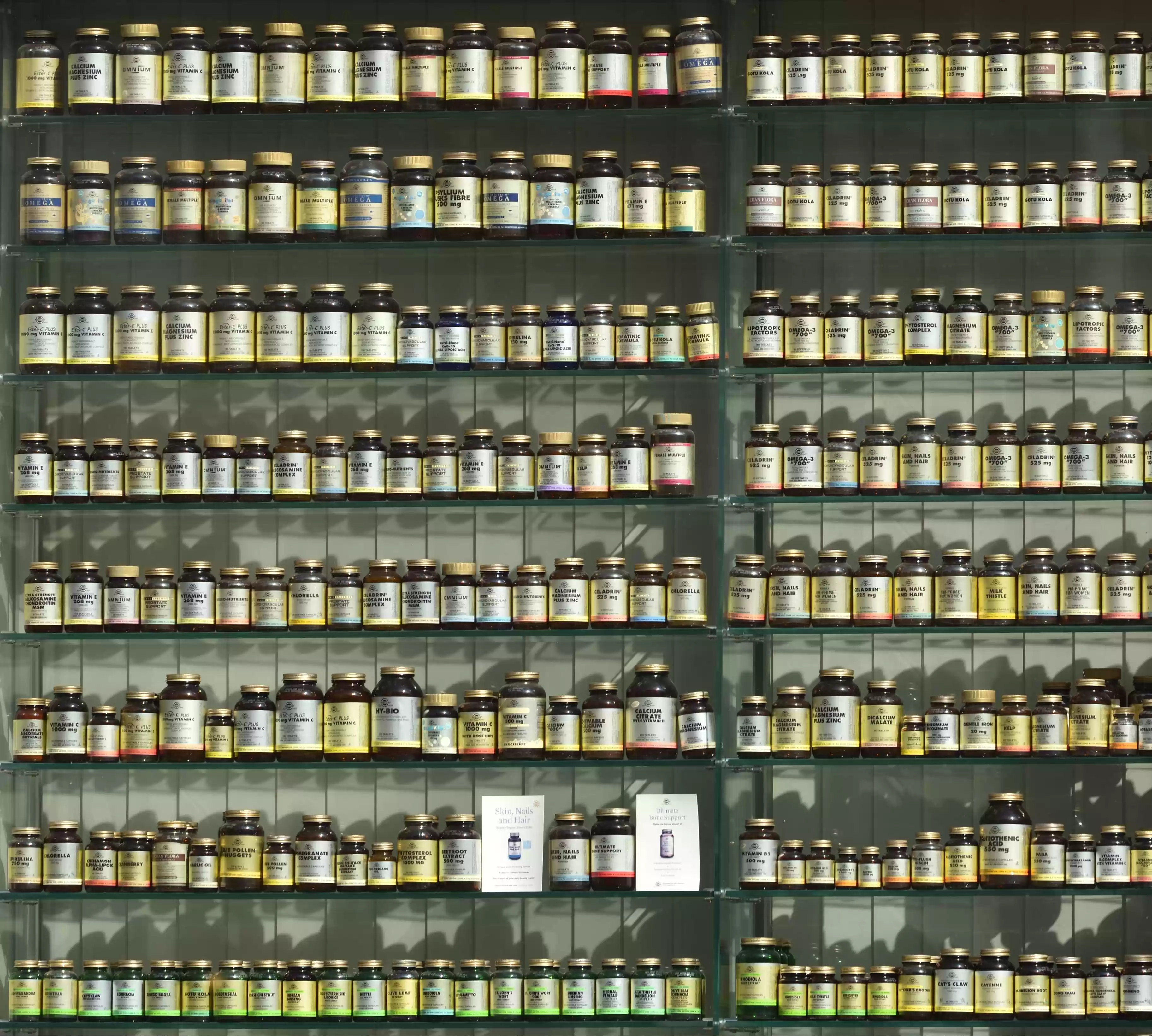

Food supplements are concentrated sources of nutrients, i.e. vitamins and minerals, substances with a nutritional or physiological purpose, or plants and plant preparations that are intended to compensate for deficiencies in a person's regular diet.

Within the framework of a regular sport practice, food supplements can be very useful since they allow the sportsman to keep a high level of energy, to recover more easily and effectively from the physical effort and to bring to the muscular tissues the necessary nutriments. In fact, in sportsmen and women, nutrient requirements are increased and losses are more numerous, so a diet, even a balanced one, may not be sufficient to cover all needs.

The muscular tissues of the athlete need sufficient protein, carbohydrate and lipid intake, they allow the body to be well prepared for the effort beforehand and to recover easily. Vitamins, anti-oxidant molecules, minerals and trace elements are also relevant to help the athlete cope with the different stages of training.

The food supplements most frequently recommended to athletes are :

- flax: it stimulates neuronal function and has positive effects on blood flow, tissue oxygenation and the cardiovascular system. It also helps to fight against inflammation and oxidation of cells following physical effort.

- spirulina: this is the most popular food supplement for athletes, it provides the energy needed before and during the effort. It is particularly rich in protein (contains nearly 70%). It also contains carbohydrates, fatty acids, minerals and vitamins.

- giseng: it helps fight against oxidative stress post-exercise and thus improves the performance and resistance of athletes to the effort.

- creatine: it allows to provide a more important effort by optimizing the energy levels at the cellular level.

- whey protein: it provides a significant protein intake, thus compensating for potential deficiencies of a conventional diet.

- branch chain amino acids (BCAA): they facilitate muscle building.

This study does not deal with food supplements that are not taken as part of a sporting activity and to improve the physical performance of the individual. Thus, food supplements intended for certain categories of people (pregnant women, elderly people), to meet aesthetic objectives (hair care, skin, nails ...), etc. will not be discussed.

All our studies are available online in PDF format

Take a look at an example of our research on another market!

Choosing this study means :

Choosing this study means :

Access to more than 35 hours of work

Our studies are the result of over 35 hours of research and analysis. Using our studies allows you to devote more time and added value to your projects.

Benefit from 6 years' experience and over 1,500 industry reports already produced

Our expertise enables us to produce comprehensive studies in all sectors, including niche and emerging markets.

Our know-how and methodology enable us to produce reports that offer unique value for money.

Access to several thousand articles and paid-for data

Businesscoot has access to all the paid economic press as well as exclusive databases to carry out its market research (over 30,000 articles and private sources).

To enhance our research, our analysts also use web indicators (semrush, trends, etc.) to identify market trends and company strategies. (Consult our paying sources)

Guaranteed support after your purchase

A team dedicated to after-sales service, to guarantee you a high level of satisfaction. +44 238 097 0676

A digital format designed for our users

Not only do you have access to a PDF, but also to a digital version designed for our customers. This version gives you access to sources, data in Excel format and graphics. The content of the study can therefore be easily retrieved and adapted for your specific needs.

Our offers :

Our offers :

the market for sports nutrition supplements | United States

- What are the figures on the size and growth of the market?

- What is driving the growth of the market and its evolution?

- What is the positioning of companies in the value chain?

- Data from several dozen databases

5 reports pack (-15%) USA United States

- 5 reports at €75.6 excluding VAT per study to choose from our American catalogue for 12 months

- Save 15% on additional studies purchased

- Choose to be refunded any unused credit at the end of the 12-month period (duration of the pack)

See the terms and conditions of the pack and the refund of unused credit.