Synthèse du marché

1.1 Introduction

A cosmetic is defined as any substance or preparation intended to be applied to the various parts of the human body (epidermis, hair system and hair, nails, lips, external genital organs) or to the teeth and mucous membranes of the mouth, for the sole purpose of cleaning, perfuming, changing their appearance and/or correcting body odors and/or protecting or maintaining them in good condition. The main types of cosmetic products available on the market include:

- Skin care products: creams, lotions, masks.

- Makeup: foundations, mascaras, lipsticks, eye shadows.

- Hair care products: shampoos, conditioners, specific treatments.

- Perfumes and fragrances: eau de toilette, eau de parfum.

- Nail care products: nail polishes, strengtheners.

- Personal hygiene products: soaps, shower gels, deodorants.

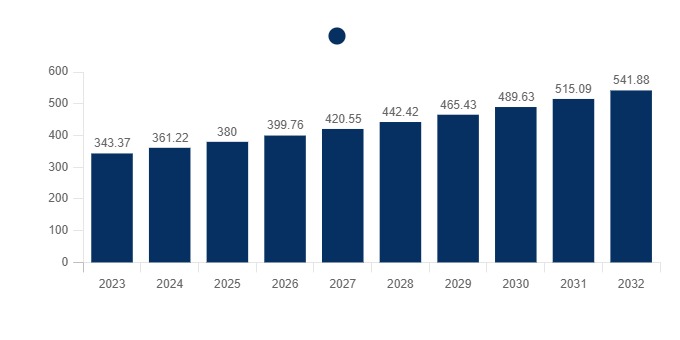

The global cosmetics market has reached a total value of 343.37 billion dollars in 2023. For the period 2024-2032 a compound annual growth rate (CAGR) of 5.4 percent under which the world market could reach at the end of the period a valueof approximately541.89 billion dollars.

This study focuses on the cosmetics market in the United Kingdom. For information on other markets in the United Kingdom, please refer to the specific studies available in the Businesscoot catalog.

1.2 The global market

Cosmetics are beauty products used for skin or body care or to accentuate the appearance of the human corm. These refer to a range of products available mainly in different categories, such as skin care and hair care. The global cosmetics market reached a value of

$343.37 billion in 2023 and is expected to grow at a CAGR of 5.2 percent from 2024 to 2032, to reach a value of about $541.89 billion.

Global cosmetics market value

World, 2023-2032, in billions of dollars ($)

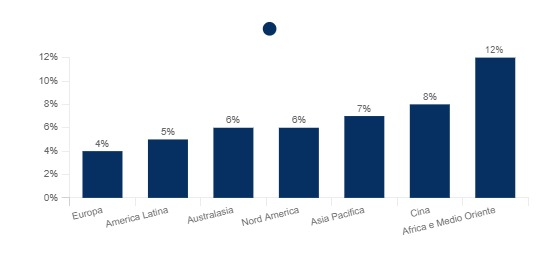

Globally, between 2022 and 2027, the cosmetics market in Africa and the Middle East is expected to grow at a compound annual growth rate (CAGR) of 12%. The markets in China and Asia Pacific stand at 8% and 7%, respectively, and North America and Australasia at 6%. Finally, the Latin American and European markets show the lowest growth values of 5% and 4%, respectively.

YOY growth rate of cosmetics sales in the retail channel, breakdown by geographic area

World, 2022-2027, %

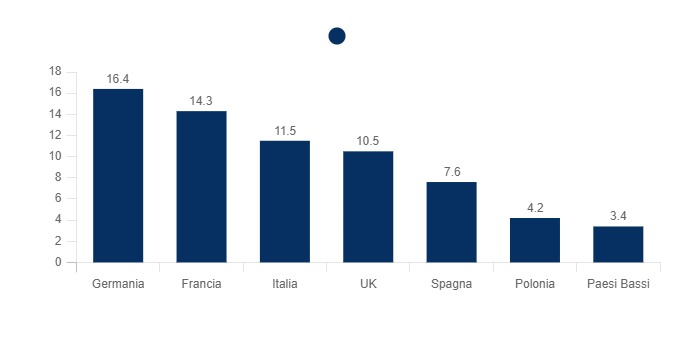

In the European context, the Germany confirms its leadership in cosmetics consumption (16.4 billion euros), followed by Francewith14.3 billion euros. L'Italy holds the third position with over 11.5 billion euros of cosmetics consumption. Fourth place for the United Kingdomwhich, with 10.5 billion euros record the least dynamic growth among the major players due to the effects generated by Brexit.

Cosmetics consumption in major European countries in 2022

Italy, 2022, in billion euros (€)

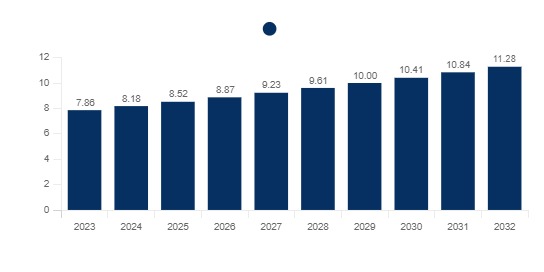

1.3 The market in the United Kingdom

In 2023, the cosmetics market in the UK is estimated at $7.86 billion. A compound annual growth rate (CAGR) of 4.1% is projected between 2023 and 2032, under which the market in this context could reach a total value of more than $11 billion by the end of the period.

Cosmetics market

United Kingdom, 2023-2032, in billions of dollars

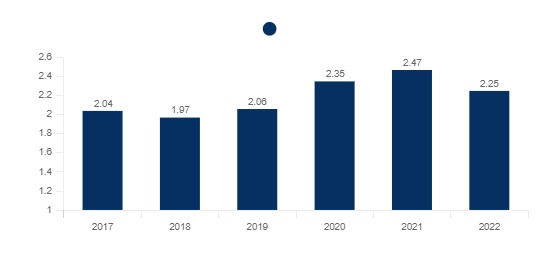

With regard to the domestic production of cosmetics, perfumes, and toiletries, there is evidence of growth in the value of production sold between 2017 and 2022. During the period analyzed, the value of production sold increased from 2.04 billion pounds to 2.25 billion pounds, representing a 10.3% increase. However, while there is a 21.1% growth between 2017, there is an 8.9% decrease in production sold between 2021 and 2022.

Value of production sold of perfumes and toiletries

United Kingdom, 2017-2022, in billions of pounds

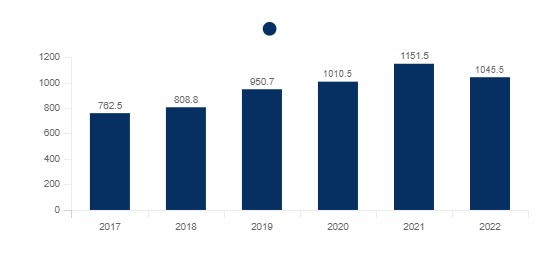

Relative to the cosmetics segment alone, between 2017 and 2022 the growth in the value of production sold is 37.1%, from £762.5 million to £1045.5 million. However, again after growth between 2017 and 2021 (+51.1%), sales contracted by 9.2% between 2021 and 2022.

Value of production sold of cosmetics (lip make-up, eye make-up, powders and earths, creams and lotions)

United Kingdom, 2017-2022, in millions of pounds

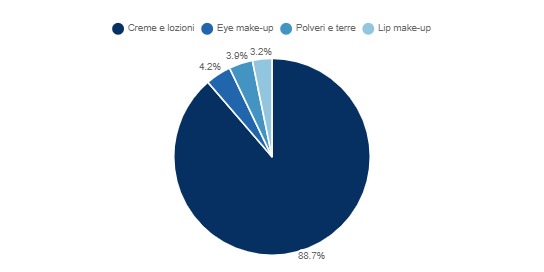

Finally, in terms of the percentage weight of each product category to the total, 88.7% of the value of production sold in 2022 can be attributed to creams and lotions. This is followed by eye make-up products (4.2%) and powders and earths (3.9%). Finally, lip make-up products account for 3.2% of total production sold.

Value of production sold of cosmetics (lip make-up, eye make-up, powders and earths, creams and lotions), breakdown by product type

United Kingdom, 2022, %

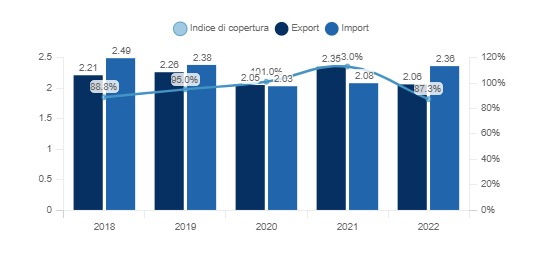

1.4 Import - Export

HS Code 3304 " is considered for the analysis of UK trade flows in relation to the cosmetics industry

Between 2018 and 2022, the UK's trade position fluctuated between net importer and net exporter as evidenced by fluctuations around 100% of the export coverage ratio, determined by the ratio of exports to imports multiplied by 100. As for UK cosmetics imports, between 2018 and 2022, the value of these decreased by 6.8% , from $2.21 billion to $2.06 billion. There is also a contraction for imports: between 2018 and 2022, the value of imports decreased from $2.49 billion to $2.35 billion, a decrease of 5.6%.

Import - export of cosmetics and toiletries products

United Kingdom, 2018-2022, in billion dollars and %

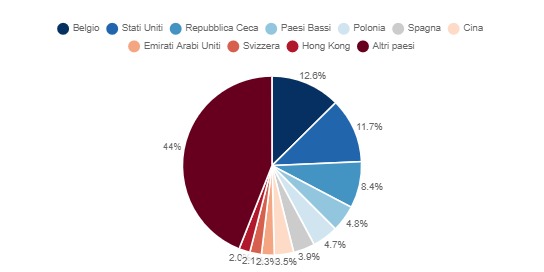

In terms of trade flows out of the UK, Belgium is the main trading partner, collecting 12.6% of total exports alone. It is followed by the United States (11.7%), the Czech Republic (8.4%), the Netherlands (4.8%)and Poland (4.7%). All other countries individually do not collect 4 percent of the total value and together contribute 57.8% of exports.

Main destination countries for cosmetics and toiletries exports

United Kingdom, 2022, %

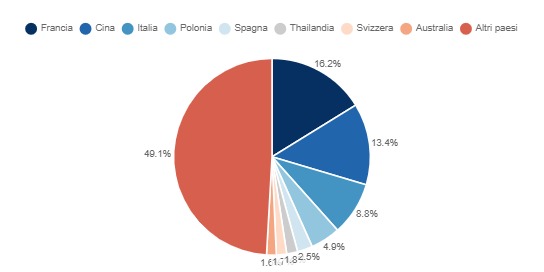

Finally, analyzing UK imports, France is the country's main trading partner contributing 16.2% of total imports. This is followed by China (13.4%), Italy (8.8%), and Poland (4.9%). The other countries individually do not reach 3% and together contribute 56.7% of imports.

Main countries of origin of cosmetics and toiletries imports

United Kingdom, 2022, %

1.5 The consequences of the Russian-Ukrainian conflict

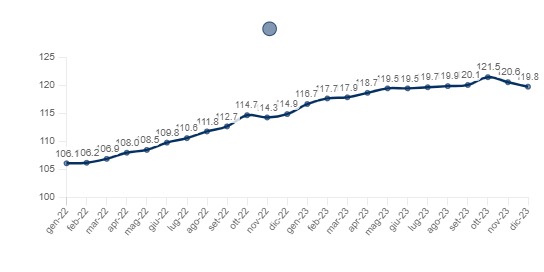

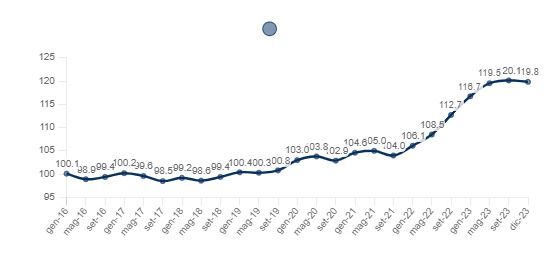

the outbreak of the Russian-Ukrainian conflict in February 2022 generated major consequences for the UK economy. The cosmetics and personal care products sector is not exempt from the effects of the conflict. Between January 2022 and December 2023, the consumer price index for the purchase of personal care products shows an increase of 13.8 points, representing a 13.8% increase in purchase prices in 23 months. Compared with 2015, the price increase stands at 19.8%.

Consumer price index for the purchase of personal care products

United Kingdom, 2022-2023, base 2015=100

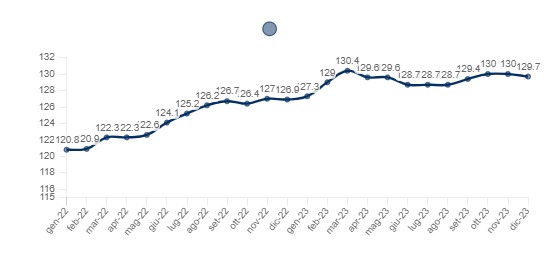

The increase in purchase prices is merely a reflection of the increase in production costs. Also, between January 2022 and December 2023, the producer price index for perfume and toiletries shows an increase of 8.9 points, representing an increase in production costs of 8.9% in 23 months. Compared with 2015, the increase in producer prices stands at 29.7%.

Producer price index for perfumes and toiletries

United Kingdom, 2022-2023, base 2015=100

Analyse de la demande

2.1 Demand in the United Kingdom

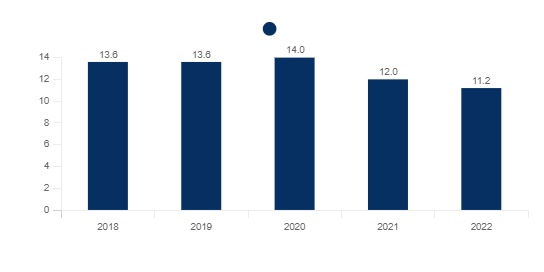

Analyzing the trend of average monthly household spending on cosmetic purchases shows a 17.6% decrease in spending between 2018 and 2022. During the period analyzed, the average monthly household expenditure decreased from £13.60 per month to £11.2 per month. However, while there is a growth of 2.9% between 2018 and 2020, between 2020 and 2020 spending contracted by 20.0%, from 14 pounds per month to 11.2 pounds per month.

Average monthly household spending on cosmetics purchases

United Kingdom, 2018-2022, in pounds

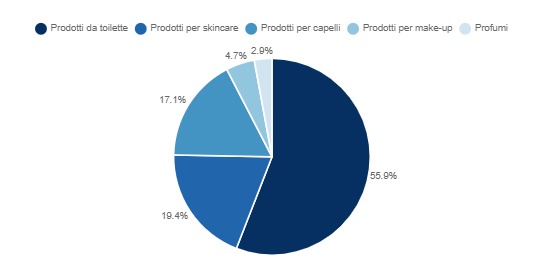

As for the breakdown of sales value among different product categories, toiletries alone collect 55.9% of the total value. This is followed by skin care products with 19.4% and hair care products with 17.1% . Finally, make-up products and perfumes account for 4.7% and 2.9% of total sales, respectively.

Sales value of cosmetic products, breakdown by product type

United Kingdom, 2022, %

2.2 Demand drivers

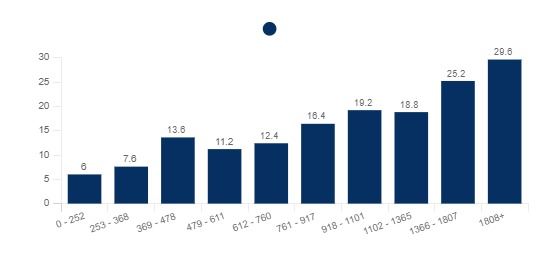

For the analysis of demand drivers, the distribution of spending on the purchase of cosmetics and hair care products in different income and age groups is considered.

Regarding the different income brackets, there is a strong correlation between the increase in average weekly income and the increase in spending on cosmetics and hair care products. In fact, while in the lowest income brackets (0-760 pounds per week) the average monthly expenditure ranges between 6 and 12.40 pounds per household, in the highest income brackets (1366+ pounds per week) the average monthly expenditure ranges between 25.20 pounds and 29.60 pounds per month.

Average monthly household spending on cosmetics and hair products, breakdown by weekly income bracket

United Kingdom, 2022, in pounds

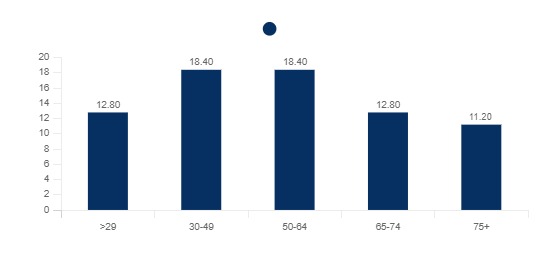

Regarding the average monthly expenditure in the different age groups, those aged between 30 and 64 have the highest expenditure values, shares at 18.40 pounds per month. Those under 30, as well as those aged 66 to 74, spend an average of 12.80 pounds per month on the purchase of cosmetics and hair care products. Finally, among those over 75, the average monthly expenditure stands at 11.20 pounds.

Average monthly expenditure on the purchase of cosmetics and hair care products, breakdown by age group

United Kingdom, 2022, in pounds

2.3 Geographical distribution of demand

To visualize the geographic distribution of demand for cosmetics in the United Kingdom, a map was created with the value of the average monthly expenditure on the purchase of cosmetics and hair care products in each member country.

The highest spending values are in England, where in 2022 households spent an average of £18.0 per month on the purchase of cosmetics and hair care products. This is followed by Northern Ireland and Scotland, where average monthly spending stands at £17.2 and £16.40 per household, respectively. Finally, households in Wales have the lowest monthly expenditure in the entire United Kingdom, averaging just £12.0 per month (66.7% of that of English households).

| COUNTRY |

AVERAGE MONTHLY EXPENDITURE |

| England |

£18.00 |

| Northern Ireland |

£17.20 |

| Scotland |

£16.40 |

| Wales |

£12.00 |

| United Kingdom |

£17.60 |

2.4 New demand trends: the "Clean Beauty"

clean beauty products are defined by their formulation free of ingredients that are potentially harmful to human health, such as parabens, petrochemicals, and synthetic fragrances. These products are made with plant-based ingredients that are responsibly sourced and humanely tested. This category of cosmetics has become popular because it offers a safer and more natural alternative to traditional beauty products that may contain toxic substances. Consumers' choice to switch to clean beauty is often motivated by health and environmental concerns. Indeed, many consumers are aware that what is applied to the skin can be absorbed into the bloodstream. As a result, there is a growing demand for products that are both effective and safe for everyday use.

(YoungLiving)

(Kripalu)

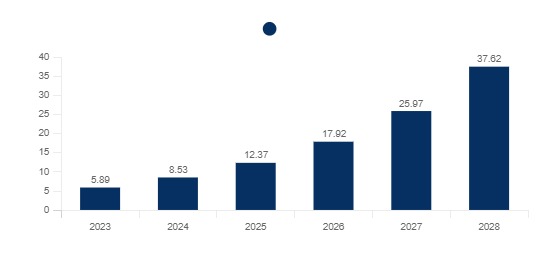

In 2023, the global market for "Clean Beauty" products is estimated at $5.89 billion. Sustained growth in the industry is expected in the near future, estimated at a CAGR of 44.9%, under which the global market could reach a total value of $37.52 billion by the end of the period.

"Clean Beauty" Product Market

World, 2023-2028, in billions of dollars

Structure du marché

3.1 The market structure

To analyze the structure of the market in the United Kingdom, enterprises under SIC Code 20.42.0 "Manufacture of perfume and toiletries" are considered. In particular, the number of active enterprises, the breakdown of the number of enterprises by staff size, and the legal status of enterprises are analyzed.

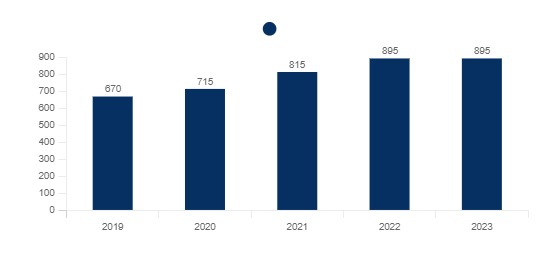

Number of enterprises

Between 2019 and 2023, the total number of enterprises active in the production of perfumes and toiletries appears to be increasing. During the period analyzed, the total number of active companies increased from 670 to 895, marking a 33.6% increase in 5 years. The growth appears to be constant during the entire period, and the outbreak of the pandemic in 2020 does not seem to have affected the industry.

Active enterprises under SIC Code 20.42.0 "Manufacture of perfume and toiletries"

United Kingdom, 2019-2023, in number

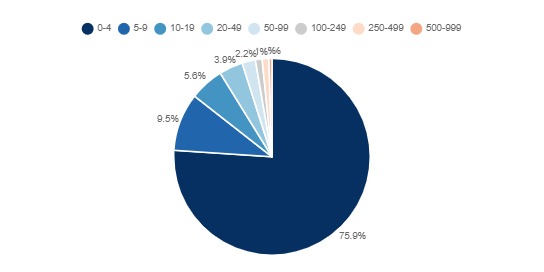

Staff size

Regarding the staff size of different companies, 75.9% of companies have between 0 and 4 employees. This is followed by firms with 5-9 employees (9.5%) and firms with 10-19 employees (5.6%). Firms with 20-49 employees are 3.9% of the total, while those with 50-99 employees are 2.2% . Finally, large firms with between 100 and 1,000 employees are just 2.9% of the total business.

Firms under SIC Code 20.42.0 "Manufacture of perfumes and toiletries," breakdown by number of employees

United Kingdom, 2023, %

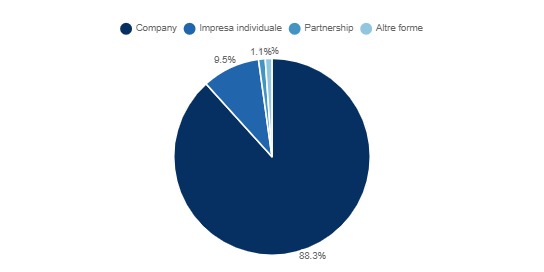

Legal status

Finally, regarding the legal status of enterprises, 88.3% of enterprises can be traced to the status of "Company." This is followed by sole proprietorships with 9.5% of the total and partnerships with 1.1%. Finally, all other forms of enterprises account for just 1.1% of the total business.

Legal form of business under SIC Code 20.42.0 "Manufacture of perfume and toiletries"

United Kingdom, 2023, %

3.2 The value chain

The value chain in the cosmetics market includes several stages from the supply of raw materials to the sale to the end consumer. Here is a general summary of the main stages:

- Raw material supply: this stage includes the production and supply of ingredients and materials used in the manufacture of cosmetic products. It includes manufacturers of oils, fragrances, dyes, preservatives, and other chemicals.

- Production and manufacturing: at this stage, raw materials are transformed into finished cosmetic products. This includes processes such as mixing, formulation, and packaging.

- Distribution and Wholesale: after production, cosmetic products are distributed to retailers through distributors or directly by the manufacturing companies.

- Retail: cosmetic products are sold to consumers through various retail channels, such as specialty stores, supermarkets, pharmacies, and e-commerce platforms.

- Marketing andAdvertising : marketing and advertising strategies are essential to increase brand awareness and influence consumers' purchasing decisions. This can include traditional advertising, digital marketing, influencer partnerships, and promotional campaigns.

Raw materials

In the cosmetics industry, functional raw materials are essential in determining the efficacy and characteristics of finished products.

- Cleansers: remove dirt from skin, hair or nails. The most common are surfactants, but exfoliants and solvents can also clean surfaces.

- Conditioners: change the feel of skin or hair to the touch and must be left on the surface to have a significant effect. Common conditioners include cationic surfactants, occlusive agents, humectants and emollients.

- Dyes: impart color to the skin or hair. Dyes are among the most regulated ingredients and must be approved for such purposes.

- Fragrances: change the smell of a product and the surface to which they are applied.

- Film formers: used to change the shape of hair to create uniform surfaces in products such as sunscreens (they are generally polymers).

- Reactives: some cosmetics involve chemical reactions, such as products to change the shape of hair, color skin or remove hair.

- Pharmaceutical actives: these are not technically cosmetics. If a product contains a pharmaceutical active, it becomes a drug. Pharmaceutical actives include sunscreens, antiperspirants, anti-dandruff, antibacterial, anti-caries, skin lighteners, anti-acne, and hair growth actives.[Chemists Corner]

Marketing and advertising

Advertising and marketing are instrumental in the cosmetics industry, driving the growth and success of brands. The marketing strategies adopted by cosmetic companies are crucial to standing out in such a competitive market.

- Building a community: the cosmetics industry consists of a large consumer audience as well as many competitors. Building a community through various channels can increase customer loyalty and grow the brand. This can include Q&A sessions on Instagram, creating engaging content on social media, and incentivizing customers to be repeat customers through discounts and point systems.

- Fluent omnichannel experience: successful brands are active on numerous distribution channels, including e-commerce sites, blogs, email newsletters, social platforms such as TikTok, Instagram, Facebook, YouTube, Pinterest, and paid advertising. Using different forms of digital marketing and promoting your brand on multiple platforms can increase brand awareness and drive traffic to it.

- User-Generated Content and Reviews: authenticuser-generated content, such as videos, images, and reviews, can be shared on the brand's social channels and website. This authentic content builds trust among consumers because it comes across as genuine and not a sales tactic.

- Collaborations with Beauty Influencers: influencer marketing is growing and has a significant impact on consumers' purchase decisions.[DAN]

In addition, the "tiktokification" of ads, where influencer content reminiscent of TikTok feeds outnumbers traditional branded ads nearly 2 to 1, underscores the importance of mobile optimization and creating authentic, platform-friendly content for social media marketing strategy.[Cosmeticsdesign]

As far as advertising is concerned, many consumers believe that we are witnessing positivity-washing, curve-washing, and diversity-washing; these hard-to-find attitudes represent an apparent sympathetic bias toward certain categories of people but are actually aimed at manipulating the most fragile or discriminated categories with the sole intent of increasing profits. According to a survey conducted by AARP (American noprofit association) about 90 percent of women of all ages do not feel represented by beauty product advertisements.

- The women who feel, on the whole, least represented are those of the boomers' generation.

- About 90% of women of different generations, would like to see a mix of ages in the advertisements and would like them to be much more realistic and representative.

- About 60% of women believe that big companies have profit as their only goal.[Mybeautik]

3.3 The main manufacturers

The following is a list of major cosmetics manufacturers in the UK:

Avon Cosmetics Limited:a leading beauty company, was founded in 1957 and is headquartered in Northampton, UK. The company is primarily engaged in the wholesale of perfumes and beauty products, and also operates in the cosmetics industry. Globally, Avon is known for being more than just a beauty company. Founded over 135 years ago, Avon has been committed to listening to women's needs and speaking for them, advocating what is important to them and helping them with their initiatives. Avon is known for creating flexible opportunities for anyone who wants to earn and learn. Their independent representatives provide millions of customers worldwide with personalized beauty advice and trusted products to help them express their individuality. The company is committed to making a positive social and environmental impact by supporting causes important to women and through the way they conduct their business.

Revolution Beauty Limited: is a UK-based beauty company founded in 2014 by Adam Minto and Tom Allsworth. The company focuses on selling makeup, skin care, and hair care products. Revolution Beauty is known for its principles of inclusivity and accessibility in the makeup world, offering a diverse range of products at affordable prices. All Revolution products are cruelty-free, with 76 percent of the range offering vegan products. In 2019, the company was recognized as the fastest growing beauty brand in the UK by the Sunday Times Fast Track 100.

Elemis Limited: founded in 1988 and located in Bristol, UK, is recognized for its expertise in the production of perfumes and toilet preparations. This British company stands out in the beauty and wellness industry because of its ability to combine scientific principles and natural elements in the creation of its products. Elemis has built a reputation for excellence, offering high-quality solutions ranging from skincare to luxury treatments, aiming to meet consumers' needs with effective and innovative products.

Clarins Uk Limited: is a subsidiary of the Clarins Group, incorporated on August 14, 1981. The company, based in London, is primarily engaged in the wholesale of perfumes and cosmetics. Clarins, recognized as a world leader in high-quality skin care and makeup, is a brand that has gained international fame for its innovative and high-quality products. The Clarins Group began more than 65 years ago, founded by Jacques Courtin-Clarins with a vision aimed at modern cosmetics and women's well-being. Today, the brand is known for its excellence in skincare and makeup products, operating in nearly 150 countries through its subsidiaries.

Royal Sanders UK Limited:founded in 2008, is a company based in Preston, Lancashire, specializing in the production of soaps and cleansers. It focuses on the development and supply of personal care products, demonstrating an unwavering commitment to innovation and quality. The company has evolved its offerings to meet the diverse needs of the market, ensuring products that meet both efficacy and environmental standards. With a customer-focused approach, Royal Sanders has established its position in the UK market as a reliable and respected manufacturer in the personal care industry.

Creightons PLC: founded in 1975 and based in Peterborough, England, is a major British company in the beauty and personal care industry. Listed on the London Stock Exchange since 1987, the company has made its mark in the consumer goods market, standing out in particular for its beauty and personal care products. Creightons' business strategy focuses on innovation and quality, aiming to respond effectively to the needs of both the consumer and professional markets. Their products range from classic skin and hair care items to more specialized products, all characterized by an ongoing commitment to research and development.

Albion Cosmetics Limited:is a major Japanese company in the luxury cosmetics industry, was founded on March 2, 1956. Headquartered in Ginza, Tokyo, the company produces and distributes a variety of cosmetic products, focusing on quality and innovation. Albion is known for creating product lines that combine tradition and modernity, and has partnered with renowned fashion brands such as "ANNA SUI" and "PAUL & JOE." Their products range from skin care lines to makeup and perfumes, which are appreciated both nationally and internationally. Albion is part of the KOSE Corporation group, further strengthening its presence in the global cosmetics market.

Professional Beauty Systems (Holding) Limited:founded in late 2006, focuses on the production of items related to beauty and personal care, such as perfumes and toilet preparations. Based in the United Kingdom, the company is committed to offering high quality beauty products while maintaining a focus on research and development to meet the evolving needs of consumers. Their product range reflects a commitment to creating innovative items that meet the demands of the contemporary beauty and wellness market.

Herrco Cosmetics Limited : is an active cosmetics manufacturing company, founded on February 17, 2009. Based in Halesworth, Suffolk, UK, the company was founded by Nigel and Sue Herrmann and is now led by their son Derek, who is qualified in cosmetic chemistry. Herrco Cosmetics is known for product innovation and technological advancement, and is committed to offering the best in cosmetics innovation, producing beloved products and seeking opportunities to reduce the impact of waste on the environment, ensuring that sustainability remains part of its DNA. The company specializes in the production of natural and organic cosmetics, certified to the Soil Association's COSMOS standard, and is proud of its production and warehouse facilities that enable it to meet the scalability needs of its customers.

Orean Personal Care Limited: founded in 2008, stands out in the personal care and beauty industry. The company, located in Cleckheaton, West Yorkshire, is committed to creating a wide range of personal care products, placing a strong emphasis on innovation and quality. Orean focuses on developing advanced formulas and unique solutions, aiming to meet the specific needs of its customers. Its commitment to excellence and sustainability has made Orean a recognized name in the beauty market, with a reputation for products that combine efficacy and care for healthy skin and hair.

| COMPANY |

YEAR FOUNDED |

CITY |

TURNOVER |

| Avon Cosmetics Limited |

1957 |

Northampton (Northamptonshire) |

£493.400.000 (2021) |

| Revolution Beauty Limited |

2014 |

London (London) |

£148.000.000 (2023) |

| Elemis Limited |

1988 |

Bristol (Bristol) |

£138.505.000 (2022) |

| Clarins Uk Limited |

1981 |

London (London) |

£110.733.900 (2022) |

| Royal Sanders UK Limited |

2008 |

Preston (Lancashire) |

£72.969.000 (2023) |

| Creightons PLC |

1975 |

Peterborough (Cambridgeshire) |

£58.467.000 (2023) |

| Albion Cosmetics Limited |

1956 |

Tokyo (Japan) |

£50.363.000 (2021) |

| Professional Beauty Systems (Holding) Limited |

2006 |

Renfrew (Renfrewshire) |

£44.777.730 (2022) |

| Herrco Cosmetics Limited |

2009 |

Halesworth (Suffolk) |

£32.246.000 (2022) |

| Orean Personal Care Limited |

2008 |

Cleckheaton (West Yorkshire) |

£31.574.024 (2022) |

3.4 The distribution

As for the distribution of cosmetics in the territory, enterprises under SIC Codes 46.45 "Wholesale trade in perfumes and cosmetics" and 47.75 "Retail trade in cosmetics and toiletries" are analyzed.

Wholesale

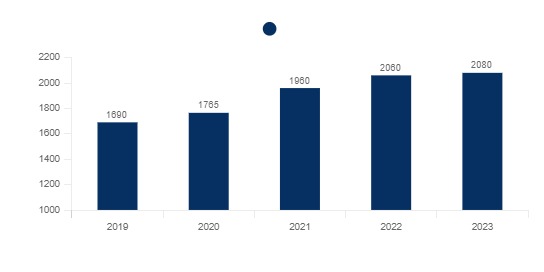

Between 2019 and 2023, as well as production enterprises, businesses devoted to wholesale distribution of cosmetics are also found to be growing. During the period analyzed, the total number of enterprises increased from 1690 to 2080, marking a growth of 23.1%. Again, growth appears to be constant throughout the period, and the outbreak of the pandemic in 2020 does not seem to have had a negative effect on the industry.

Perfume and cosmetics wholesale enterprises (SIC Code 46.45.0)

United Kingdom, 2019-2023, in numbers

Detail

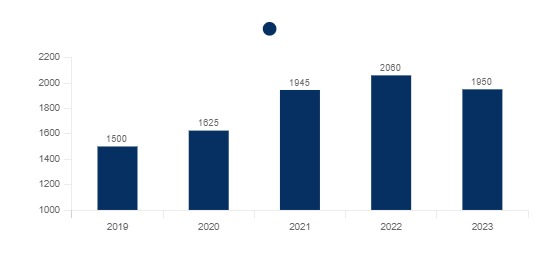

In terms of retail businesses, growth is shown between 2019 and 2023. During the period analyzed, the total number of businesses grew by 30.0%, from 1,500 to 1,950. However, unlike the previous case, the growth is not constant throughout the entire period. While between 2019 and 2022 there is a growth of 37.3%, between 2022 and 2023 the total number of businesses contracts by 5.3%.

Cosmetics and toiletries retail businesses (SIC Code 47.75.0)

United Kingdom, 2019-2023, in number

Major players active in the retail trade of cosmetics and toiletries include:

Boots Uk Limited: founded in 1849 by John Boot, is a renowned British chain of pharmacies and health and beauty stores. Headquartered in Beeston, Nottinghamshire, the company has established a strong presence in the UK, boasting about 2,200 stores as of 2022. Boots is known for its wide range of health, beauty, and pharmaceutical products, as well as optical and hearing care services, and is one of the largest retailer chains in the UK and Ireland by revenue and number of stores.

Superdrug Store PLC: is a major retail chain in the UK, specializing in health and beauty products. Founded in 1964 by the Goldstein brothers in London, Superdrug has experienced rapid expansion. As of December 2017, the company operated 796 stores in the United Kingdom. Superdrug is known for its wide range of products including cosmetics, skin care products and health care items, as well as services such as pharmacies and nursing clinics in more than 220 stores.

Savers Helth and Beauty Limited: founded in 1988, is a discount store chain with more than 500 stores in the United Kingdom, part of the A.S. Watson Group. It positions itself as a value retailer, offering a variety of health, beauty, household goods, medicines and fragrances. The company expanded rapidly in the 1990s and continued to grow even after it was purchased by A.S. Watson in 2000.

Space NK Limited: is a British retailer of personal care products and cosmetics, founded in 1991 by Nicky Kinnaird. The first Space NK store was opened in 1993 in Covent Garden, London. The chain has grown over the years, and through December 2023, has 75 stores in the United Kingdom, with most stores located in England. Space NK offers a range of products including cosmetics, skin care products and gadgets, with a selection that includes more than 130 brands including Drunk Elephant, Nars, Charlotte Tilbury and Diptyque, as well as exclusive brands such as Boy Smells and Rose Inc.

Lush Retail Limited: was founded in 1995 by Mark Constantine, his wife Mo Constantine and five other co-founders. The company is known for producing and selling a variety of handmade cosmetic products, including creams, soaps, shampoos, shower gels, lotions, moisturizers, scrubs, masks, and other skin and hair care products. Lush has gained a reputation for its ethical and sustainable products, emphasizing the use of natural ingredients and reduced packaging. Currently, Lush has 951 stores worldwide.

| COMPANY |

YEAR FOUNDED |

STORES |

TURNOVER |

| Boots Uk Limited |

1849 |

2200 |

£6.512.000.000 (2022) |

| Superdrug Store PLC |

1964 |

796 |

£1.367.000.000 (2022) |

| Savers Helth and Beauty Limited |

1988 |

500 |

£672.600.000 (2022) |

| Lush Retail Limited |

1995 |

101 |

£139.600.000 (2022) |

Space NK Limited

|

1991 |

75 |

£146.620.179 (2022) |

Analyse de l'offre

4.1 Type of the offer

| COSMETIC CATEGORY |

DESCRIPTION |

PRODUCTS INCLUDED |

| Skin care products |

These products are designed to improve the look and feel of the skin. The skin care category is the largest in the cosmetics market and includes products that stay on the skin such as moisturizers and anti-aging, as well as products designed to remove impurities such as cleansers, exfoliants, and masks.

|

Anti-aging and anti-wrinkle creams

Moisturizing and nourishing creams

Face and eye cleansers and makeup removers

Eye contours and specific areas

Products for skin impurities

Face wipes

Toning lotions

Mask and exfoliants

Depigmentants |

| Hair care products |

This category includes products intended to improve the appearance and health of hair, such as shampoos, conditioners, intensive treatments, and styling products. Hair products can be further classified according to their function and the type of problem they address (e.g., dryness, frizz, dandruff). |

Coloring shampoos, tinted foams

Aftershampoos, conditioners and masks

Lotions and shock treatment

Lacquers

Gels, waters and gums

Fixers and structuring mousses |

| Tinted cosmetics |

These products are used to change skin color and appearance and include foundations, lipsticks, blushes, eye shadows, eyeliners, and mascaras. Nail products, such as nail polishes and nail care products, also fall into this category. Color cosmetics are among the most regulated in the industry because of restrictions on the coloring ingredients used. |

Mascaras

Outlines and pencils

Eyeshadows

Foundations and tinted creams

Cheek correctors, blushes and earths

Powders

Lipsticks and lip glosses

Protectors, colorless bases and sun sticks

Outliners and pencils

Nail polishes

Creams, gels, lotions and nail products

Solvents and other products

|

| Fragrances |

Includes perfumes, colognes, body sprays and scented lotions. Fragrances are intended to modify natural body odor and are a significant part of the cosmetics market. |

Toilet waters, perfumes and women's extracts

Men's toilet waters, perfumes and extracts |

| Personal care products |

This category covers a range of products that do not fall into the other categories, such as oral hygiene products (e.g., toothpastes and mouthwashes) and deodorants/antiperspirants. These products are essential to the daily personal care routine of many consumers. |

Deodorants and antiperspirants

Sunscreens and pigmenting agents

Moisturizers, nutrients, exfoliants

Cellulite products

Multi-purpose creams

Firming, zone-specific and anti-aging body creams

Depilatories

Body waters and oils

Soaps, foams and shaving gels

Aftershave

Treatment creams

|

4.2 The prices

Between 2016 and 2023, the consumer price index for the purchase of personal care products shows an increase of 19.7 points, representing a 19.7% increase in consumer prices. However, while between January 2016 and Jan. 2022 there is an increase of just 2.9 points (+2.9%), between Jan. 2022 and Dec. 2023 the increase stands at 16.8 points, representing a price increase of 16.8% in 23 months. The increase between January 2022 and December 2023 is 5 times higher than that recorded during the entire 2016-2022 period.

Consumer price index for personal care products

United Kingdom, 2016-2023, base 2015=100

The following are price examples for some product types broken down by category and manufacturer:

Eye cosmetics

Lip cosmetics

(Boots)

Facial Cosmetics

(Boots)

4.3 New supply trends

The trend toward innovative and environmentally friendly packaging in the cosmetics industry reflects a growing interest in sustainability. Companies are adopting biodegradable, recyclable and reusable packaging solutions. This includes:

- Eco-friendly materials: companies are adopting biodegradable, recycled and natural materials as an alternative to traditional plastic. These include glass, bamboo, sustainable cardboard, and post-consumer recycled plastic.

- Refill systems: reusable packaging and refill systems are becoming increasingly popular. These systems allow consumers to purchase the container once and then purchase only refills, reducing waste generation.

- Minimalist design: a simple and functional design is not only visually appealing, but also reduces the use of excessive and unnecessary materials, helping to reduce environmental impact.

- Environmental certifications and standards: companies are seeking environmental certifications that ensure the sustainability and eco-friendliness of their packaging, such as those offered by organizations like FSC (Forest Stewardship Council).

- Innovation and technology: the adoption of new technologies in packaging production enables the development of more efficient and sustainable solutions, such as the use of compostable materials and the reduction of packaging weight to reduce emissions during transport.

(Sulapac)(Cosmeticpackagingnow)

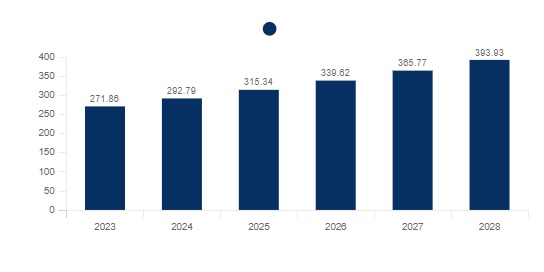

Globally, the sustainable packaging market has reached a value of $271.86 billion in 2023. Over the period 2023-2028, a compound annual growth rate (CAGR) of 7.7% is estimated, under which the global market could reach a total value of $393.39 billion by the end of the period.

Sustainable packaging market

World, 2023-2028, in billions of dollars

Règlementation

5.1 The legislation

The legislative framework inherent in the cosmetics industry aims to ensure the quality, safety and origin of products placed on the market. Some of the main legislative references adopted by the UK are:

- The Product Safety and Metrology (Amendment and Transitional Provisions) Regulations 2022: includes amendments to various existing regulations concerning product safety and metrology. These amendments were introduced to adapt UK legislation after the UK's exit from the European Union. The regulations include period extensions for some transitional provisions, adjustments to product marking regulations, and changes to some specific regulations related to product safety and product compliance.

- Schedule 34 of the Product Safety and Metrology Statutory Instrument: makes changes to Regulation (EC) No. 1223/2009 concerning cosmetic products. These changes include adjustments to definitions, responsibilities of manufacturers, importers, and distributors, and notification procedures. The aim is to adapt the regulation to the UK's exit from the European Union, ensuring that cosmetic products are safe and compliant in the post-Brexit environment.

- The Cosmetic Products Enforcement Regulations 2013: establishes the framework for the enforcement of Regulation (EC) No. 1223/2009, which covers the safety and compliance of cosmetic products. These regulations outline enforcement powers and procedures related to cosmetic products, ensuring their safety and compliance with regulatory requirements. This includes provisions on labeling, responsibilities of manufacturers and importers, and the authority of market control bodies to ensure compliance and safety of cosmetic products.

- The Cosmetic Products (Restriction of Chemical Substances) (No. 2) Regulations 2023: includes new amendments regarding the use requirements for cosmetic ingredients. These amendments mainly concern restricted ingredient lists and permitted UV filters, based on the opinions of the Scientific Advisory Group on Chemical Safety in Consumer Products (SAG-CS).

- Regulation (EC) No. 1223/2009: establishes rules that every cosmetic product placed on the market must comply with in order to ensure the proper functioning of the internal market and a high level of human health protection.

Positionnement des acteurs

6.1 Segmentation

|

COMPANY |

TURNOVER |

| Manufacturers |

Avon Cosmetics Limited |

£493.400.000 (2021) |

| Revolution Beauty Limited |

£148.000.000 (2023) |

| Elemis Limited |

£138.505.000 (2022) |

| Clarins Uk Limited |

£110.733.900 (2022) |

Royal Sanders UK Limited

|

£72.969.000 (2023) |

| Retailers |

Boots Uk Limited |

£6.512.000.000 (2022) |

| Superdrug Store PLC |

£1.367.000.000 (2022) |

| Savers Helth and Beauty Limited |

£672.600.000 (2022) |

Space NK Limited

|

£146.620.179 (2022)

|

Companies

Avon Cosmetics Limited

DUNS: NA

Turnover:

578.32 million € (2021)

Description:

A leading beauty company, it was founded in 1957 and is headquartered in Northampton, UK. The company is primarily involved in the wholesale of perfumes and beauty products, and also operates in the cosmetics industry. Globally, Avon is known for being more than just a beauty company. Founded over 135 years ago, Avon has been committed to listening to women's needs and speaking for them, advocating what is important to them and helping them with their initiatives. Avon is known for creating flexible opportunities for anyone who wants to earn and learn. Their independent representatives provide millions of customers worldwide with personalized beauty advice and trusted products to help them express their individuality. The company is committed to making a positive social and environmental impact by supporting causes important to women and through the way they conduct their business.

External Sources and News:

| YEAR |

BILLING |

| 2021 |

£493.400.000 |

| 2020 |

£558.200.000 |

| 2019 |

£714.500.000 |

Revolution Beauty Limited

DUNS: NA

Turnover:

173.47 million € (2023)

Description:

It is a UK-based beauty company founded in 2014 by Adam Minto and Tom Allsworth. The company focuses on selling makeup, skincare, and hair care products. Revolution Beauty is known for its principles of inclusivity and accessibility in the makeup world, offering a diverse range of products at affordable prices. All Revolution products are cruelty-free, with 76 percent of the range offering vegan products. In 2019, the company was recognized as the fastest growing beauty brand in the UK by the Sunday Times Fast Track 100.

External Sources and News:

| YEAR |

BILLING |

| 2023 |

£148.000.000 |

| 2022 |

£151.800.000 |

| 2021 |

£131.100.000 |

Elemis Limited

DUNS: NA

Turnover:

162.35 million € (2022)

Description:

Founded in 1988 and located in Bristol, UK, it is recognized for its expertise in the production of perfumes and toilet preparations. This British company stands out in the beauty and wellness industry because of its ability to combine scientific principles and natural elements in the creation of its products. Elemis has built a reputation for excellence, offering high-quality solutions ranging from skincare to luxury treatments, aiming to meet consumers' needs with effective and innovative products.

External Sources and News:

| YEAR |

BILLING |

| 2022 |

£138.505.000 |

| 2021 |

£105.381.000 |

| 2020 |

£123.006.000 |

Clarins Uk Limited

DUNS: NA

Turnover:

129.79 million € (2022)

Description:

It is a subsidiary of the Clarins Group, established on August 14, 1981. The company, headquartered in London, is primarily engaged in the wholesale of perfumes and cosmetics. Clarins, recognized as a world leader in high-quality skincare and makeup, is a brand that has gained international fame for its innovative and high-quality products. The Clarins Group began more than 65 years ago, founded by Jacques Courtin-Clarins with a vision aimed at modern cosmetics and women's well-being. Today, the brand is known for its excellence in skincare and makeup products, operating in nearly 150 countries through its subsidiaries.

External Sources and News:

| YEAR |

BILLING |

| 2022 |

£110.733.900 |

| 2021 |

£109.047.612 |

| 2020 |

£107.400.368 |

Royal Sanders UK Limited

DUNS: NA

Turnover:

85.52 million € (2023)

Description:

Founded in 2008, it is a company based in Preston, Lancashire, specializing in the production of soaps and detergents. It focuses on the development and supply of personal care products, demonstrating an unwavering commitment to innovation and quality. The company has evolved its offerings to meet the diverse needs of the market, ensuring products that meet both efficacy and environmental standards. With a customer-focused approach, Royal Sanders has established its position in the UK market as a reliable and respected manufacturer in the personal care industry.

External Sources and News:

| YEAR |

BILLING |

| 2023 |

£72.969.000 |

| 2022 |

£66.354.000 |

| 2021 |

£88.793.000 |

Boots Uk Limited

DUNS: NA

Turnover:

7.63 billion € (2022)

Description:

Founded in 1849 by John Boot, it is a renowned British chain of pharmacies and health and beauty stores. Headquartered in Beeston, Nottinghamshire, the company has established a strong presence in the United Kingdom, boasting about 2,200 stores as of 2022. Boots is known for its wide range of health, beauty, and pharmaceutical products, as well as optical and hearing care services, and is one of the largest retailer chains in the UK and Ireland by revenue and number of stores.

External Sources and News:

| YEAR |

BILLING |

| 2022 |

£6.512.000.000 |

| 2021 |

£5.812.000.000 |

| 2020 |

£5.948.000.000 |

Superdrug Store PLC

DUNS: NA

Turnover:

1.61 billion € (2022)

Description:

It is a major chain of stores in the United Kingdom, specializing in health and beauty products. Founded in 1964 by the Goldstein brothers in London, Superdrug has experienced rapid expansion. As of December 2017, the company operated 796 stores in the United Kingdom. Superdrug is known for its wide range of products including cosmetics, skin care products and health care items, as well as services such as pharmacies and nursing clinics in more than 220 stores.

External Sources and News:

| YEAR |

BILLING |

| 2022 |

£1.367.000.000 |

| 2021 |

£1.168.000.000 |

| 2020 |

£1.111.000.000 |

Savers Helth and Beauty Limited

DUNS: NA

Turnover:

788.51 million € (2022)

Description:

Founded in 1988, it is a discount store chain with more than 500 stores in the United Kingdom, part of the A.S. Watson Group. It positions itself as a value retailer, offering a variety of health, beauty, home goods, medicines and fragrances. The company expanded rapidly in the 1990s and continued to grow even after it was purchased by A.S. Watson in 2000.

External Sources and News:

| YEAR |

BILLING |

| 2022 |

£672.600.000 |

| 2021 |

£567.200.000 |

| 2020 |

£536.100.000 |