Market overview

1.1 Introduction

Ham is the cured or cooked preparation of the pork leg or shoulder. The ham market is a component of the charcuterie industry. it should be noted that this study concerns exclusively pork ham, and therefore excludes "poultry ham".

In Spain, there are two specific types of ham: white ham, made from white (pink) pigs, and Iberian ham, made from Iberian pigs. While the former is not specific to Spain, the latter, Iberian ham, reflects the unique history, know-how and flavors of Spanish culture. Iberian ham is thus characterized as a luxury product with high added value, exported worldwide.

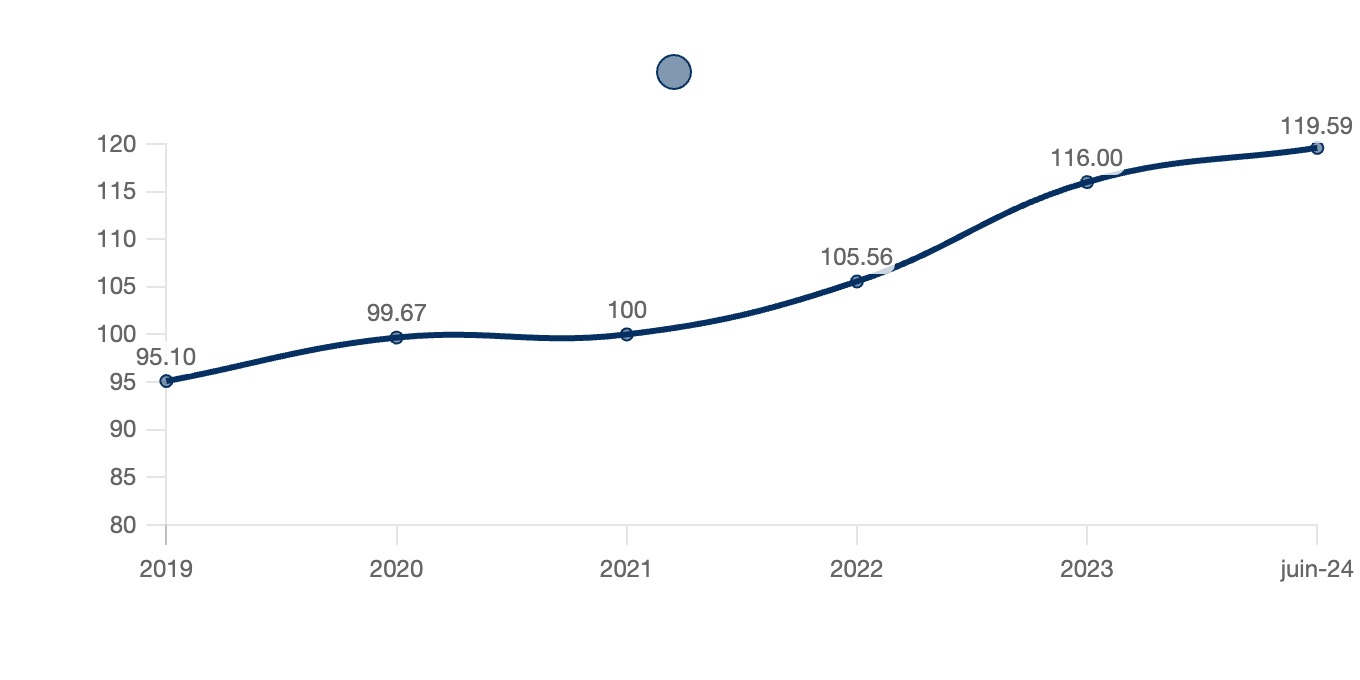

The market continues to expand. At national level, salesare set to rise by 9.73% between 2019 and 2023, despite the covid 19 pandemic. When we focus on the Iberian ham segment, the increase is even greater, with sales up 22.50%, thanks in particular to new international outlets.

1.2 The global market

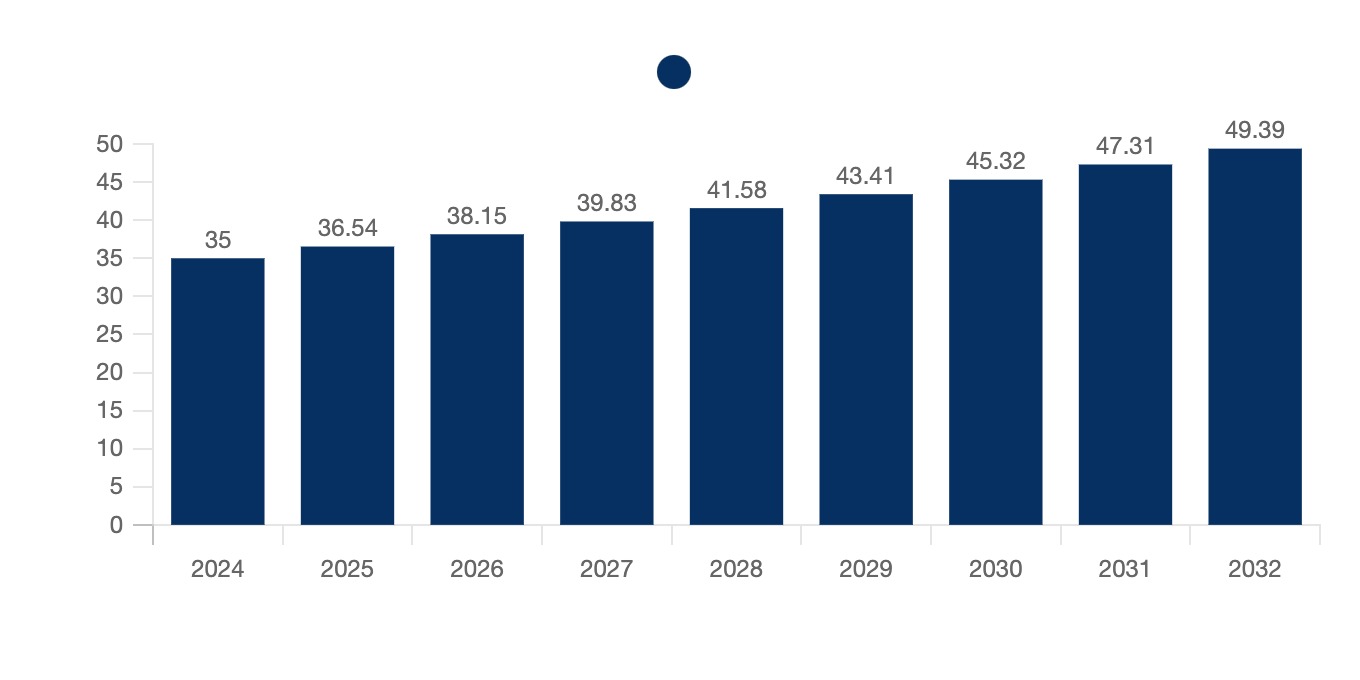

the global ham market is set for sustained growth between 2024 and 2032, with an estimatedCAGR of 4.4%. In 2024, the market is valued at $35 billion, and should reach $49.39 billion in 2032, representing an overall increase of 41.1% over the period.

This steady growth translates into annual increases, with projected values of $36.54 billion in 2025, $38.15 billion in 2026, and $45.32 billion in 2030. This dynamic is driven by several factors: growing demand in emerging markets, constant innovation in charcuterie products, and a growing preference for premium products in developed countries.

Global ham market forecasts

World, 2024-2032, $ billion

1.3 The domestic market

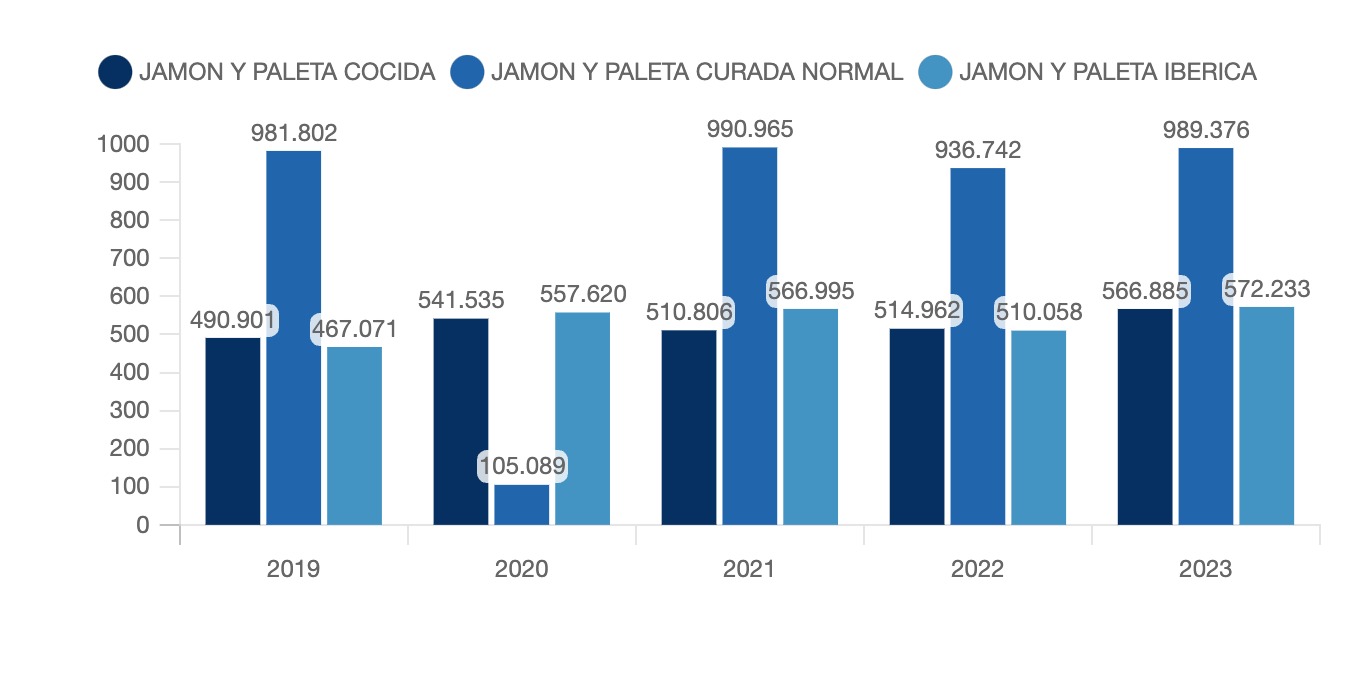

Between 2019 and 2023, ham sales in Spain's domestic channel grew overall, from 1939.77 million euros in 2019 to 2128.49 million euros in 2023, an increase of 9.73%. this trend was marked by significant variations by segment.

-

cooked hams and pallets: this segment showed steady growth, rising from 490.90 million euros in 2019 to 566.89 million euros in 2023, an increase of 15.48% over the period. after a slight decline in 2021(-5.67% on 2020), sales rebounded to reach their highest level in 2023(+10.08% on 2022).

-

classic cured ham and pallet: this segment has seen fluctuating trends. after peaking in 2020 at 1,050.90 million euros(+7.04% on 2019), it fell in 2021(-5.71%) to 936.74 million euros, before recovering in 2023 to 989.38 million euros(+5.62% on 2022).

-

iberian ham and palette: this segment has seen the strongest growth. In 2023, sales amounted to 572.23 million euros, compared with 467.07 million euros in 2019, an increase of 22.50%. despite a slight decline in 2022(-10.04% vs. 2021), the segment reached a new peak in 2023(+12.18% vs. 2022).

These figures show that, although there have been fluctuations over the period, the Spanish ham sector continues to grow thanks to sustained demand for its various segments, in particular Iberian ham and shoulder, which stands out as the product with the highest added value.

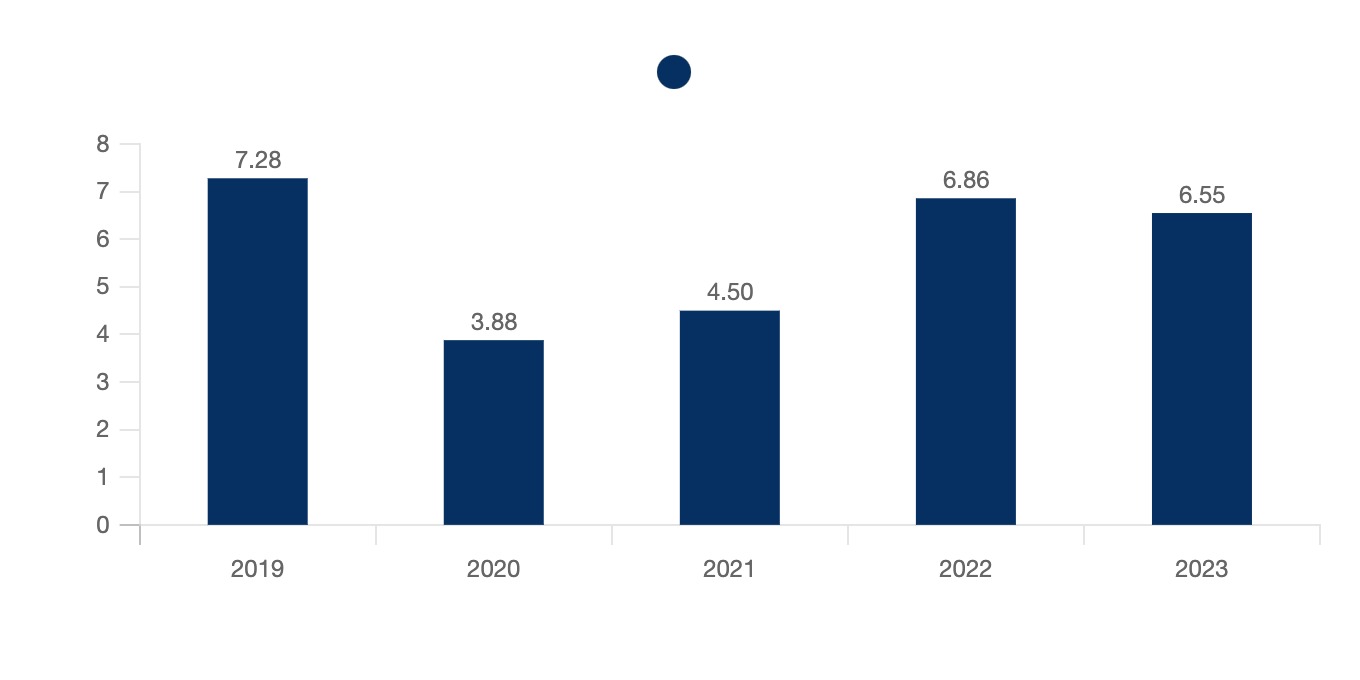

Ham consumption in the HORECA (Hotels, Restaurants, Cafés) channel in Spain has seen significant variations between 2019 and 2023. In 2019, consumption was 7.28 million kg. This dropped significantly in 2020, to 3.88 million kg, down (46.4%) on 2019, mainly due to the COVID-19 pandemic that affected business in the HORECA sector. In 2021, consumption rose slightly to 4.50 million kg, representing an increase of (16% ) on 2020. In 2022, a more marked recovery took place with 6.86 million kg, up (52.7%) on 2021, marking the sector's recovery from the health restrictions. In 2023, consumption fell slightly to 6.55 million kg, down (4.5%) on 2022, but still high compared with previous years. These data show marked fluctuations in ham consumption within the HORECA channel, influenced by economic and health factors.

Ham consumption in the HORECA channel

Spain, 2019-2023, million kg

1.4 Foreign trade

Fresh ham:

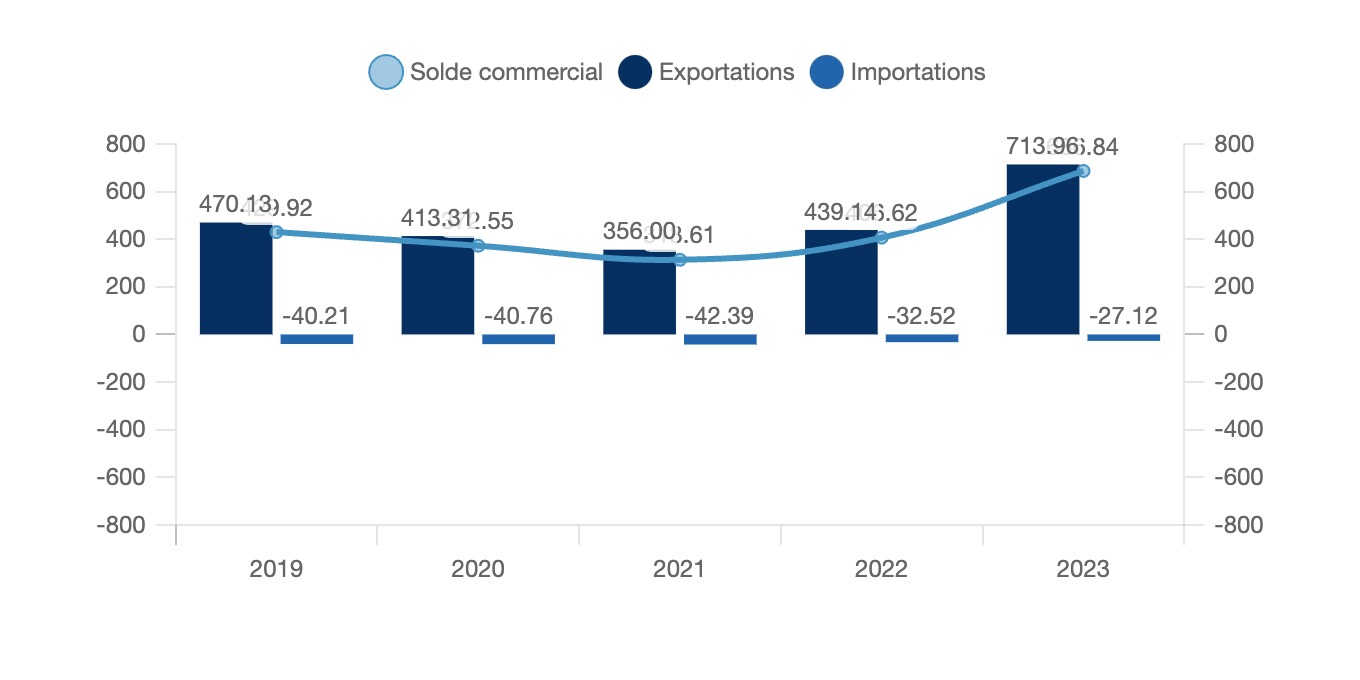

Between 2019 and 2023, Spanish foreign trade in hams, shoulders and bone-in cuts, fresh or chilled, showed a marked change, both in terms of exports and the trade balance. Exports almost doubled over the period, rising from $470.13 million in 2019 to $713.96 million in 2023, an increase of +51.8%. This dynamic illustrates the strong development of international demand for these emblematic products.

Imports, though modest, have fallen steadily, from -$40.21 million in 2019 to -$27.12 million in 2023, recording a -32.5% decline. This trend reflects a reduction in import requirements, probably due to growing self-sufficiency and the competitiveness of local producers.

The trade balance, meanwhile, showed impressive progress, increasing by +59.8% between 2019($429.92 million) and 2023($686.84 million). This improvement was particularly notable between 2022 and 2023, with an increase of +68.9%, underlining a recent acceleration in the surplus balance.

This data highlights the strength of the Spanish ham and shoulder industry on the world market, driven by strong export growth and effective import control. This reflects increased competitiveness and growing international recognition for the quality of Spanish products.

Foreign trade of "Hams, shoulders and cuts thereof, bone-in, fresh or chilled."

Spain and the world, 2019-2023, $ million

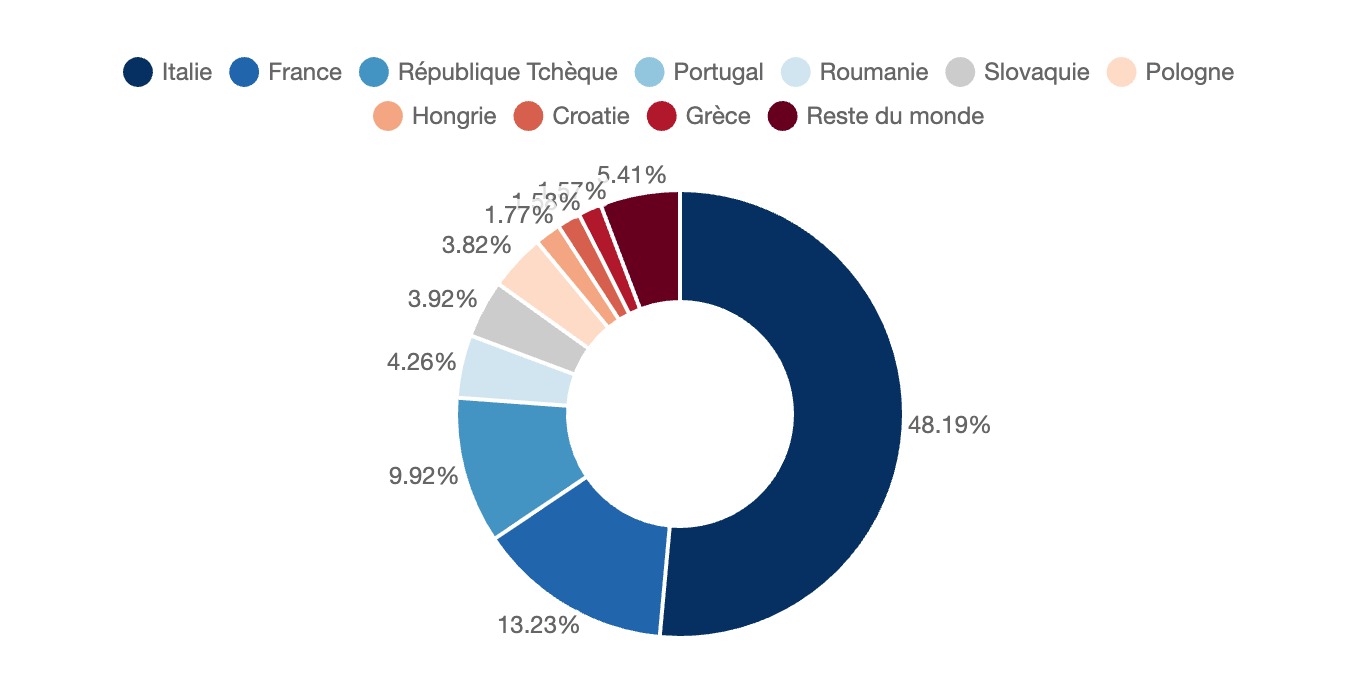

Exports:

In 2023, Italy was by far Spain's main trading partner for exports of bone-in hams, shoulders and cuts, fresh or chilled, accounting for 48.19% of the total. France came second with 13.23%, confirming its key role as the second largest market for these Spanish products. The Czech Republic, with 9.92%, completed the podium, underlining the growing importance of Central European markets.

Other notable destinations included Portugal(4.26%) and Romania(4.26%), as well as Slovakia(3.92%) and Poland(3.82%), testifying to the strong appeal of these products throughout Eastern Europe. Market shares in Hungary(1.77%), Croatia(1.58%) and Greece(1.57%) were more modest, but illustrated the diversity of Spanish exports in the region.

Finally, the rest of the world accounted for 5.41% of exports, testifying to an international openness beyond the European continent. These data highlight the dominance of European markets in Spanish processed meat exports, with a strong concentration on neighboring markets such as Italy and France, while also revealing opportunities to strengthen trade with other regions.

Spanish exports of "Hams, shoulders and cuts thereof, bone-in, fresh or chilled."

Spain and the World, 2023, M

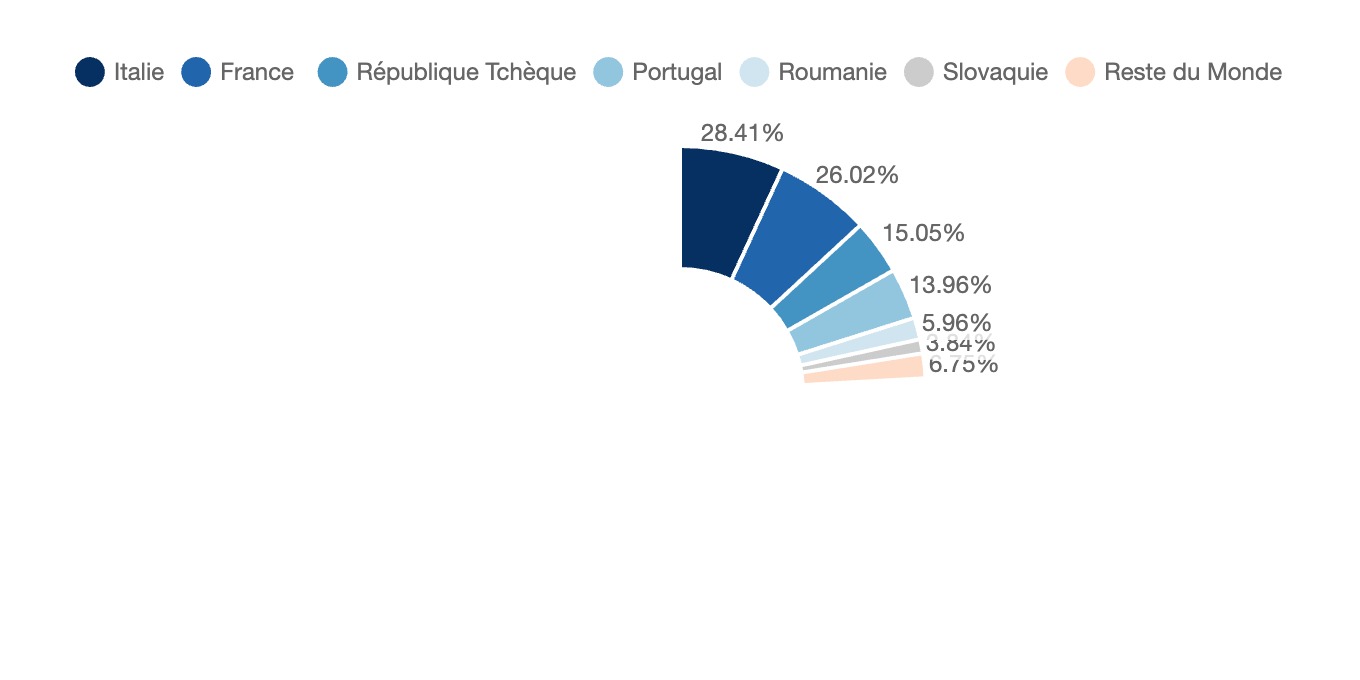

Imports:

In 2023, Spanish imports of bone-in hams, shoulders and cuts, fresh or chilled were dominated by Italy, which accounted for 28.41% of the total. France followed closely behind with 26.02%, underlining its key role as a major supplier of these products to Spain. The Czech Republic, with 15.05%, positioned itself as another important player, reinforcing Central Europe's place in trade with Spain.

Portugal(13.96%) and Romania(5.96%) also contributed significantly to imports, reflecting active trade with these neighboring and Eastern European countries. Slovakia, with 3.84%, rounded out the main partners, while the rest of the world accounted for 6.75%, highlighting limited but diversified trade beyond Europe.

Spanish imports of "Hams, shoulders and cuts thereof, bone-in, fresh or chilled."

Spain and the world, 2023, %

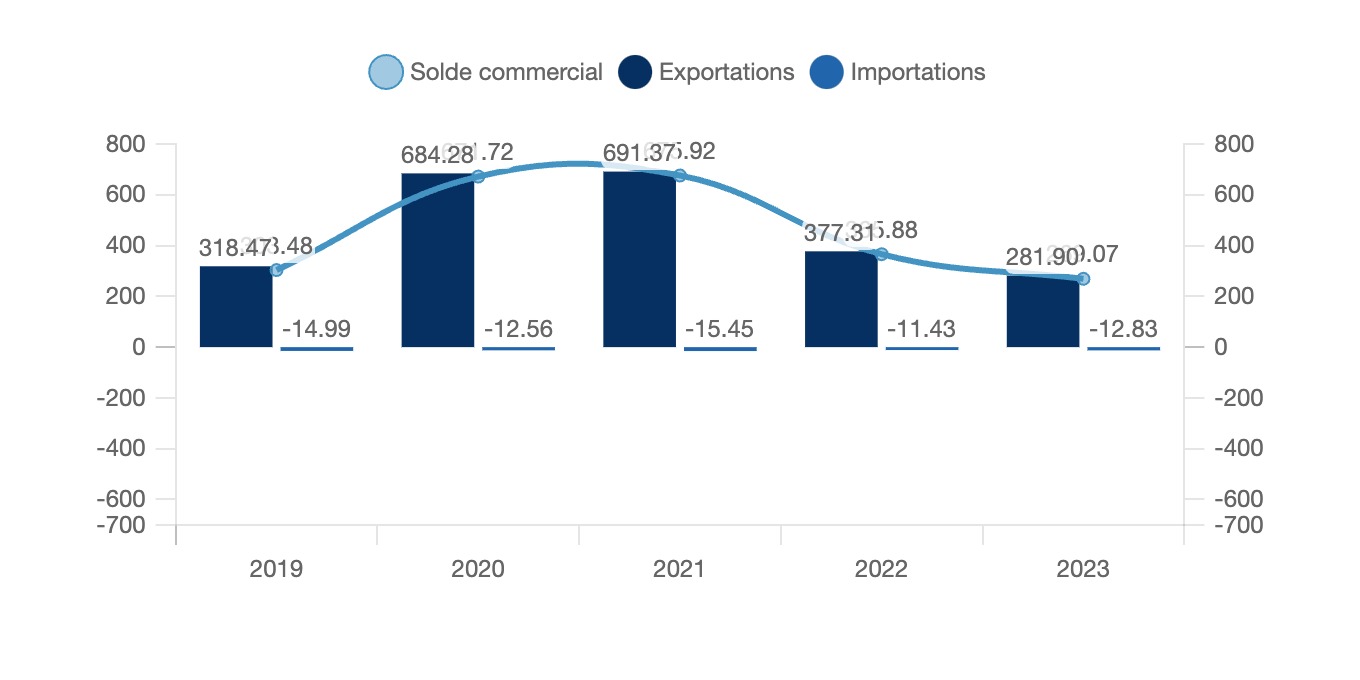

Hams, shoulders and cuts thereof, bone-in, frozen :

Between 2019 and 2023, Spain's foreign trade in frozen bone-in hams, shoulders and cuts fluctuated significantly, reflecting global market dynamics and changes in demand. Exports peaked in 2021 at $691.37 million, almost doubling compared with 2019($318.47 million), before gradually declining to $281.90 million in 2023, down -59.2% on the 2021 peak.

Imports, though marginal, have fluctuated slightly over the years. They have varied between -$14.99 million in 2019 and -$12.83 million in 2023, with a low point of -$11.43 million in 2022, testifying to Spain's low dependence on imports for this type of product.

The trade balance, largely in surplus, has followed the same trend as exports. After peaking in 2021 at $675.92 million, it fell to $269.07 million in 2023, down -60.2% on its peak. This decrease reflects the contraction in exports, although Spain remains a major net exporter in this segment.

Evolution of foreign trade in "hams, shoulders and cuts thereof, bone-in, frozen."

Spain and the world, 2019-2023, $ million

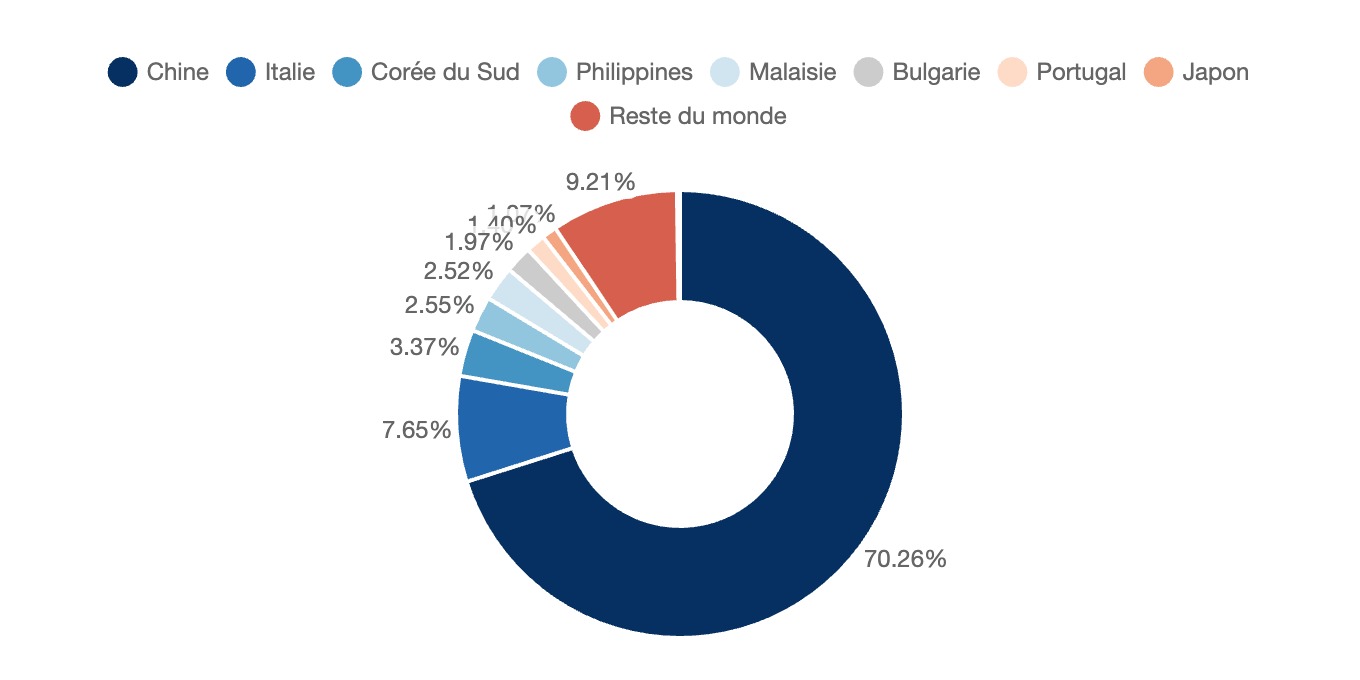

Exports:

In 2023, Spanish exports of frozen bone-in hams, shoulders and cuts were largely dominated by China, which accounted for 70.26% of the total. This figure reflects this market's strong dependence on Spanish products and China's growing importance as a key trading partner in this segment.

Italy, the second most important destination, contributed 7.65% of exports, confirming its position as the main European market for these products. Other Asian countries, such as South Korea(3.37%), the Philippines(2.55%) and Malaysia(2.52%), also played a significant role, testifying to the appeal of Spanish products in this region.

In Europe, destinations such as Bulgaria(1.97%) and Portugal(1.40%) made more modest but significant contributions, while Japan(1.07%) strengthened the presence of Spanish products in the high-end Asian market.

Finally, the rest of the world accounted for 9.21% of exports, reflecting a diversification of outlets beyond the main Asian and European markets. These figures highlight the dominance of the Asian market, particularly China, in Spanish exports of frozen hams, while underlining growth opportunities in other international markets.

Destination of Spanish exports of frozen bone-in hams, shoulders and cuts thereof.

Spain and the world, 2023, %

Imports:

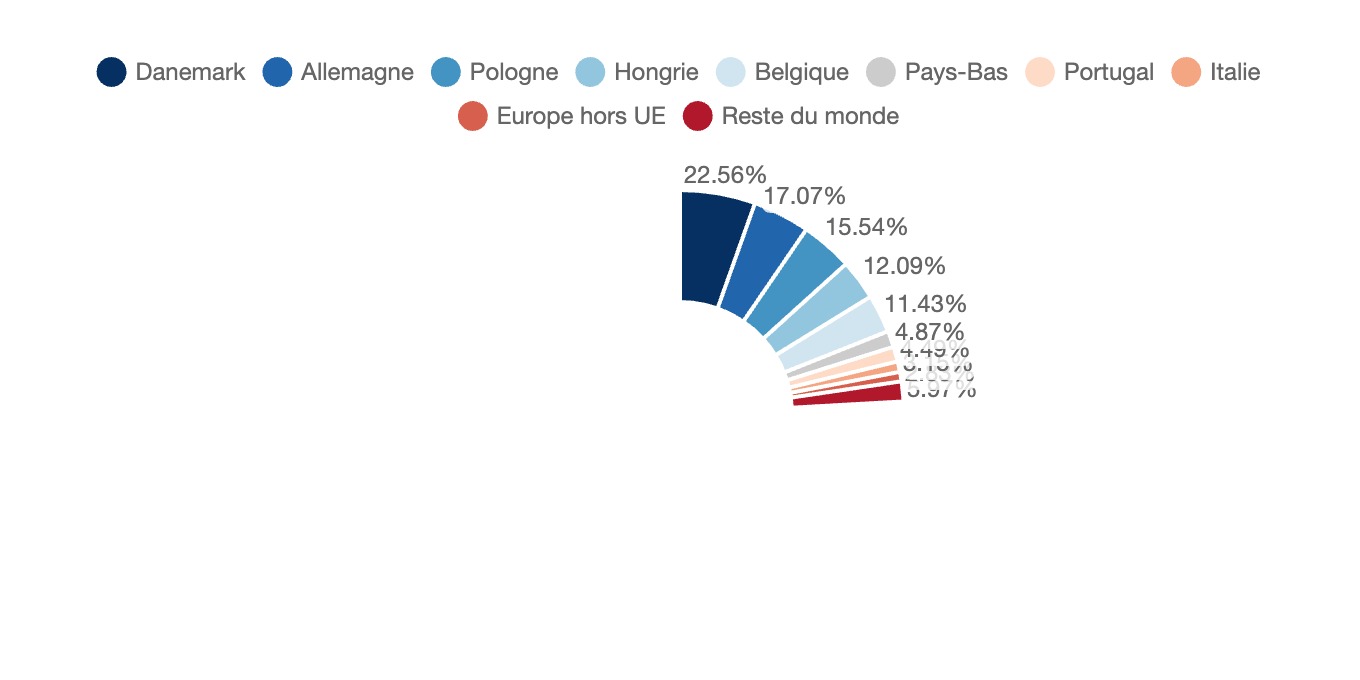

In 2023, Spanish imports of frozen bone-in hams, shoulders and cuts came mainly from European countries, with a clear dominance by Denmark, which accounted for 22.56% of total imports.Germany followed with 17.07%, consolidating its position as the second main supplier, while Poland occupied third position with 15.54%, underlining the growing importance of Central Europe in this trade.

Other notable suppliers included Hungary(12.09%) and Belgium(11.43%), reinforcing the role of Central and Western European countries. The Netherlands and Portugal contributed more modestly, with 4.87% and 4.49% respectively, whileItaly accounted for 3.15%, reflecting a more limited share in Spanish imports.

Europe outside the European Union accounted for 2.83% of imports, reflecting reduced flows with non-EU countries. Finally, the rest of the world accounted for 5.97%, indicating a limited but significant diversification towards partners outside the European continent.

Origins of Spanish imports of frozen bone-in hams, shoulders and cuts thereof.

Spain and the world, 2023, %

Canned ham :

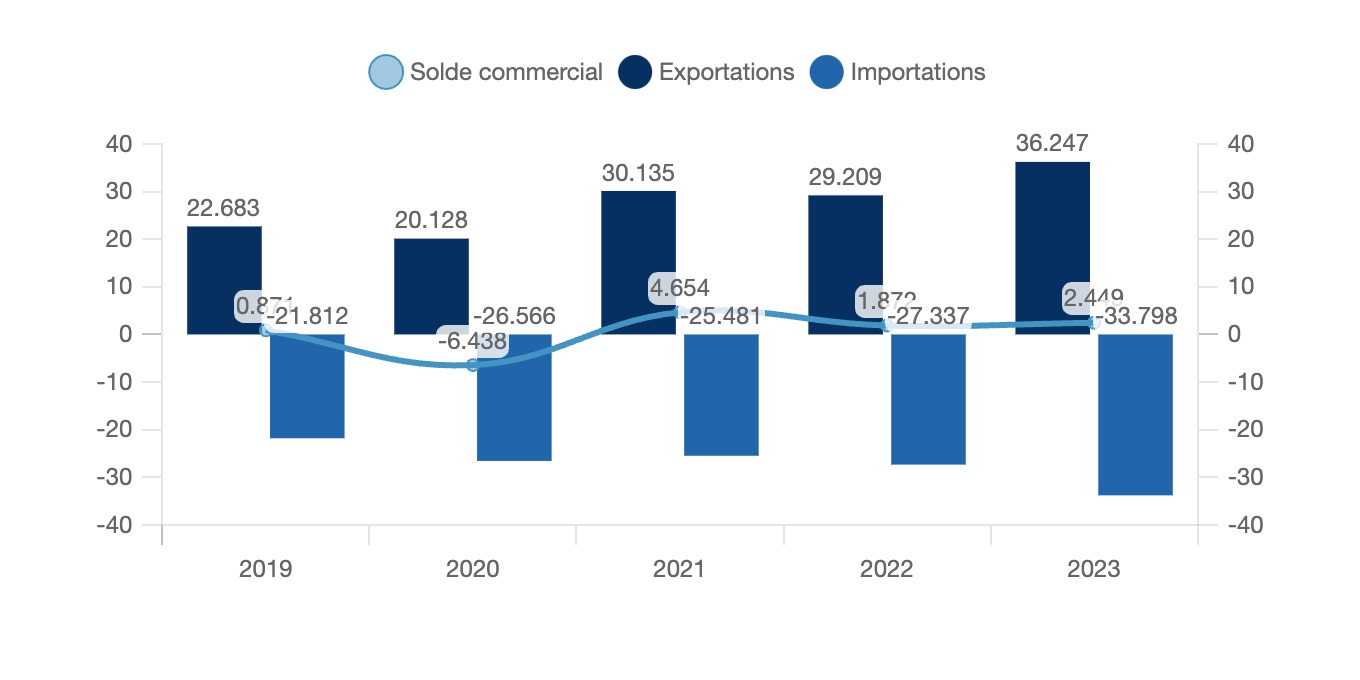

Between 2019 and 2023, Spanish foreign trade in prepared or preserved hams and ham cuts (including cooked, smoked or canned) showed significant variations. Exports rose steadily over the period, from $22.683 million in 2019 to $36.247 million in 2023, representing growth of +59.9%. This increase reflects growing international demand for quality Spanish products.

On the other hand, imports have also risen, from -$21.812 million in 2019 to -$33.798 million in 2023, an increase of +55.0%. This increase in imports indicates an opening up of the Spanish market to processed products from other countries.

The trade balance, although positive in three of the five years, has shown considerable volatility. In 2019, it stood at $0.871 million, before turning into a deficit in 2020 at -$6.438 million due to a sharp rise in imports. In 2021, it returned to surplus at $4.654 million, before falling back to $1.872 million in 2022, finally reaching $2.449 million in 2023, an increase of +30.8% on 2022.

Foreign trade in "Hams and cuts thereof, prepared or preserved (including cooked, smoked or preserved)."

Spain and the World, 2019-2023, $ million

Exports:

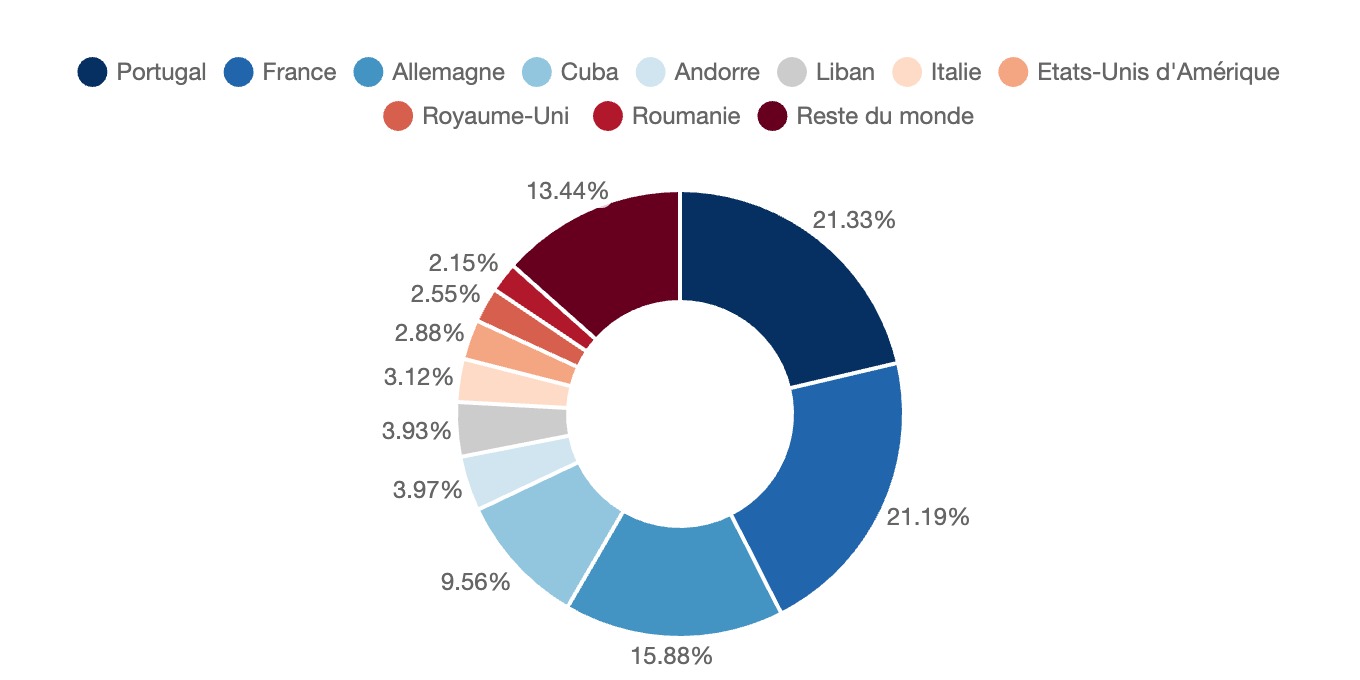

In 2023, Spanish exports of canned ham were largely dominated by European destinations, with Portugal and France leading the way, accounting for 21.33% and 21.19% of total exports respectively. These two neighboring countries, closely linked to Spain by their geographical proximity and historical trade, were the main outlets for this product.

Germany came third with 15.88%, confirming the importance of the European market for Spanish exporters. Outside Europe, more specific markets such as Cuba(9.56%) and Lebanon(3.93%) also showed notable demand, reflecting the appeal of Spanish products in more remote regions.

Among other destinations, Andorra(3.97%),Italy(3.12%), the USA(2.88%) and the UK(2.55%) accounted for smaller but significant shares, reflecting a diversification of exports. Romania and the rest of the world contributed 2.15% and 13.44% respectively, underlining the interest in canned ham in smaller or emerging markets.

Destinations of Spanish canned ham exports

Spain and lde

Imports :

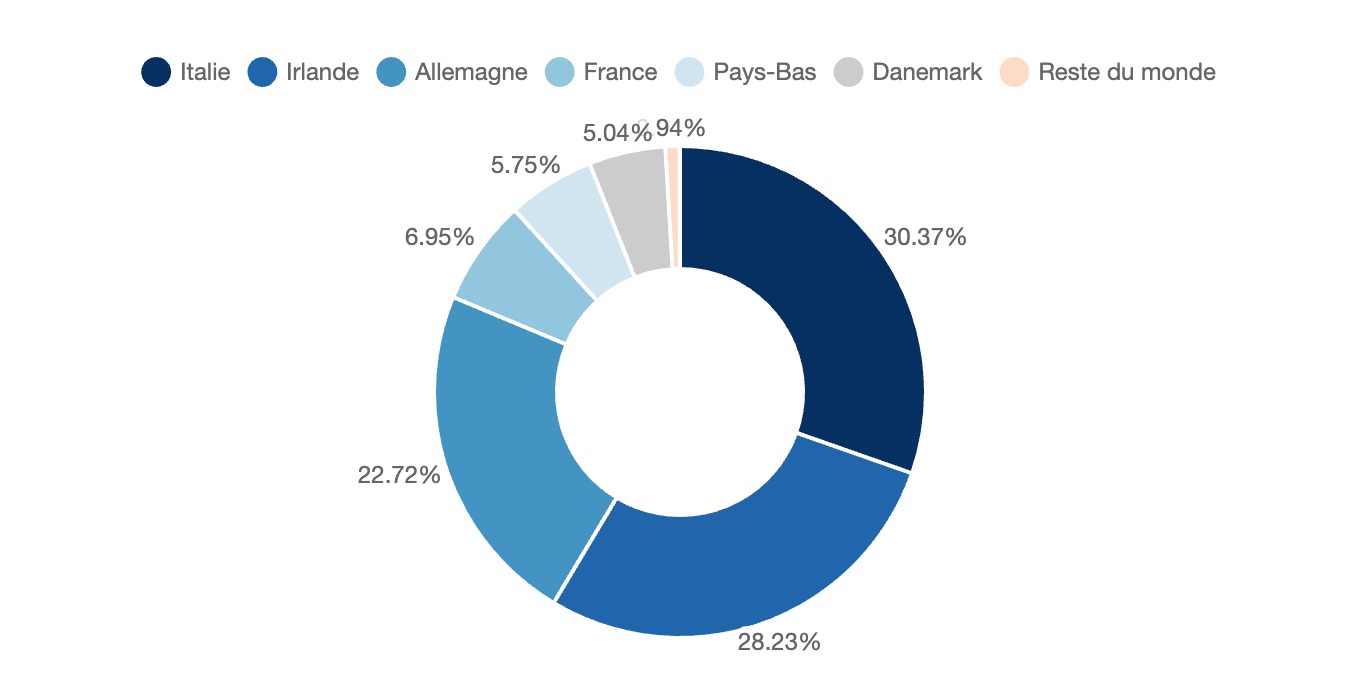

In 2023, Spanish imports of canned ham were heavily concentrated on European partners.Italy was the main supplier, accounting for 30.37% of total imports, closely followed byIreland(28.23%) andGermany(22.72%). These three countries dominated trade, underlining their key role in supplying Spain with canned ham.

France contributed 6.95%, while the Netherlands(5.75%) and Denmark(5.04%) had smaller but still significant shares. The rest of the world, with just 0.94%, played a marginal role in imports, demonstrating Spain's low dependence on non-European suppliers for this type of product.

These data illustrate the strong predominance of intra-European trade in Spanish imports of canned ham, with a marked concentration on a few main partners, notably Italy, Ireland and Germany.

Breakdown of Spanish canned ham imports

Spain, 2023, % of total

Cured and smoked ham:

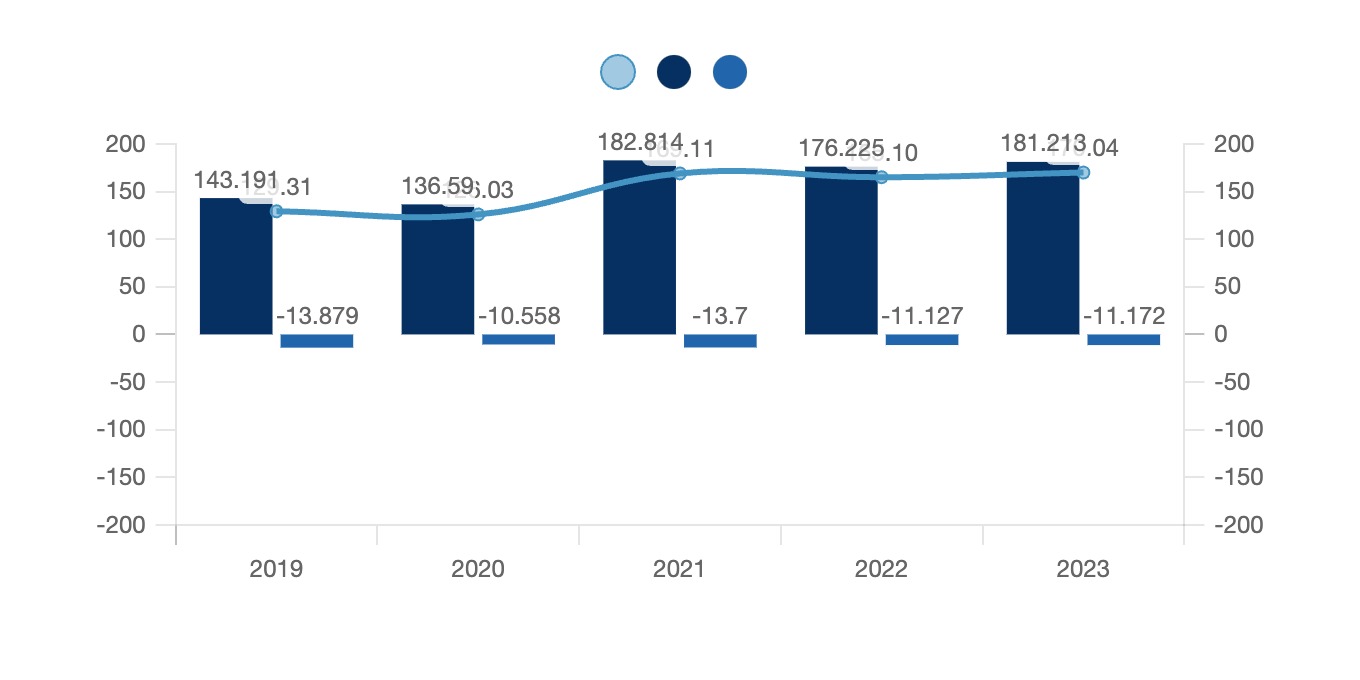

Between 2019 and 2023, Spanish foreign trade in pork meats, salted or in brine (including hams and shoulders) showed a notable increase in exports, although imports remained relatively modest. Exports rose by 26.5% over the period, from $143.191 million in 2019 to $181.213 million in 2023. This increase reflects growing international demand for these traditional Spanish products.

Imports, meanwhile, remained low and stable, varying between -$13.879 million in 2019 and -$11.172 million in 2023. This low dependence on imports underlines Spain's ability to produce cured or brined pork locally to meet domestic and international demand.

The trade balance thus maintained a significant surplus throughout the period, peaking in 2021 at $169.11 million, before stabilizing at around $170.04 million in 2023, up 31.5% on 2019. This commercial performance reflects the competitiveness of Spanish producers on the world market.

Foreign trade in "Pork meat, salted or in brine (including hams and shoulders)."

Spain and the World, 2019-203, $ million

Exports:

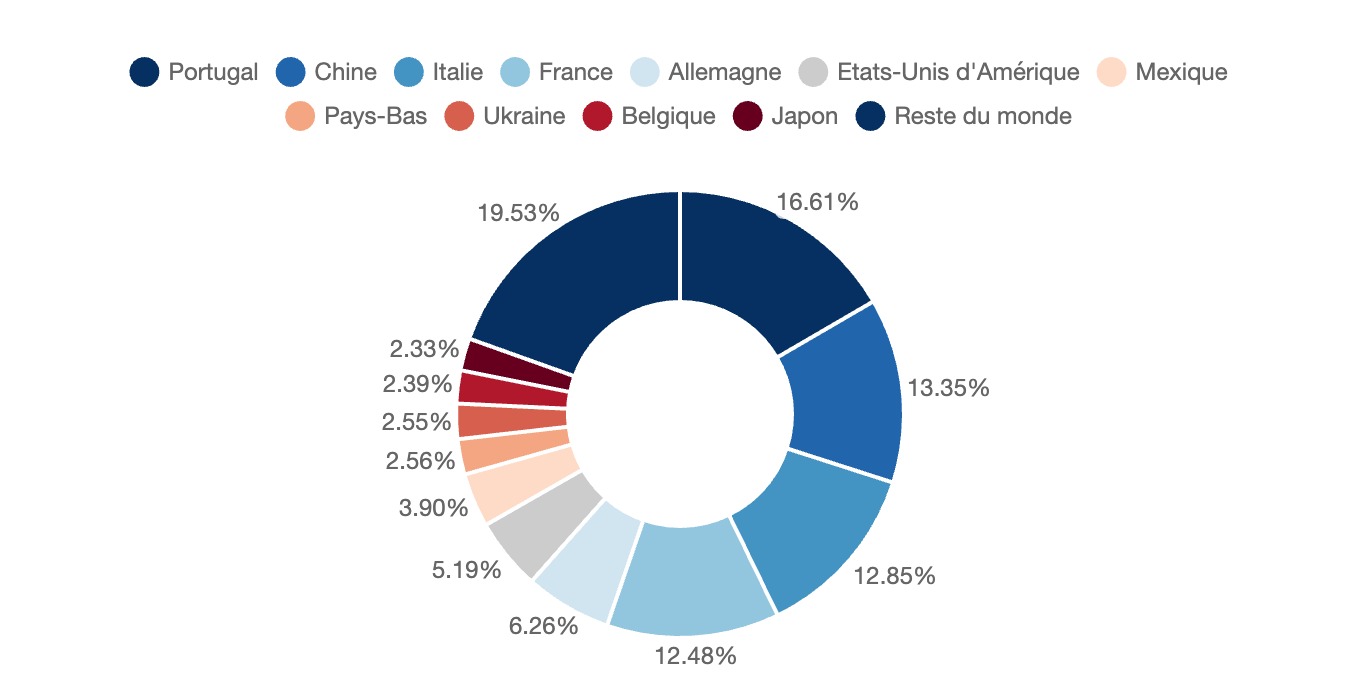

In 2023, Spanish exports of salted or cured pork meats, including hams and shoulders, were spread across a variety of markets, with a strong concentration on European and Asian destinations. Portugal was the main outlet, accounting for 16.61% of total exports, followed by China(13.35%), which confirmed its role as a key partner due to its growing demand for processed pork products.

Italy(12.85%) and France(12.48%) were also important destinations, reflecting geographical proximity and close trade with these two European neighbors.Germany, with 6.26%, rounded out the top 5 major markets.

Outside Europe, the United States(5.19%) and Mexico(3.90%) stood out as significant markets in America, illustrating the appeal of Spanish products in this region. The Netherlands(2.56%) andUkraine(2.55%) made more modest but significant contributions, while Belgium(2.39%) and Japan(2.33%) consolidated their positions in Spanish exports.

The rest of the world, accounting for 19.53%, testifies to the diversification of destinations, with flows to emerging markets and those less traditional for Spanish products. These figures reflect the competitiveness of Spanish pork meats on the world market, underpinned by strong European demand and constant expansion into Asian and American markets.

Spanish export destinations for "Pork meats, salted or in brine (including hams and shoulders)"

Spain and the world, 2023, %

Imports:

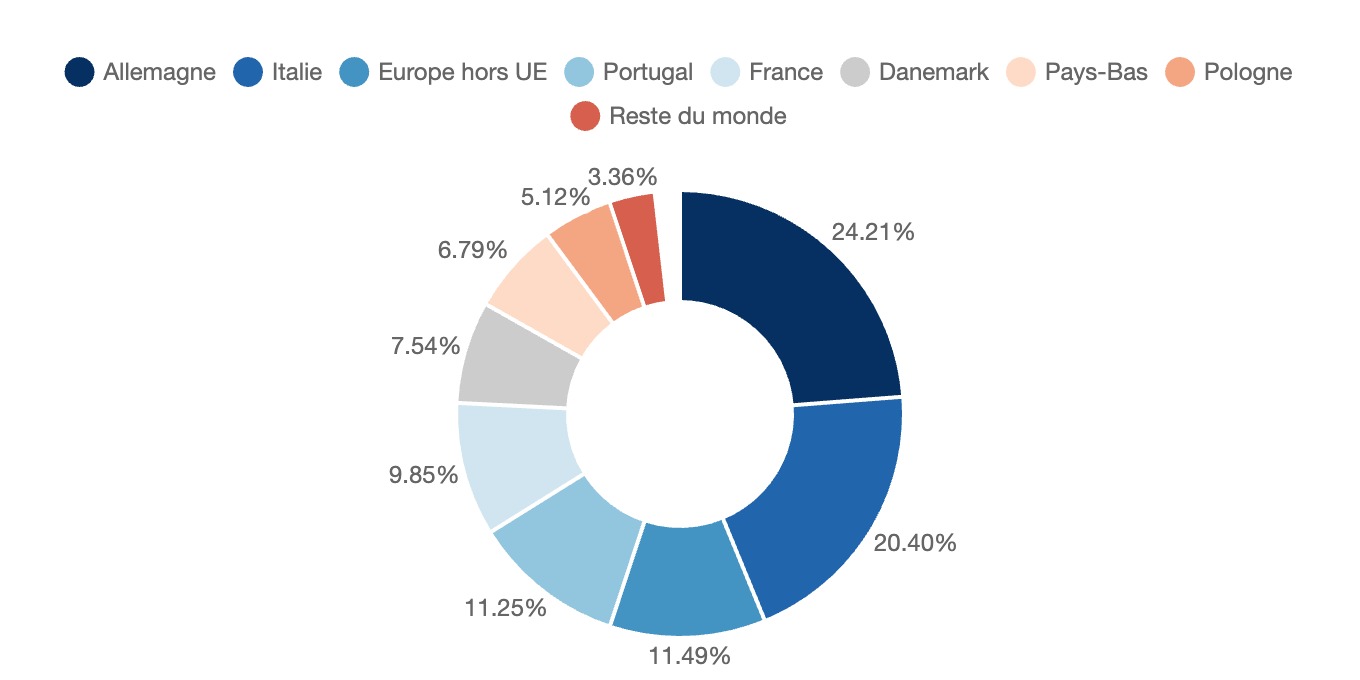

In 2023, Spanish imports of salted, cured, smoked or similar ham were mainly dominated by European countries, withGermany in the lead, accounting for 24.21% of total imports.Italy, the second largest supplier, contributed 20.40%, reinforcing the predominance of our two main European partners.

Imports fromEurope outside the European Union accounted for 11.49%, a significant percentage that illustrates the diversification of trade beyond EU borders. Portugal(11.25%) and France(9.85%) also played an important role, consolidating their positions among Spain's main trading partners.

Among other suppliers, Denmark(7.54%), the Netherlands(6.79%) and Poland(5.12%) made notable contributions, albeit in smaller proportions. The rest of the world, with 3.36%, played a marginal role, demonstrating a low dependence on non-European imports.

These data highlight a clear concentration of imports on European markets, with a strong dependence on Germany and Italy, while demonstrating a limited openness to world trade for this type of product.

Origins of Spanish imports of cured ham etc...

Spain, 2023, %

1.5 The best hams of 2024

The two best hams of 2024 were recently crowned in the Prix Alimentos de España awards. In the jamón serrano category (or other recognized quality figures), the prize went to "Jamones Perfecto" de la Denominación de Origen Protegida (DOP) Jamón de Teruel. This ham was praised for its homogeneous, balanced mass, with a cut showing intense, brilliant red magro and uniform marbling. Its pinkish-white grace and characteristic smell of cured and aged ham were also highlighted, underlining its balanced taste.

In the jamón ibérico de bellota category, the award went to "Juan Manuel Gran Selección 2020" from the Guijuelo DOP. This ham was rewarded for its elongated piece with fine caña, homogeneous mass and intense cherry-red magro with uniform marbling. The brilliant pinkish-white grace and smell of aged jamón ibérico also impressed the jury, who particularly appreciated its slightly salty, mild taste with intense notes of aging.

The two winners were chosen from 60 samples, 25 in the serrano category and 35 in the ibérico category. This distinction confirms the excellence and quality of the hams produced in these regions, further boosting their international renown.

Source :[Cárnica]

Demand analysis

2.1 Household consumption

In Spain, ham-related statistics also include other products under the processed meat nomenclature. In order to study the particularities of ham consumption, we will base ourselves on the latter.

The processed meat market :

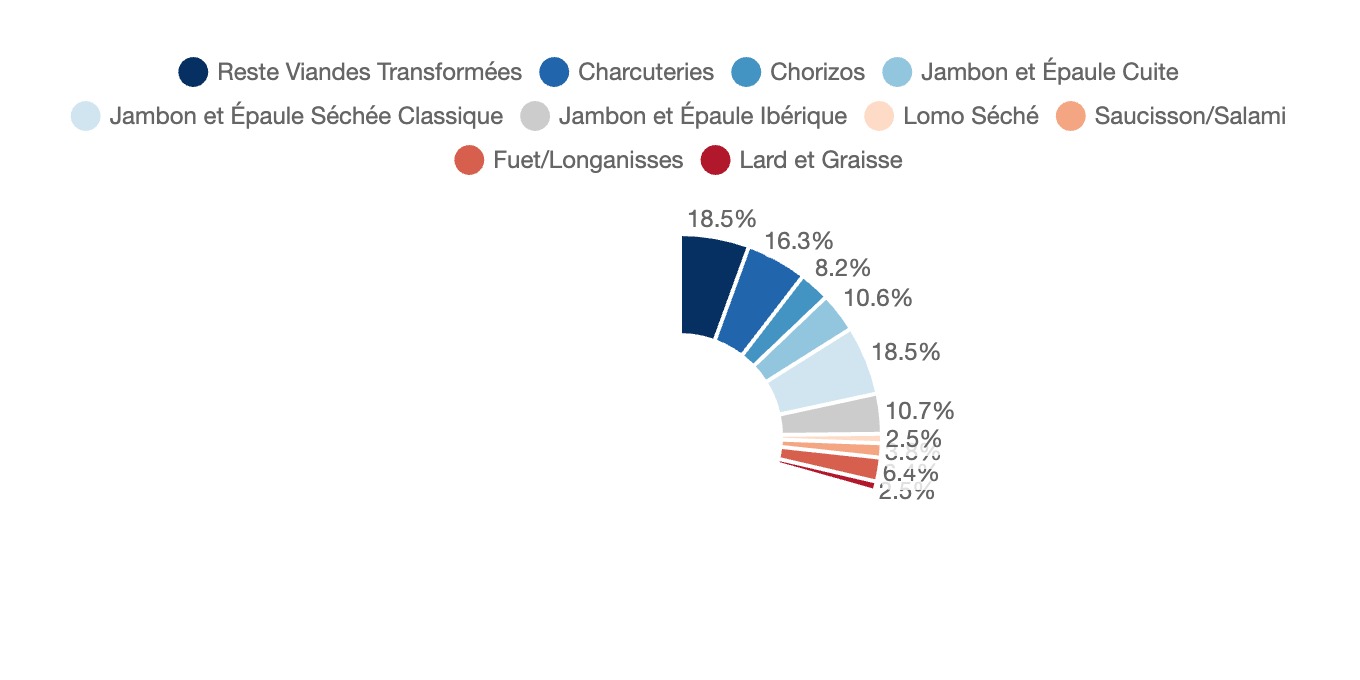

In Spain in 2023, the value breakdown of the processed meat market highlights the predominance of processed meat leftovers and classic cured hams and shoulders, each accounting for 18.5% of the total value. These products play a central role in Spanish consumption, not least thanks to their versatility and cultural appeal. Cured meats, at 16.3%, and cooked hams and shoulders, at 10.7%, also confirm their importance in consumer preferences.

Top-of-the-range Iberian hams and shoulders account for 10.6%, underlining their status as a refined but less common choice. Chorizos, another emblematic specialty, occupy 8.2%, while dried lomos, at 6.4%, round out the range of popular specialties.

Products with a smaller contribution, such as fuets/longanisses(3.8%), sausage/salami(2.5%) and bacon and fat(2.5%), show their more niche or specific nature in the consumer basket.

This breakdown reflects the high diversity of the market, with a mix of everyday products and local specialties, in response to the varied tastes and eating habits of Spaniards.

Value breakdown of the processed meat market

Spain, 2023, % of total

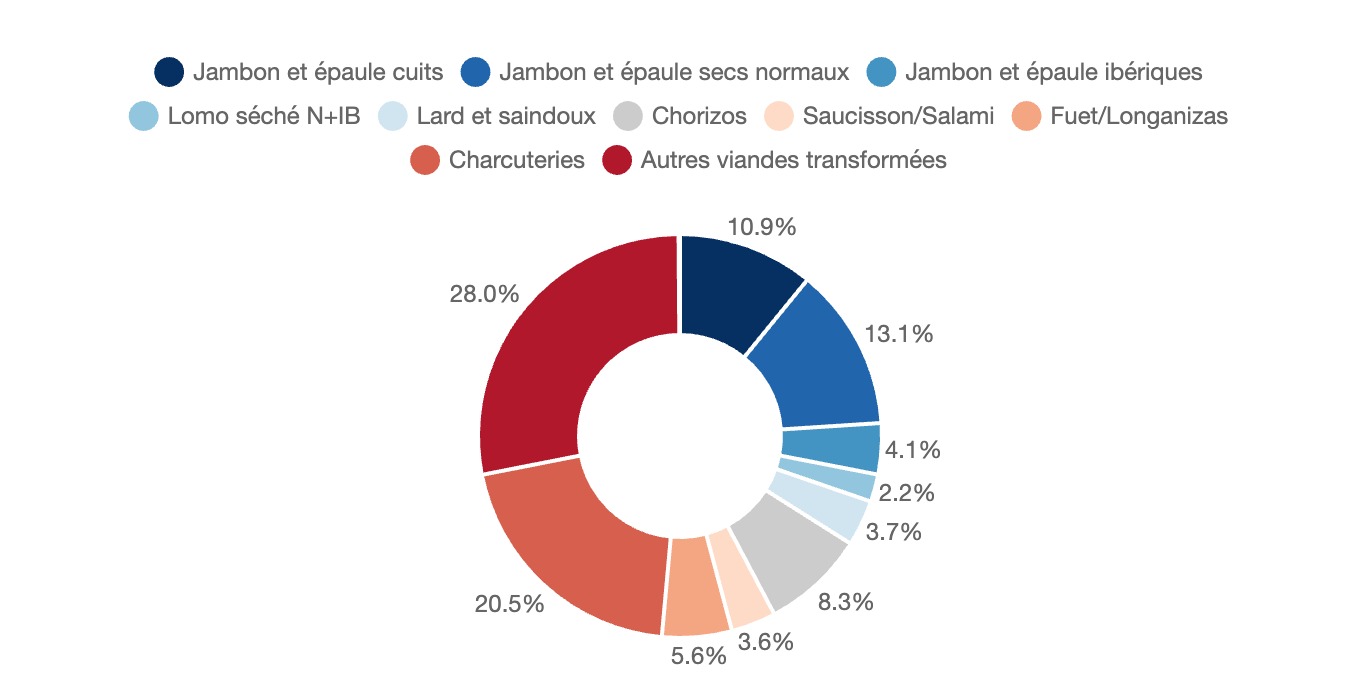

In terms of volume, the breakdown of the various ham segments within the Spanish processed meat market in 2023 reveals trends that complement those observed in terms of value. Other processed meats largely dominate the market in volume terms, accounting for 28.0%, followed by cured meats, which total 20.5%. These two segments confirm their preponderance in consumer habits, with a significant presence in daily meals.

Among products specifically related to ham, normal dry-cured hams and shoulders stand out with 13.1%, a figure that reflects their importance as a mainstream product. Cooked hams and shoulders contribute 10.9%, reflecting their popularity as a convenient and affordable consumption option. By contrast, the more exclusive Iberian hams and shoulders account for a more modest 4.1%, confirming their premium status.

Other segments, such as chorizo(8.3%), fuet and longanizas(5.6%), and dried lomo(2.2%), maintain a significant presence, in line with their roots in Spanish culinary traditions. Sausages/salamis(3.6%) and lard(3.7%) complete this breakdown, but in more modest volumes.

Volume breakdown of ham segments within the Spanish processed meat market

Spain, 2023, % of total

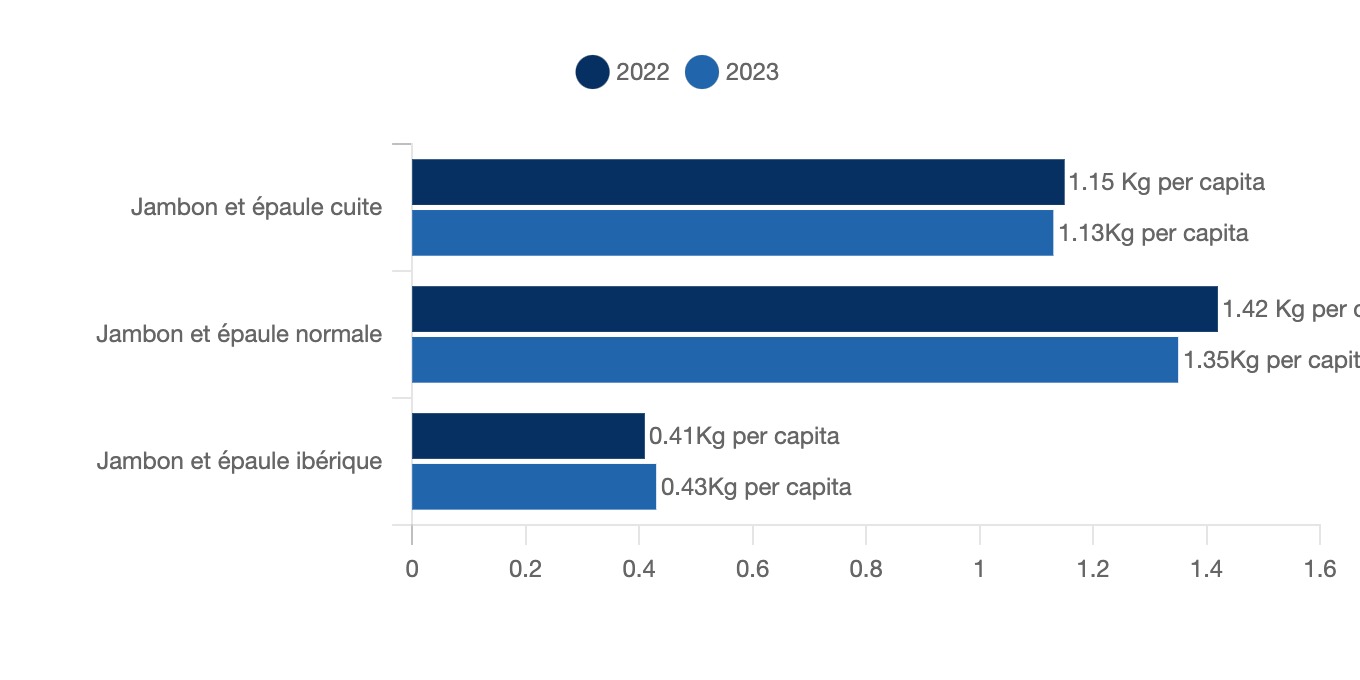

In terms of consumption per head of ham in Spain, between 2022 and 2023, subtle variations were observed according to ham type. Consumption of cooked hams and shoulders fell slightly, from 1.15 kg/head in 2022 to 1.13 kg/head in 2023, reflecting a slight contraction in this segment, possibly due to a reduction in the number of hams consumed.contraction in this segment, possibly due to market saturation or a shift in preferences towards other categories.

Similarly, consumption of normal dry-cured ham and shoulders has fallen from 1.42 kg/head in 2022 to 1.35 kg/head in 2023(-4.9%). This decline could be explained by an increased search for premium products or a diversification of eating habits.

By contrast, consumption of Iberian ham and shoulders, a symbol of quality and prestige, has risen moderately, from 0.41 kg/head in 2022 to 0.43 kg/head in 2023(+4.9%). This increase confirms consumers' growing attraction to top-of-the-range products, despite their generally higher cost.

Domestic consumption per head of ham

Spain, 2022-2023, kg/head

Consumer study:

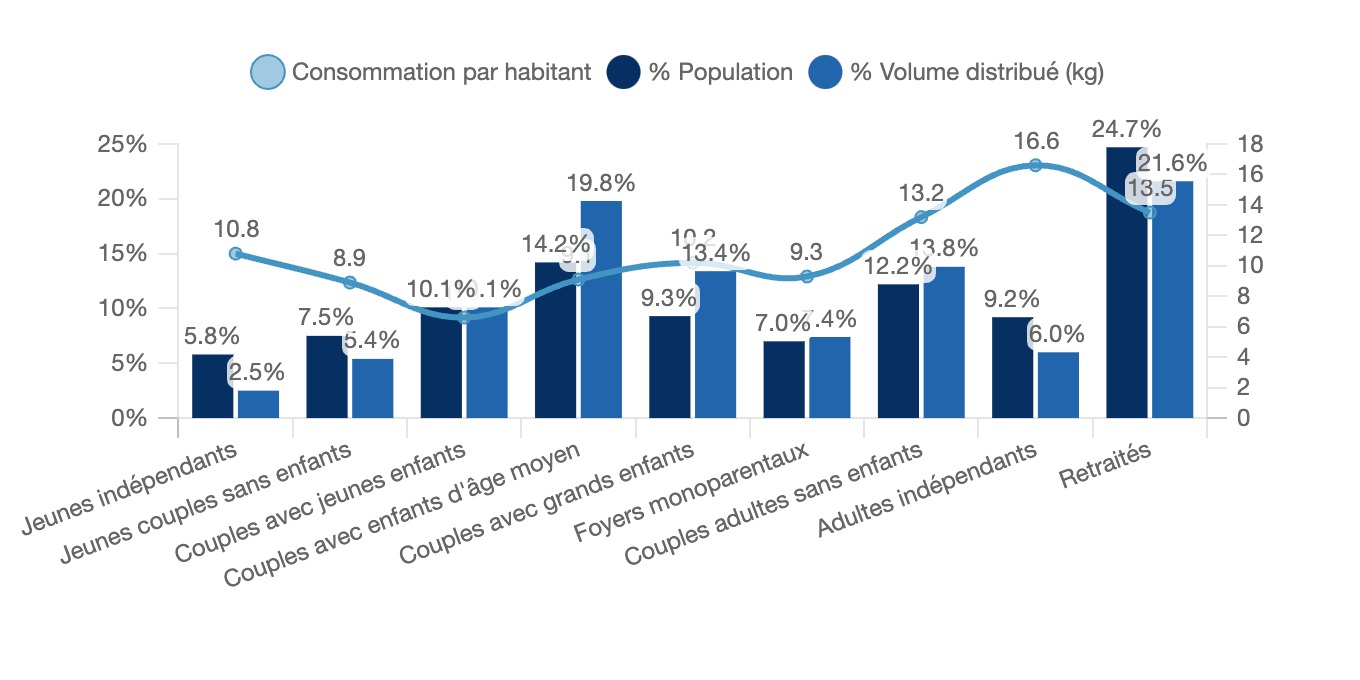

Processed meat consumption in Spain in 2023 varied significantly according to household composition, highlighting distinct eating behaviors according to family structures and lifestyles. Pensioners, who represented 24.7% of the population, accounted for the largest share of the volume distributed, at 21.6%, and a high average consumption of 13.5 kg per capita, reflecting their central role in the processed meat market.

Middle-aged couples with children, although representing 14.2% of the population, made a significant contribution to the volume distributed, with 19.8%, thanks to high family consumption. Their per capita consumption remained moderate, however, at 9.1 kg, due to the generally larger size of these households.

Adult couples without children and young couples without children showed different patterns of consumption. The former, representing 12.2% of the population, consumed 13.2 kg per capita, well above the national average, while young childless couples, with a smaller population(7.5%), consumed a more modest 8.9 kg per capita.

Young self-employed people and self-employed adults, although together making up a sizeable share of the population(5.8% and 9.2% respectively), contributed little to the overall volume distributed, at 2.5% and 6.0%, despite contrasting per capita consumption: 10.8 kg for self-employed young people and 16.6 kg, the highest, for self-employed adults.

Finally, couples with grown-up children(9.3% of the population) and single-parent households(7.0%) were at intermediate levels. The former consumed 10.2 kg per capita, while the latter, with a share of volume slightly higher than their demographic weight(7.4% of volume for 7.0% of population), posted an average consumption of 9.3 kg.

These data revealed that households with a classic family structure generally consumed more in volume terms, while independent adults and pensionerss were distinguished by high per capita consumption, reflecting more individualized or quality-oriented eating habits.

Processed meat consumption by household situation

Spain, 2023, %, kg/head

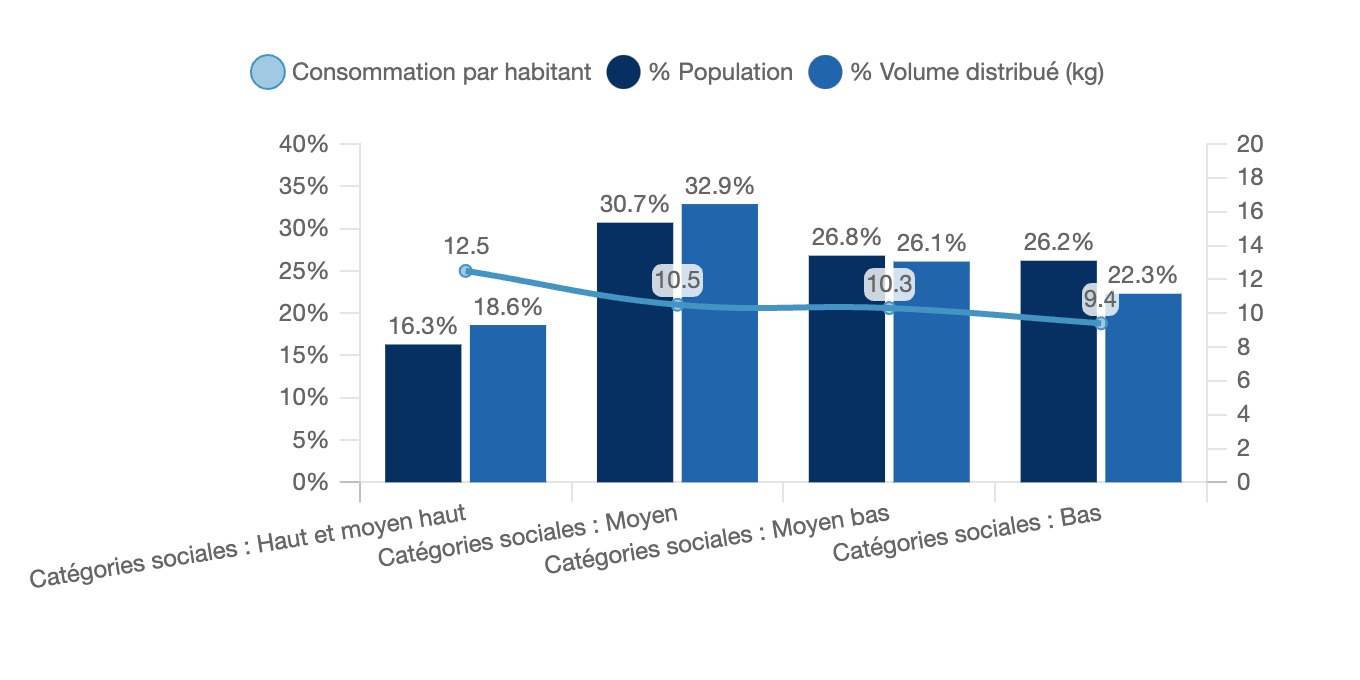

Consumption of processed meat in Spain in 2023 also varied according to social category, revealing marked differences between socio-economic levels. The high and upper-middle social categories, representing 16.3% of the population, contributed 18.6% of the total volume distributed, with an average per capita consumption of 12.5 kg, the highest among all categories. This relative over-consumption reflected greater access to quality products and a propensity to spend more on meals including processed meats.

The middle social categories, which made up 30.7% of the population, showed a proportional contribution to the volume distributed(32.9%) and an average consumption of 10.5 kg per inhabitant. This shows that this social category, which is in the majority, has a consumption behavior in line with its demographic weight, reflecting a preference for affordable, everyday products.

On the other hand, the lower-middle social categories, with 26.8% of the population, slightly under-contributed to the total volume distributed(26.1%), with a per capita consumption of 10.3 kg, slightly lower than that of the middle categories. The lower social categories, representing 26.2% of the population, had the lowest share of the volume distributed(22.3%) and a per capita consumption of 9.4 kg, illustrating more restricted access to this type of product.

These data show that, although the highest social categories consume more per capita, the middle and lower categories remain key market segments due to their significant demographic weight. This underlines the importance of offering a diversified range of products, adapted to the budgets and preferences of each social category.

Processed meat consumption by income level

Spain, 2023, %, kg/head

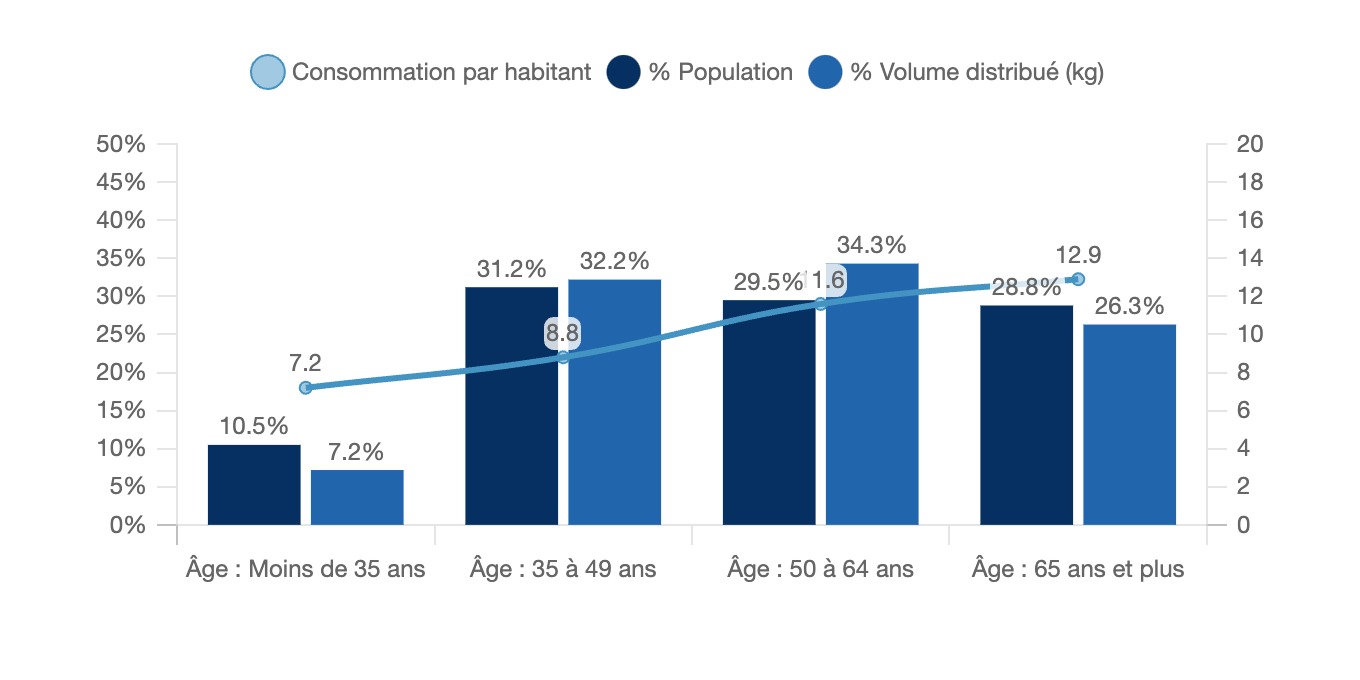

Finally, when analyzing processed meat consumption by age, generational differences in Spain in 2023 are particularly marked. Those aged 65 and over, representing 28.8% of the population, recorded the highest per capita consumption, reaching 12.9 kg, while contributing 26.3% of the total volume distributed. This generation, strongly attached to traditional products, remains a key pillar of the processed meat market.

The 50-64 age group, although constituting a slightly higher proportion of the population(29.5%), made the greatest contribution to the volume distributed, with 34.3%, and a high average per capita consumption of 11.6 kg. Their predominant role is explained by their purchasing power and entrenched eating habits.

The 35-49 age group, with 31.2% of the population, was also a major consumer, accounting for 32.2% of the total volume distributed, with an average per capita consumption of 8.8 kg. This category, in the active phase of life, is characterized by food choices often influenced by family and professional needs.

By contrast, the under-35s, who represent 10.5% of the population, made a modest contribution to total consumption, with 7.2% of the volume distributed and per capita consumption limited to 7.2 kg. This low contribution reflects different eating habits, possibly influenced by preferences for other types of product, tighter budgets, or increased attention to alternative food trends.

Processed meat consumption by age group

Spain, 2023, %, kg/head

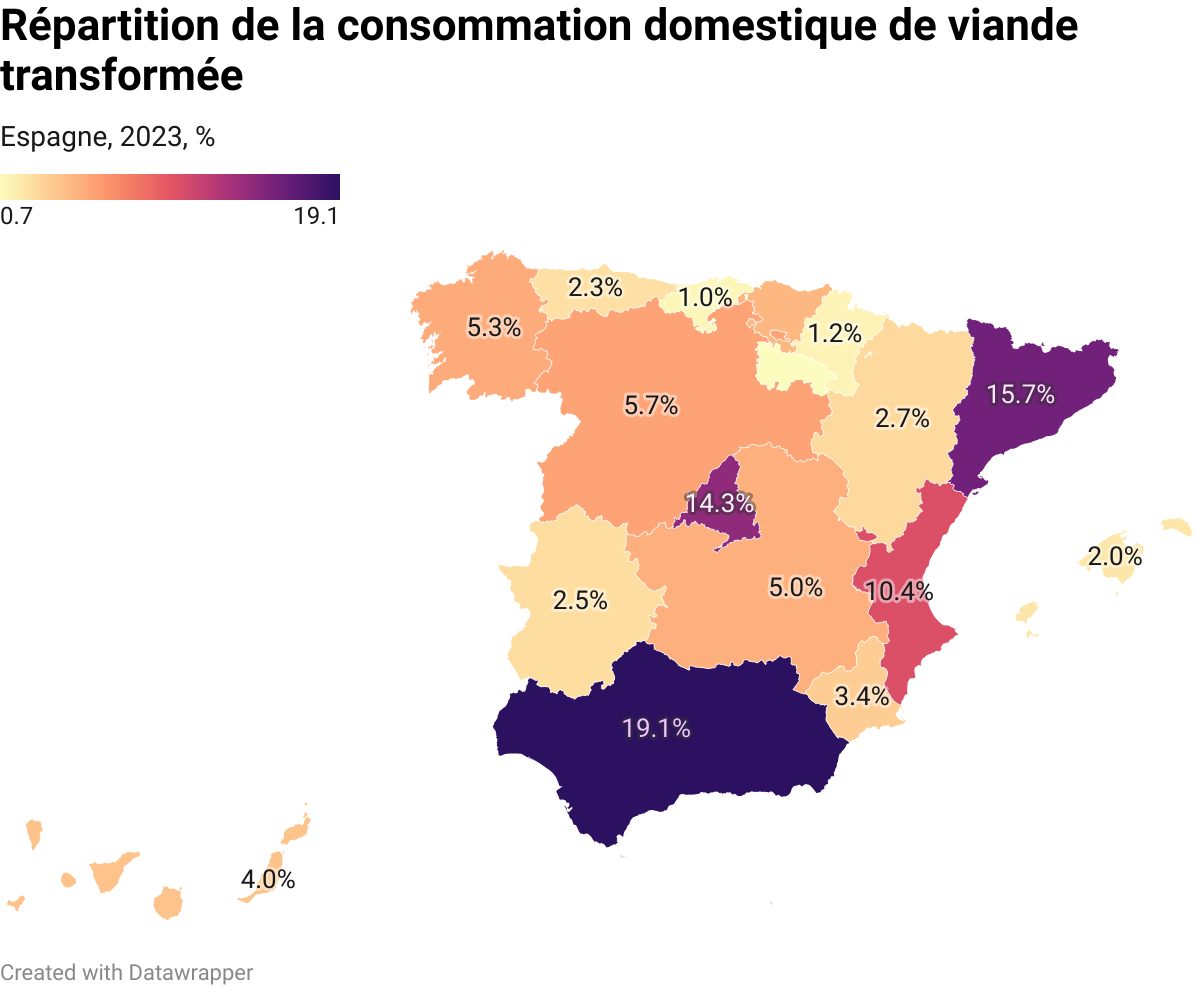

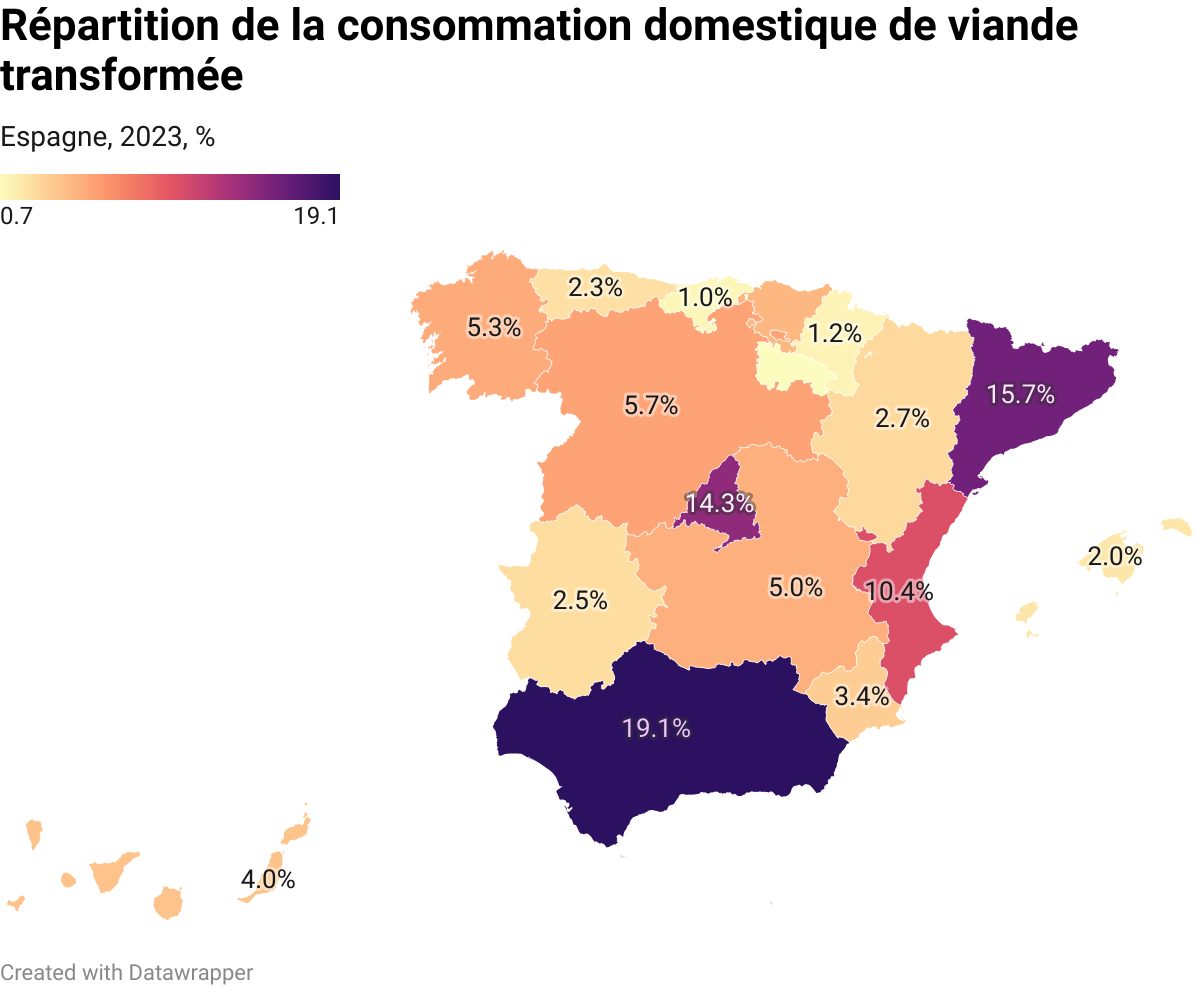

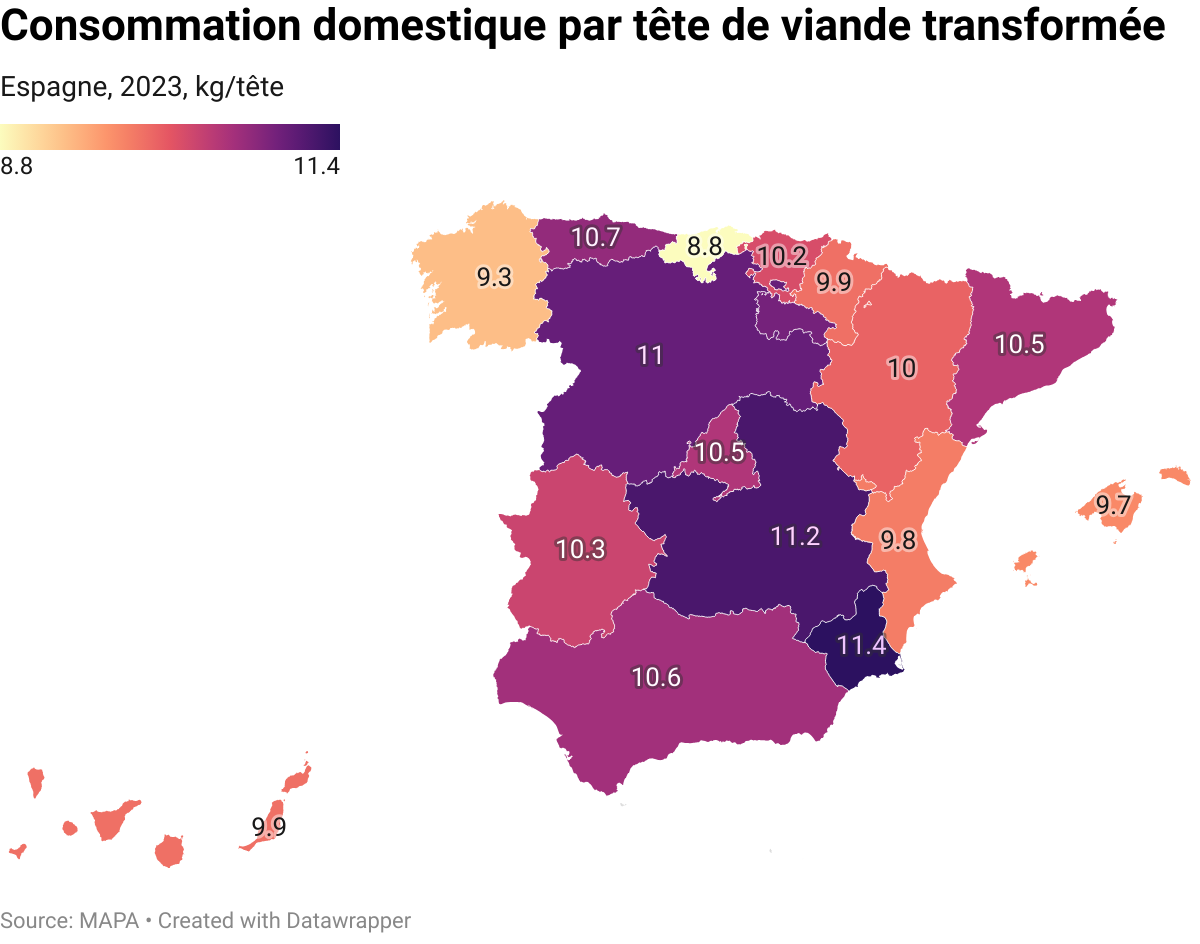

Geographical analysis:

In 2023, the distribution of domestic processed meat consumption in Spain varied considerably between the Autonomous Communities (CCAA).Andalusia stood out as the region with the highest consumption, accounting for 19.1% of total consumption, followed by Catalonia(15.7%) and the Community of Madrid(14.3%). These three regions, with their large populations and strong culinary traditions, dominated the market.

By contrast, the regions with the lowest consumption were La Rioja, with just 0.7%, Cantabria(1.0%) and Navarre(1.2%). These low shares can be explained by a smaller population or less dependence on processed meat in local eating habits.

Intermediate regions included the Comunidad Valenciana(10.4%), Castilla y León(5.7%) and Galicia(5.3%), where consumption remained significant. Other areas, such as the Canary Islands(4.0%) and the Basque Country(4.6%), had more modest shares, but retained a significant place in the national market.

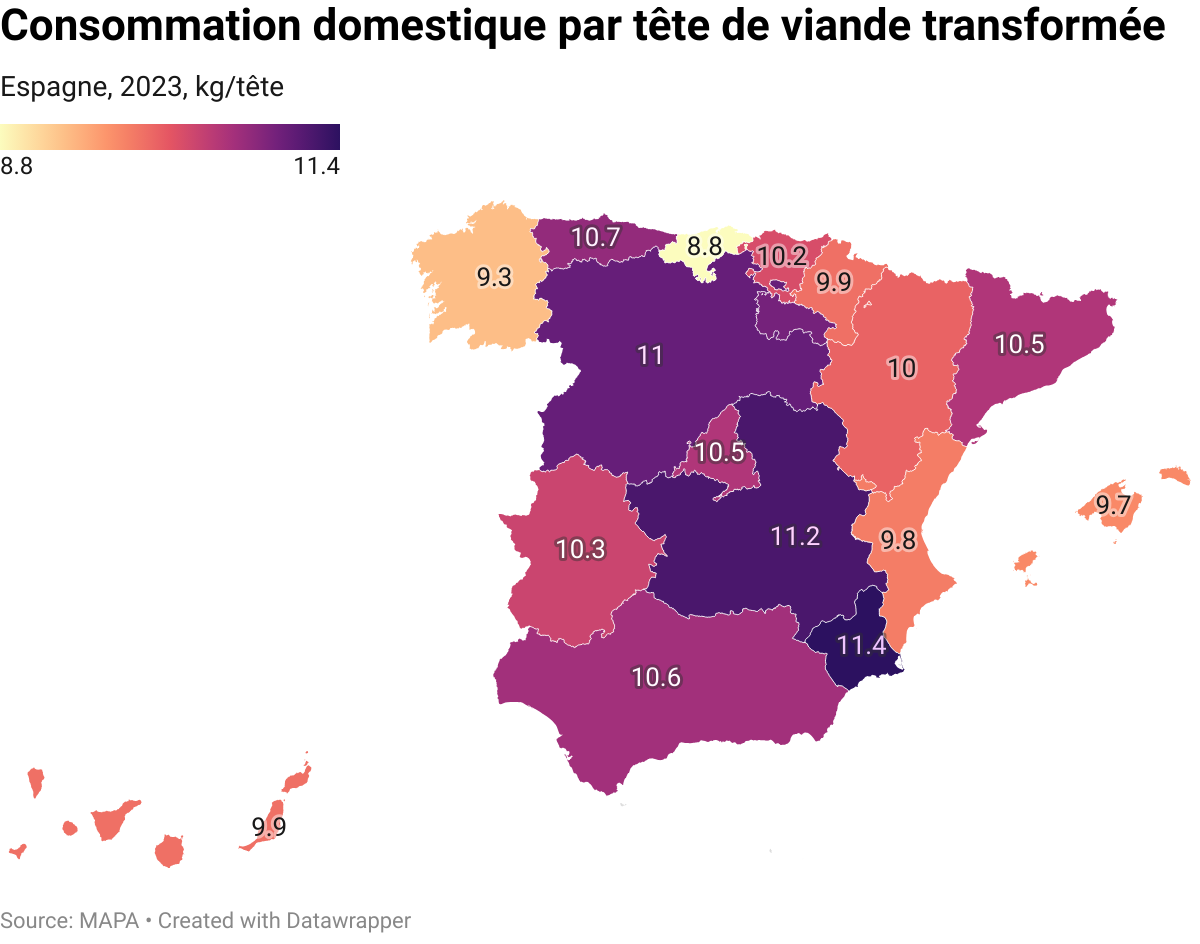

However, this distribution of volume is mainly explained by the uneven distribution of Spain's population. When analyzing per capita consumption, the results show relative uniformity, irrespective of region.

Domestic consumption per capita hovers around 10 kg/year in the majority of regions. For example, areas such as the Murcia Region(11.4 kg), Castilla-La Mancha(11.2 kg) and Castilla y León(11.0 kg) show slightly above-average levels.average, but with no significant differences from regions such as Catalonia(10.5 kg) orAndalusia(10.6 kg). on the other hand, some regions such as Cantabria(8.8 kg) and Galicia(9.3 kg) are slightly below, although the differences remain modest.

These data underline that, despite apparent disparities in total consumption volumes linked to population density, per capita processed meat consumption habits remain similar across the country. This indicates a relatively homogeneous market, which facilitates the implementation of national strategies by producers and distributors.

2.2 Extra-domestic consumption

Ham market segmentation:

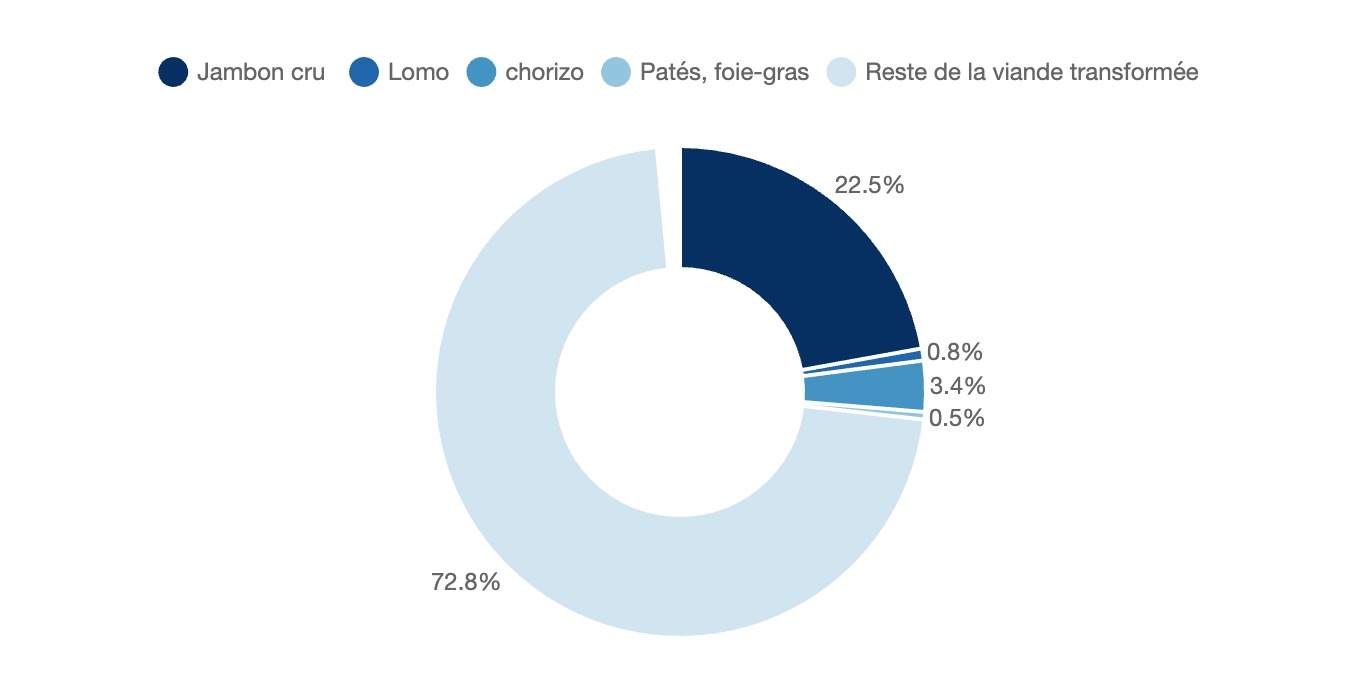

In Spain in 2023, the processed meat market within the HORECA sector (Hotels, Restaurants and Cafés) was largely dominated by categories other than cured ham, lomo, chorizo and products such as foie gras or pâtés. The "rest of processed meat" category accounted for 72.8% of market share, reflecting the wide variety of products used in this sector.

However, cured ham emerged as the leading product among the individual segments, with a significant share of 22.5%, testifying to its essential role in Spanish gastronomy, particularly on restaurant and hotel menus.

Chorizo, with a share of 3.4%, occupies a lesser place but remains a key product due to its use in a variety of traditional dishes. By contrast, the lomo(0.8%) and pâtés and foie gras(0.5%) segments have smaller shares, underlining their more specific and targeted use in the HORECA sector.

These figures reflect a significant concentration on the most versatile and popular products, notably cured ham, while leaving a significant place for other processed meats, adapted to the diverse needs of the professional catering sector.

HORECA processed meat market segmentation

Spain, 2023, % of total

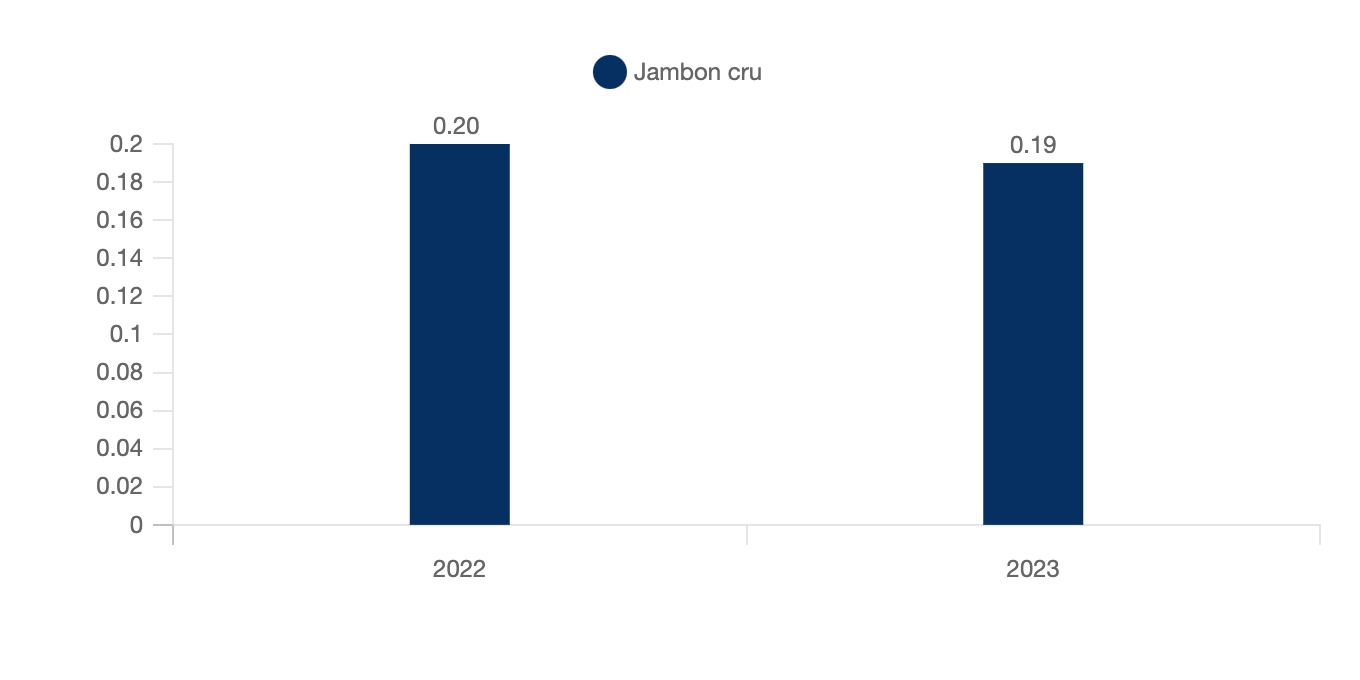

Per capita consumption of cured ham outside the home, however, showed a slight decline between 2022 and 2023. In 2022, each person consumed an average of 0.20 kg of cured ham in HORECA establishments, a quantity that fell to 0.19 kg in 2023, a decrease of 5%.

Extra-domestic ham consumption per head

Spain, 2022-2023, kg/head

Consumer study:

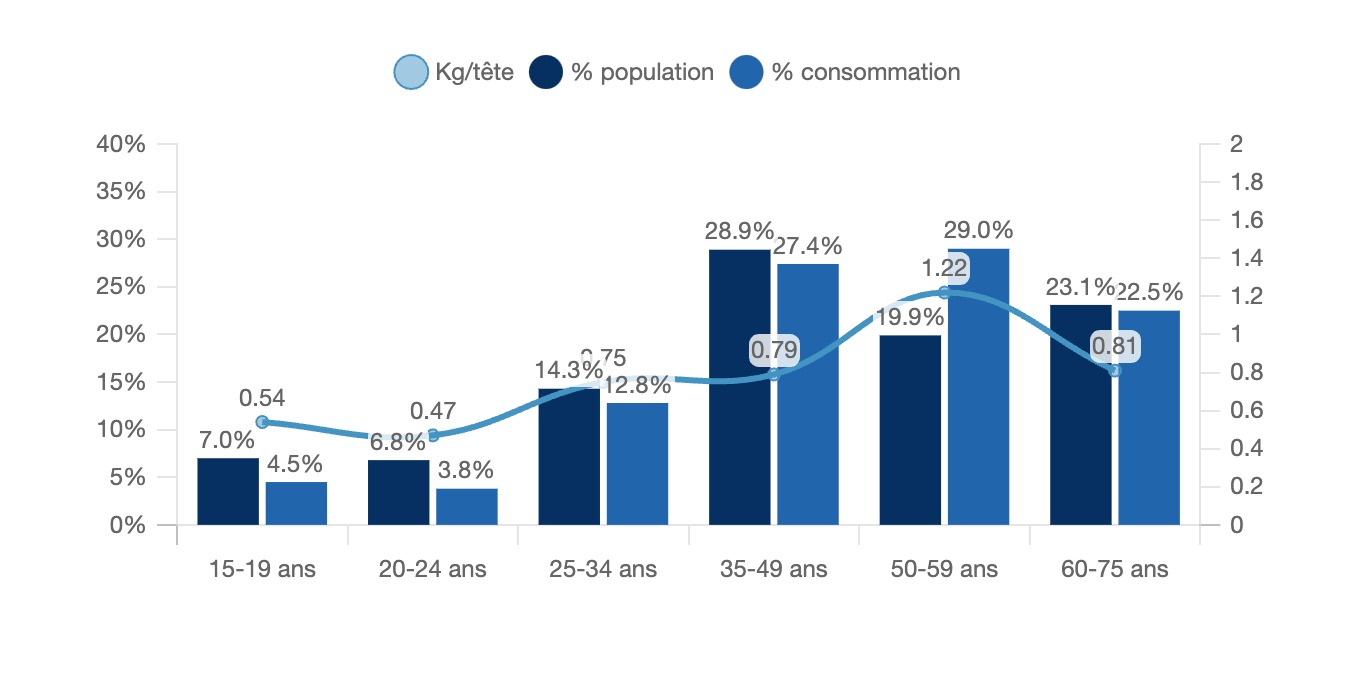

In 2023, consumption of processed meat, including cured ham, varied significantly by age group, revealing marked differences in Spaniards' eating habits outside the home.

The 50-59 age group stood out as the biggest consumers, accounting for 29.0% of total consumption for just 19.9% of the population, with an average of 1.22 kg per head. Their contribution far exceeded their demographic weight, underlining a strong preference for this type of product, probably linked to traditional eating habits and more stable purchasing power.

The 35-49 age group also played an important role, with 27.4% of consumption for 28.9% of the population, consuming an average of 0.79 kg per head. The 60-75 age group followed with 22.5% of consumption, although they represented a slightly higher proportion of the population(23.1%), with an average consumption of 0.81 kg.

By contrast, the younger generations, notably the 15-19 and 20-24 age groups, showed much lower levels of consumption, accounting for just 4.5% and 3.8% of total consumption respectively, despite their significant share of the population(7.0% and 6.8%). Their average per capita consumption remained limited to 0.54 kg and 0.47 kg, probably reflecting different eating habits, less access to the HORECA sector or a growing interest in alternatives to processed meat.

These data highlighted a concentration of processed meat consumption, and in particular cured ham, among older generations, while younger generations adopted distinct eating behaviors. This segmentation by age was a key indicator for adjusting the commercial strategies of players in the sector.

Consumption of processed meat outside the home, by age group

Spain, 2023, % of population, % of consumption, kg/head

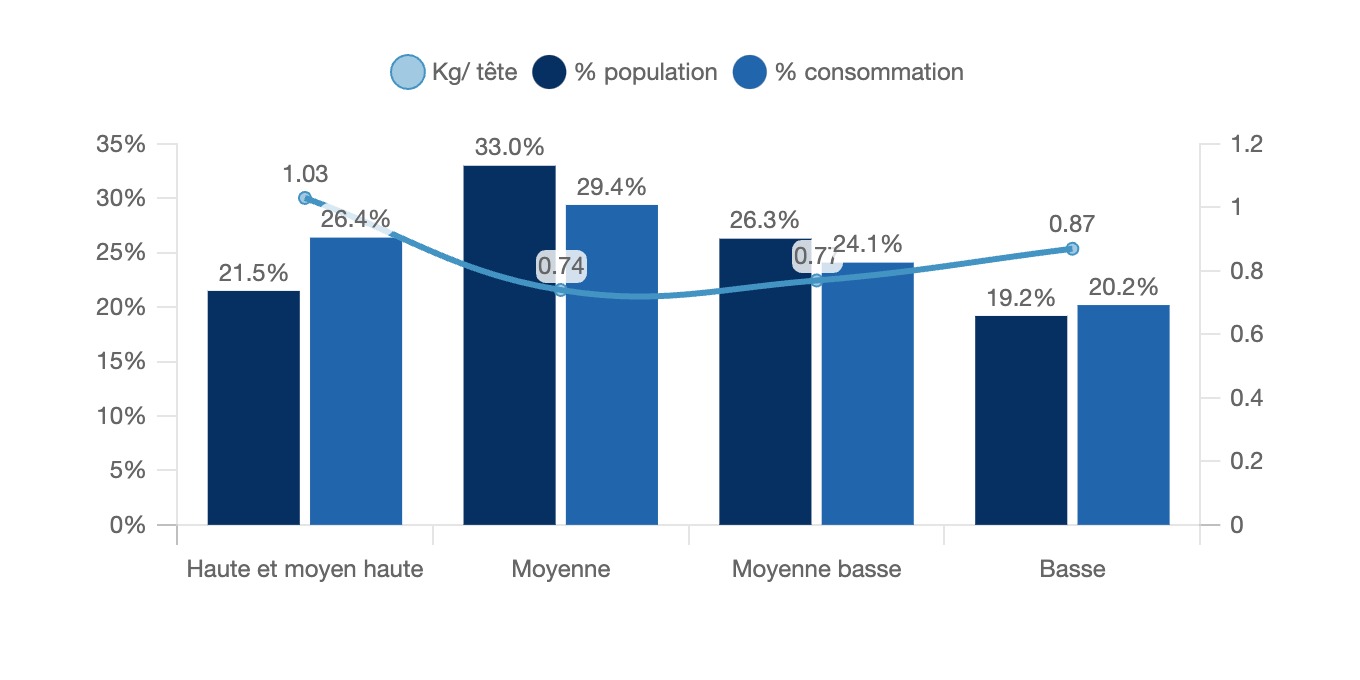

The following graph provides further information on the consumption of processed meat outside the home in Spain, as a function of income:

Individuals belonging to the high and middle-high income categories proved to be the biggest consumers per head, with an average of 1.03 kg, accounting for 26.4% of total consumption, whereas they represented only 21.5% of the population. This over-representation illustrates a greater financial capacity to frequent HORECA establishments and a preference for quality products, often associated with these incomes.

Middle-income groups contributed 29.4% of total consumption, slightly below their share of the population(33.0%), with an average per capita consumption of 0.74 kg. Although the majority in demographic terms, their per capita consumption remained lower than that of the more affluent categories, probably due to more limited budgets.

Low- and middle-income households accounted for 24.1% and 20.2% of total consumption respectively, in line with their share of the population(26.3% and 19.2%). However, their per capita consumption was slightly higher than that of average incomes, with 0.77 kg for low-middle incomes and 0.87 kg for low incomes, which may reflect a less expensive choice of products or a higher proportion of meals taken away from home for practical reasons.

Consumption of processed meat outside the home as a function of income

Spain, 2023, % of population, % of consumption, kg/head

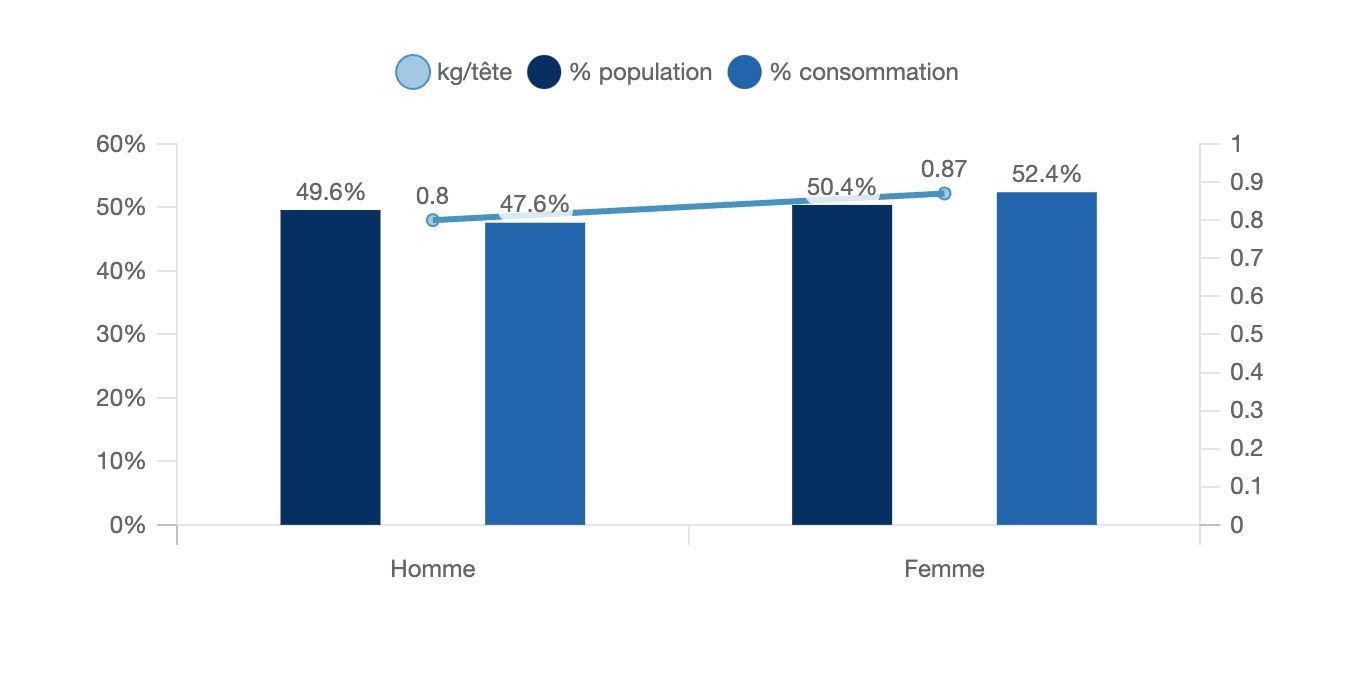

By gender, women, representing 50.4% of the population, contributed 52.4% of total consumption, with an average per capita consumption of 0.87 kg. This over-representation suggests a slightly greater preference for meals away from home, or a more frequent choice of processed meat products in this context.

In contrast, men, who made up 49.6% of the population, accounted for 47.6% of total consumption, with an average per capita consumption of 0.80 kg. Although slightly lower than that of women, their consumption remains significant, confirming their significant role in this market.

Extra-domestic consumption of processed meat by gender

Spain, 2023, % (in %)

Geographical distribution:

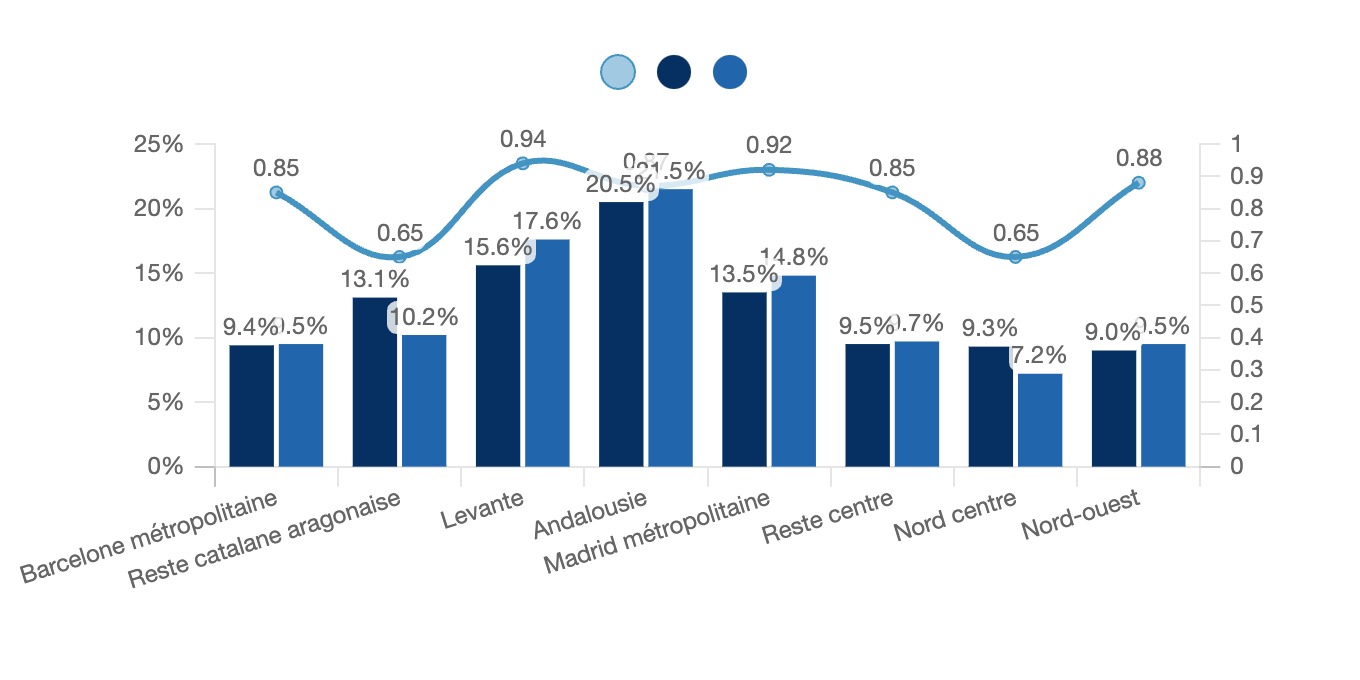

In 2023, extra-domestic consumption of processed meat in Spain showed significant regional disparities, reflecting cultural, economic and demographic differences.

Andalusia stood out as the region with the highest share of consumption, accounting for 21.5% of total consumption, well above its share of the population(20.5%). With an average per capita consumption of 0.87 kg, this region illustrates a strong attachment to processed meat, probably influenced by local culinary traditions and a social culture focused on eating out.

Levante and the Madrid metropolitan region also posted high shares, with 17.6% and 14.8% of consumption respectively, slightly higher than their demographic proportions(15.6% and 13.5%). Per capita consumption was high in these regions, reaching 0.94 kg in Levante, the highest of all regions, and 0.92 kg in Madrid, testifying to their economic dynamism and the attractiveness of the HORECA sector.

Metropolitan Barcelona, on the other hand, despite its population density(9.4%), accounted for only 9.5% of consumption, with an average of 0.85 kg per head, slightly below the major consuming regions. Similar trends were observed in the rest of Catalonia and Aragon(13.1% of the population, 10.2% of consumption) and in Nord Centre(9.3% of the population, 7.2% of consumption), with lower average consumption, around 0.65 kg per head.

Finally, the North-West and Rest of Centre regions are at intermediate levels, representing 9.5% and 9.7% of consumption respectively, close to their demographic share, with per capita consumption of 0.88 kg and 0.85 kg.

These data reveal that the Levante, Madrid and Andalusia regions are the main drivers of extra-domestic consumption of processed meat, while other areas, such as the North-Central region, show more modest behavior. This underlines the importance for HORECA players of adapting their offer to regional preferences in order to maximize their impact on this diversified market.

Breakdown of extra-domestic processed meat consumption by region

Spain, 2023, % population, % consumption, kg/head

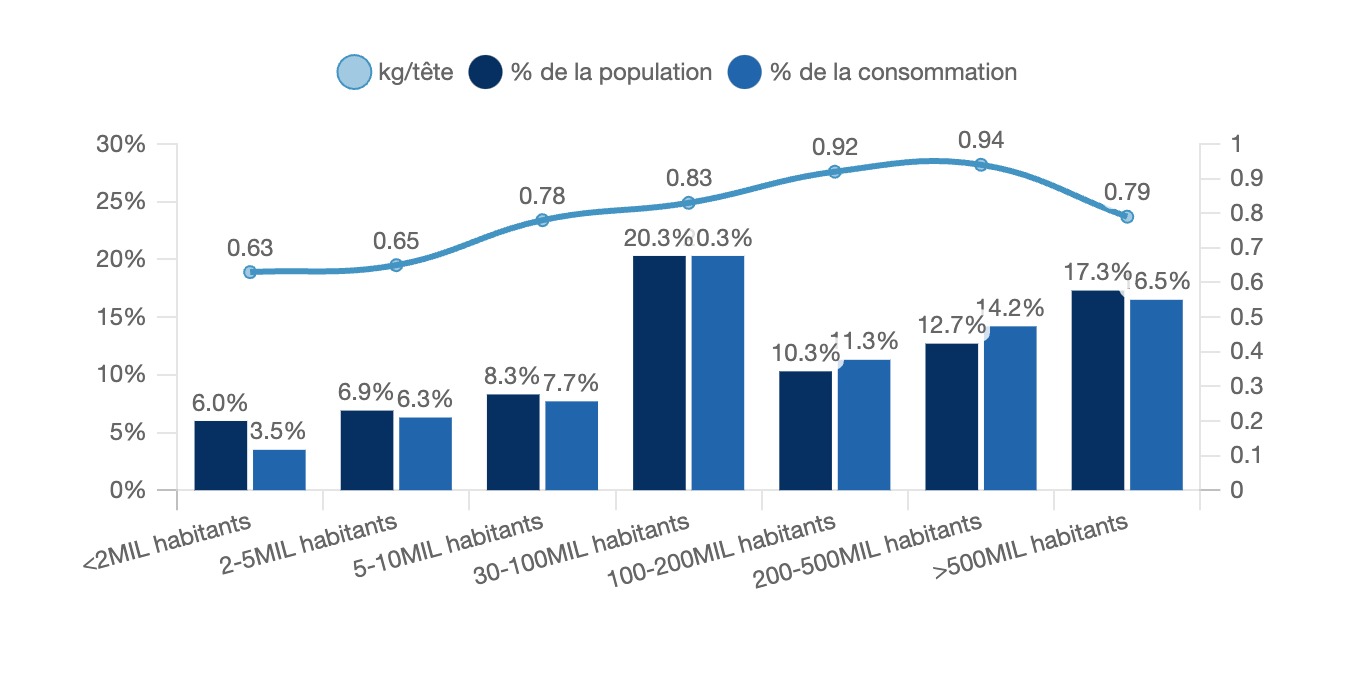

In 2023, extra-domestic consumption of processed meat in Spain also showed an interesting distribution according to the size of conurbations, reflecting specific dynamics linked to urban and rural lifestyles.

Large conurbations with populations of 200,000 to 500,000 showed the highest average per capita consumption, reaching 0.94 kg, reflecting a marked habit of eating out. These cities, which account for 12.7% of the population, contributed 14.2% of total consumption, demonstrating the significant dynamism of the HORECA sector in these urban areas.

Agglomerations with 100,000 to 200,000 inhabitants followed with an average per capita consumption of 0.92 kg, slightly exceeding their demographic share(10.3% of the population, 11.3% of consumption). These areas seem to maintain a balance between population density and foodservice attractiveness.

On the other hand, in very large cities of over 500,000 inhabitants, although the population share is significant(17.3%), average per capita consumption is slightly lower, at 0.79 kg, and their contribution to total consumption(16.5%) is below their demographic weight. This could be explained by more varied access to food alternatives or a diversification of consumption patterns.

Medium-sized towns and cities(30,000 to 100,000 inhabitants) account for a significant proportion of the population(20.3%) and make an identical contribution to total consumption(20.3%), with an average of 0.83 kg per head, reflecting consumption in line with their demographic weight.

Finally, small towns and villages(fewer than 10,000 inhabitants) show lower average consumption per head, at 0.63 kg for municipalities with fewer than 2,000 inhabitants, and 0.65 kg for those with 2,000 to 5,000 inhabitants. These areas, representing 6.0% and 6.9% of the population respectively, make a modest contribution to total consumption(3.5% and 6.3%). These figures show a lesser reliance on meals away from home, consistent with more rural lifestyles.

These data underline the importance of urban areas, particularly medium-sized towns, in the market for processed meat consumed away from home, while also highlighting more modest consumption habits in smaller towns. Players in the HORECA sector can use this information to fine-tune their strategy according to the density and behavior of local populations.

Extra-domestic consumption of processed meat according to size of conurbation

Spain, 2023, % of population, % of consumption, kg/head

2.3 Spanish diets

The following section highlights Spanish cooking and eating habits

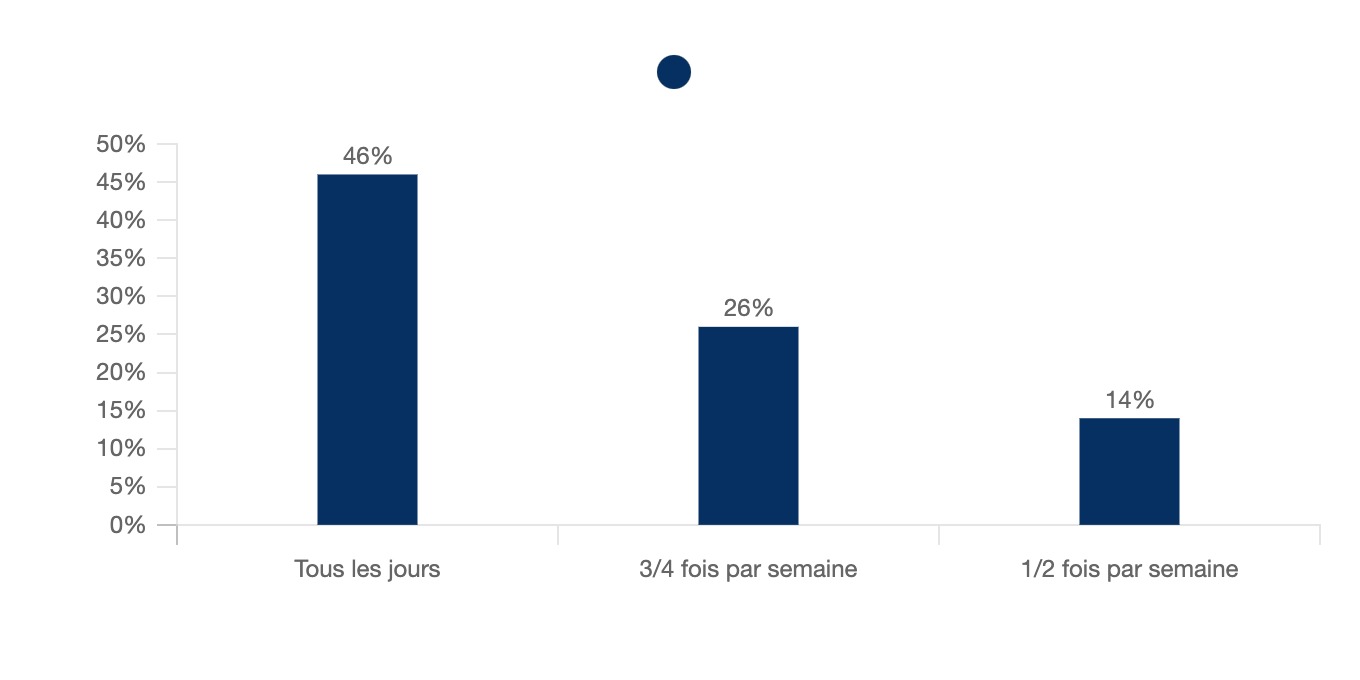

Cooking habits:

In 2023, the majority of Spaniards cooked frequently at home, with 46% preparing meals every day. Some 26% cooked 3-4 times a week, while 14% did so 1-2 times a week. These data show that home cooking remains a common practice in Spain, although the frequency varies according to individual habits.

Cooking frequency of Spaniards

Spain, 2023, % of total

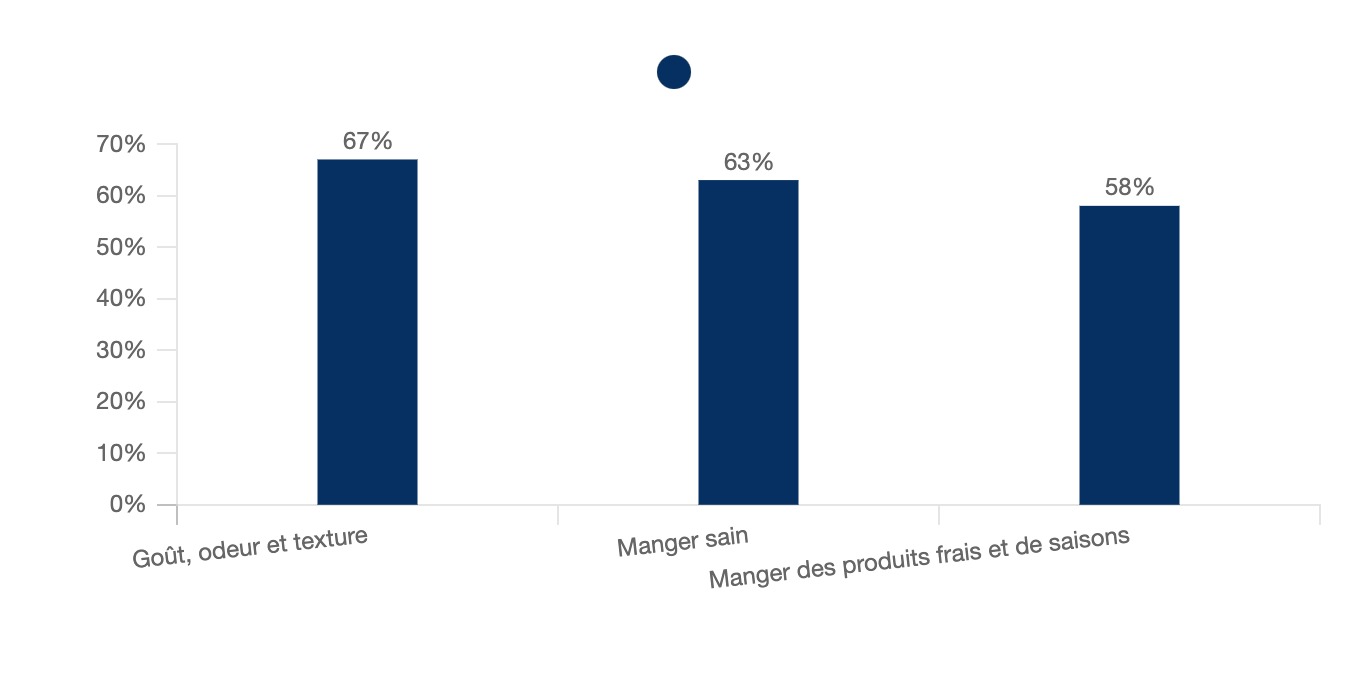

In 2023, the most decisive criteria for preparing a dish in Spain were mainly focused on sensory satisfaction, with 67% of Spaniards giving priority to taste, smell and texture. Health also figured prominently, with 63% giving priority to healthy eating. What's more, 58% of Spaniards were keen to eat fresh, seasonal produce, reflecting a growing interest in more sustainable, quality food.

Determining criteria for the preparation of a dish

Spain, 2023, %

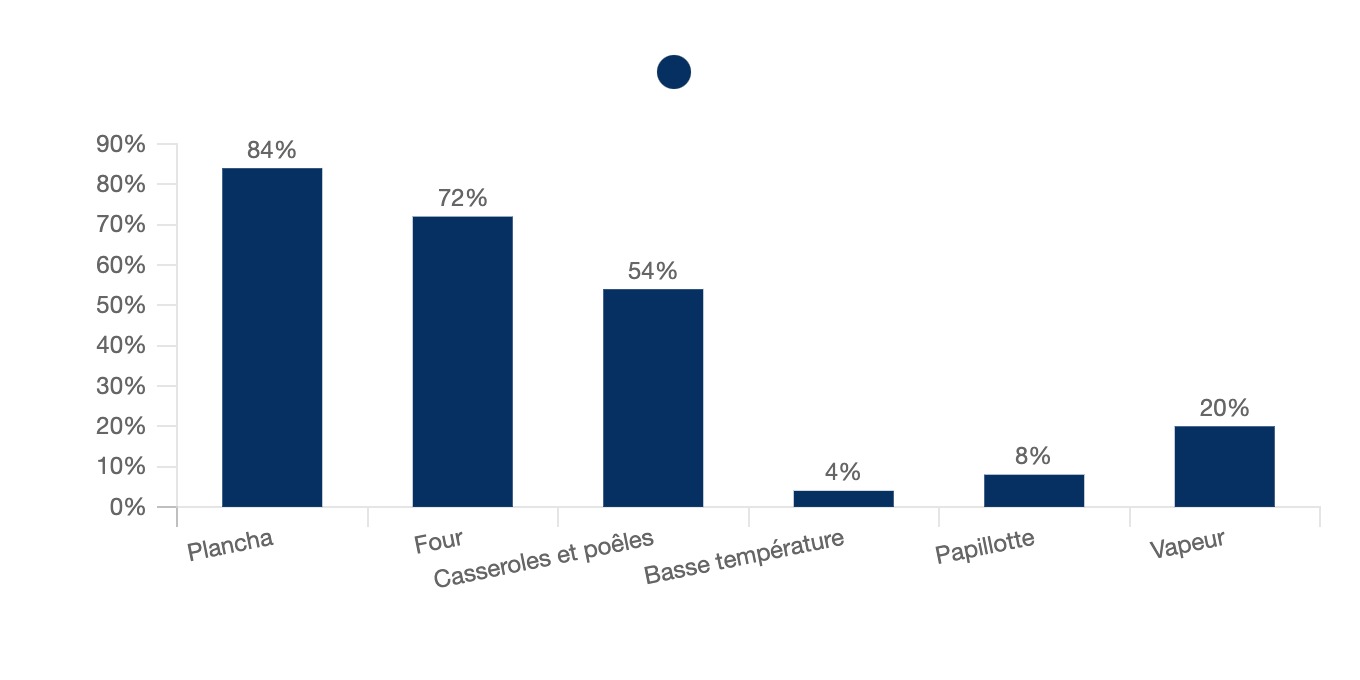

In 2023, Spaniards' favorite cooking techniques were dominated by the plancha, used byused by 84% of cooks, followed by the oven at 72% and pots and pans at 54%. More specific cooking methods, such as steaming(20%), papillote(8%) and low-temperature cooking(4%), were less popular, but are still present in certain culinary practices. These data show a preference for simple, fast techniques, while leaving room for healthier, less common methods.

Spaniards' preferred cooking techniques

Spain, 2023, % of total

Healthy eating:

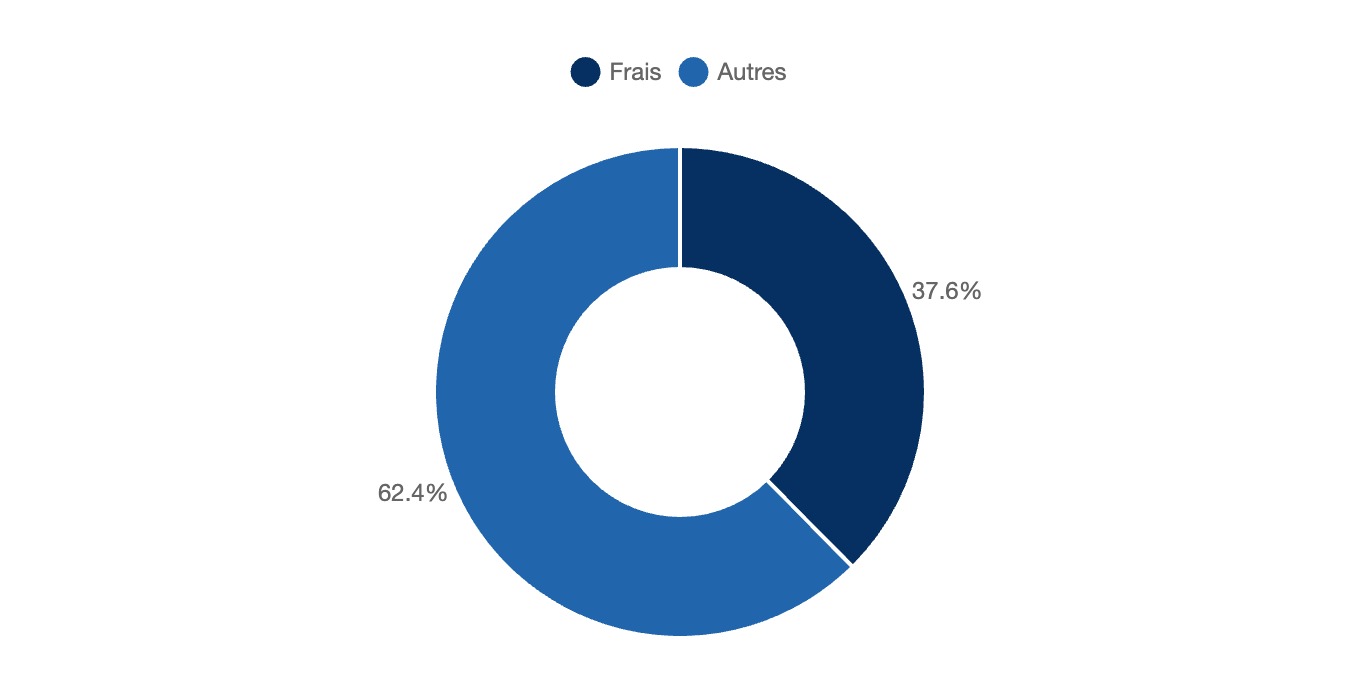

In 2023, fresh food consumption accounts for 37.6% of total food consumption in Spain, while the remaining 62.4% is accounted for by other types of food, such as processed, preserved or frozen products. This breakdown shows a preference for non-fresh foods, although fresh products continue to occupy a significant share of overall food consumption in Spain.

Share of fresh food consumption in total food consumption

Spain, 2023, % (in %)

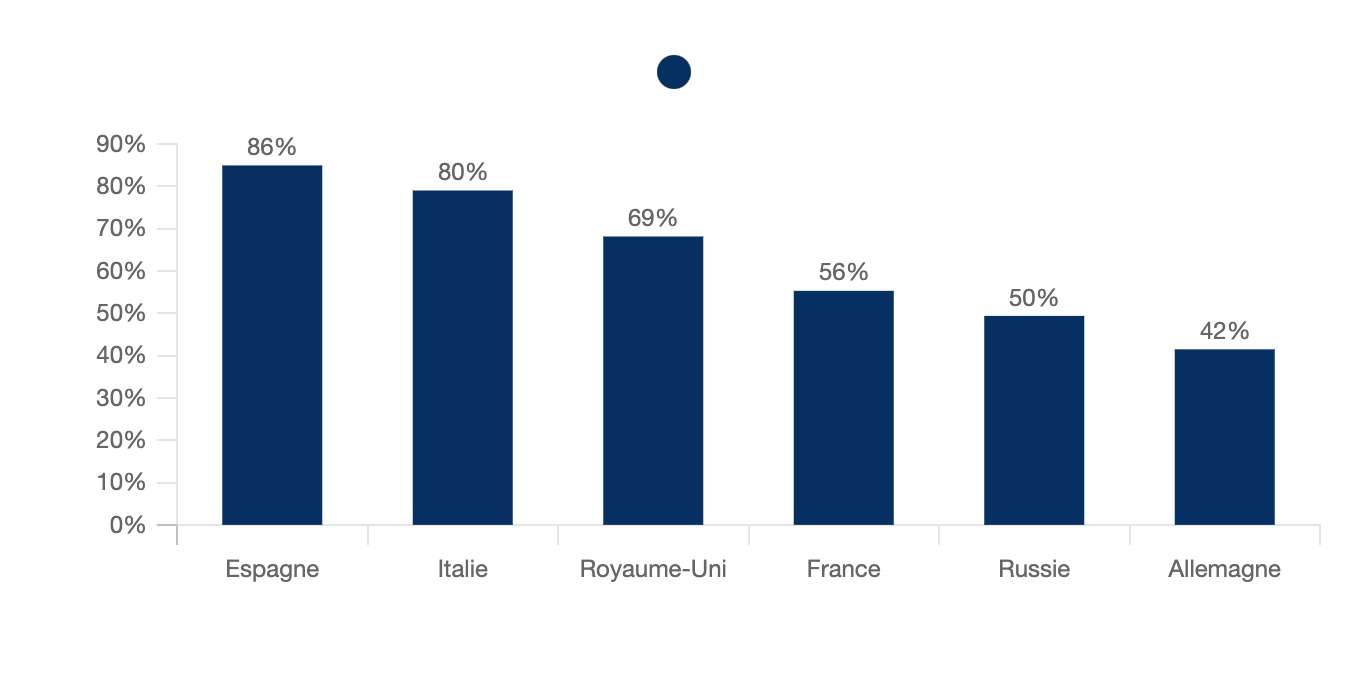

In 2023, the importance of healthy food varied considerably across Europe, with higher levels of concern in some countries. In Spain, 86% of the population attached great importance to eating healthily, followed closely byItaly with 80%. In the UK, 69% of the population were concerned, while in France it was 56%. In Russia, 50% of people were concerned about healthy eating, and in Germany the proportion was lower, at 42%. These figures show a significant difference in the importance attached to healthy eating across Europe.

The importance of healthy food in Europe

Europe, 2023, %, %, %, %, %, %, %, %, %, %, %, %

Local food is healthier

Spain, 2023, %, Spain, 2023, %, Spain, %, Spain, 2023, %, Spain

Diets:

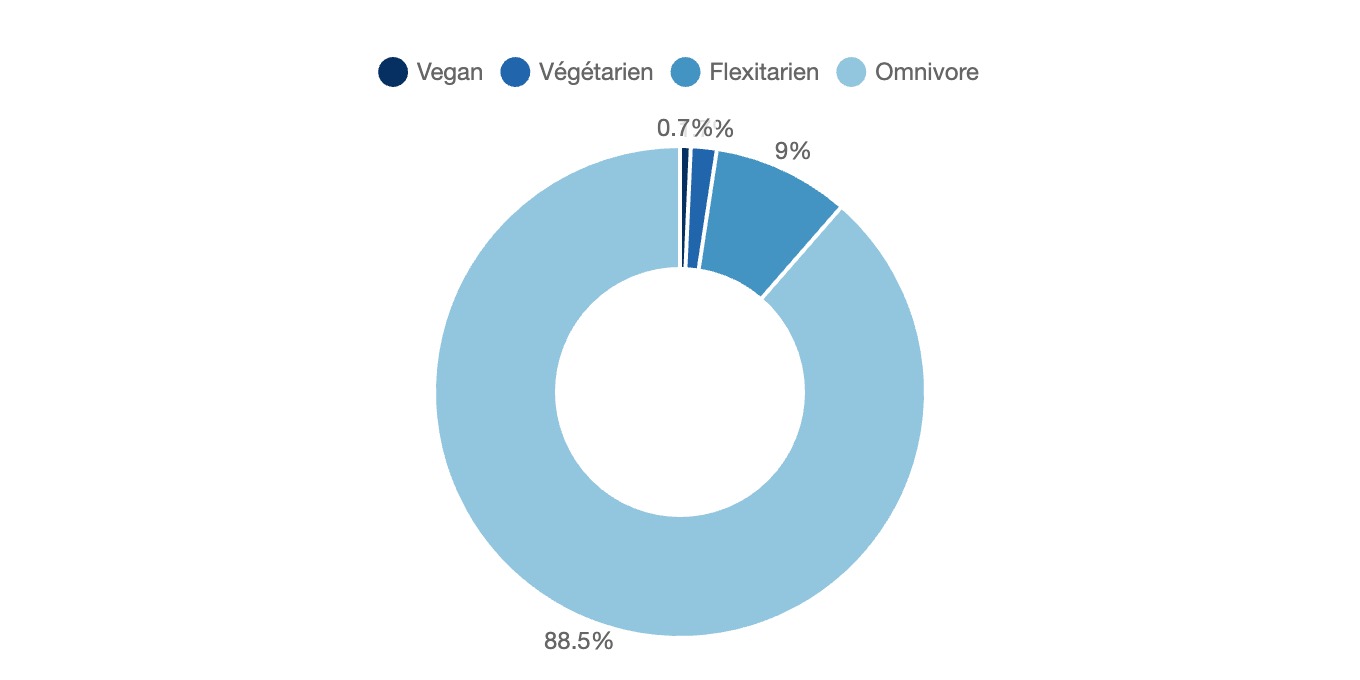

In 2023, the vast majority of Spaniards followed an omnivorous diet, representing 88.5% of the population. Flexitarians, who limit their meat consumption without excluding it altogether, made up 9% of Spaniards. Vegetarian diets were followed by 1.7% of the population, while vegans, who exclude all animal products, accounted for just 0.7%. These figures show that, although plant-based diets are gaining in popularity, the omnivorous diet remains dominant in Spain.

Spanish diets

Spain, 2023, % of total

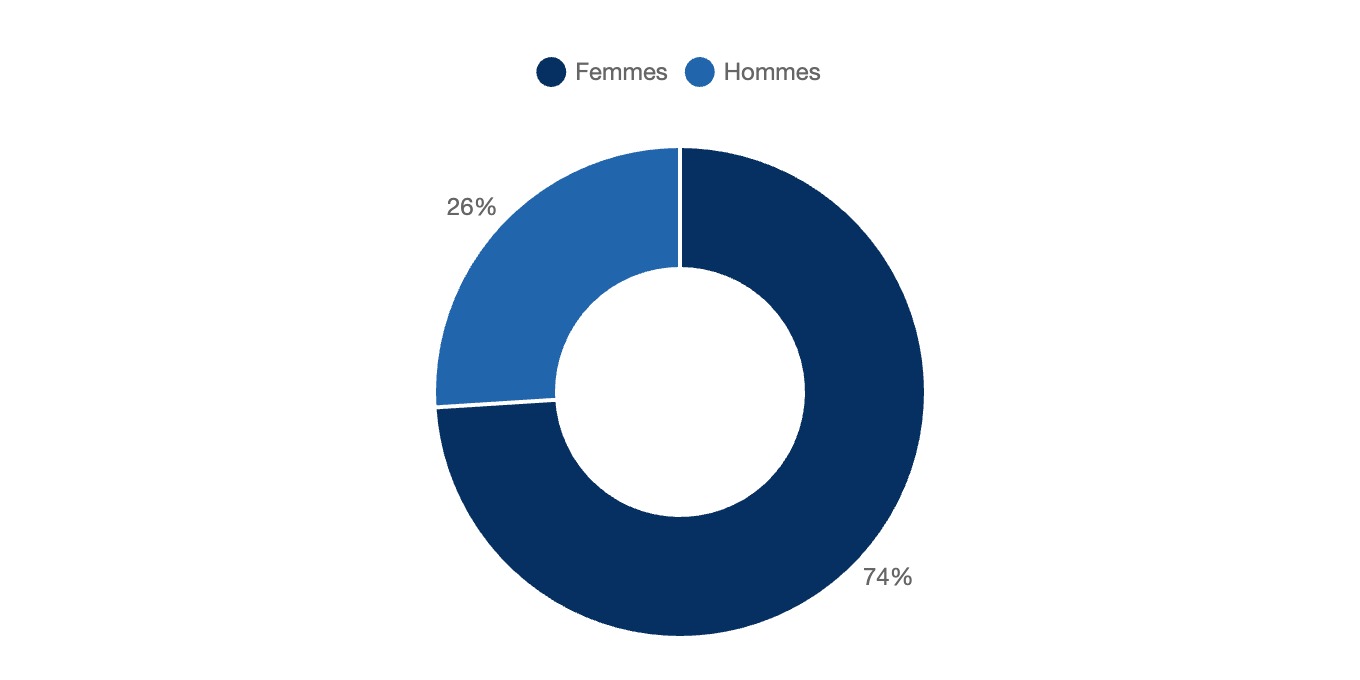

Finally, in 2023, the breakdown of vegetarians and vegans in Spain showed a clear majority of women, who accounted for 74% of followers of these diets, against 26% ofmen.

Gender distribution of vegetarians and vegans

Spain, 2023, % (in %)

2.4 Iberian ham

What people know about ham

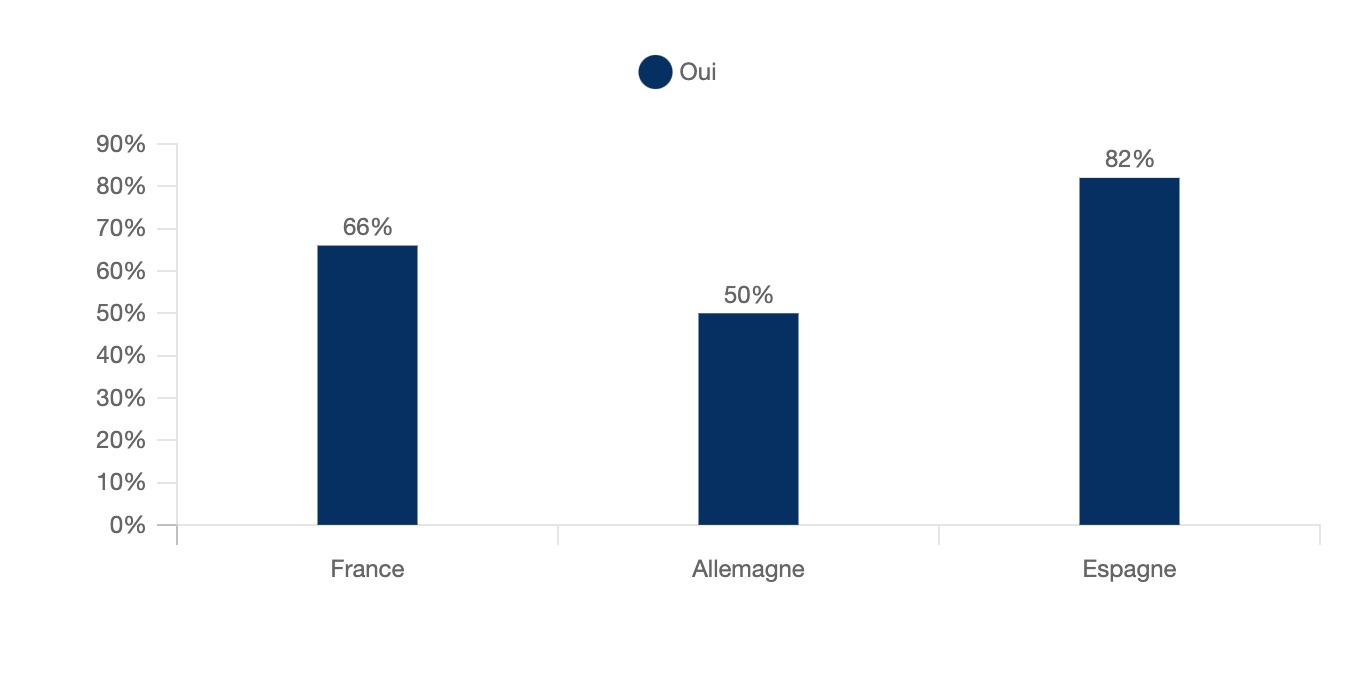

in 2024, a significant majority of the Spanish population(82%) considered Iberian ham to be an emblematic element of Spanish culture, confirming its central role in the country's gastronomic heritage. In comparison, 66% of French people shared this opinion, as did 50% of Germans . This shows that Iberian ham is associated with Spain and its culture.

Do you consider Iberian ham to be emblematic of Spanish culture?

Spain, 2024, %

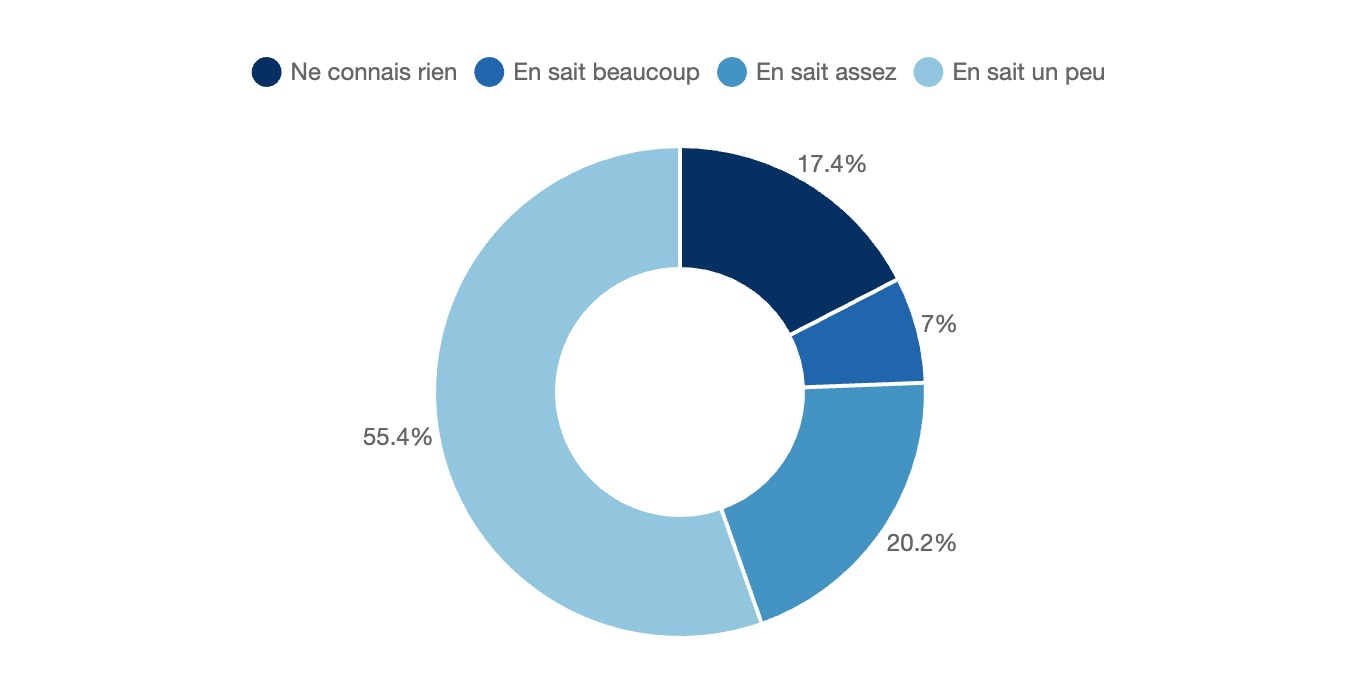

In 2024, Spaniards demonstrated a varied level of knowledge about Iberian ham. A relative majority, 55.4%, claimed to know a little about the product, while 20.2% felt they knew enough. A smaller proportion, 7%, considered themselves very knowledgeable, while 17.4% said they knew nothing at all about the subject.

Spaniards' knowledge of Iberian ham

Spain, 2024, % of total

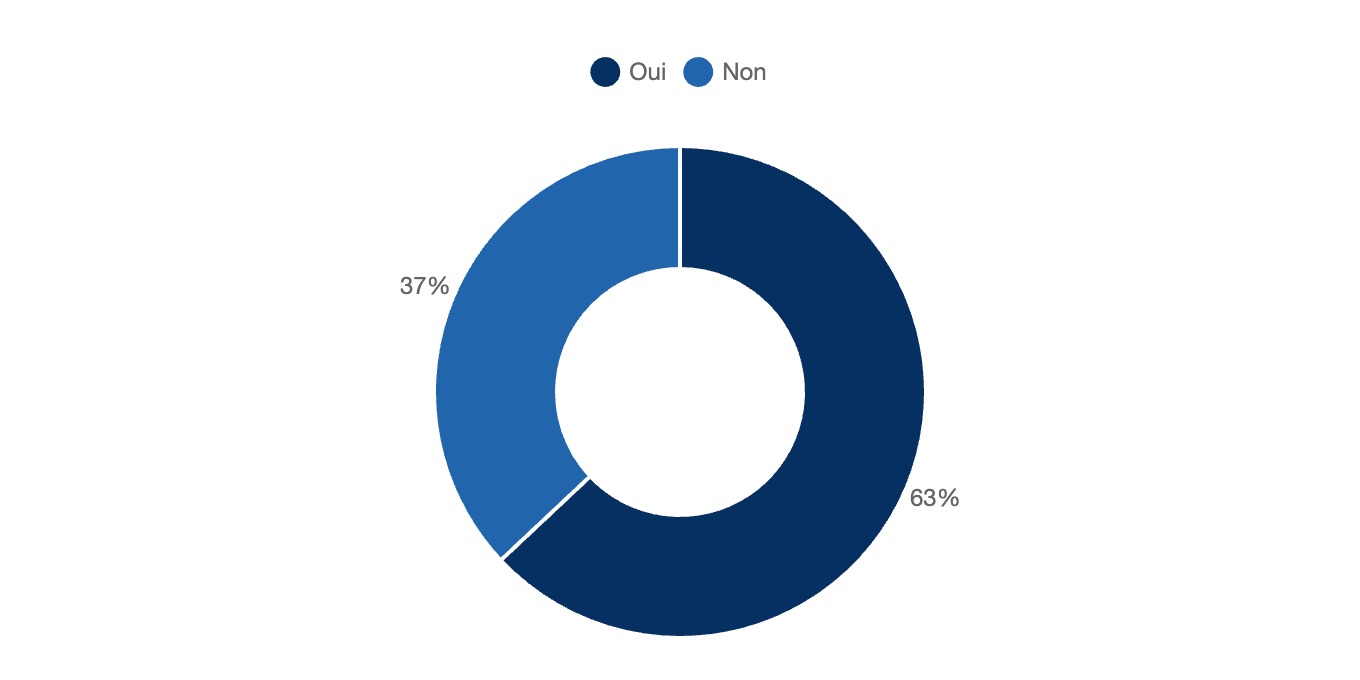

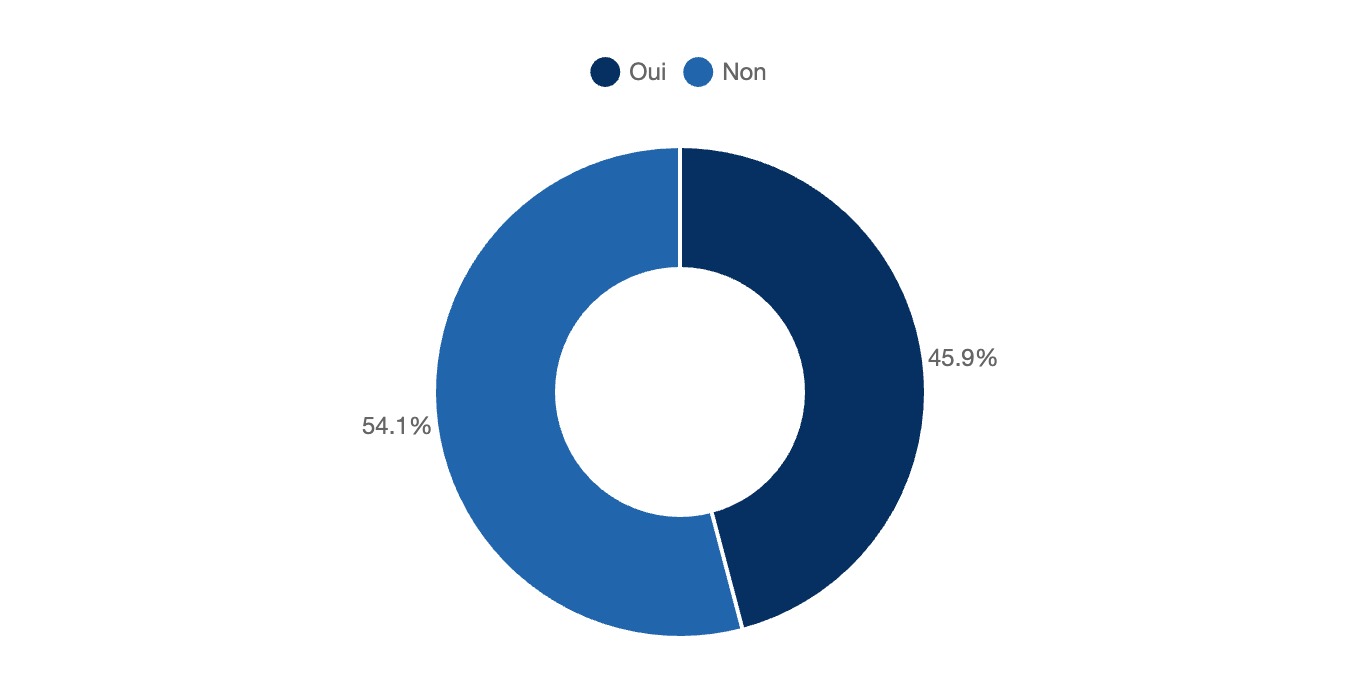

The survey also revealed that only 45.9% of Spaniards knew that Iberian ham requires a minimum of 20 months maturing, while 54.1% were unaware of this fact. These results highlighted a general lack of knowledge regarding the specific production characteristics of Iberian ham, despite its cultural and gastronomic importance in Spain. This highlighted a potential need for education and awareness-raising around this flagship product.

Know that Iberian ham is aged for at least 20 months

Spain, 2024, %

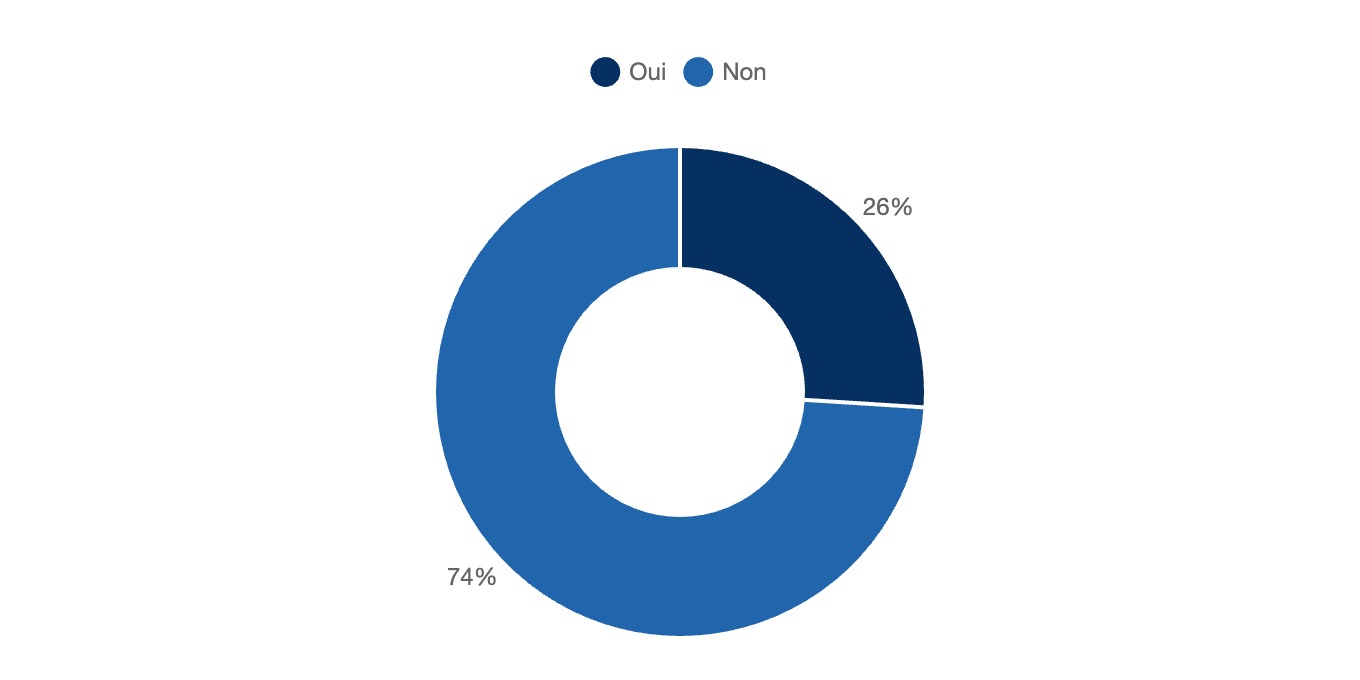

What's more, only 26% of Spaniards said they knew the difference between Serrano ham and Iberian ham, compared to 74% who didn't know.

Know the difference between Serrano and Iberian ham

Spain, 2024, % (%)

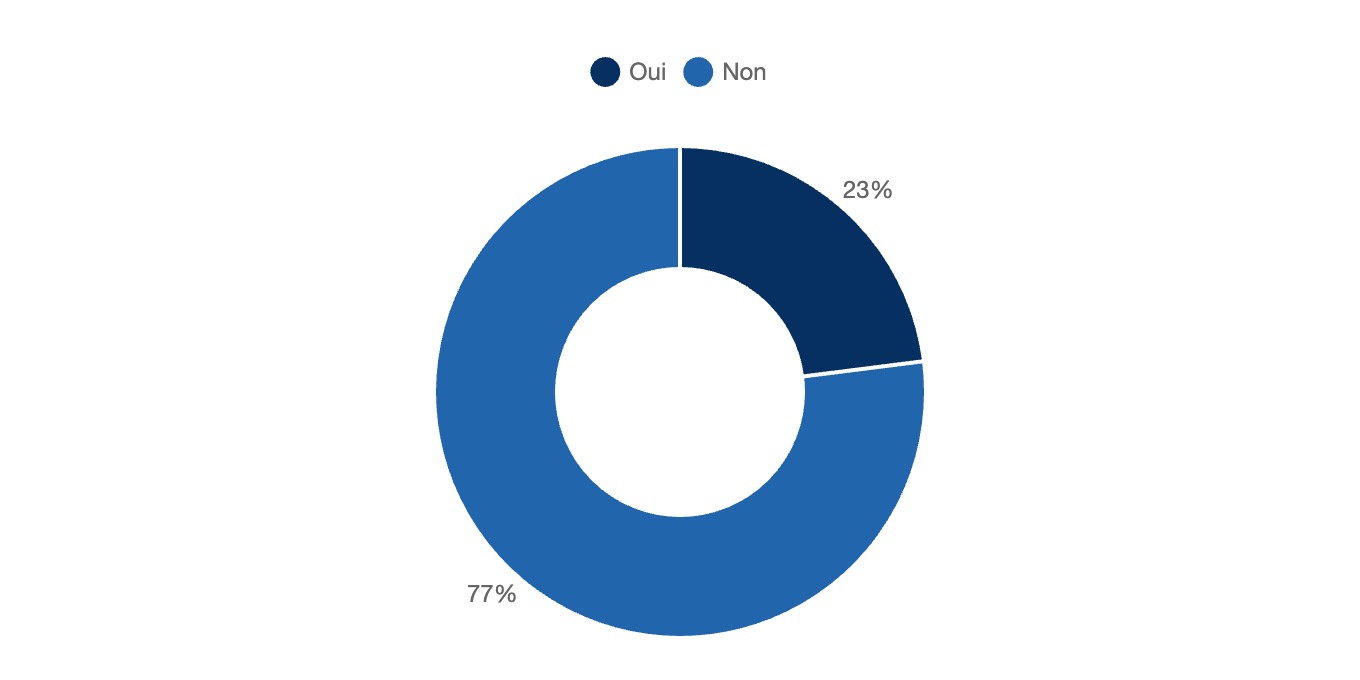

Finally, only 23% of Spaniards claimed to know about the Montanera, the period during which Iberian pigs feed on acorns in the dehesas, while 77% were unaware of this key concept linked to the production of quality Iberian ham.

Knowledge of Montanera

Spain 2024, % of sales

Consumption habits:

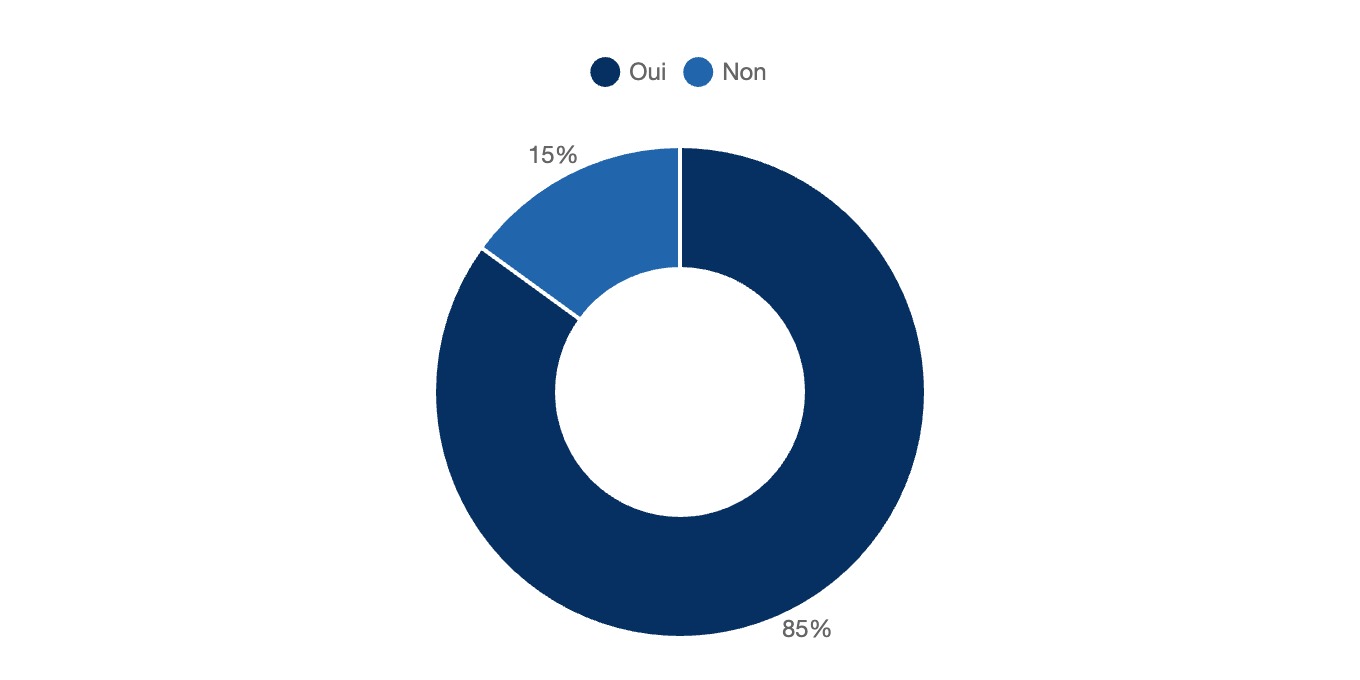

In 2023, 85% of the Spanish population had consumed Iberian ham.

Spaniards who ate Iberian ham in 2023

Spain, 2023, % of population

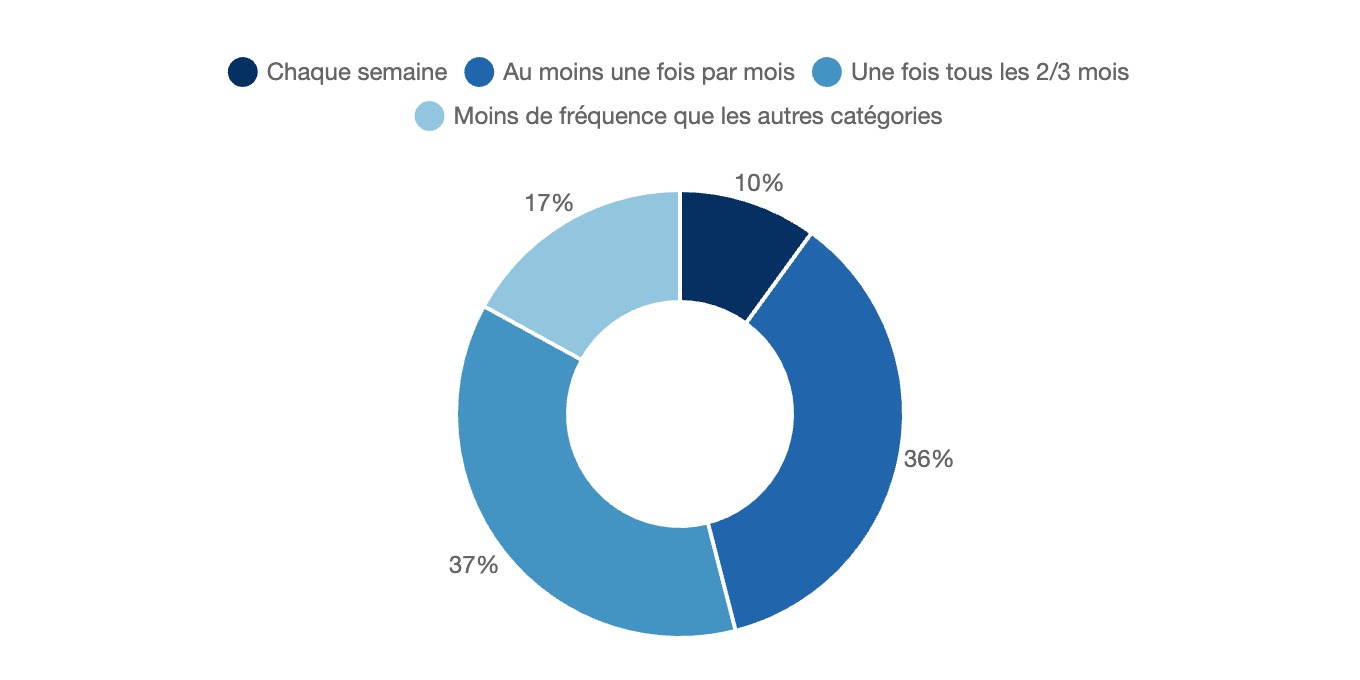

In terms of Iberian ham consumption habits in 2024, 10% of Spaniards ate Iberian ham every week, while 36% said they ate it at least once a month. The relative majority, 37%, consumed Iberian ham once every two or three months, and 17% did so with greater frequency than the other categories.

Iberian ham consumption habits

Spain, 2024, % of total

Finally, when it comes to the best time to eat Iberian ham, 52.1% of Andalusians prefer to eat it at breakfast, reflecting a strong regional tradition. In the rest of the country, the preferred time to enjoy ham was dinner, chosen by 62.4% of Spaniards. This confirms that, for the majority, dinner is perceived as the best time to enjoy this emblematic product.

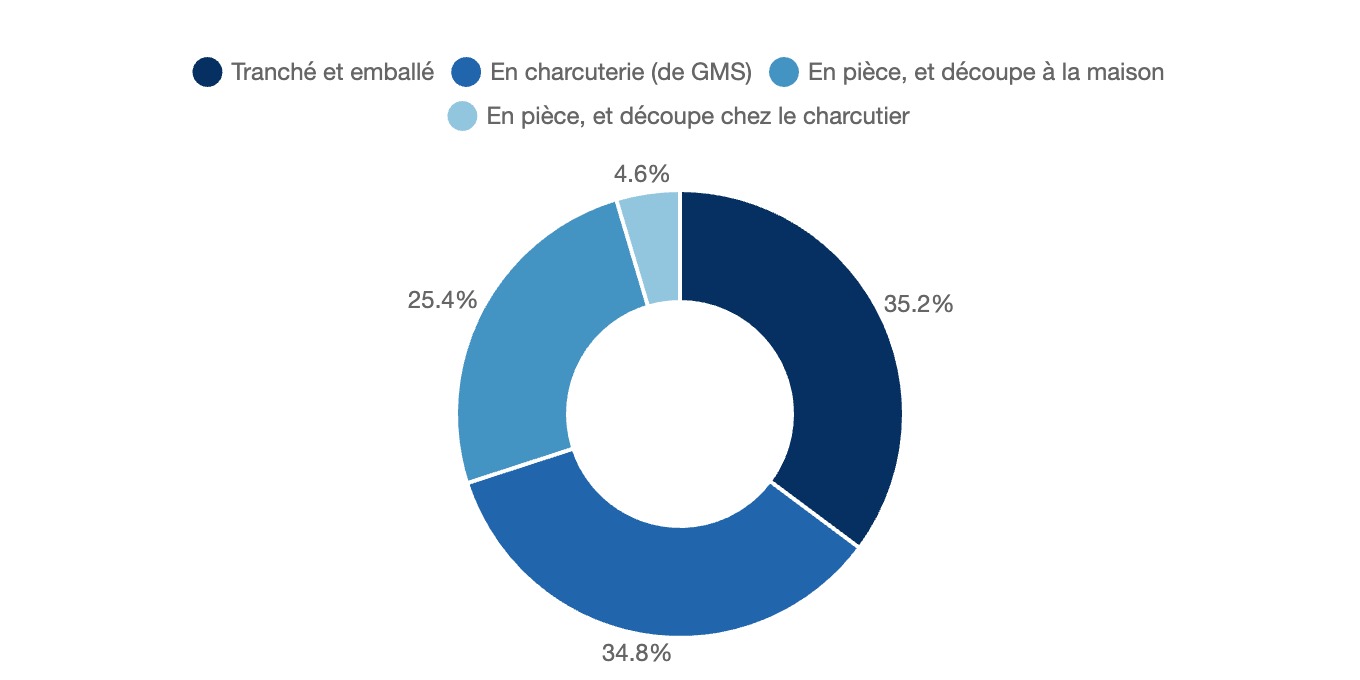

In Spain in 2024, preferences for purchasing formats of Iberian ham were varied. The most popular format was sliced and packaged, chosen by 35.2% of consumers, closely followed by delicatessen (from supermarkets), with 34.8%. Buying by the piece, for cutting at home, attracted 25.4% of buyers, while only 4.6% preferred buying by the piece with cutting at the delicatessen, a more traditional but minority format.

Preferred ham purchase formats

Spain, 2024, % of total

Finally, among the most important criteria for buying an Iberian ham, we note that for 18-35 year-olds, price was the most important criterion in their consumption choices. On the other hand, for consumers over 56, knowledge of the product and its quality were of prime importance. It's also worth noting that in France and Germany, ham consumption is particularly associated with the festive season.

Taste as the main purchasing criterion

Europe, 2024, % (in %)

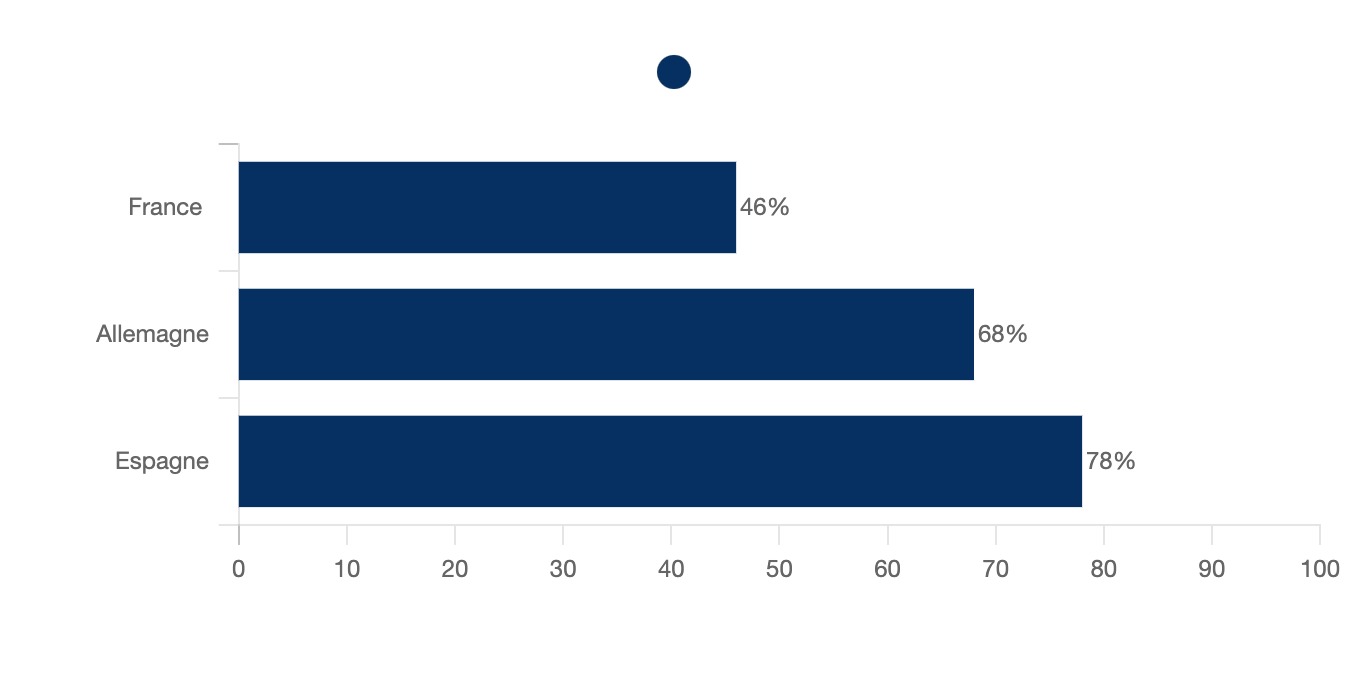

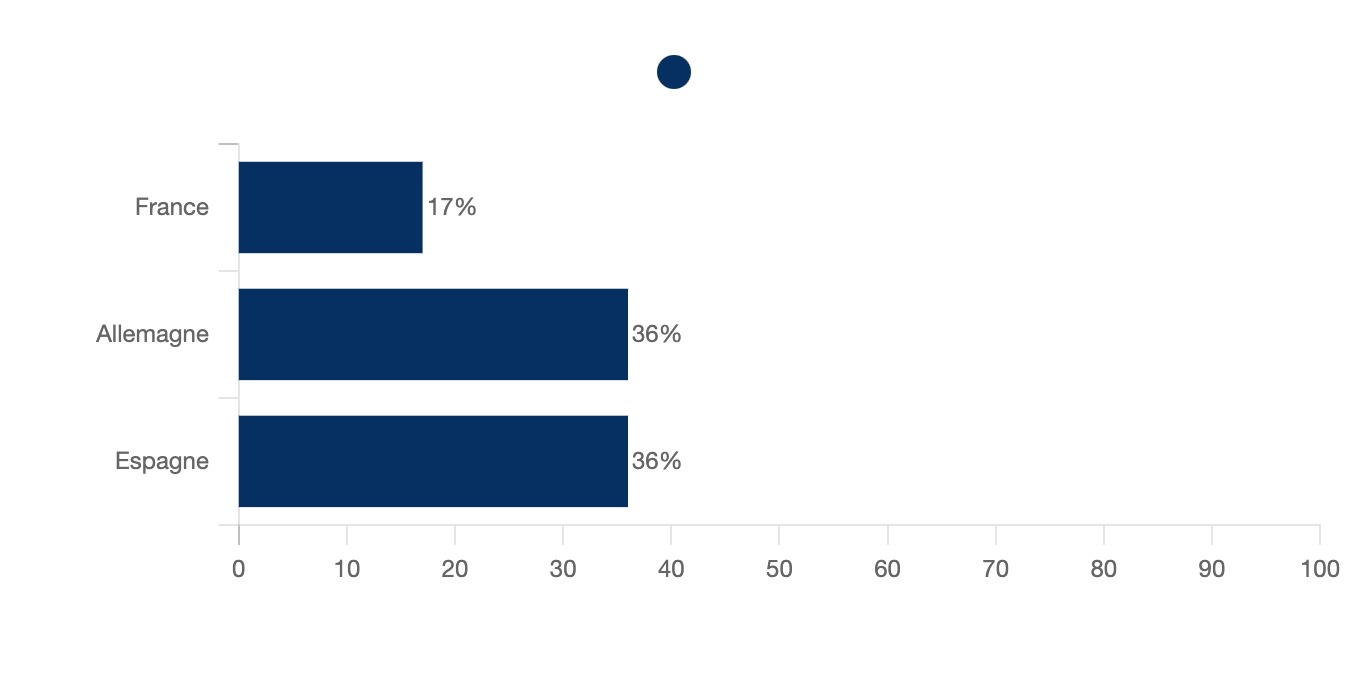

In 2024, perceptions of ham-related animal welfare varied considerably across Europe. In France, only 17% of respondents associated ham with animal welfare practices, while in Germany and Spain, this perception was significantly higher, reaching 36% in both countries. This shows, except in France, the importance of meeting these criteria in order to match this new demand trend.

Perception of animal welfare in relation to ham

Europe, 2024, % (in %)

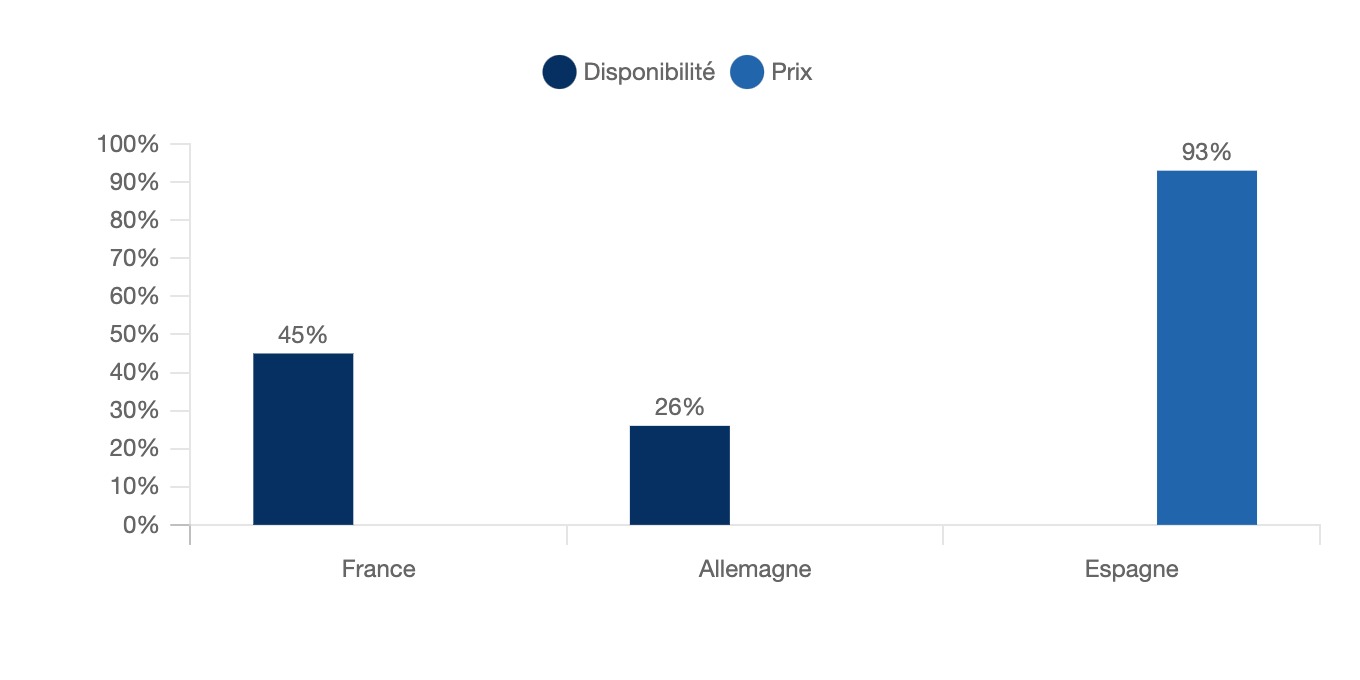

In 2024, the main barriers to buying Iberian ham varied from one European country to another. In France, 45% of consumers identified availability as a major barrier, while in Germany the proportion was lower, at 26%. Price was a significant barrier for 93% of respondents, with Spaniards highlighting this criterion as the main barrier, unlike other countries.

Main barriers to purchase

Europe, 2024, % of total

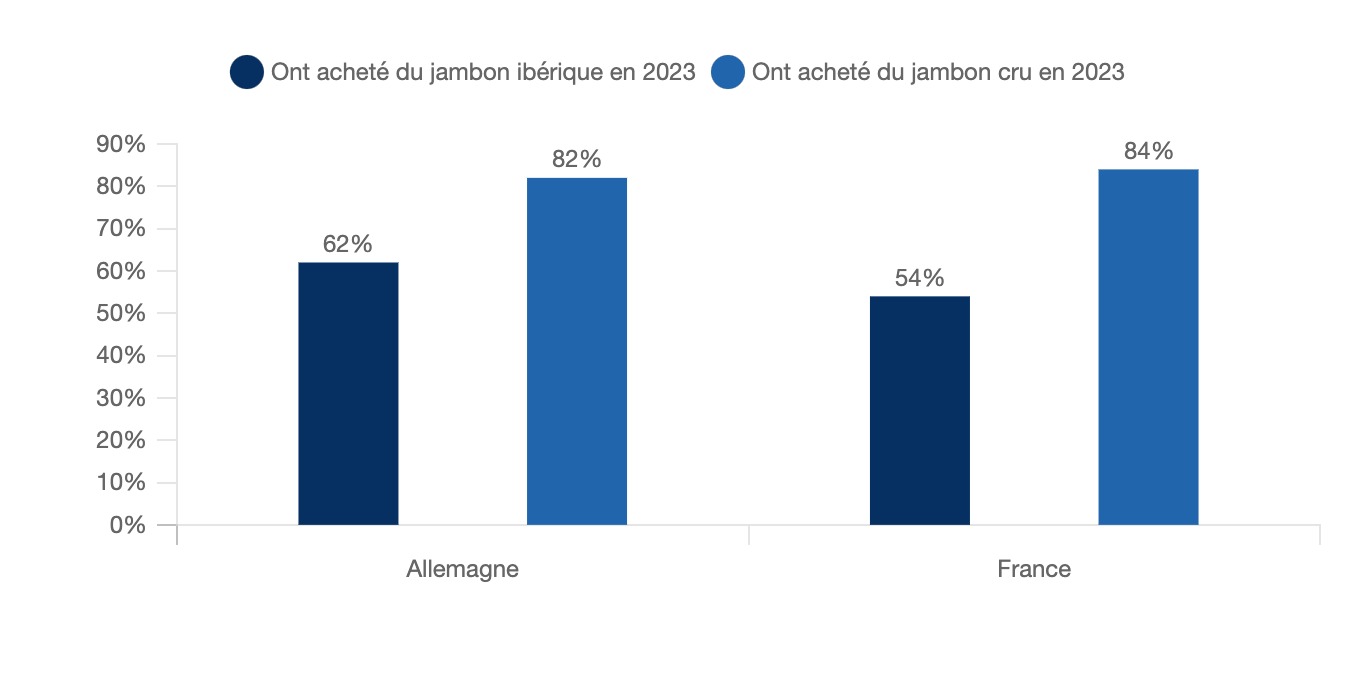

In 2023, consumption of Iberian ham was slightly higher in Germany than in France, with 62% of Germans buying this product versus 54% of French. Cured ham, on the other hand, met with similar demand in both countries, with 82% of Germans and 84% of Frenchmaking this purchase. Also, the high proportion of consumers who consumed cured ham points to potential outlets for Iberian ham in these countries.

Germans, French and cured ham

Europe, 2024, % of total

2.5 Seasonality of ham consumption

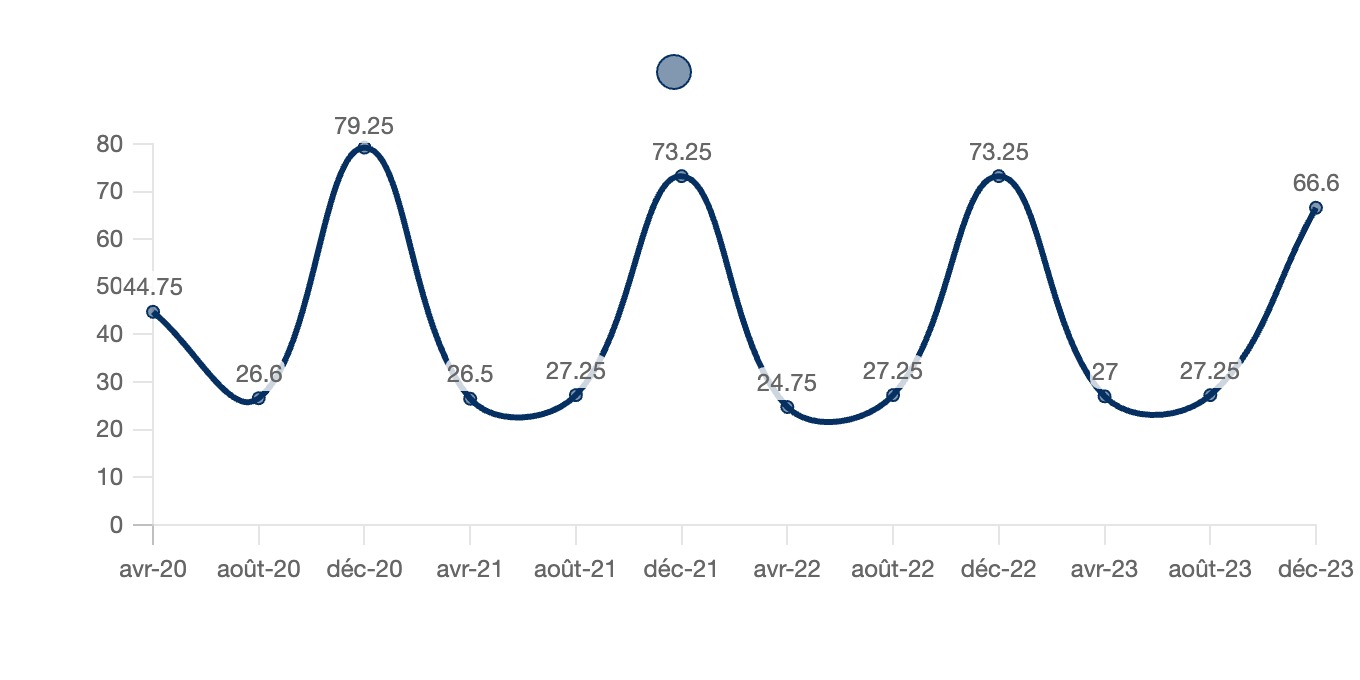

Between 2020 and 2023, interest in the term "jamón " in Spain, as measured by Google Trends indices, reveals strong seasonality linked to consumption of this emblematic product. The data show notable peaks in December each year, clearly illustrating its association with the festive season, a period traditionally marked by an increase in demand for festive products, including in particular, Iberian ham.

- December 2020: The index reaches 79.25, one of the highest levels observed, underlining its importance during the Christmas celebrations.

- The same trends are repeated in December 2021(73.25) and December 2022(73.25), confirming the key role of this period in ham consumption.

- By contrast, the months ofApril andAugust show much lower indices, fluctuating between 24.75 and 27.25, reflecting less interest outside the festive season.

Jamón" search interest in Spain

Spain, 2020-2023, google Trends indexes

2.6 Towards the internationalization of Iberian ham

Iberian ham, the emblem of Spanish gastronomy, is experiencing unprecedented international expansion, driven by an ambitious promotional strategy and growing consumer appeal for these premium products. Its exceptional quality, artisanal production process and unique flavours make it the product of choice on world markets. Thanks to targeted campaigns and strategic collaborations, Iberian ham and Serrano are gradually establishing themselves as essential gastronomic references in many countries, reinforcing their image as symbols of Spanish culinary excellence.

-

Mexico:

The Mexican market has established itself as one of the main outlets for Serrano ham outside Europe, with a 15% increase in imports by 2024, reaching 2,500 tons. Promotional campaigns, collaborations with local chefs and improved distribution in major chains have helped to meet Mexican consumers' growing interest in this gourmet product. Despite the challenge of high prices, Mexico offers significant growth potential for Serrano ham, consolidating its place in local gastronomy.

-

Netherlands:

In the Netherlands, Serrano ham continues to grow in popularity, withexports set to increase by 12.71% in 2024. Targeted initiatives, such as training courses for professionals and partnerships with local media, have raised its profile. CJSE has succeeded in positioning this quality product as a gastronomic benchmark, responding to Dutch consumers' growing interest in premium foods.

-

China:

Since 2018, China has become a key market for Iberian ham, with a 104% growth in exports over five years (to 2023). ASICI's awareness campaigns have reached 700 million consumers, incorporating training for professionals and culinary events. This market, often perceived as prestigious and sophisticated, represents a strategic opportunity for the Iberian sector, with solid growth prospects.

-

United Kingdom:

With 1,685.76 tons exported in 2023, theUK represents a strategic opportunity for Serrano ham. Widespread availability in all the major supermarket chains reflects a marked interest on the part of British consumers. Promotional efforts, notably at events such as The International Food & Drink Event, have strengthened the awareness and reputation of this flagship product of Spanish gastronomy.

-

Germany:

Germany is one of the main European markets for Iberian ham. In 2024, educational initiatives such as support for the "Koch des Jahres" competition raised the profile of this gourmet product. ASICI's targeted campaigns helped boost the presence of Iberian ham in gastronomy schools, restaurants, and culinary events, consolidating its place among Germany's benchmark gastronomic products.

Conclusion:

Iberian ham, a true luxury product, stands out for its exceptional quality, its artisanal production process and its unique character, all of which give it high added value. Thanks to targeted, ambitious promotional strategies, it is gradually establishing itself as a benchmark on international markets. Buoyed by growing demand for premium products, Iberian ham is set for a flourishing future, consolidating its role as a symbol of Spanish gastronomic excellence on the international stage.

Sources : Cárnica : Mexico, Alemania, Reino Unido, Países Bajos, China

Market structure

3.1 Ham production

ham-making, a natural, artisanal process:

Ham-making is a meticulous and complex process, based on traditional skills handed down from generation to generation. It combines tradition, natural conditions and modern techniques to produce a product of excellence. Here are the detailed steps in the ham-making process, as practiced by renowned producers such as Nevadensis.

1. Raw material selection

-

Inspection and selection of pieces: Each piece of meat is rigorously inspected to guarantee optimum quality right from the start.

-

Rejection of non-conforming parts: Any part that fails to meet quality standards is returned to the supplier.

-

Food safety guarantee: The parts selected are chosen according to rigorous criteria to meet sanitary requirements.

2. Traceability and initial inspection

-

Certificate creation: Each piece is registered with a unique certificate that tracks its entire production cycle, like a ham "DNI".

-

Quality analysis: pH and temperature measurements to ensure that meat meets stability and maturation requirements.

3. Curing

-

Exclusive use of sea salt: Salting with natural sea salt promotes dehydration and prevents the development of pathogenic micro-organisms.

-

Even distribution: The salt is applied evenly to the piece, contributing to preservation while intensifying the ham's aromas and flavors.

4. Washing

5. Post-salting

6. Drying and curing

-

Natural conditions: Hams are hung in natural drying rooms, where clean, fresh air plays a key role.

-

Duration: This stage can last between 3 and 6 months, depending on the size of the piece and climatic conditions.

-

Transformation of fat: The fat infiltrates the muscle fibers, enriching the flavors and developing the characteristic aromas of the ham.

7. Ripening

-

Extended curing: Pieces are transferred to temperature- and humidity-controlled cellars for further maturing.

-

Flavor development: Natural enzymatic reactions create complex, subtle flavors. This stage lasts between 14 and 36 months for Iberian hams.

8. Application of manteca

9. Final quality control

-

Artisan inspection: Master jamoneros (ham makers) assess the condition of the pieces, checking texture, flavor and appearance.

-

Certification: Labels such as DOP or IGP are affixed to guarantee product origin and quality.

Source :[Nevadensis]

3.2 Production

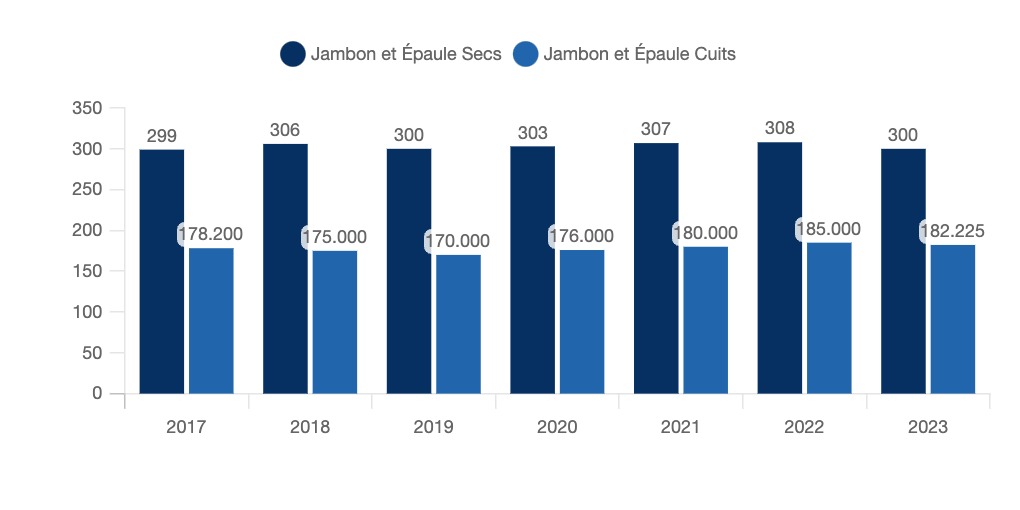

Between 2017 and 2023, ham production in Spain showed interesting variations, both for dry and cooked hams and shoulders.

For dry-cured hams and shoulders, production rose slightly from 299,000 tons in 2017 to 308,000 tons in 2022(+3.0%). However, in 2023, a slight decline was recorded, with production of 300,000 tonnes(-2.6% compared to 2022).

By contrast, production of cooked ham and shoulder has followed a more marked trajectory, although it fell slightly between 2017 and 2019, from 178,200 tonnes to 170,000 tonnes(-4.6%). Since 2020, production has gradually increased, reaching 182,225 tonnes in 2023(+7.2% on 2020). This marks a recovery and continued growth in recent years.

Ham production in Spain 2

Spain, 2017-2023, thousands of tons

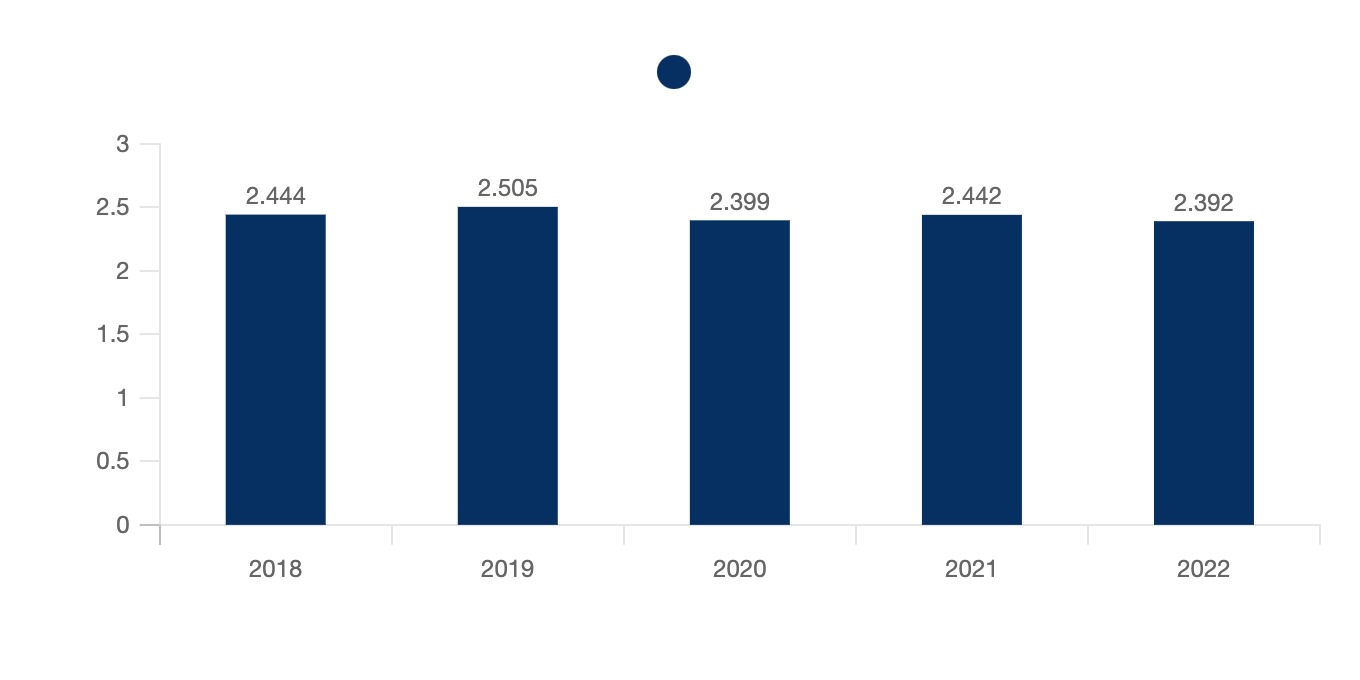

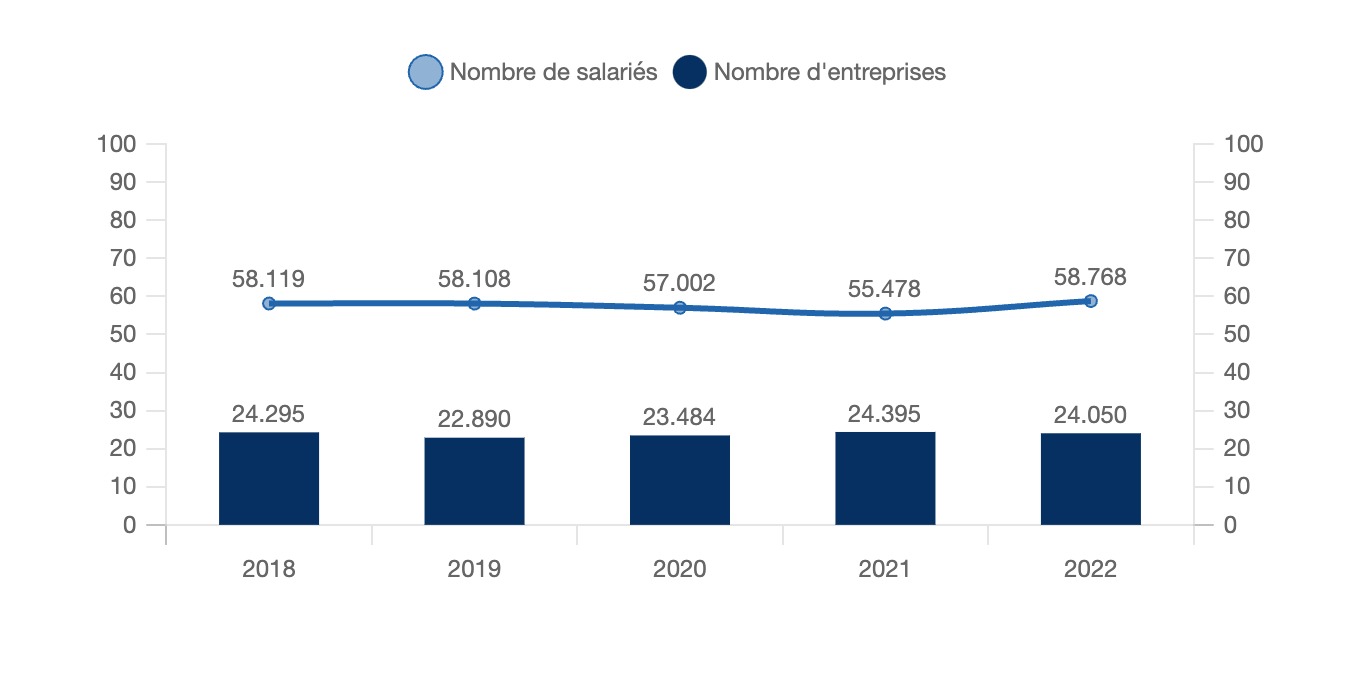

Although in 2022 there were some 1,500 companies dedicated to ham production, the statistical codes defined by the INE do not allow for a more precise approach to the market than the "processed meat production" product category. Although the following figures therefore include other types of product, they are still the most accurate for studying ham production. Thus, between 2018 and 2022, the number of companies dedicated to the production of meat products in Spain fluctuated slightly, from 2,444 thousand in 2018 to 2,392 thousand in 2022, an overall drop of 2.13%. After a moderate rise in 2019(+2.5%) to 2,505 thousand, this figure fell in 2020(-4.2%) before stabilizing in 2021(+1.8%).

Evolution of the number of companies dedicated to the production of meat products

Spain, 2018-2022, thousands of companies

Iberian ham production zones:

Iberian ham is one of the most emblematic products of Spanish gastronomy, and its quality is closely linked to the production areas. The main regions producing Iberian hams and paletas are located mainly in the south and southwest of Spain, areas that meet very specific criteria in terms of climate, geography and the quality of the dehesas where Iberian pigs are raised. The combination of these natural factors contributes to the unique taste and superior quality of Iberian ham.

The Guijuelo region, located in the province of Salamanca, is one of the most prestigious production areas for Iberian ham. Guijuelo was Spain's first Denomination of Origin (D.O.) for Iberian ham, and is famous for its mild, fruity, melt-in-the-mouth flavor. Guijuelo's continental Mediterranean climate, with very cold winters and hot, dry summers, is perfect for drying and curing hams. Rainfall is low and the average temperature fluctuates between 25° and 35°, which favors the curing process.

The mountainous geography of the region, surrounded by the Cordillera Central, the Montes de Toledo and the Sierra Morena, as well as plains and valleys at an average altitude of around 1,000 meters above sea level, also contribute to excellent ham curing. Guijuelo's Iberian pigs are fed mainly on acorns from the region's dehesas, which extend into the neighboring provinces of Tolède, Ávila, Segovia and Zamora, with cork and holm oak forests that favor the quality of the animals and the ham.

Extremadura is one of the most important regions for the production of Iberian bellota ham. The region's dehesas are ideal for rearing Iberian pigs, thanks to the quality of the pastures and the abundance of acorns in autumn. Extremadura's climatic conditions, with hot summers and mild winters, as well as its mountainous terrain, contribute to the optimal maturing of the ham.

Extremadura ham is highly prized for its characteristic deep flavor and marbled texture, the result of the combination of its natural diet and the curing process in traditional drying sheds.

The Jabugo region, in the province of Huelva, is probably the best-known and most emblematic production area for Iberian ham in Spain. Located in the Sierra de Aracena mountains, Jabugo is famous for its exceptional quality bellota ham. The Iberian pigs raised in the dehesas of Jabugo feed on acorns and other natural products, giving them an unmistakable flavor.

The region's microclimate, with wet winters and hot summers, combined with itsaltitude, favors the curing process that makes Jabugo ham such a gourmet product. Ripening in natural caves in the Sierra allows the ham to develop a unique, complex flavor.

The Los Pedroches region, located in the province of Córdoba, is another renowned production area for Iberian ham. This region is particularly famous for its high-quality bellota ham, produced from Iberian pigs fed mainly on acorns, which grow abundantly in the region's dehesas.

The climate of Los Pedroches is Mediterranean, with mild winters and hot summers, ideal for the production of quality ham. Pastures rich in acorns, grasses and other natural vegetation are ideal for the pigs' diet, enabling the meat to develop an exceptional taste and texture. The region's geography, characterized by gently undulating terrain, also plays an important role in product quality, as it favors a natural drying oven for the hams.

Los Pedroches hams are renowned for their firm texture and intense flavor, with nutty aromas and a hint of dried fruit, characteristic of Iberian bellota ham.

Source :[Dehesacharra]

3.3 Distribution

Processed meat distribution:

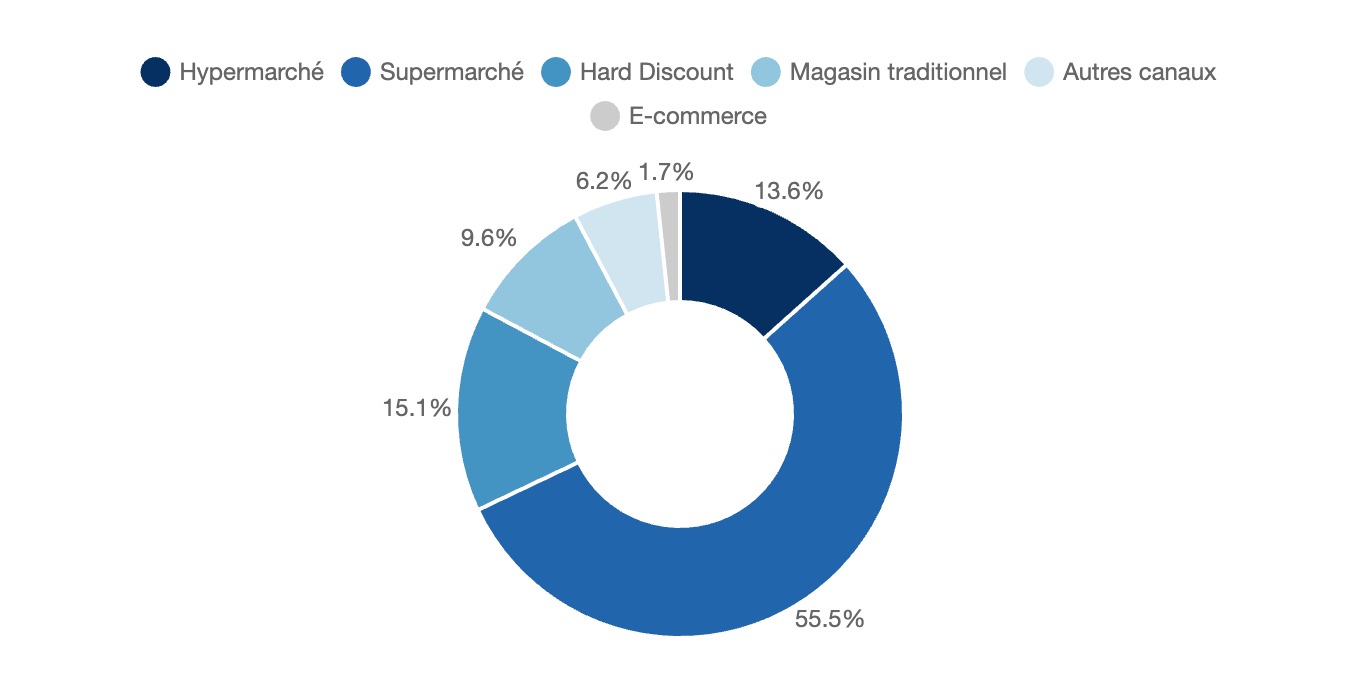

In Spain in 2023, the processed meat market was largely dominated by supermarkets, which captured 55.5% of market share, confirming their central role in the distribution of these products. Hard discount chains came second with 15.1%, followed by hypermarkets with 13.6%. Traditional stores maintained a significant presence with 9.6%, while other channels contributed 6.2% of sales. Finally, e-commerce, although still marginal, accounted for 1.7%, demonstrating growth potential in this segment. This breakdown illustrates the predominance of the major retailers, while leaving a significant place for alternative and traditional channels.

Distribution of market share by retailer in the processed meat market

Spain, 2023, % (in %)

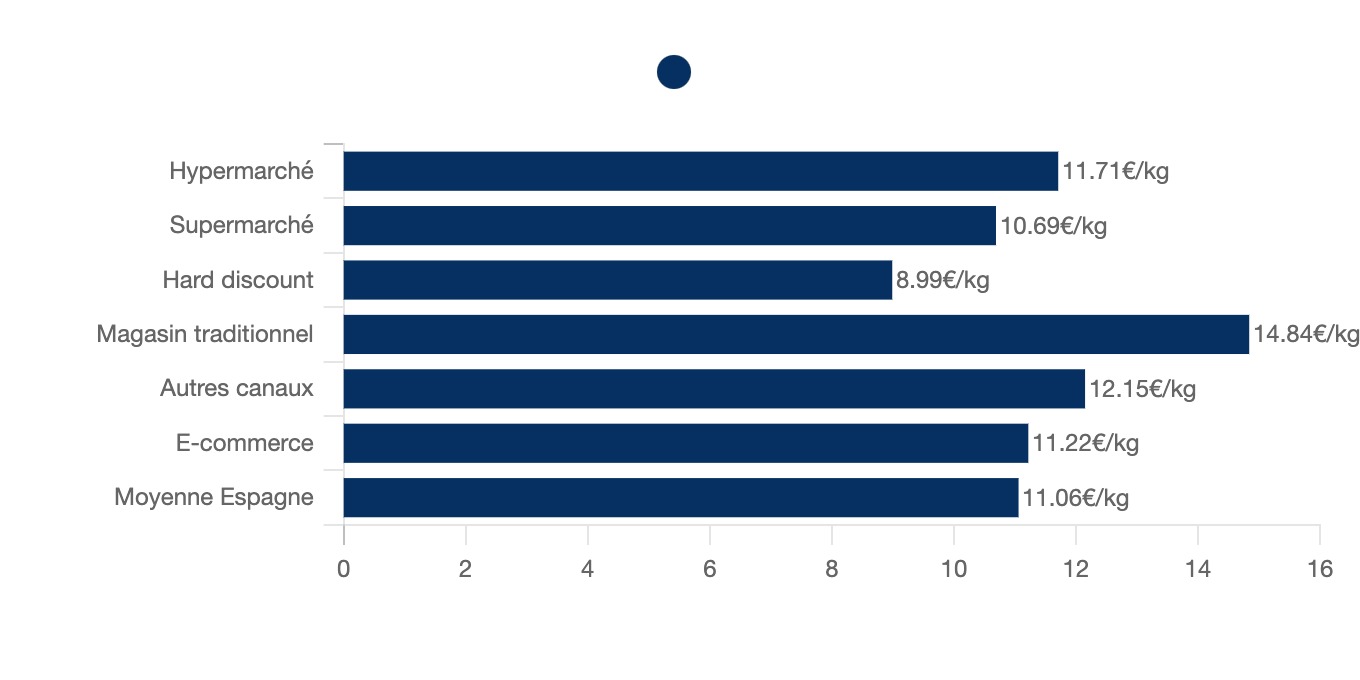

The average price of processed meat, including ham, varied according to distribution channel. Traditional stores posted the highest price at €14.84/kg, followed by other channels at €12.15/kg. Hypermarkets and e-commerce offered slightly lower prices, at €11.71/kg and €11.22/kg respectively, while supermarkets were below the national average(€10.69/kg). Hard discounters offered the most competitive prices, at €8.99/kg, well below the Spanish average of €11.06/kg, reflecting a noticeable variation between different types of retailers.

Processed meat prices by distribution channel

Spain, 2023, % (%)

Reminder of distribution market shares:

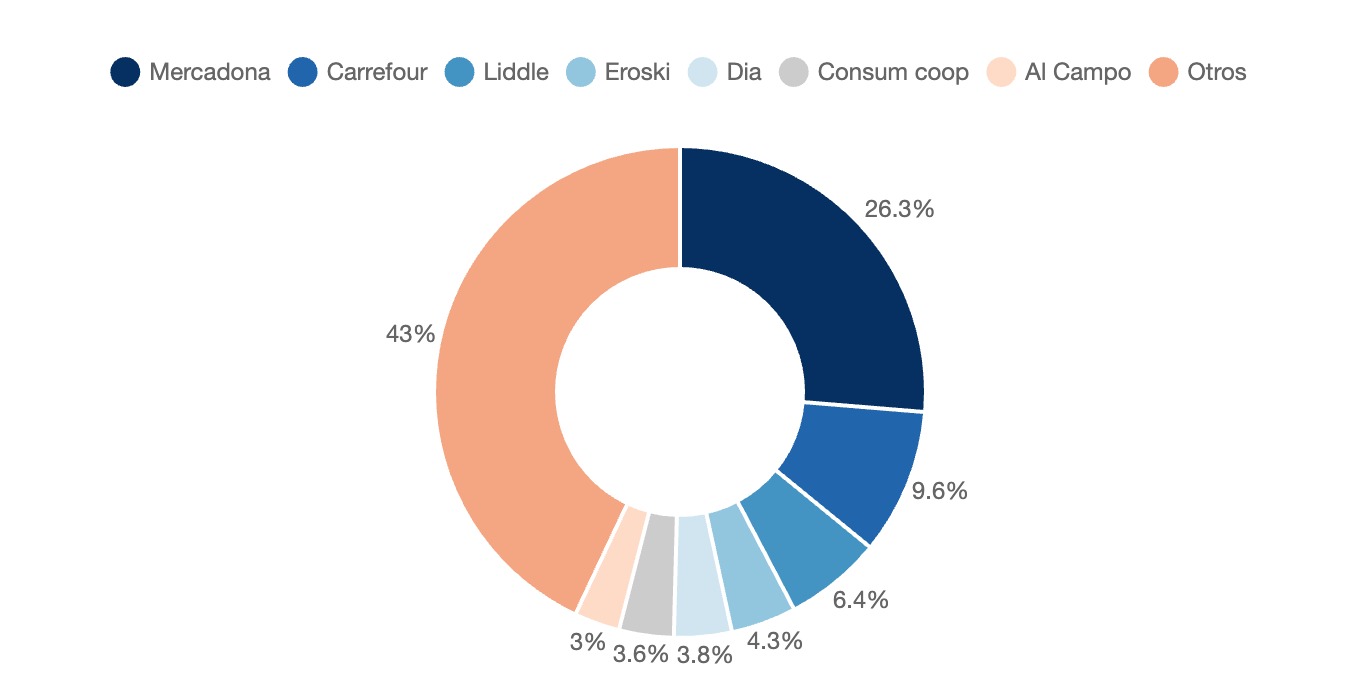

In Spain in 2024, Mercadona dominated the retail market with a market share of 26.3%, confirming its position as undisputed leader. Carrefour came second with 9.6%, while Lidl ranked third with 6.4%. Other players, such as Eroski(4.3%), Dia(3.8%), Consum Coop(3.6%) and Al Campo(3%), posted more modest market shares. Finally, the rest of the sector was fragmented, with 43% split between various distributors, underlining the diversity of supply in the Spanish retail landscape.

Distribution market share in Spain

Spain, 2024, % of total

Butchers and delicatessens sector (specialized distribution):

Between 2018 and 2022, the butchery and delicatessen sector in Spain went through a period of fluctuations in both the number of businesses and the number of employees. The number of businesses fell slightly, from 24,295 in 2018 to 24,050 in 2022, representing an overall decline of -1.0%. However, this trend has followed an uneven trajectory: after a significant decline in 2019(-5.8% on 2018), the sector recovered in 2020(+2.6%) and 2021(+3.9%), before falling back slightly in 2022(-1.4%). These variations reflect the gradual adaptation of companies to structural and cyclical challenges.

The number of employees has also seen marked changes. It rose from 58,119 in 2018 to 58,768 in 2022, showing a slight overall increase of +1.1% over the period. Nevertheless, this increase masks significant fluctuations. Between 2018 and 2021, a steady decline was recorded, reaching -4.5% in 2021 with 55,478 employees, the lowest point of the period. This trend was reversed in 2022, when a notable upturn took place, with an increase of +5.9% on 2021, returning to a level slightly above that of 2018.

These variations reflect not only market transformations, but also the impact of economic and health crises, such as the COVID-19 pandemic, which disrupted consumer habits and supply chains. Despite these challenges, the slight growth in the number of employees in 2022 suggests a certain resilience in the sector and an adaptation to new market dynamics, notably through renewed demand for local, quality products.

Growth in the number of butchers and delicatessens

Spain, 2018-2022, thousands of companies, thousands of employees

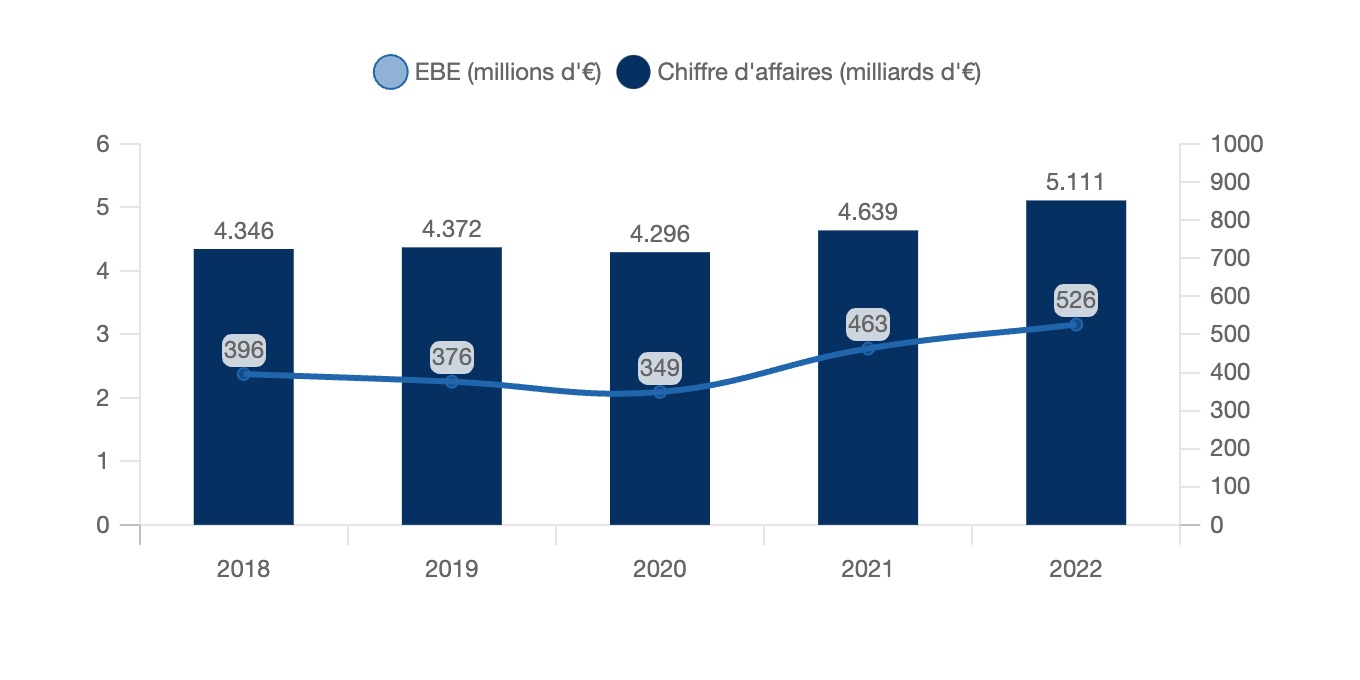

Between 2018 and 2022, the butcher's and delicatessen sector in Spain showed a positive trend in terms of sales and gross operating surplus (EBITDA), despite fluctuations linked to economic dynamics and changes in consumption.

Sales rose significantly, from 4.346 billion euros in 2018 to 5.111 billion euros in 2022, an overall increase of +17.6%. This growth was not linear: after a slight increase in 2019(+0.6%), sales fell in 2020(-1.7%), impacted by restrictions linked to the COVID-19 pandemic and the decline in out-of-home consumption. However, the sector rebounded strongly in 2021(+8.0%) and maintained this momentum in 2022(+10.2%), reaching its highest level for the period.

Gross operating profit (EBITDA ) also showed an upward trend, rising from 396 million euros in 2018 to 526 million euros in 2022, an overall increase of +32.8%. This figure illustrates an improvement in the sector's profitability, albeit marked by significant variations. After declines in 2019(-5.1%) and 2020(-7.2%), EBITDA recorded a clear rebound in 2021(+32.7%) and further growth in 2022(+13.6%).

These developments reflect the sector's successful adaptation to economic challenges, thanks in particular to an increase in demand for local, quality products during a period of economic recovery. By 2022, the high level of sales and EBITDA underlines not only the sector's resilience, but also its ability to capture value in a transforming market. This underlines the importance of effective resource and cost management in maintaining and improving profitability.

Sales and EBITDA trends in the Spanish butchery and delicatessen sector

Spain, 2018-2022, € billion, € million

Offer analysis

4.1 Offer typology

Differences between cured and cooked ham :

Cured ham:

Cured ham is a product dried and matured without cooking, giving it an intense flavor and firm texture.

-

Method of preparation:

- The meat (often the pork leg) is salted to remove moisture.

- It is then left to dry in the open air or in cellars, sometimes for several months or even years (depending on the type of ham).

- No cooking process is involved.

-

Famous examples:

- Serrano ham (Spain).

- Parma ham (Italy).

- Bellota Iberian Ham (Spain).

-

Characteristics:

- Intense, often salty flavor.

- Firm but melt-in-your-mouth texture, especially in premium hams.

- Dark red appearance with marbling of fat.

-

Consumption:

- Generally eaten in thin slices.

- Accompanies cold dishes, tapas, or served on its own.

Cooked ham:

Cooked ham is a product prepared by cooking, which gives it a softer texture and milder taste.

-

Method of preparation:

- The meat is generally brined (soaked in a solution of salted water and aromatics).

- It is then cooked at low temperature (in the oven or in hot water).

- Sometimes it is also smoked after cooking.

-

Famous examples:

- Jambon blanc (France).

- Jambon à l'os or roast ham.

- Prince de Paris ham.

-

Characteristics:

- Mild flavor, less salty than cured ham.

- Soft, moist texture.

- Uniform pink appearance.

-

Consumption:

- Often used in sandwiches, croque-monsieur, quiches or gratins.

- Can be served hot or cold.

Difference between cured ham and Iberian ham:

Iberian ham is produced from Iberian pigs, a breed endemic to southwestern Spain and Portugal. These pigs are renowned for their ability to infiltrate fat into their muscle fibers, resulting in rich, complex flavors. White ham comes from white pigs, often breeds such as Duroc, Landrace, Large White or Pietrain, raised mainly on an intensive diet.

Iberian ham is classified according to the pigs' diet. Bellota ham comes from pigs fed on acorns and free-range pastures. Cebo de Campo ham comes from pigs fed a mixed diet, including pasture and cereals, in semi-free-range conditions. Finally, Cebo ham comes from pigs fed exclusively on compound feed on intensive farms. By contrast, the pigs from which white ham is produced are mainly fed cereals and compound feed.

- Maturation process and duration :

Maturation of Iberian ham can last from 14 to 36 months, with gradual natural drying to develop complex aromas. The curing period for cured ham is shorter, between 7 and 16 months, often accelerated in controlled environments.

- Categories and denominations :

Iberian ham is classified according to breed purity and diet. Labels use color codes to indicate quality: black for 100% Iberian Bellota, red for crossbred Bellota, green for Cebo de Campo and white for Cebo. White ham is classified by geographical labels such as Jamón Serrano, DOP Teruel or IGP Trévelez, and by terms indicating the length of maturation (Bodega for 9 months, Reserva for 12 months, Gran Reserva for 15 months).

- Production and consumption:

Iberian ham accounts for only 10% of Spanish production and is considered a top-of-the-range product, often reserved for special occasions. Cured ham, which accounts for 90% of production, is more affordable and suitable for everyday consumption.

Source : JamonLovers

Types of ham

Ham, the emblem of Iberian and Mediterranean gastronomy, is distinguished by its many varieties. These distinctions are based on the breed of pig, its diet, production techniques and quality labels. Here is an organized and enriched typology of the main types of ham:

1. Iberian ham

- Origin: Produced from Iberian pigs, mainly raised in southwest Spain and Portugal.

- Characteristics:

- Free-range or semi-intensively raised pigs.

- Fed on acorns (bellota) or cereals (cebo).

- Matured for up to 36 months.

- Melting texture and intense flavor.

- Famous variants with DOP:

- DOP Jabugo: Produced in the Sierra de Aracena, benefiting from an ideal microclimate.

- DOP Guijuelo: From Salamanca, with a mild flavor and subtle aroma.

- DOP Dehesa de Extremadura: Produced in the rich dehesas of Extremadura.

- DOP Los Pedroches: Produced in the north of Cordoba, with 100% Iberian pigs.

2. Serrano ham

- Origin: Made from white pigs (Landrace, Duroc or Large White) raised in mountainous areas.

- Characteristics:

- Traditional Speciality Guaranteed (TSG) by the European Union.

- Minimum maturation period of 30 weeks in a cool, dry environment.

- Mild flavor and slightly pinkish color.

- Variants:

- Consorcio del Jamón Serrano Español: Extended ripening (45 weeks) with 100% Spanish origin.

3. Bellota ham

- Origin: From free-range Iberian pigs fed exclusively on acorns during montanera.

- Characteristics:

- Superior quality and delicate texture thanks to unsaturated fats.

- Deep flavor with woody and dried fruit notes.

4. White ham

- Origin: Produced from farm-raised, grain-fed white pigs.

- Characteristics:

- Intended for mass consumption.

- Light flavor and more affordable price.

- Example: DOP Teruel, low in cholesterol and salt.

5. Regional hams with DOP

- DOP Teruel: Produced from white pigs in mountainous areas of the province of Teruel. Mild and low in salt content.

- DOP Trevélez: Produced in the Sierra Nevada, using only sea salt and a long curing process.

6. Parma Ham

- Origin: Produced in the Parma region of Italy.

- Characteristics:

- Minimal salting for a mild, refined flavor.

- Slow ripening (up to 12 months), no artificial preservatives.

7. Cooked ham (or "York" ham)

- Origin: Prepared from hind legs treated with brine before cooking.

- Characteristics:

- Tender texture and pinkish color.

- Different grades available (extra, first and second).

8. Pavo ham (turkey)

- Origin: Made from turkey legs.

- Characteristics:

- Low fat content.

- Rich in proteins, vitamins and minerals.

- Ideal for low-calorie diets.

9. Paletilla (shoulder)

- Origin: Made from the forelegs of pigs.

- Characteristics:

- Smaller size and lower cost than ham.

- More intense flavor due to shorter curing time.

10. Specific variants

- Jamón de Huelva (DOP): Similar to Jabugo, with a production process based on traditional techniques.

- Jamón de Guijuelo (DOP): Renowned for its mildness and exceptional quality.

- Jamón de Extremadura (DOP): Produced in a favorable natural environment with 100% Iberian pigs.

11. Duroc Ham

- Origin: Produced from Duroc pigs, renowned for their fat infiltration.

- Characteristics:

- Intense flavor and juicy texture.

- Often used for premium Serrano hams.

Source: La Trastienda Sanxenxo

4.2 Offer segmentation

The price-based segmentation of the Spanish ham market is structured around different categories, reflecting both product quality and consumer expectations:

1. Premium segment

-

Characteristics: Mainly Iberian bellota ham, recognized for its artisanal production, the quality of the meat from acorn-fed pigs, and a long maturing period (24 to 36 months).

-

Price: Very high, often over €80-100/kg.

-

Target: Consumers looking for exclusive products, often for special occasions or celebrations, and attached to quality labels (DOP, 100% Iberian).

-

Examples: Brands such as Cinco Jotas, Carrasco Guijuelo.

2. Medium-high segment

-

Characteristics: Iberian cebo de campo or cebo hams, from pigs raised in semi-free-range or intensive farming conditions, fed on piensos (compound feed). Matured for a shorter period than bellota (12 to 24 months).

-

Price: Between €40 and €80/kg.

-

Target: Consumers looking for a superior-quality product at a more affordable price than bellota.

-

Examples: Iberian hams from less prestigious brands or sold in supermarkets.

3. Intermediate segment

-

Characteristics: Includes quality jamón serrano, often produced from white pigs (Duroc, Large White). Maturation varies between 9 and 15 months.

-

Price: Between €20 and €40/kg.

-

Target: Households looking for a good-quality product for regular consumption or for special occasions.

-

Examples: Jamón serrano Reserva or Gran Reserva.

4. Economy segment (entry-level)

-

Characteristics: Includes industrial serrano or curado hams, with minimal maturing (9 months). These products feature a standardized taste and a competitive price.

-

Price: Below €20/kg.

-

Target: Price-sensitive consumers, often for daily consumption or sliced for sandwiches.

-

Examples: Private labels or hams sold in large packs.

5. Low-cost segment

-

Characteristics: Hams generally from intensive farming, sometimes with shortened maturing processes. Less aromatic, these products aim to satisfy a basic demand.

-

Price: Below €10/kg.

-

Target: Consumers looking for the lowest price, often for family consumption or culinary use.

-

Examples: Distributor brands of major retail chains.

Summary of dynamics

-

The premium and medium-high segments are growing, driven by a move upmarket by consumers attached to the quality and prestige of Iberian ham.

-

The economy and low-cost segments dominate in terms of volume, but their growth is limited by lower margins and intense competition from private labels.

4.3 Prix

Les tableaux ci-dessous présentent de façon non exhaustive l'offre de jambons au sein de la grande distribution en Espagne en décembre 2024 :

Offre de Mercadona en Décembre 2024 :

|

Type de Jambon

|

Produit

|

Format

|

Prix Unitaire

|

Marque

|

|

Jambons Ibériques

|

Paleta de cebo ibérica La Hacienda del ibérico

|

100 g

|

4,90 €/ud.

|

La Hacienda del ibérico

|

|

Paleta de cebo ibérica La Hacienda del ibérico

|

5 kg (approx.)

|

58,00 €/ud.

|

La Hacienda del ibérico

|

|

Jamón cebo ibérico cortado a máquina

|

160 g (approx.)

|

8,24 €/ud.

|

-

|

|

Jamón cebo ibérico cortado a cuchillo

|

90 g (approx.)

|

5,85 €/ud.

|

-

|

|

Jambons Serrano

|

Jamón serrano Incarlopsa lonchas extrafinas

|

120 g

|

2,45 €/ud.

|

Incarlopsa

|

|

Jamón serrano lonchas Incarlopsa

|

240 g

|

4,10 €/ud.

|

Incarlopsa

|

|

Jamón serrano medias lonchas Jamcal

|

2 x 120 g

|

4,15 €/pack

|

Jamcal

|

|

Jamón serrano reserva cortado a cuchillo

|

90 g (approx.)

|

3,51 €/ud.

|

-

|

|

Jamón serrano gran reserva Costa Brava sin aditivos

|

90 g

|

2,30 €/ud.

|

Costa Brava

|

|

Jamón serrano cortado a máquina

|

160 g (approx.)

|

3,68 €/ud.

|

-

|

|

Jambons Cuits

|

Jamón cocido extra Hacendado finas lonchas

|

2 x 225 g

|

3,45 €/pack

|

Hacendado

|

|

Jamón cocido Hacendado lonchas

|

200 g

|

2,41 €/ud.

|

Hacendado

|

|

Jamón cocido extra Hacendado finas lonchas

|

200 g

|

2,05 €/ud.

|

Hacendado

|

|

Jamón cocido extra sándwich Hacendado lonchas

|

250 g

|

2,05 €/ud.

|

Hacendado

|

|

Jamón cocido Noel lonchas

|

120 g

|

2,30 €/ud.

|

Noel

|

|

Pechuga de pavo bajo en sal Hacendado finas lonchas

|

2 x 200 g

|

3,55 €/pack

|

Hacendado

|

|

Pechuga 92% pavo Hacendado lonchas

|

200 g

|

2,65 €/ud.

|

Hacendado

|

|