Market Summary

1.1 Definition and presentation

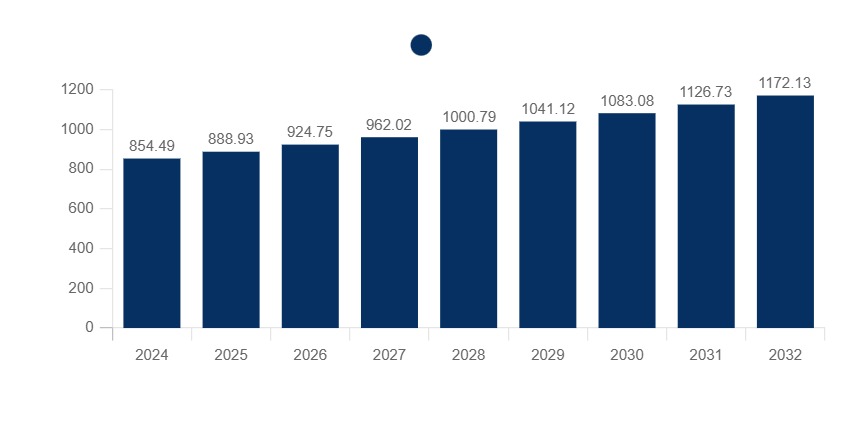

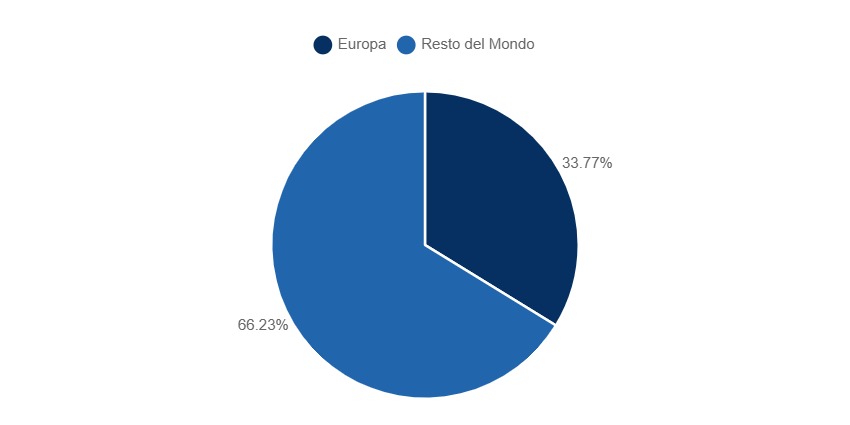

The size of the global beer market will grow from USD 851.15 billion in 2024 to USD 1,172.13 billion by 2032, with a compound annual growth rate (CAGR) of 4.03% during the forecast period.Europe dominated the market with a 33.77 percent share in 2023. Beer is one of the most popular beverages globally compared to any other alcoholic beverage and is gaining immense popularity, especially among Millennials and Generation Z, due to its various formulations, varieties, and flavor offerings.

Between 2023 and 2029, the value of the European beer market shows steady growth, rising from $277.38 billion to $372.99 billion. Alcoholic beverages play an important role in all European countries and are an integral part of the region's culture, heritage and nutrition. The European Union is one of the leading beer-producing areas in the world. L'alcohol industry in Europe is a diverse sector, composed mainly of small and medium-sized enterprises, including microbreweries and breweries that operate locally, regionally or nationally.

From 2023 to 2029, the Italian market is projected to grow steadily, with an overall increase of about 35 percent and a compound annual growth rate (CAGR) in line with that of Europe of just over 5 percent. Per capita consumption of beer in Italy has increased significantly, rising by more than 11 percent, showing a growing interest among consumers and a positive market trend. In terms of market structure, the number of companies active in beer production in Italy has grown significantly, showing an increase of 76.5 percent in six years, as well as the number of employees operating with an increase of 25,2%.

1.2 The global market

The global beer market size was estimated at US$821.39 billion in 2023 and is expected to grow from US$851.15 billion in 2024 to US$1,172.13 billion by 2032, with a compound annual growth rate (CAGR) of 4.03% during the forecast period. Europe dominated the beer market with a market share of 33.77 percent in 2023. Beer is one of the most popular beverages globally compared to any other alcoholic beverage and is gaining immense popularity, especially among Millennials and Generation Z, due to its various formulations, varieties, and flavor offerings. In the past, flavored fermented beverages were consumed mainly in regions such as Europe and North America, but in recent times demand has grown exponentially worldwide. This factor has positively influenced the entire business. The emergence of new brewing technologies in developing economies has also positively influenced customers' consumption patterns. In addition, consumers are looking for innovative alcoholic beverages that come in a variety of flavors, which is driving the growth of the global beer market. Asia-Pacific is the second largest market. The region has huge potential for liquor producers and its production worldwide. The regional market is led by countries such as India, China, Australia and others, where consumers are increasing alcohol consumption. According to Anheuser-Busch InBev, the Asia-Pacific region is the fastest growing region in the beer industry and is estimated to account for 53 percent of growth between 2014 and 2025.

Global beer market value

World, 2024-2032, in US$ billion

Improving economic conditions and rising Gross Domestic Product (GDP) growth in developing regions, such as Asia-Pacific and South America, have led to an increase in per capita consumer disposable income. This increase in consumer disposable income is an important factor contributing to the growth of the alcoholic beverage industry. According to Kirin Holdings Co. one of Japan's leading beverage companies, global beer consumption in 2021 increased for the first time during the post-COVID-19 recovery period. Market growth was mainly supported by strong demand in China and Asia as these regions experienced solid economic growth. Global consumption increased by 4 percent to 185.60 million kiloliters due to the reduced impact of the COVID-19 pandemic. In recent years, craft beer has gained popularity in the Asian market, including China, India and Japan, due to its quality, taste and variety of flavors, and stakeholders have continued to expand their business operations. According to the Brewers Association, the number of active craft breweries in the United States has increased from 9,119 in 2022 to 9,336 in 2023. Therefore, factors such as GDP growth, the growing influence of craft beers in Asian countries and the increasing number of craft breweries globally are expected to push the growth of the global beer market.

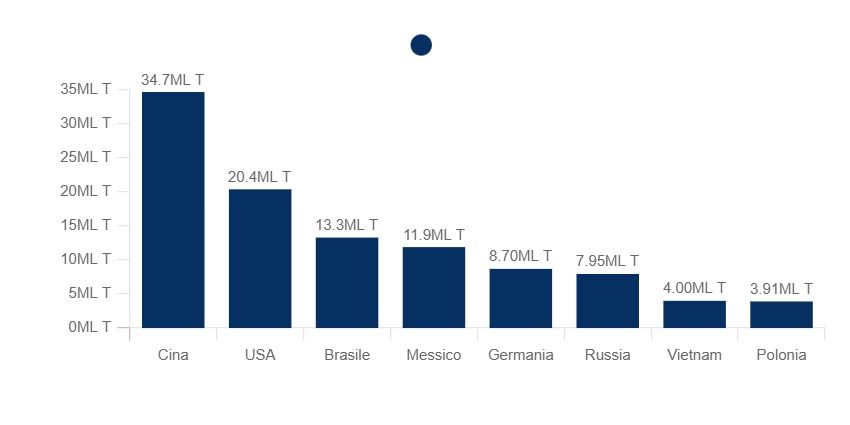

In 2023, China is the world's largest producer of beer with 34.7 million tons, far surpassing the United States, which occupies second place with 20.4 million. Brazil follows with 13.3 million, while Mexico produces 11.9 million. Germany, known for its brewing tradition, reaches 8.7 million tons, surpassing Russia and Vietnam with 7.95 and 4 million respectively. Poland closes the list with 3.91 million. China produces about 70 percent more than the U.S. and more than eight times the amount produced by Poland.

World beer production by country

World, 2023, in millions of tons

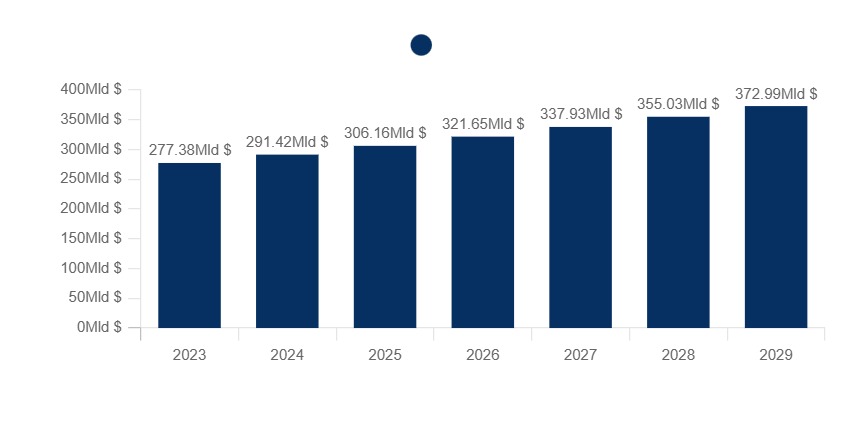

1.3 The European market

Between 2023 and 2029, the value of the European beer market shows steady growth from $277.38 billion to $372.99 billion. The compound annual growth rate (CAGR) of 5.06 percent confirms that the value of the European beer market between 2023 and 2029 increases steadily and sustained. This growth rate is consistent with the 34.5 percent increase observed during the period.

Alcoholic beverages play an important role in all European countries and are an integral part of the region's culture, heritage and nutrition. The European Union is one of the leading beer-producing areas in the world. According to data from Brewers of Europe, beer consumption in Europe in 2021 was 342,212,000 hectoliters, showing a minimal increase of 0.25 percent from the previous year. In terms of structure, the alcohol industry in Europe is a diversified sector, composed mainly of small and medium-sized enterprises, including microbreweries and breweries that operate locally, regionally or nationally. It also includes major European breweries that are world leaders in their fields. The emergence of new microbreweries and small breweries in recent years is a significant sign of the industry's potential for innovation. The overall alcohol content and harmful use of alcohol in Europe have decreased, as some consumers are switching to low-alcohol products and non-alcoholic varieties in this category. Therefore, these consumer preferences are expected to support the growth of the European market.

European beer market value

Europe, 2023-2029, in US$ billion

In 2023, Europe accounts for 33.77 percent of the global beer market value, while the rest of the world covers 66.23 percent.

Breakdown of global market value

World, 2023, in %

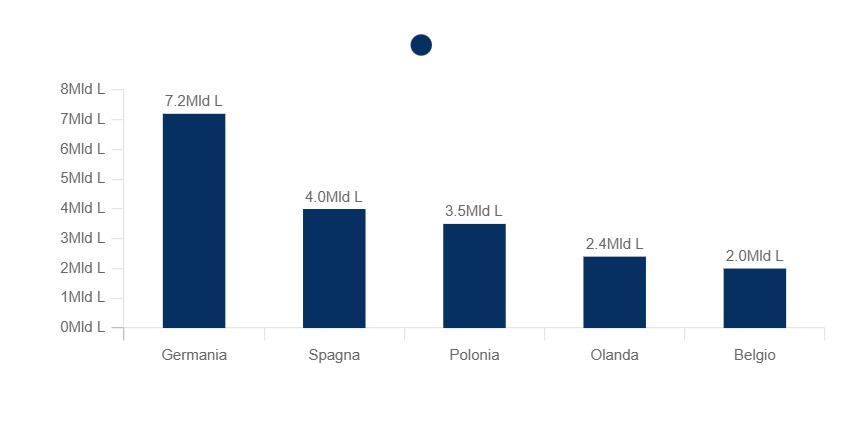

In 2023, Germany remains the largest producer of beer in Europe with 7.2 billion liters, almost twice as much as Spain, which follows with 4 billion. Poland ranks third with 3.5 billion, while the Netherlands and Belgium contribute 2.4 and 2 billion liters, respectively. Germany clearly dominates the European landscape, producing about 44 percent more than Spain and more than three times the amount of Belgium.

Major European beer producers

Europe, 2023, in billion liters

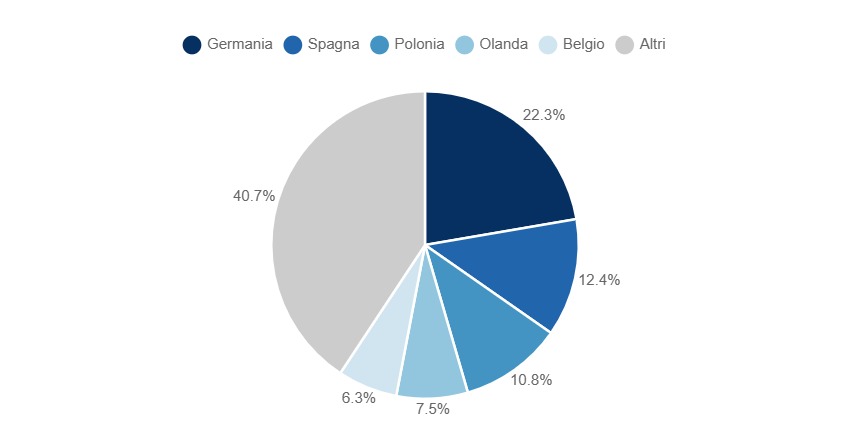

Germany accounts for 22.3 percent of European beer production, confirming it as the leading producer. Spain follows with 12.4%, while Poland and the Netherlands cover 10.8% and 7.5%, respectively. Belgium contributes 6.3 percent. The other European countries together account for 40.7 percent of total production.

Breakdown of European beer production

Europe, 2023, in %

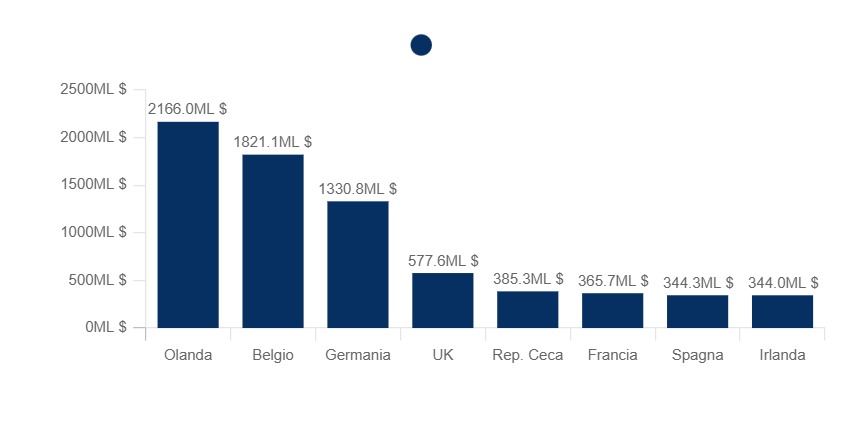

In 2023, the Netherlands is the largest European exporter of beer with exports worth $2,166 million, followed by Belgium with $1,821.1 million. Germany, while being the largest European producer, ranks third among exporters with 1,330.8 million. The United Kingdom and the Czech Republic contribute 577.6 and 385.3 million, respectively, while France, Spain and Ireland close the list with exports between $344 and 365 million. The Netherlands exports about 63 percent more than Germany, highlighting its strength in the international beer trade.

Major European beer exporters

Europe, 2023, in millions of US$

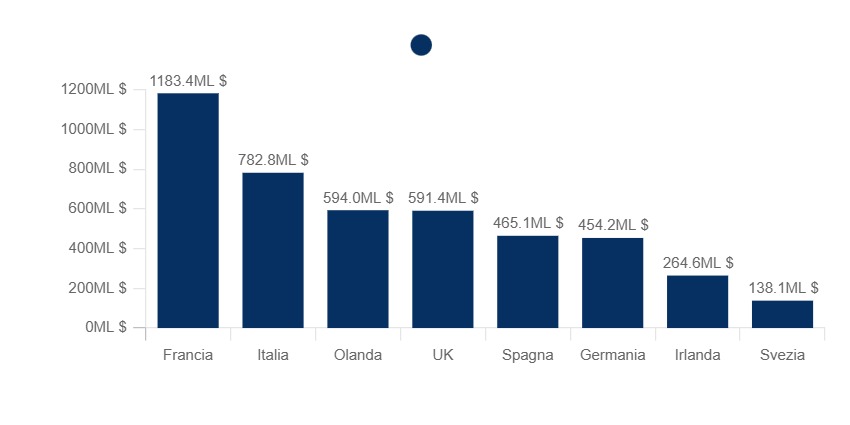

In 2023, France is the largest beer importer in Europe with US$1,183.4 million, followed by Italy with US$782.8 million. The Netherlands, despite being the largest exporter, imports 594 million, almost at the same level as the United Kingdom with 591.4 million. Spain and Germany, major producers, import 465.1 and 454.2 million, respectively. Ireland and Sweden, with 264.6 and 138.1 million, close the ranking. France imports about 51 percent more than Italy, showing strong domestic demand for beer.

Major European beer importers

Europe, 2023, in millions of US$

1.4 The Italian market

The Italian beer market has gone through significant changes in recent years, marking an overall growth despite the difficulties caused by the pandemic. When analyzing both the value of production sold and the turnover of brewing companies, a solid recovery emerges, taking the sector to higher levels than in the pre-pandemic period.

The value of production sold increased by 35.7 percent between 2017 and 2023, from 1.93 billion to 2.62 billion. After an initial growth, 2021 saw a sharp decline to 1.44 billion, but the sector then recovered quickly, reaching the highest level in the entire period analyzed in 2023.

Value of beer production sold [11051010]

Italy, 2017-2022, in billion €

At the same time, the turnover of beer companies grew by 38.7 percent between 2017 and the 2024 estimate, rising from €2.17 billion to €3.01 billion. After a decline in 2020 and a swing in 2021-2022, the industry showed an acceleration in 2023, with growth set to continue in 2024. These figures indicate a strong recovery and expansion of the market, supported by increased demand and growth strategies of companies in the industry.

Turnover of companies involved in brewing [1105]

Italy, 2017-2022, in billion €

1.5 Imports and Exports

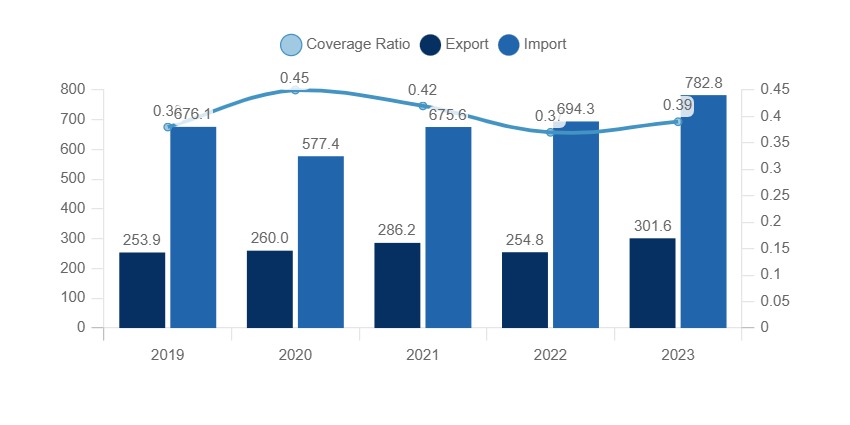

Between 2019 and 2023, Italy experienced growth in beer exports, rising from $253.9 million in 2019 to $301.6 million in 2023, an increase of 18.8 percent. However, imports increased more significantly, from $676.1 million in 2019 to $782.8 million in 2023, an increase of 15.8 percent. The coverage ratio, which measures the proportion of exports to imports, has remained relatively stable, but still below 50 percent, fluctuating between 0.37 and 0.45. This indicates that Italy consistently imports much more than it exports, with a slight improvement in 2020 (0.45), followed by a decrease in 2022 and 2023, where the rate dropped to 0.39.

Imports, exports and beer coverage rate

Italy, 2019-2023, in millions of US$

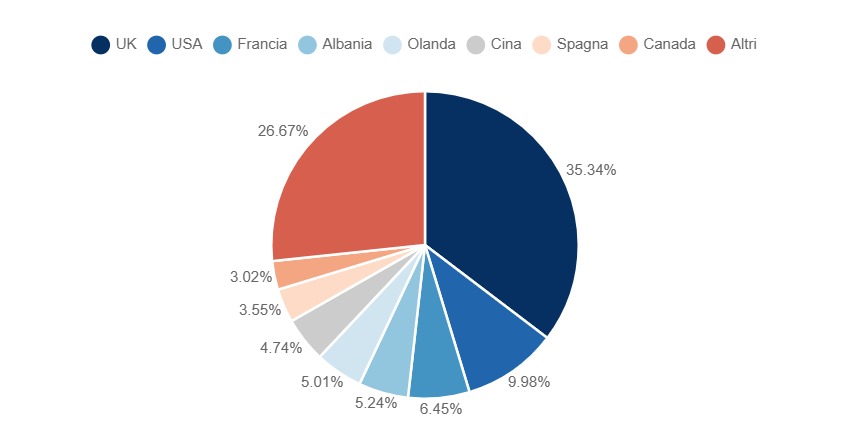

In 2023, the United Kingdom is the main recipient of Italian beer exports, accounting for 35.34 percent of the total, followed by the United States at 9.98 percent and France at 6.45 percent. Albania and the Netherlands account for 5.24% and 5.01%, respectively. China (4.74 percent), Spain (3.55 percent) and Canada (3.02 percent) are also significant markets, while the remaining 26.67 percent of exports are distributed among other countries.

Main destination countries for beer exports

Italy, 2023, in %

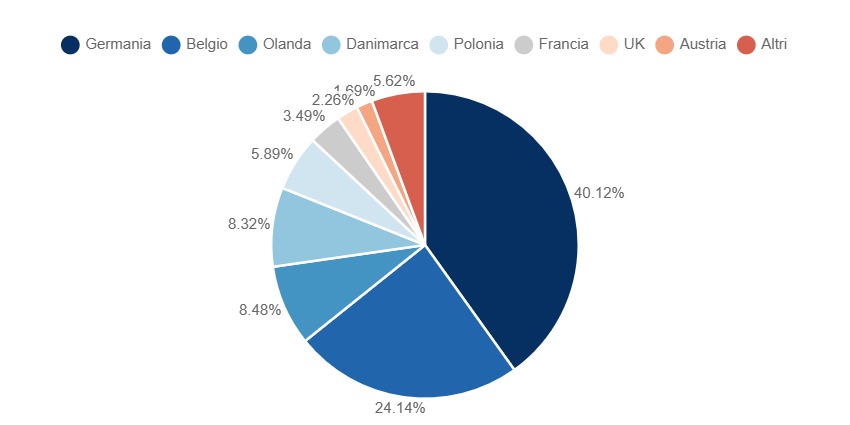

In 2023, Germany is the main supplier of imported beer to Italy, accounting for 40.12 percent of imports, followed by Belgium with 24.14 percent and the Netherlands with 8.48 percent. Denmark and Poland contribute 8.32% and 5.89%, respectively. Other relevant countries are France (3.49%), the United Kingdom (2.26%) and Austria (1.69%), with the remaining 5.62% coming from other countries.

Main countries of origin of beer imports

Italy, 2023, in %

1.6 Inflation suffered by the sector

In recent years, the beer sector in Italy has faced significant challenges due to inflation, which has affected the entire supply chain, from production to distribution. Rising costs of raw materials, such as barley and hops, have created significant pressure on producers, exacerbated by the ever-increasing energy costs needed to power production processes, such as fermentation and refrigeration. Transportation costs have also increased due to rising fuel prices, negatively affecting distribution in both domestic and foreign markets. Faced with these increases, many breweries have had to pass on some of these costs to the end consumer, leading to a general increase in beer prices, both in supermarkets and on the premises. This has greatly affected consumption habits: many people have reduced the number of purchases or switched to cheaper brands, which has especially penalized craft breweries and premium brands. For small brewers, especially craft brewers, the situation has been particularly difficult, as they do not have the same margins as large companies to be able to absorb the increased costs. Some have tried to respond by reducing production, while others have been forced to close. However, there has been no shortage of creative responses: some companies have focused on innovations in production processes and the launch of new products, such as low-alcohol beers or beers made with local ingredients to keep costs down. On the marketing side, many companies have stepped up promotions, trying to attract consumers with special offers or more convenient formats. In parallel, large brewers have sought to improve internal efficiency, investing in technology and automation to keep operating costs down. An interesting trend has also been local beers, which have seen an increase in demand due to a growing focus on sustainability and the need to reduce transportation costs. In the long term, the brewing industry will have to continue to navigate an uncertain economic environment, with inflation likely to remain high for a while longer. Innovation and the ability to adapt will be crucial, along with possible government interventions such as incentives for small breweries or tax breaks. In any case, the Italian brewing industry is demonstrating remarkable resilience, trying to reinvent itself in a time of economic hardship.

Beer producer price index [1105] for the industry - monthly data - base 2021=100

Italy, 2022-2024, index

The Beer Producer Price Index in Italy between July 2022 and July 2024 shows an overall increase. In July 2022, the index was at 102.8, while in July 2024 it stands at 108.4, an increase of 5.45 percent. Growth was most pronounced between December 2022 and January 2023, when the index rose from 104.6 to 108.1, signaling a significant increase in a short period. After this peak, values stabilized, hovering slightly around 109 for most of 2023 and 2024. A slight decline from the highs is observed in recent months, but the index remains above the initial level of 2022.

Demand analysis

2.1 Overview of demand

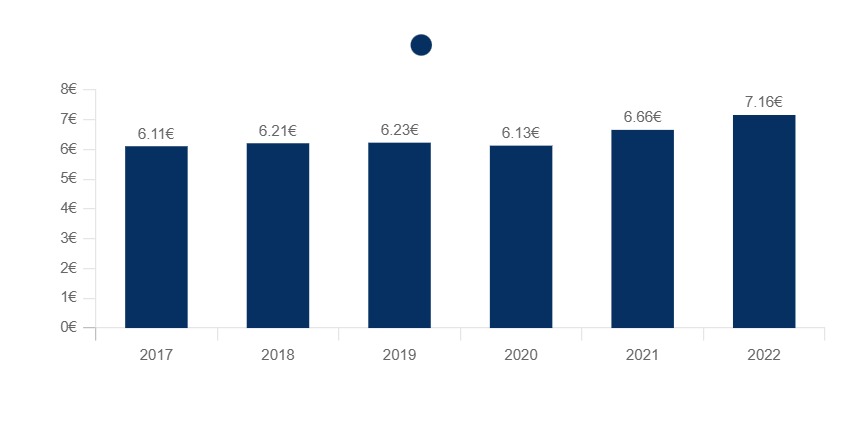

Between 2017 and 2023, average household spending on beer increased by 18 percent, from €6.11 to €7.21. After a moderate growth until 2020, 2021 marked a significant acceleration, with the increase remaining constant until 2023.

Average household expenditure item for beer

Italy, 2017-2022, in current &euro

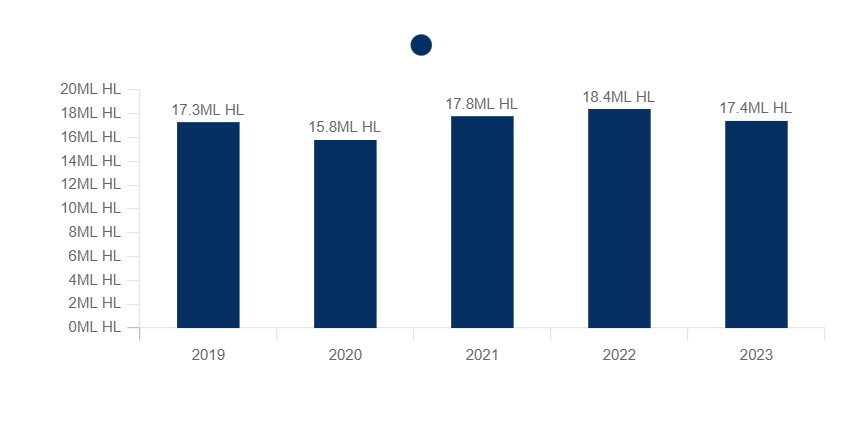

Between 2019 and 2023, beer production in Italy showed an overall growth of 0.6 percent, rising from 17.3 to 17.4 million hectoliters. After a significant contraction in 2020, with a drop of 8.7 percent to 15.8 million hectoliters, production rose steadily, reaching a peak of 18.4 million hectoliters in 2022. In 2023 there is a slight decline to 17.4 million hectoliters.

Beer production

Italy, 2019-2023, in millions of hectoliters

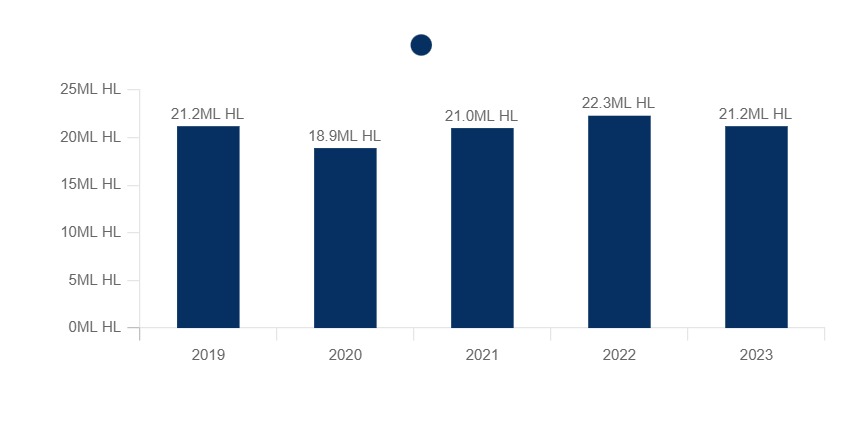

Consumption remained unchanged at 21.2 million hectoliters. After a contraction in 2020, when it fell 10.8 percent to 18.9 million hectoliters, there was a recovery in the following two years, culminating in 2022 with 22.3 million hectoliters. In 2023, however, consumption returned to 2019 levels.

Beer consumption

Italy, 2019-2023, in millions of hectoliters

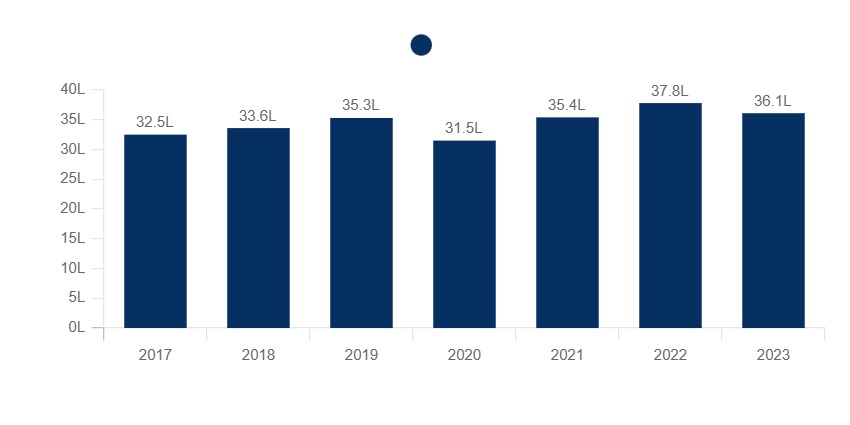

Instead, analyzing per capita consumption shows an increase of 11.1 percent, from 32.5 to 36.1 liters per year. After a steady increase until 2019, peaking at 35.3 liters, a decline to 31.5 liters is observed in 2020, probably due to the impact of the pandemic. Thereafter, consumption resumes rapidly, reaching a high of 37.8 liters in 2022, before declining slightly to 36.1 liters in 2023.

Per capita consumption of beer

Italy, 2017-2022, in liters/year

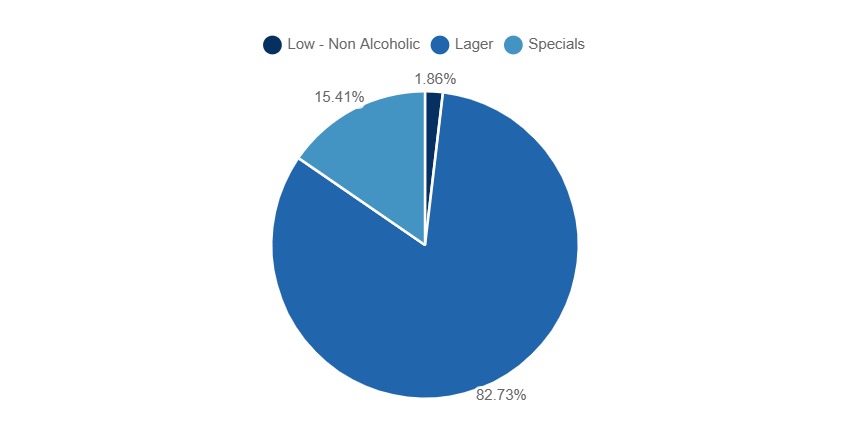

In 2023, the beer market in Italy was dominated by Lagers, accounting for 82.73 percent of total consumption. "Specials" beers made up 15.41%, showing a more niche but still relevant presence. Low-alcohol or non-alcoholic beers had a marginal share of 1.86 percent.

Beer market segmentation

Italy, 2023, in %

2.2 Geographical distribution of demand

Data on average monthly household spending on beer in Italy show significant geographic variation. Households in the Northeast and Northwest record the highest spending, at 7.38 euros, while in the South and Islands spending is slightly lower, standing at 7.28 euros. The Center stands out with the lowest expenditure, at 6.45 euros, a difference of 12.6 percent from the northern regions.

| REGION |

VALUE (€) |

| NORTH-EAST |

7.38 |

| NORTH-WEST |

7.38 |

| SOUTH |

7.28 |

| ISLANDS |

7.28 |

| CENTER |

6.45 |

In 2023, Lombardy emerges as the region with the highest number of beer consumers aged 11 and older in Italy, with 4531, followed by Lazio (2624) and Veneto (2301). Smaller regions such as Valle d'Aosta and Molise record the lowest figures, with 62 and 148 consumers, respectively. In the South, Campania (2478) and Sicily (2102) show significant numbers, while regions such as Calabria (918) and Basilicata (225) have lower consumption. This suggests a distribution of beer consumption related to both population and cultural and socioeconomic factors.

| DEN_REG |

VALUE |

| Piedmont |

1936 |

| Aosta Valley/Vallée d'Aoste |

62 |

| Liguria |

707 |

| Lombardy |

4531 |

| Trentino-Alto Adige/Südtirol |

511 |

| Veneto |

2301 |

| Friuli-Venezia Giulia |

582 |

| Emilia-Romagna |

2154 |

| Tuscany |

1749 |

| Umbria |

390 |

| Marche |

687 |

| Latium |

2624 |

| Abruzzo |

654 |

| Molise |

148 |

| Campania |

2478 |

| Apulia |

1798 |

| Basilicata |

225 |

| Calabria |

918 |

| Sicily |

2102 |

| Sardinia |

725 |

2.3 Demand drivers

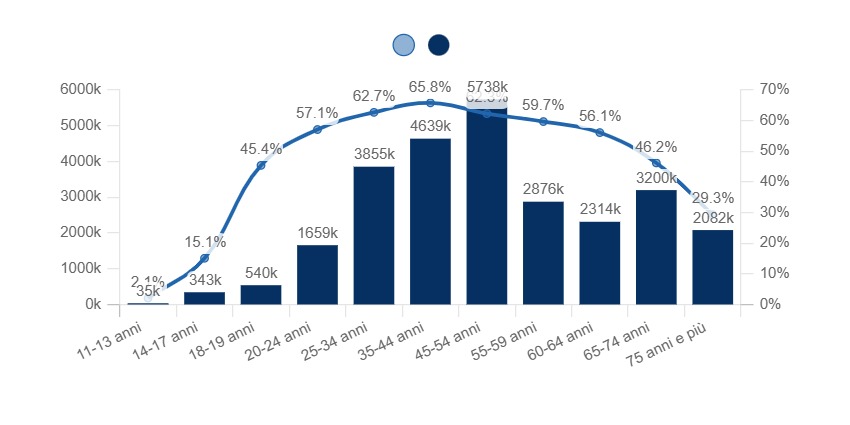

In 2023, in Italy, beer consumption among people aged 11 and older shows a gradual increase with age up to the 45-54 age group, and then begins to decline. The number of consumers increases significantly among young adults, with 5,738,000 consumers in the 45-54 age group representing the absolute peak. The rate of consumers, per 100 people in the same age group, rises from 2.1 percent among 11-13-year-olds to 65.8 percent among 35-44-year-olds, showing a steady increase. After age 45, the consumer rate gradually declines, falling to 29.3 percent among people aged 75 and older, a 55.5 percent reduction from peak consumption.

People aged 11 and older who consume beer

Italy, 2023, in thousands, per 100 people with the same characteristics

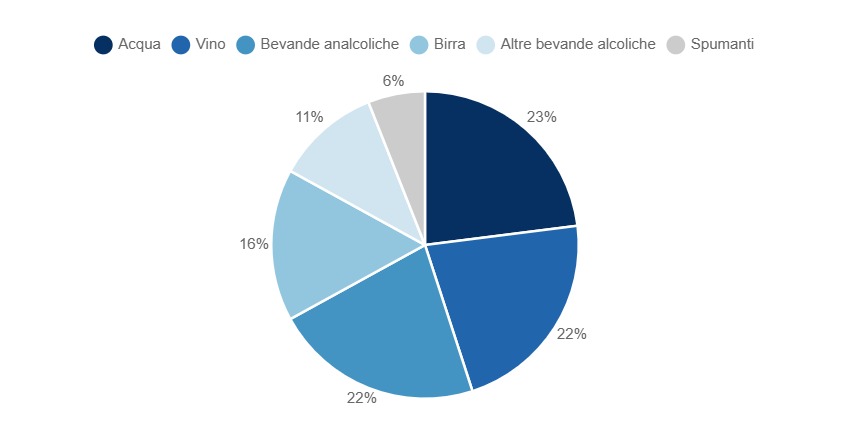

In 2024, the national breakdown of beverage spending in Italy shows a relatively balanced distribution among several categories. Water accounts for 23 percent of total spending, followed by wine and soft drinks, both at 22 percent. Beer makes up 16 percent of spending, while other alcoholic beverages account for 11 percent. Sparkling wines have the lowest share, at 6 percent. These data indicate that Italians distribute their beverage spending among water, wine, and soft drinks almost evenly, with a minor preference for beer and sparkling wines.

National distribution of beverage spending

Italy, 2024, in %

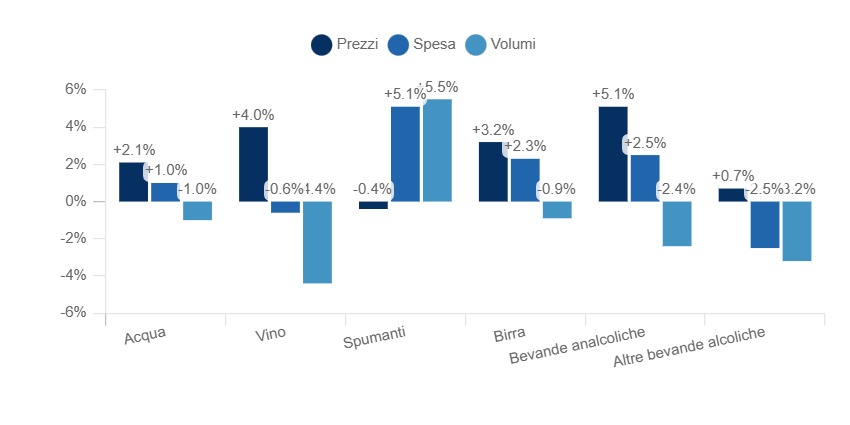

In 2024, demand trends for different beverage categories in Italy show interesting trends in prices, spending and volumes. Prices increased for all categories except sparkling wines, which saw a slight decline of 0.4 percent. The most significant increase was for soft drinks (+5.1 percent), followed by wine (+4.0 percent) and beer (+3.2 percent). Despite the price increase, spending on wine and other alcoholic beverages decreased by 0.6 percent and 2.5 percent, respectively, while it increased significantly for sparkling wines (+5.1 percent). Spending on water, beer and soft drinks increased by 1.0%, 2.3% and 2.5% respectively. In terms of volumes, an overall decrease is observed, except for sparkling wines, which increased by 5.5%. Consumption volumes of wine, soft drinks, other alcoholic beverages, water and beer decreased, with wine experiencing the most significant reduction (-4.4%).

Demand trends by breakdown

Italy, 2024, in %

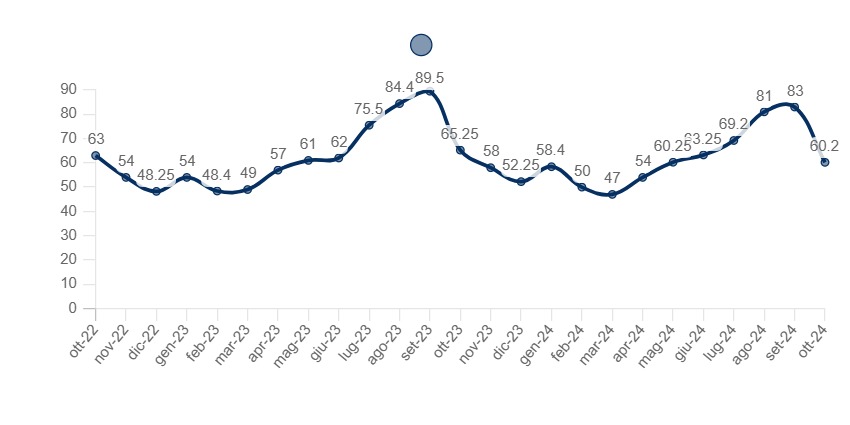

2.4 Trends in beer demand

In the period between October 2022 and October 2024, the trend of online beer searches in Italy shows an interesting evolution. Starting from an index of 63 in October 2022, there is a decrease to 48.25 in December of the same year, followed by a gradual recovery in the following months. The summer of 2023 marks a peak, with the index reaching 84.4 in August, then declining slightly in the fall months. A similar behavior is seen in 2024, with a new summer peak of 81 in August. Overall, comparing October 2022 (63) with October 2024 (60.2), there is a 4.4 percent decrease in the search index. The numbers represent search interest relative to the highest point on the graph in relation to the region and period indicated. A value of 100 indicates the highest search frequency of the term, 50 indicates half of the searches. A score of 0, on the other hand, indicates that not enough data were found for the term.

Trends in online searches for beer

Italy, 2022-2024, index

Online searches for beer in Italy between 2022 and 2024 show an interesting geographic distribution. Sardinia records the highest value, with an index of 100, followed by Friuli-Venezia Giulia (98) and Trentino-Alto Adige/Südtirol (94). In contrast, regions such as Sicily (64) and Campania (57) are at the bottom of the ranking. a greater concentration of interest is evident in northern regions, while southern regions, with the exception of Puglia (74), show a lower propensity for beer-related online searches.

| Region |

Value |

| Sardinia |

100 |

| Friuli-Venezia Giulia |

98 |

| Trentino-Alto Adige/Südtirol |

94 |

| Valle d'Aosta/Vallée d'Aoste |

90 |

| Veneto |

86 |

| Lombardy |

86 |

| Marche |

82 |

| Emilia-Romagna |

81 |

| Molise |

80 |

| Abruzzo |

79 |

| Piedmont |

78 |

| Apulia |

74 |

| Liguria |

74 |

| Basilicata |

74 |

| Tuscany |

73 |

| Calabria |

73 |

| Latium |

71 |

| Umbria |

70 |

| Sicily |

64 |

| Campania |

57 |

2.5 New trends in demand

The beer market is undergoing a significant transformation, driven by changes in consumer preferences and an evolution in producers' offerings.

1. Growth of craft and independent beers

- Craft beers continue to gain popularity, especially among younger consumers and so-called "beer enthusiasts." Demand is shifting toward locally brewed beers with a strong focus on quality, natural ingredients, and a variety of styles. Craft breweries are experimenting with innovative recipes and bold flavors, often related to local cultures or traditions. This has created a dynamic and fragmented market, where small independent breweries compete with big brands, trying to distinguish themselves with storytelling linked to the local area.

2. Low-alcohol and non-alcoholic beers

- With an increasing focus on health and wellness, the demand for low-alcohol and nonalcoholic beers is rising sharply. Many consumers, particularly in younger generations such as millennials and Gen Z, are opting for products that allow them to enjoy the taste of beer without the effect of alcohol. Manufacturers are investing in new technologies to improve the taste of non-alcoholic beers, making them more similar to traditional versions in terms of taste experience.

3. Sustainability and environmentally friendly packaging

- Consumers are increasingly concerned about the environmental impact of the products they buy, and this is also reflected in their choice of beers. There is a growing demand for beers brewed using sustainable methods, using organic or local raw materials, and reducing the use of resources such as water and energy during the brewing process. Packaging is also undergoing a transformation, with an increased emphasis on the use of recyclable or biodegradable materials, such as aluminum cans or reusable glass bottles.

4. Innovation in flavors and alternative ingredients

- Beer consumers are increasingly open to new taste experiences. This has prompted breweries to experiment with unconventional ingredients such as exotic fruits, spices, flowers, and even vegetables. Flavored beers, such as sour beers and fruit beers, are growing in popularity. In addition, there is growing interest in beers fermented with wild yeasts, such as Belgian Lambic-style beers, which offer complex and distinctive flavor profiles.

5. Growth in gluten-free and special dietary needs beers

- With the rise of gluten-free diets and food intolerances, gluten-free beers are becoming increasingly relevant. This once limited niche market is growing rapidly, with a wide range of styles and flavors now available. This trend is also responding to a growing segment of consumers who are looking for products suitable for specific diets, such as vegan or low-sugar.

6. Premium and personalized experiences

- Many consumers are willing to pay more for premium beers, with an emphasis on high-quality products, elegant packaging, and unique drinking experiences. The market is seeing a growing demand for "limited edition" or storytelling beers that convey a sense of exclusivity. In addition, customization services are developing, such as the ability to order custom-created beers for specific events or to create custom labels.

7. Increased online sales and home delivery

- Pandemic has accelerated the shift toward online sales, and this trend looks set to continue. More consumers prefer to purchase beer through digital platforms, taking advantage of a wide selection and home delivery options. Breweries and retailers are investing in e-commerce, creating engaging digital experiences and offering subscriptions for regular home delivery of beers.

8. Internationalization of tastes

- With increased travel and globalization, consumers are exploring beer styles from other parts of the world. Asian, African, and South American beer styles are gaining ground, and there is an increased openness to beers with global cultural influences. This trend also leads to collaborations between breweries from different countries and greater diversity in global offerings.

9. Collaborations and limited editions

- Collaborations between craft breweries or between breweries and other food & beverage companies have become a common phenomenon. These partnerships often lead to the creation of limited-edition beers, which attract collectors and enthusiasts eager to try something unique. These collaborations can also include companies from other sectors, such as coffee, chocolate or even spirits, offering multidisciplinary taste experiences.

Market structure

3.1 Structure and dynamics of the Italian market

From 2018 to 2023, the number of companies active in brewing in Italy grew significantly. It rose from 610 companies in 2018 to 1077 in 2023, an increase of 76.5 percent in six years. The growth rate was particularly pronounced between 2022 and 2023, with an increase of 247 companies, a sign of strong dynamism in the sector in recent years.

Number of enterprises active in brewing [11.05]

Italy, 2018-2023, in numbers

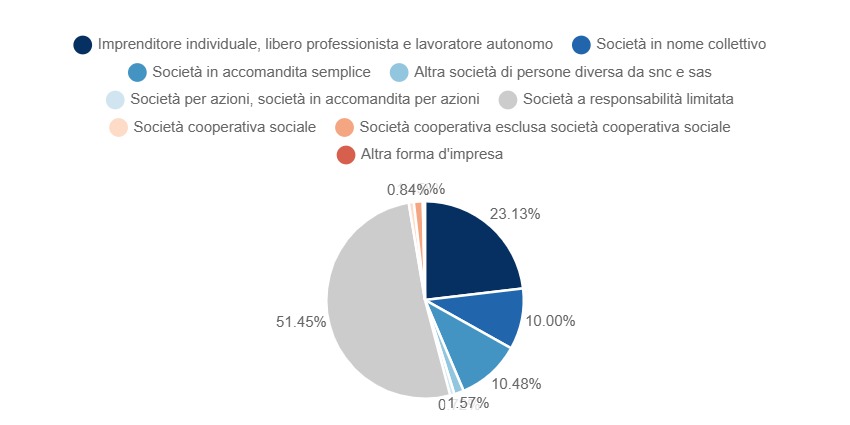

In 2022, the majority of businesses active in brewing in Italy were limited liability companies, accounting for 51.45 percent of the total. Sole proprietors, freelancers and the self-employed made up 23.13 percent, followed by general partnerships (10 percent) and limited partnerships (10.48 percent). Other legal forms, such as cooperatives or joint stock companies, had a much lower weight, with percentages ranging from 0.36 percent to 1.57 percent, signaling a clear predominance of SRL and sole proprietorship type business structures.

Legal form of companies active in brewing

Italy, 2022, in %

Between 2017 and 2022, the number of people employed in brewing in Italy increased steadily from 3917 in 2017 to 4906 in 2022, a total increase of 25.2 percent. Despite a slight decline between 2019 and 2020, probably related to general economic factors, growth resumed in 2021, peaking in 2022.

Number of employees working in brewing [11.05]

Italy, 2017-2022, in numbers

The beer market in Italy shows rapid growth in the number of firms (+76.5 percent from 2018 to 2023) compared to that of employees (+25.2 percent from 2017 to 2022). This suggests a fragmentation of the sector, with many new small companies, most of them artisanal, employing fewer people. The market is expanding, but with smaller-scale firms.

3.2 Value Chain

- Procurement ofraw materials: Acquisition of key ingredients such as barley, hops, yeast and water.

- Malting: Barley is transformed into malt through soaking, germination and drying processes.

- Brewing: Malt is mixed with water, boiled with hops and fermented with yeast to produce beer.

- Packaging: The beer is filtered, carbonated and packaged in bottles, cans or kegs.

- Distribution: Beer is transported from the brewery to wholesalers, retailers and restaurants.

- Marketing and Sales: Branding, promotions and advertising to sell beer to consumers.

- Retail and Consumption: Beer reaches end consumers through supermarkets, bars, and restaurants.

Diagram of production of one hectoliter of beer

1. Raw materials:

- Malt: 12 kg

- Water: 300 L

- Unmalted cereal: 4 kg

- Hops: 0.26 kg

- Yeast: 790 g (concentration 10% dry)

2. Preparation process:

- The raw materials are placed in the mash tun and the grain mash boiler, where saccharification takes place.

- Next, the wort is filtered and boiled in the brewing boiler.

- Wort production: 74 L of wort is obtained.

3. Waste and use of by-products:

- During the process, trebbie (16 kg) is produced, which can be used as animal feed.

4. Fermentation:

- After cooling the wort, fermentation and maturation take place.

- The yeast is collected (1.6 kg) and can be used for other uses in the food industry.

5. Packaging stage:

- After fermentation, the beer is transferred to bottles or tanks in the cellars and then filtered.

- It is then bottled and packaged in various formats: kegs, returnable bottles, non-returnable bottles, and cans.

6. Energy consumption:

- To produce one hectoliter of beer in Italy, energy consumption is about 95 MJ (~7 kWh).

- Total water used is 420 L, with total grain of 16 kg, yeast of 0.8 kg, and hops of 0.3 kg.

3.3 Distribution channels

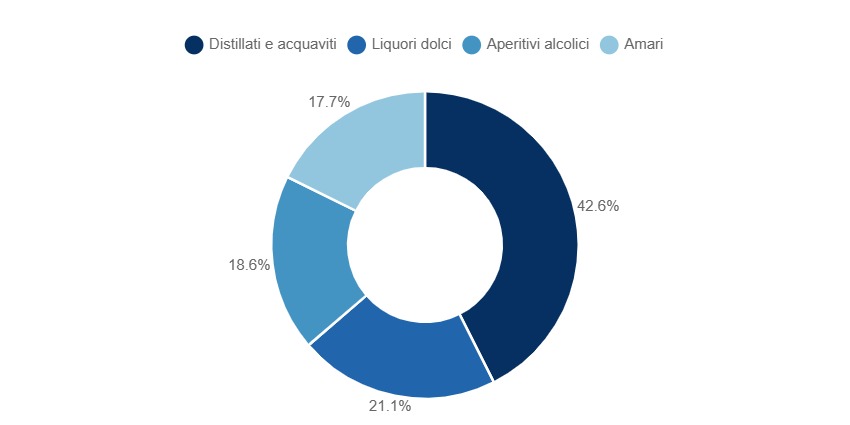

In 2023, value sales in Italy's large-scale retail trade (GDO) were dominated by distillates and spirits, accounting for 42.6 percent of the total. This was followed by sweet liqueurs with 21.1 percent, alcoholic aperitifs with 18.6 percent, and finally bitters with 17.7 percent. This indicates a clear dominance of distilled spirits and brandies over other categories of alcoholic beverages, highlighting a consumer preference for these products.

Breakdown of categories in total value sales in the large-scale retail trade

Italy, 2023, in %

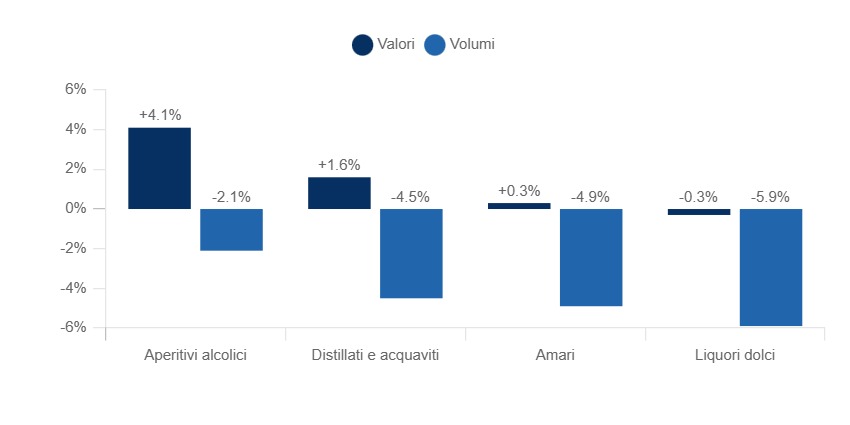

Between 2022 and 2023, value sales in Italy's large-scale retail trade showed growth for alcoholic aperitifs (+4.1 percent), spirits and brandies (+1.6 percent), and bitters (+0.3 percent), while sweet liqueurs showed a slight decline (-0.3 percent). However, sales volumes decreased for all categories, with sweet liqueurs experiencing the most significant decrease (-5.9%), followed by bitters (-4.9%), distilled spirits and brandies (-4.5%), and alcoholic aperitifs (-2.1%).

Sales trends by category in the large-scale retail trade

Italy, 2022-2023, in %

3.4 The main players in the market

The main companies in Italy are as follows:

- Ab-Inbev Italia: Anheuser-Busch InBev Italia S.p.A. is the Italian subsidiary of AB InBev, a world leader in beer production. The Italian office is located in Piazza Gae Aulenti n.8, Milan. AB InBev Italia distributes prestigious brands such as Corona, Beck's, Leffe, Tennent's Super, Franziskaner, Hoegaarden, Birra del Borgo and Goose Island. In 2020, the company opened its new headquarters in Milan, which also serves as the headquarters for the Central Europe Business Unit, strengthening its presence in the Italian market. Starting January 1, 2025, AB InBev will have exclusive rights to distribute and promote San Miguel products in Italy, further expanding its brand portfolio in the country.

- Heineken: Founded in 1864 in Amsterdam by Gerard Adriaan Heineken, it is one of the world's leading brewing companies. The company owns more than 165 breweries in more than 70 countries, and is best known for its light lager beer. Among its most famous brands are Amstel, Desperados, Sol, and Birra Moretti. It developed its unique A-Yeast yeast in 1886, which is a key element in the beer's distinctive taste, with delicate fruity notes. Despite its global expansion, it continues to maintain strong ties to its origins as a family business.

- Birra Peroni: It is a historic Italian company established in 1846 by Francesco Peroni in Vigevano, Lombardy. Over time, the company has become one of the most important in the Italian brewing industry. In 1864, Giovanni Peroni, the founder's son, moved production to Rome, contributing to the brand's expansion. Today it is part of the Asahi Group, after being acquired in 2016. The company's flagship product is Peroni Nastro Azzurro, a pale lager beer inspired by the "Nastro Azzurro," an award won by the Italian ocean liner SS Rex in 1933. In addition to Peroni Nastro Azzurro, the product range includes other variants such as Peroni Gran Riserva and Peroni Crystall.

- Forst Beer: Founded in 1857 in Lagundo, South Tyrol, it is one of the oldest breweries in Italy. The company, which is still family-owned, is known for its strong connection to the land and respect for nature. Using high-quality spring water from the surrounding mountains, Birra Forst is renowned for producing high-quality beers such as Forst Premium, Kronen and Sixtus. With an annual production of about 700,000 hectoliters, it mainly serves the Italian market and also owns the historic Menabrea Brewery, acquired in 1991.

- Carlsberg: Founded in 1847 by J.C. Jacobsen in Copenhagen, it is one of the world's largest brewing companies. Its best known beer is Carlsberg Pilsner, but the company also produces other well-known brands such as Tuborg, Kronenbourg 1664, and Somersby. It pioneered the science of brewing, establishing the Carlsberg Laboratory in 1875, where significant advances were made, such as the discovery of the yeast Saccharomyces carlsbergensis and the development of the pH scale. The company is known for its philanthropic activities, supported by the Carlsberg Foundation, which funds scientific and cultural research. It has a global presence, with main operations in Europe, Asia and Africa, and produces both alcoholic and non-alcoholic beverages.

- Birra Castello: Established in 1997 in San Giorgio di Nogaro, it quickly gained a prominent place in the Italian beer scene, capitalizing on the local brewing tradition. The brewery acquired the historic Pedavena plant in 2006, enriching its experience and production capacity. It currently produces beers such as Castello Premium Lager, Superior, and Dolomiti, known for their quality and eco-sustainable approach. has implemented several environmental initiatives, such as rail transportation to reduce CO2 emissions. In 2023, the company sold the San Giorgio di Nogaro plant to the Danish Royal Unibrew group, while maintaining and enhancing production at the Pedavena plant.

- Menebrea Beer: Founded in 1846 in Biella, Piedmont, it is the oldest brewery in Italy still in operation. With more than 175 years of history, the beer is brewed using traditional low-temperature fermentation techniques and high-quality raw materials, including pure water from the Biella Alps, which imparts a unique flavor. The brewery is famous for its two main varieties: Menabrea Bionda, a light lager with a balanced and light flavor, and Menabrea Ambrata, an amber lager with a more complex and robust taste, with notes of caramel and toffee. is still run today by the Thedy family, heirs of the founders, and produces about 100,000 hectoliters of beer annually, with a significant portion destined for export to several countries. The beer is matured for six weeks in the plant's underground cellars, keeping the original process unchanged for more than a century.

- Amarcord Beer: Founded in 1997 in Rimini, Emilia-Romagna, it takes its inspiration from Federico Fellini's famous film and represents Italian craftsmanship. The brewery is distinguished by its use of high-quality raw materials, including spring water from Mount Nerone. Among its best-known beers are Gradisca, a light lager, and Volpina, a red ale.

- Birrificio del Ducato: Established in 2007 in Roncole Verdi, in the province of Parma, it is one of Italy's most award-winning craft breweries and has earned both national and international recognition. it is known for its innovative production, ranging from traditional unfiltered and unpasteurized beers to experimental beers, often aged in barrels. Among its most popular beers are Viaemilia, a pilsner with a fresh, balanced taste, and Verdi Imperial Stout, a full-bodied stout with notes of roasted malt and chocolate. In 2016, Birrificio del Ducato became part of the Duvel Moortgat Group, which acquired 70 percent of its shares in 2018.

- Birra Del Borgo: On the market since 2005 thanks to Leonardo Di Vincenzo in Borgorose, Lazio, it has quickly established itself as one of Italy's leading craft breweries. The brewery is known for its ability to combine tradition and innovation, creating high-quality beers using local ingredients, such as spelt grown on the Duchessa Mountains. Among its most popular beers are ReAle, an amber IPA inspired by English India Pale Ales, and Duchessa, a saison with a floral and fruity flavor. is also notable for its experimental beers, such as Equilibrista, a blend of beer and Sangiovese wort. In 2016, Birra del Borgo was acquired by the giant AB InBev.

- Semedorato Beer: It is a Sicilian brewery founded in 2014 in Sommatino, in the province of Caltanissetta. It stands out for producing premium beers made from pure barley malt, using local ingredients such as water from the Madonie Mountains and a careful selection of aromatic hops. The best-known beer is Semedorato Premium Lager, an aromatic and fruity-tasting blonde with 5 percent alcohol, which won the 2015 Cerevisia Award as the best lager in Southern Italy. In addition to the lager, the brewery also produces other beers such as Golden Seed, a red double malt that won first prize at the World Beer Awards in London in 2017, and Himera, a craft beer that reflects the flavors of the Mediterranean.

| Companies |

Turnover 2021 (€) |

Turnover 2022 (€) |

Turnover 2023 (€) |

| Heineken |

678.8ML |

753.8ML |

826.6ML |

| Ab-Inbev Italy |

440.9ML |

476.0ML |

n/a |

| Peroni Beer |

444.9ML |

503.2ML |

583.1ML |

| Forst Beer |

113.0ML |

140.8ML |

157.7ML |

| Carlsberg |

123.7ML |

135.3ML |

139.8ML |

| Castle Beer |

114.8ML |

125.9ML |

128.6ML |

| Menebrea Beer |

35.6ML |

42.9ML |

45.9ML |

| Amarcord Beer |

10.6ML |

10.5ML |

10.6ML |

| Birrificio del Ducato |

1.64ML |

7.05ML |

8.09ML |

| Birra del Borgo |

6.74ML |

4.71ML |

n/a |

| Semedorato Beer |

3.42ML |

4.81ML |

4.56ML |

Supply analysis

4.1 Analysis and type of supply

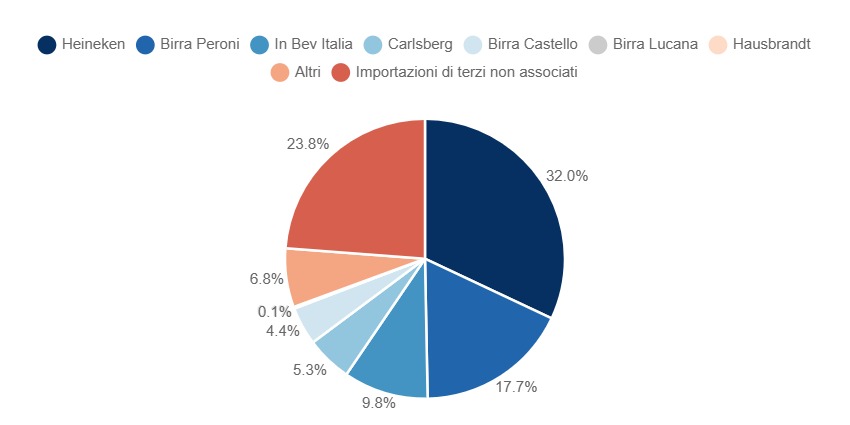

In 2023, Heineken dominated the Italian beer market with 32 percent of the total released for consumption. Birra Peroni ranked second with 17.7 percent, while In Bev Italia followed with 9.8 percent. Carlsberg and Birra Castello have more modest shares of 5.3 percent and 4.4 percent, respectively. Minor producers, such as Birra Lucana and Hausbrandt, account for only a small fraction (0.1 percent each). "Non-member third-party imports" make up a significant portion of the market, accounting for 23.8 percent, far outpacing other local producers.

Beer released for consumption

Italy, 2023, in %

The beer market offers a wide range of products, each characterized by different production styles, ingredients and tastes. The table below presents the main beer categories, each with a brief description and some well-known examples. This diversification responds to different consumer preferences and global trends toward innovation and quality.

| Category |

Description |

Examples |

| Industrial Beer |

Beers produced on a large scale, standardized, and distributed nationally or internationally. |

Heineken, Budweiser, Peroni |

| Craft Beer |

Beers brewed in small batches, with attention to ingredients and creativity. |

BrewDog, Baladin, Sierra Nevada |

| Specialty Beer |

High-quality beers with special ingredients or unique brewing techniques. |

Cantillon, Rodenbach |

| Lager Beer |

Low-fermented beer with clean, smooth taste. Includes styles such as pilsner, helles, bock. |

Pilsner Urquell, Stella Artois, Beck's |

| Ale Beer |

High-fermented beer with more complex and fruity taste. Includes pale ale, IPA, stout. |

Guinness, Samuel Smith, Bass Pale Ale |

| Abbey and Trappist beers |

Beers brewed following ancient monastic traditions, often rich and complex with high alcohol content. |

Chimay, Westvleteren, Rochefort |

| Gluten-Free and Non-alcoholic Beers |

Beers formulated gluten-free or low/no alcohol, intended for consumers with intolerances or who avoid alcohol. |

Estrella Damm Daura, Heineken 0.0 |

| Sustainable and Organic Beers |

Beers brewed sustainably, organically and with attention to environmental impact. |

New Belgium Brewing, Brasserie Dupont |

| Sour Beer and Wild Ales |

Beers with sour flavor due to wild yeasts, with styles such as lambic, gueuze, Berliner Weisse. |

The Bruery, 3 Fonteinen, Mikkeller |

| Imported Beer |

Beers brewed in countries other than the consumer market, valued for authenticity and tradition. |

Asahi, Paulaner, Duvel |

4.2 Price trends in the market

Between September 2022 and September 2024, the Italian Beer Consumer Price Index increased from 107.0 to 118.4, with an overall growth of 10.6 percent. It peaked in January 2024 at 119.5, followed by a slight decline in the following months, and then stabilized between 117.5 and 118.4 during the summer of 2024. The general trend shows a steady increase in prices in 2023, while in 2024 the pace of growth seems to slow down with slight fluctuations.

Consumer price index of Beer [0213] for the whole community (base 2015=100) - monthly data

Italy, 2022-2024, index

From 2016 to 2023, the consumer price index for beer in Italy increased by 16.7 percent, from 100.1 to 116.8. Between 2016 and 2021, prices remained relatively stable, with minimal changes around the base value (100). However, there was a sharp increase of 4.6 percent in 2022 from 2021, followed by another significant increase of 11.3 percent in 2023.

Consumer price index of Beer [0213] for the whole community (base 2015=100) - annual averages

Italy, 2016-2023, index

Over the period 2022-2023, Italy recorded an average price growth of 8.8 percent. Food showed an increase of 9.5 percent, followed by non-alcoholic beverages with an increase of 7.4 percent. Alcoholic beverages had a growth of 3.2 percent, while tobacco showed a minimal increase of 0.2 percent. Compared with the overall index, foodstuffs showed a higher change, while alcoholic beverages and tobacco had significantly lower growths.

% change in average price growth

Italy, 2022-2023, in %

Following the categorization of beers into premium, mid-priced and economy, a striking price difference can be observed. In fact, premium beers can cost up to fourteen times more than economy beers-for example, Weissbier/Weizen/Wheat Beer EUR15.15 per liter versus Alpen 7 Plato EUR1.09 per liter.

|

Category

|

Price range per liter (euro)

|

|

Premium

|

4.55 or higher

|

|

Medium

|

1.81 - 4.54

|

|

Economical

|

1.80 or lower

|

Source: Price Finder

The most popular sizes for domestic beers are the 330ml or 660ml, both alone or in a 3- or 6-pack; while for imported beers the most popular seems to be the 500ml.

|

Category

|

Most popular package sizes

|

|

Premium domestic lagers

|

660 ml or 330 ml

|

|

Imported premium lager

|

500 ml

|

|

Medium-priced domestic

|

660 ml or 330 ml

|

|

Average price imported

|

500 ml

|

|

Cheap

|

660 ml or 330 ml

|

In terms of packaging type, glass bottles outperform the other two categories, capturing 83.5 percent market share. Kegs are a popular option mainly for on-trade, while cans do not even hold 5 percent of the market.

|

Packaging

|

Share

|

Image

|

|

Glass bottle

|

83,5%

|

|

|

Drum

|

11,6%

|

|

|

Can

|

4,9%

|

|

Source: Assobirra

4.3 New supply trends

The beer market is undergoing a major transformation, driven by several emerging trends that are redefining consumer supply and expectations. These trends are the result of changing demographics, food preferences, and sustainability. Here are the major trends in beer supply:

1. Craft beers and microbreweries

- In recent years, there has been an exponential growth of craft breweries, which offer beers with unique flavors and distinctive production processes. Consumers, especially millennials, are looking for authentic experiences and local products, so they prefer beers brewed on a small scale over industrial brands. The variety of beer styles is a strength of microbreweries, which experiment with unusual ingredients, aromatic hops, and aging methods such as barrel-aging.

2. Low-alcohol and nonalcoholic beers

- A significant trend is the growing demand for low-alcohol or nonalcoholic beers, driven by a focus on health and wellness. Consumers, especially younger ones, are becoming increasingly aware of alcohol consumption and are looking for alternatives that allow them to enjoy the taste of beer without the side effects. This has led manufacturers to improve the quality of non-alcoholic beers, removing the old stigma that labeled them as less tasty.

3. Sustainability and organic ingredients

- Sustainability is another key driver for the beer market. Breweries are investing in greener production practices, such as using renewable energy, recycling water, and sustainable packaging (recyclable or biodegradable cans and bottles). In addition, there is a growing supply of organic beers, brewed with organically grown ingredients, and attention is being paid to short supply chains to support local producers.

4. Innovation in ingredients and flavors

- Innovation is at the heart of the new beer landscape. Producers are experimenting with exotic and natural ingredients, such as fruits, spices, herbs, and even tea or coffee. Sour beers, for example, are gaining popularity, as are beers flavored with citrus or other fruity notes. Unfiltered "hazy" IPA (India Pale Ale) beers, with a more cloudy texture and fruity flavor, are also in high demand.

5. Functional beers

- Another emerging trend is the introduction of "functional" beers, which are beers enriched with ingredients that offer health benefits. One example is the use of probiotics, or beers with added protein and vitamins for athletes. These beers fit into the broader "better for you" trend, which also involves other food sectors.

6. Local and regional beers

- The concept of "localism" is increasingly strong. Consumers are more likely to support local breweries that reflect regional traditions and distinctiveness. This trend also ties in with wine tourism, where breweries offer tasting experiences directly in their establishments, often pairing beer with local gastronomy.

7. Beers with low levels of gluten

- The growing number of people who are gluten intolerant or who choose to follow gluten-free diets has led brewers to develop beers specifically for this market. Gluten-free beers, once considered niche, are now readily available and expanding due to better quality recipes and production processes.

8. Innovative packaging

- Packaging plays an important role in purchasing decisions, and today we see a trend toward more innovative and sustainable formats. In addition to classic glass bottles, we are seeing the introduction of "slim" size cans, mini-kegs for household use, and reusable containers. Labeling has also seen an evolution, with attractive designs and transparency in terms of ingredients and nutritional information.

9. Collaborations between breweries and brands from other sectors

- An interesting phenomenon is the collaboration between breweries and brands from different sectors, such as spirits, coffee, or desserts. These partnerships make it possible to create innovative, often limited-edition beers that attract the attention of consumers seeking novelty. One example is beers aged in whiskey barrels or flavored with artisanal chocolate.

10. Digital and beer-tech experiences

- Beer e-commerce has experienced strong growth, with digital platforms offering a wide variety of beers that are difficult to find in traditional channels. Breweries are also leveraging technology to create interactive experiences, such as virtual tastings, or apps that help consumers discover new beers based on their tastes through machine learning algorithms.

Rules and regulations

5.1 Market regulation

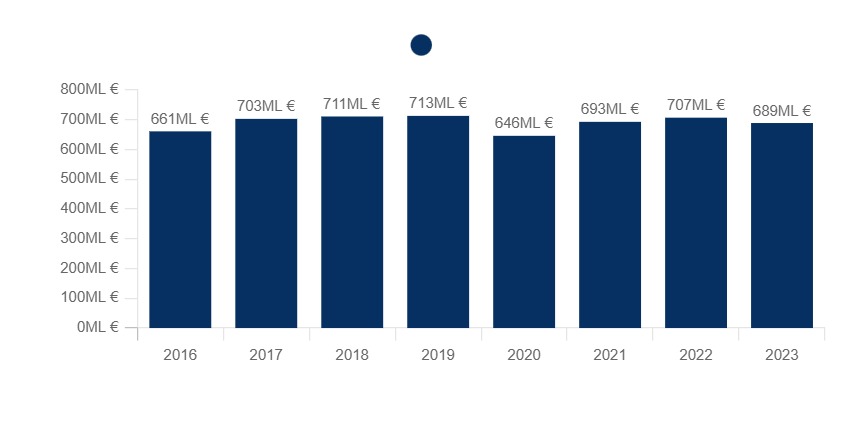

Excise taxes on alcoholic beverages in Italy between 2016 and 2023 show a seesaw trend. After an initial increase from 2016 to 2019, where they rise from 661 million to 713 million (+7.9 percent), there is a sharp decrease in 2020 to 646 million (-9.4 percent), probably related to the effects of the pandemic. In the next two years, excise taxes rise again, reaching 707 million in 2022. However, in 2023 there is another slight decrease to 689 million (-2.5 percent from the previous year).

Excise taxes on alcoholic beverages

Italy, 2016-2023, in millions of €

In Italy, the regulation of beer is quite articulated and covers different aspects, from production to sale. Laws and regulations ensure quality, safety and correct information for consumers.

Beer is classified mainly according to its alcohol content. Legislative Decree No. 109 of January 27, 1992 establishes the different categories: non-alcoholic beer (less than 1.2 percent alcohol), light beer (between 1.2 percent and 3.5 percent) and regular beer (over 3.5 percent). Another important distinction concerns craft beer, defined by Legislative Decree No. 135 of 2016, which regulates its production: it must be obtained without pasteurization or microfiltration and must have a production of less than 200,000 hectoliters per year. Craft beer has seen a great development and is appreciated for its quality, often linked to local tradition.

As far as production is concerned, breweries must comply with strict hygiene and health regulations imposed by EC Regulation No. 852/2004 on the hygiene of foodstuffs. This regulation requires facilities to maintain high standards of cleanliness and safety to avoid contamination. European regulations are enforced to ensure that the product is safe for consumption by regulating every step of the process, from ingredient selection to bottling.

On the fiscal side, beer is subject to a tax called excise duty, calculated according to alcohol content. Excise taxes were regulated by Law No. 160/2019, which introduced a reduction for microbreweries producing up to 10,000 hectoliters per year, to promote small-scale production and incentivize local craft beer production.

Labeling is another essential aspect regulated by EU Regulation No. 1169/2011. Producers must ensure that the beer label carries basic information such as ingredients, alcohol content, container volume, and expiration date. This allows consumers to have all the information they need to make an informed choice, promoting transparency in the market.

Beer advertising is also regulated. The Code of Advertising Self-Discipline imposes strict restrictions, prohibiting the promotion of excessive consumption or the association between alcohol consumption and health benefits. Advertising campaigns must therefore be carefully managed to avoid potentially harmful messages.

Finally, the distribution and sale of beer requires specific licenses, according to the provisions of Legislative Decree No. 59/2010, which regulates the activities of serving alcoholic beverages. Premises must comply with sanitation regulations and sales hours established by local authorities to ensure that alcohol consumption takes place in a safe and responsible manner.

Positioning of actors

6.1 Market segmentation

| Companies |

Turnover 2021 (€) |

Turnover 2022 (€) |

Turnover 2023 (€) |

| Heineken |

678.8ML |

753.8ML |

826.6ML |

| Peroni Beer |

444.9ML |

503.2ML |

583.1ML |

| Ab-Inbev Italy |

440.9ML |

476.0ML |

n/a |

| Forst Beer |

113.0ML |

140.8ML |

157.7ML |

| Carlsberg |

123.7ML |

135.3ML |

139.8ML |

| Castle Beer |

114.8ML |

125.9ML |

128.6ML |

| Menebrea Beer |

35.6ML |

42.9ML |

45.9ML |

| Amarcord Beer |

10.6ML |

10.5ML |

10.6ML |

| Birrificio del Ducato |

1.64ML |

7.05ML |

8.09ML |

| Birra del Borgo |

6.74ML |

4.71ML |

n/a |

| Semedorato Beer |

3.42ML |

4.81ML |

4.56ML |

Companies

Heineken

DUNS: P.IVA 00610140071

Turnover:

826.62 million € (2023)

Description:

Founded in 1864 in Amsterdam by Gerard Adriaan Heineken, it is one of the world's leading brewing companies. The company owns more than 165 breweries in more than 70 countries, and is best known for its light lager beer. Among its most famous brands are Amstel, Desperados, Sol, and Birra Moretti. It developed its unique A-Yeast yeast in 1886, which is a key element in the beer's distinctive taste, with delicate fruity notes. Despite its global expansion, it continues to maintain strong ties to its origins as a family business.

External Sources and News:

| Year |

Turnover |

Profit |

| 2021 |

€ 678.825.000 |

€ 89.908.000 |

| 2022 |

€ 753.408.489 |

€ 71.162.880 |

| 2023 |

€ 826.615.955 |

€ 91.538.930 |

Data:

DUNS: P.IVA 00610140071

Address: LOCALITA' L'ILE-DES-LAPINS, 11, POLLEIN, VALLE D'AOSTA

Birra Peroni

DUNS: P.IVA 06996881006

Turnover:

583.12 million € (2023)

Description:

It is a historic Italian company established in 1846 by Francesco Peroni in Vigevano, Lombardy. Over time, the company became one of the most important in the Italian brewing industry. In 1864, Giovanni Peroni, the founder's son, moved production to Rome, contributing to the brand's expansion. Today it is part of the Asahi Group, after being acquired in 2016. The company's flagship product is Peroni Nastro Azzurro, a pale lager beer inspired by the "Nastro Azzurro," an award won by the Italian ocean liner SS Rex in 1933. In addition to Peroni Nastro Azzurro, the product range includes other variants such as Peroni Gran Riserva and Peroni Crystall.

External Sources and News:

| Year |

Turnover |

Profit |

| 2021 |

€ 444.933.000 |

€ 98.421.000 |

| 2022 |

€ 503.211.275 |

€ 28.959.225 |

| 2023 |

€ 583.122.706 |

€ 6.790.087 |

Data:

DUNS: P.IVA 06996881006

Address: VIA RENATO BIROLLI, 8, ROMA

Birra Forst

DUNS: P.IVA 00100500214

Turnover:

157.75 million € (2023)

Description:

Established in 1857 in Lagundo, South Tyrol, it is one of the oldest breweries in Italy. The company, which is still family-owned, is known for its strong connection to the land and respect for nature. Using high-quality spring water from the surrounding mountains, Birra Forst is renowned for producing high-quality beers such as Forst Premium, Kronen and Sixtus. With an annual production of about 700,000 hectoliters, it mainly serves the Italian market and also owns the historic Menabrea Brewery, acquired in 1991.

External Sources and News:

| Year |

Turnover |

Profit |

| 2021 |

€ 112.957.457 |

€ 3.182.494 |

| 2022 |

€ 140.843.912 |

€ 7.549.981 |

| 2023 |

€ 157.747.915 |

€ 7.600.114 |

Data:

DUNS: P.IVA 00100500214

Address: VIA VENOSTA, 8, LAGUNDO, BOLZANO

Carlsberg

DUNS: P.IVA 02534610122

Turnover:

139.8 million € (2023)

Description:

Founded in 1847 by J.C. Jacobsen in Copenhagen, it is one of the largest brewing companies in the world. Its best known beer is Carlsberg Pilsner, but the company also produces other well-known brands such as Tuborg, Kronenbourg 1664 and Somersby. It pioneered the science of brewing, establishing the Carlsberg Laboratory in 1875, where significant advances were made, such as the discovery of the yeast Saccharomyces carlsbergensis and the development of the pH scale. The company is known for its philanthropic activities, supported by the Carlsberg Foundation, which funds scientific and cultural research. It has a global presence, with main operations in Europe, Asia and Africa, and produces both alcoholic and non-alcoholic beverages.

External Sources and News:

| Year |

Turnover |

Profit |

| 2021 |

€ 123.668.575 |

€ -2.114.634 |

| 2022 |

€ 135.325.631 |

€ -7.815.401 |

| 2023 |

€ 139.798.617 |

€ -4.850.316 |

Data:

DUNS: P.IVA 02534610122

Address: VIA GIORGIO WASHINGTON, 70, MILANO

Birra Castello

DUNS: P.IVA 01994920302

Turnover:

128.59 million € (2023)

Description:

Established in 1997 in San Giorgio di Nogaro, it quickly gained a prominent place in the Italian beer scene, capitalizing on the local brewing tradition. The brewery acquired the historic Pedavena plant in 2006, enriching its experience and production capacity. It currently produces beers such as Castello Premium Lager, Superior, and Dolomiti, known for their quality and eco-sustainable approach. has implemented several environmental initiatives, such as rail transportation to reduce CO2 emissions. In 2023, the company sold the San Giorgio di Nogaro plant to the Danish Royal Unibrew group, while maintaining and enhancing production at the Pedavena plant.

External Sources and News:

| Year |

Turnover |

Profit |

| 2021 |

€ 114.812.328 |

€ 4.197.331 |

| 2022 |

€ 125.897.550 |

€ 4.053.242 |

| 2023 |

€ 128.587.745 |

€ 32.212.761 |

Data:

DUNS: P.IVA 01994920302

Address: VIA ANTONIO MEUCCI, 1, SAN GIORGIO DI NOGARO, UDINE

Birra Menabrea

DUNS: P.IVA 01511760025

Turnover:

45.88 million € (2023)

Description:

Established in 1846 in Biella, Piedmont, it is the oldest brewery in Italy still in operation. With more than 175 years of history, the beer is brewed using traditional low-temperature fermentation techniques and high-quality raw materials, including pure water from the Biella Alps, which imparts a unique flavor. The brewery is famous for its two main varieties: Menabrea Bionda, a light lager with a balanced and light flavor, and Menabrea Ambrata, an amber lager with a more complex and robust taste, with notes of caramel and toffee. is still run today by the Thedy family, heirs of the founders, and produces about 100,000 hectoliters of beer annually, with a significant portion destined for export to several countries. The beer is matured for six weeks in the plant's underground cellars, keeping the original process unchanged for more than a century.

External Sources and News:

| Year |

Turnover |

Profit |

| 2021 |

€ 35.593.952 |

€ 3.503.057 |

| 2022 |

€ 42.858.279 |

€ 4.552.976 |

| 2023 |

€ 45.883.003 |

€ 4.684.391 |

Data:

DUNS: P.IVA 01511760025

Address: VIA RAMELLA GERMANIN, 4, BIELLA

Birra Amarcord

DUNS: P.IVA 03757570407

Turnover:

10.56 million € (2023)

Description:

Founded in 1997 in Rimini, Emilia-Romagna, it takes its inspiration from Federico Fellini's famous film and represents Italian craftsmanship. The brewery is distinguished by its use of high-quality raw materials, including spring water from Mount Nerone. Among its best-known beers are Gradisca, a light lager, and Volpina, a red ale.

External Sources and News:

| Year |

Turnover |

Profit |

| 2021 |

€ 10.587.667 |

€ 465.947 |

| 2022 |

€ 10.525.744 |

€ 392.975 |

| 2023 |

€ 10.559.079 |

€ -128.220 |

Data:

DUNS: P.IVA 03757570407

Address: VIA FLAMINIA, 171, RIMINI

Birrificio del Ducato

DUNS: P.IVA 02389170347

Turnover:

8.09 million € (2023)

Description:

Established in 2007 in Roncole Verdi, in the province of Parma, it is one of Italy's most awarded craft breweries and has earned both national and international recognition. it is known for its innovative production, ranging from traditional unfiltered and unpasteurized beers to experimental beers, often aged in barrels. Among its most popular beers are Viaemilia, a pilsner with a fresh, balanced taste, and Verdi Imperial Stout, a full-bodied stout with notes of roasted malt and chocolate. In 2016, Birrificio del Ducato became part of the Duvel Moortgat Group, which acquired 70 percent of its shares in 2018.

External Sources and News:

| Year |

Turnover |

Profit |

| 2021 |

€ 1.643.295 |

€ -1.005.346 |

| 2022 |

€ 7.053.720 |

€ -129.002 |

| 2023 |

€ 8.088.548 |

€ 120.913 |

Data:

DUNS: P.IVA 02389170347

Address: STRADA ARGINE, 43, SORAGNA, PARMA

Birra del Borgo

DUNS: P.IVA 01503350702

Turnover:

4.71 million € (2022)

Description:

On the market since 2005 thanks to Leonardo Di Vincenzo in Borgorose, Lazio, it has quickly established itself as one of Italy's leading craft breweries. The brewery is known for its ability to combine tradition and innovation, creating high-quality beers using local ingredients, such as spelt grown on the Duchessa Mountains. Among its most famous beers are ReAle, an amber IPA inspired by English India Pale Ales, and Duchessa, a saison with a floral and fruity flavor. is also notable for its experimental beers, such as Equilibrista, a blend of beer and Sangiovese wort. In 2016, Birra del Borgo was acquired by the giant AB InBev.

External Sources and News:

| Year |

Turnover |

Profit |

| 2020 |

€ 5.295.837 |

€ -5.404.229 |

| 2021 |

€ 6.744.427 |

€ -6.578.715 |

| 2022 |

€ 4.708.973 |

€ -13.542.191 |

Data:

DUNS: P.IVA 01503350702

Address: VIA BASENTO, 37, ROMA

Birra Semedorato

DUNS: P.IVA 01836290856

Turnover:

4.56 million € (2023)

Description:

It is a Sicilian brewery founded in 2014 in Sommatino, in the province of Caltanissetta. It stands out for producing premium beers made from pure barley malt, using local ingredients such as Madonie water and a careful selection of aromatic hops. The best-known beer is Semedorato Premium Lager, an aromatic and fruity-tasting blonde with 5 percent alcohol, which won the 2015 Cerevisia Award as the best lager in Southern Italy. In addition to the lager, the brewery also produces other beers such as Golden Seed, a red double malt that won first prize at the World Beer Awards in London in 2017, and Himera, a craft beer that reflects the flavors of the Mediterranean.

External Sources and News:

| Year |

Turnover |

Profit |

| 2021 |

€ 3.420.922 |

€ 36.784 |

| 2022 |

€ 4.808.373 |

€ 31.741 |

| 2023 |

€ 4.561.584 |

€ 35.568 |

Data:

DUNS: P.IVA 01836290856

Address: STRADA PROVINCIALE 2 - C.DA MARCATO BIANCO, S.N., SOMMATINO, CALTANISSETTA

AB InBev

DUNS: 321336208

Turnover:

54.9 billion € (2023)

Description:

- Created in 2008 through the merger of Anheuser-Busch and InBev, the Belgian company specializes in beer brewing.

- The group employs over 17,000 people and is the world's leading brewer

- Its main brands are Leffe, Hoegaarden, Cubanisto, Corona and Jupiler, mainly in the premium segment.

- To increase its presence not only in manufacturing but also in distribution, the Belgian group acquired French distributor Interlinks in 2016, which also owns the online platform saveur-biere.com.

Data:

DUNS: 321336208

Legal Name: AB INBEV FRANCE

Address: 38 ALL VAUBAN IMMEUBLE CRYSTAL ZAC EURALILLE ROMARIN, 59110 LA MADELEINE

Number of employees: Entre 250 et 499 salariés (2020)

Capital: 3 800 000 EUR

Financial Data:

| Year |

2021 |

2020 |

2019 |

2018 |

2017 |

2016 |

2015 |

| Turnover |

755 922 948 |

688 116 172 |

709 582 398 |

663 480 522 |

606 835 329 |

545 952 318 |

493 458 286 |

| Gross margin (€) |

446 604 110 |

420 170 076 |

440 351 868 |

383 312 758 |

364 377 502 |

336 403 911 |

292 830 170 |

| EBITDA (€) |

34 924 652 |

34 595 641 |

64 196 271 |

54 600 704 |

48 381 131 |

41 975 739 |

36 834 874 |

| Operating profit (€) |

22 677 689 |

20 684 551 |

42 579 649 |

39 817 377 |

36 413 738 |

32 765 704 |

29 613 756 |

| Net profit (€) |

10 624 146 |

9 097 549 |

19 971 279 |

19 397 296 |

28 488 096 |

18 807 541 |

11 877 821 |

| Turnover growth rate (%) |

9,9 |

-3 |

6,9 |

9,3 |

11,2 |

10,6 |

- |

| Ebitda margin rate (%) |

4,6 |

5 |

9 |

8,2 |

8 |

7,7 |

7,5 |

| Operating margin rate (%) |

3 |

3 |

6 |

6 |

6 |

6 |

6 |

| Working Capital (turnover days) |

8,6 |

4,8 |

0,2 |

-2,9 |

13 |

0,7 |

1,8 |

| Working Capital requirements (turnover days) |

-0,9 |

13,3 |

8,2 |

-6,7 |

22 |

-15,3 |

-12,4 |

| Net margin (%) |

1,4 |

1,3 |

2,8 |

2,9 |

4,7 |

3,4 |

2,4 |

| Added value / Turnover (%) |

28,9 |

29,9 |

33,8 |

33,1 |

33,1 |

33,2 |

33,1 |

| Wages and social charges (€) |

26 068 297 |

24 496 195 |

26 877 984 |

26 377 861 |

27 680 176 |

25 943 410 |

24 584 906 |

| Salaries / Turnover (%) |

3,4 |

3,6 |

3,8 |

4 |

4,6 |

4,8 |

5 |

Company Managers:

| Position |

First Name |

Last Name |

Age |

Linkedin |

| Président |

Pieter |

ANCIAUX |

35 |

|

| Membre du conseil d'administration |

Arnaud |

CLAEYS |

45 |

|

| Membre du conseil d'administration |

Florestan |

FALIZE |

31 |

|

| Membre du conseil d'administration |

Stefaan |

DEROOST |

37 |

|

![Valore della produzione venduta di birra [11051010]](/images/charts/364c042a-475f-435c-a888-05a0ef6ab034.jpg)

![Fatturato delle aziende operanti nella produzione di birra [1105]](/images/charts/9e8cb515-d610-4ffd-b47c-a6b6b6f8fc2c.jpg)

![Indice dei prezzi alla produzione di birra [1105] dell'industria - dati mensili - base 2021=100](/images/charts/e9d9f0cc-c41a-464c-9c20-b8730ed23894.jpg)

![Numero di imprese attive nella produzione di birra [11.05]](/images/charts/2ef72f30-d176-4c7a-9a66-9b68622391b0.jpg)

![Numero di addetti operanti nella produzione di birra [11.05]](/images/charts/87edd5c3-32b0-4539-889b-98eab45bf0c4.jpg)

![Indice dei prezzi al consumo di Birra [0213] per l'intera collettività (base 2015=100) - dati mensili](/images/charts/7fac5a40-8a6e-42fb-9325-16fcbc64ace6.jpg)

![Indice dei prezzi al consumo di Birra [0213] per l'intera collettività (base 2015=100) - medie annue](/images/charts/fcce5b5e-4ade-4e5d-a7c8-e8ff6bceed22.jpg)